http://www.iaeme.com/IJM/index.as 105 editor@iaeme.com

International Journal of Management (IJM)

Volume 8, Issue 3, May– June 2017, pp.105–115, Article ID: IJM_08_03_011

Available online at

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=8&IType=3

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

DETERMINANTS OF FOREIGN PORTFOLIO

INVESTMENT AND THEIR EFFECTS ON THE

INDIAN STOCK MARKET

S. Raghavan

Ph. D Research Scholar in Commerce,

Alagappa University, Karaikudi, India

Dr. M. Selvam

Research Guide, International Business,

Alagappa University, Karaikudi, India

ABSTRACT

This article aims at focusing on the facts in the financial series of Foreign Portfolio

Investment (FPI) and its determinants. The study considers Exchange Rate, Consumer

Price Index, Index of Industrial production, SENSEX, NIFTY and Foreign Exchange

Reserve as determinants. The FPI regime commenced on June 01, 2014 to harmonize

different routes for foreign portfolio investments i.e. Foreign Institutional Investors

(FIIs), Sub Accounts and Qualified Foreign Investors, uniform entry norms, adoption

of risk based know your customer (KYC) norms etc. The monthly Data of variables were

collected from the websites, addressing bseindia.com, https://in.investing.com

/indices/s-p-cnx-nifty-historical-data, stats.oecd.org, SEBI and www.rbiindia.com for

the period from Jun 2014 to Dec 2016. The effect of Foreign Portfolio Investment (FPI)

is analysed with its determinants for Correlation, Co-integration and Casual

relationships for the period after the introduction of the FPI Regime. The first order

differences of the variables were tested. The Co-Integration test gives the existence of

one Co- integrating variable vector in the equations. The Equation at none shows the

p-value of 0.000 in both trace and Lmax test and confirming one co-Integrating vector

and there is a long- run relationship among variables and hence the null hypothesis of

no Co-Integration is rejected. The Granger causality gives the result that we can accept

the null hypothesis that FPI does not granger cause and effect ER. But the null

hypothesis is rejected that ER does not cause and effect FPI and there is a unidirectional

relationship between the variables. There are no causalities between FPI and

CPI/IIP/SENSEX/NIFTY/FER and vice-versa. The study has suggested that though FPI

has many advantages to the country but it should have certain limit that should not lead

to inflation where the prices may go up.

Key words: ER, SENSEX, NIFTY, CPI, IIP, FER, FPI

Determinants of Foreign Portfolio Investment and Their Effects on The Indian Stock Market

http://www.iaeme.com/IJM/index.as 106 editor@iaeme.com

Cite this Article: S. Raghavan and Dr. M. Selvam, Determinants of Foreign Portfolio

Investment and Their Effects on The Indian Stock Market. International Journal of

Management, 8(3), 2017, pp. 105–115.

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=8&IType=3

1. INTRODUCTION

Security Exchange and Board of India (SEBI) constituted a “Committee on Rationalization of

Investment Routes and Monitoring of Foreign Portfolio Investments” (the Committee), under

the Chairmanship of Shri K. M. Chandrasekhar, comprising representatives from Government

of India, Reserve Bank of India and various market participants. The Committee made

recommendations regarding harmonization of different routes for foreign portfolio investments

i.e. Foreign Institutional Investors (FIIs), Sub Accounts and Qualified Foreign Investors,

uniform entry norms, adoption of risk based KYC norms etc. The Board, in its meeting held on

June 25, 2013 accepted the recommendations of the Shri K.M. Chandrasekhar Committee.

SEBI (Foreign Portfolio Investors) Regulations, 2014

In order to implement the recommendations of the Committee, the SEBI (Foreign Portfolio

Investors) Regulations, 2014 (the Regulations) have been framed and the same have been

notified on January 07, 2014. The FPI regime shall commence from June 01, 2014. Salient

features of the Regulations are as under:

Major Salient features of the SEBI (Foreign Portfolio Investors) Regulations,

2014

Foreign Portfolio Investors (FPIs)

1. Existing Foreign Institutional Investors, Sub Accounts and Qualified Foreign Investors

(QFIs) shall be merged into a new investor class termed as “FPIs”.

2.

