http://www.iaeme.com/IJM/index.asp 1 editor@iaeme.com

International Journal of Management (IJM)

Volume 9, Issue 5, September–October 2018, pp. 1–9, Article ID: IJM_09_05_001

Available online at

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=9&IType=5

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

PUBLIC EXPENDITURE AND NATIONAL

INCOME OF INDIA: INVESTIGATING

WAGNERIAN LAW

Dhyani Mehta

Assistant Professor, Economics and Finance,

Institute of Management, Nirma University, India

ABSTRACT

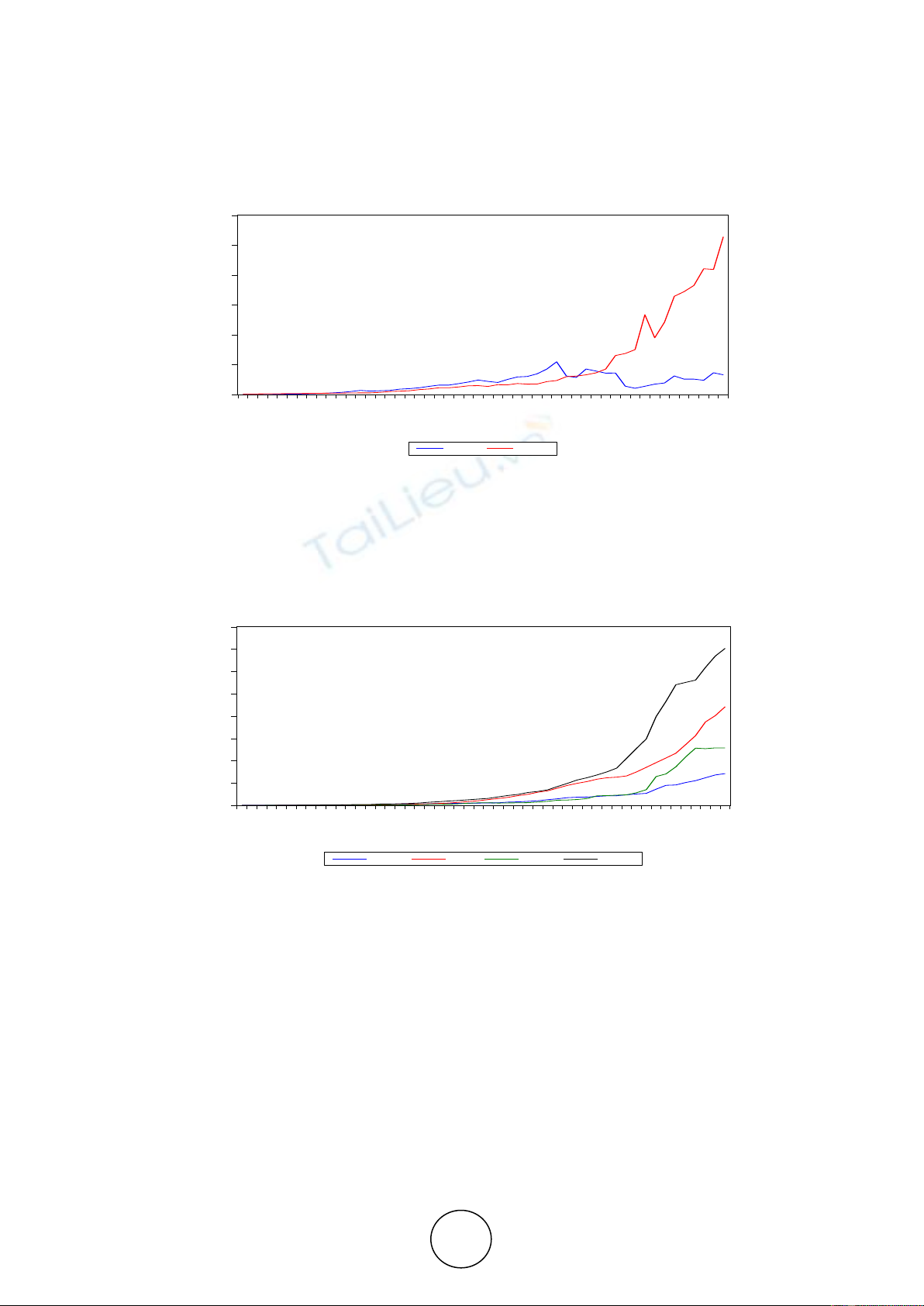

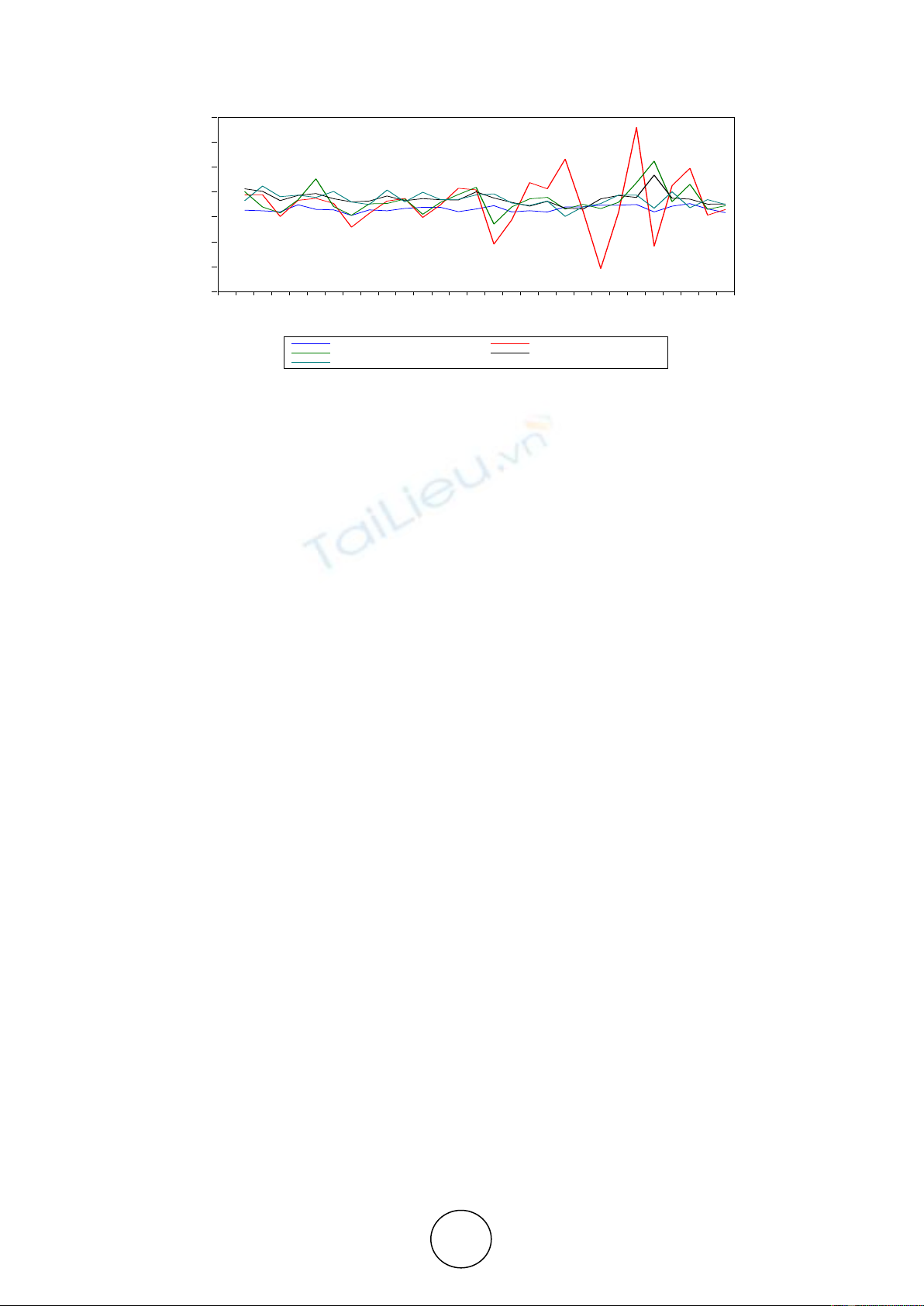

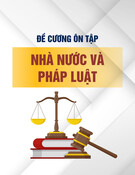

This study tried to empirically test the causal relationship and the direction of

causality between public expenditure and GDP in India, using annual data from 1966-

67 to 2015-16. The methodology employed was econometric model of the

cointegration and the Granger Causality test. The estimates shows that the variables

are stationary at first difference and follows I(1) order of integrations. Causality test

estimates shows bidirectional causal relationship running from GDP to Revenue

Expenditure and from Capital Expenditure to GDP. The estimates do not support the

existence of Keynesian hypothesis and Wagner’s Law at the disaggregate level in

India.

Key words: Public Expenditure, Wagner’s law, Keynesian hypothesis, Cointegration,

Granger Causality.

Cite this Article: Dhyani Mehta, Public Expenditure and National Income of India:

Investigating Wagnerian Law. International Journal of Management, 9 (5), 2018, pp.

1–9. http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=9&IType=5

1. INTRODUCTION

Can increase in public expenditure influence economic growth? What evidence exists on the

direct relationship between public expenditure and economic growth? There is lot of debate in

public finance literatures based on views of different school of thoughts in economics. There

are both theoretical and empirical evidence on the relationship between public expenditure

and Gross domestic product (GDP) growth (Blanchard, 2008). If public expenditure

negatively influences economic growth then policymakers need to be aware of these

relationships when formulating and implementing macroeconomic policy; and if public

expenditure enhances economic growth, or at a minimum does not present obstacles to

growth. However, it is important for policy makers to manage the debt, which arises due to

increased public expenditure and its impact on economy.

Public Expenditure is one of the important growth driver of any economy; GDP growth

should be sustained for a developing economy to address issues like unemployment, poverty,

inflation etc. Public expenditure plays a very crucial role in economic growth and stability.