SEBI approved Designated Depository Participants (DDPs) shall register FPIs on behalf

of

SEBI Subject to compliance with KYC requirements.

3. FPI shall be required to seek registration in any one of the following categories:

• “Category I Foreign Portfolio Investor” which shall include Government and Government

related foreign investors etc;

• “Category II Foreign Portfolio Investor” which shall include appropriately regulated broad

based funds, broad based funds whose investment manager is appropriately regulated, university

funds, university related endowments, pension funds etc;

• “Category III Foreign Portfolio Investor” which shall include all others not eligible under

Category I and II foreign portfolio investors.

4. All existing FIIs and Sub Accounts may continue to buy, sell or otherwise deal in securities

under the FPI regime.

2. REVIEW OF LITERATURE

Kumar (2001) investigated the effects of FII inflows on the Indian stock market represented by

the SENSEX using monthly data from January 1993 to December 1997. Kumar (2001) inferred

that FII investments are more driven by Fundamentals and they do not respond to short-term

changes or technical position of the market.

Rai and Bhanumurthy (2004), in their research paper titled "Determinants of FII in India:

The Role of Return, Risk, and Inflation", tried to examine the determinants of FII flows in India.

S. Raghavan and Dr. M. Selvam

http://www.iaeme.com/IJM/index.as 107 editor@iaeme.com

The proposed hypothesis of the study was that risk and inflation in a domestic country (like

Indian economy) and return in a foreign market (like USA economy) would have an adverse

impact on the FII flows, whereas risk and inflation in foreign country (like USA economy) and

yield in domestic country (like Indian economy) would have a positive impact on the FII flows.

Sikdar et al (2006) studied the relationship between foreign capital flows (FDI, FPI) and

other economic variables during 1997 to 2003. The study observed that under the regime of

liberalization policy, the outcomes were highly surprising. The composition of capital inflow

had undergone a major change over these years. Dependence on foreign aid had come down

drastically and funds in the form of Foreign Portfolio Investment (FPI), Foreign Direct

Investment (FDI), external commercial borrowings and non- resident Indians deposits had

come to be recognized as the major sources of capital flows in India as concluded by this study.

Wang, Wang and Huang (2010) used the oil prices, gold price, and exchange rates of dollar

in contrast with currencies and stock markets of Germany, Japan, Taiwan, China and the USA.

This study derives results from empirical results that there exists co-integration and long-term

stable relationship among these variables in the mentioned countries except the USA.

Aynur PALA¹, Bilgin ORHAN ORGUN

2

(2015), in their research paper titled” The effect

of macro economic variables on foreign portfolio investments: an implication for Turkey”

Journal of Business, Economics & Finance ISSN: 2146 – 7943,Year: 2015 Volume: 4

Issue:1observed that the deposit interest rate, gross national income and current account balance

have had a positive effect on FPI.

Muhammad Afaq Haider

1

Muhammad Asif Khan

2

& Elyas Abdulahi

2

(2016)

, in their study

paper titled “Determinants of Foreign Portfolio Investment and Its Effects on China”,

International Journal of Economics and Finance, have stated that the GDP, Population growth,

Exchange rate, and External debt have significantly affected the Foreign Portfolio investment

of CHINA.

Many researchers have done their studies in India for FIIs regime only but not especially

on FPI. This study attempts to study the effect of FPI and its determinants on the stock market

after the introduction of FPI regime.

3. OBJECTIVES OF THIS STUDY

The main objectives of the study are:

• To identify the determinants of FPIs flows to India.

• To determine the existence of co-integrating vectors of Foreign Portfolio Investment with

Exchange Rate, Consumer Price Index, Index of Industrial Production, SENSEX, NIFTY and

Foreign Exchange Reserve.

• To check whether there exists causality among the selected variables.

4. SOURCES OF DATA

The study is completely based on secondary data collected from various data sources. To

analyse the co-integration and casual relationship of variables, the study considered the monthly

SENSEX and NIFTY data from bseindia.com and https://in.investing.com/indices/s-p-cnx-

nifty-historical-data respectively. The data for Exchange Rate and Consumer Price Index were

collected from stats. oecd.org and Foreign Institutional Investments from SEBI website. The

data on Index of Industrial Production and Foreign Exchange Reserve were from

www.rbiindia.com. The monthly Data cover the period from June 2014 to Dec 2016.

Determinants of Foreign Portfolio Investment and Their Effects on The Indian Stock Market

http://www.iaeme.com/IJM/index.as 108 editor@iaeme.com

5. RESEARCH METHODOLOGY

Foreign Portfolio Investment consists of total investment inflow in the country. Six variables

are taken into the account for a comprehensive study with Foreign Portfolio Investment and

those variables are chosen on the basis of previous literature which may influence the FPI. The

previous studies analyzed only a few variables. This study includes CPI which is a proxy of

Inflation and gives special attention to IIP.

In this study, the secondary data have been used to achieve its objective of identifying the

determinants of FPIs flows to India. The differenced time series based on monthly data for the

above mentioned period for all the variables under study have been used for analysis. If we fail

to take a difference when the process is non-stationary, regressions on time will often yield a

spuriously significant linear trend, and our forecast intervals will be much too narrow

(optimistic) at long lead times.

Variables

Dependent

variable

FPI = Foreign Portfolio Investment

Independent

variables

CPI = Consumer Price Index, FER =Foreign Exchange Reserve, IIP =Index of

Industrial Production (General), ER=Exchange Rate, =SENSEX and NIF = NIFTY.

Hypotheses of the study

To set out the results of the stated objectives, the following hypotheses are developed for the

study and tested using appropriate tools.

1) H

0

: FPI /ER/CPI/IIP/SENSEX/NIFTY/FER is non-stationary time series or has unit root.

H

1

: FPI/ER/CPI/IIP/SENSEX/ NIFTY/FER is stationary time series or has no unit root.

2) H

0

: There is a Co-integration relationship between FPI and ER/CPI/IIP/SENSEX/

NIFTY/FER.

H1: There is no Co-integration relationship between FPI and ER/CPI/IIP/SENSEX/

NIFTY/FER.

3) H

0

: FPIs does not granger cause CPI/ FER/IIP/ ER/ SENSEX /NIFTY.

H

1

: FPIs granger causes CPI/ FER/IIP/ ER/ SENSEX/ NIFTY.

Tools applied

To test the stated hypotheses, the following research methods have been used for the study:

1) Descriptive Statistics

Descriptive statistics are used to evaluate the mean, median, standard deviation and kurtosis of

the selected variables.

2) Correlation Test

Correlation coefficient test is used to find out the relationship between the variables.

3) Unit Root Test (Augmented Dickey Fuller Test)

Prior to testing causality test, there is a need for checking whether the data are stationary or not.

In this study, the Augmented Dickey-Fuller Test (ADF) proposed by is applied to find out the

same.

S. Raghavan and Dr. M. Selvam

http://www.iaeme.com/IJM/index.as 109 editor@iaeme.com

4) Co-integration Test

Co-integration theory was developed by Granger to examine the long-run relationship. The

purpose of co-integration test is to determine whether a group of non-stationary series is co-

integrated or not and also explores the long-run equilibrium relationship among the variables.

The two types of Johansen test is employed, first, the λ trace statistics test whether the number

of co-integrating vector is zero or one, then the λ max statistic tests whether a single co-

integration equation is sufficient. Both the test statistics are given as follows:

Tr a ce (r) = − T ∑l o g ( 1 − λ )

i=r+1

(1)

λ = T l o g ( 1 − λ )

In this framework, it is desirable to obtain at least one co-integrating vector, r = 1 to

establish the model. The Trace test is a joint test that tests the null hypothesis of no co-

integration (H0: r = 0) against the alternative hypothesis of co-integration (H1: r > 0). The

Maximum Eigen value test conducts tests on each Eigen value separately. It tests the null

hypothesis that the number of co-integrating vectors is equal to r against the alternative of r+1

co-integrating vectors. A significantly non-zero Eigen value indicates a significant co-

integrating vector.

5) Granger Causality Test

It is important to note that correlation analysis is not sufficient to have an in-depth study of

relationship between the variables. There exists a more relevant concept called the concept

of causality. This test is conducted to know whether the behaviour of one variable is

caused by another given variable or vice versa. In order to know the causality between the

given variables under consideration, granger causality econometric model has been applied for

this purpose.

6. ANALYSIS

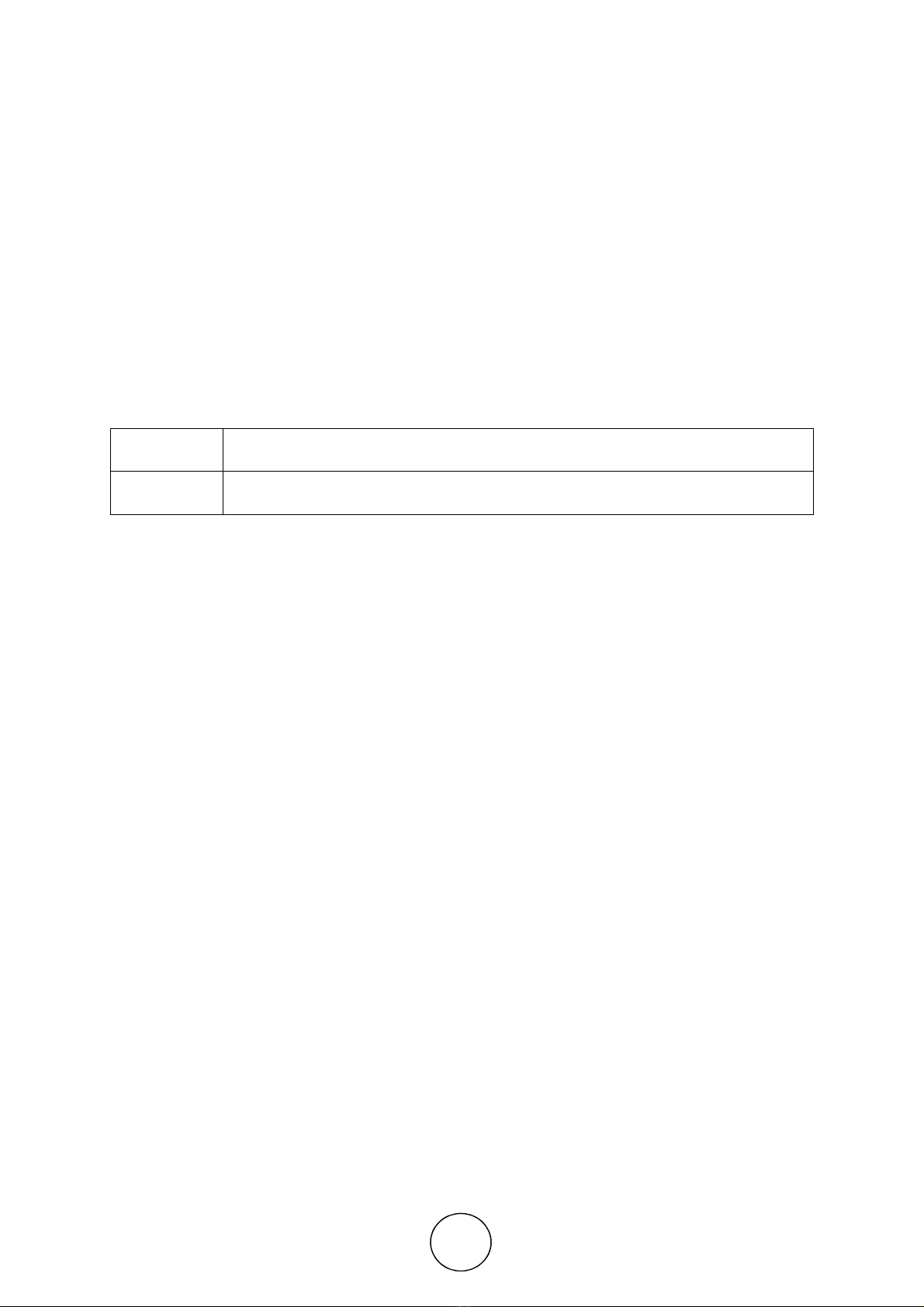

Table1 gives the summary statistics of FPI and its determinants. Regarding the normality, the

value of skewness and kurtosis are considered. The Ex.kurtosis values of NIFTY, SENSEX

and IIP show that the data are sharp. The variables are not distributed normally in full, but

are distributed very close to normal distribution as the median values of variables are very

close to average values except in FPI.

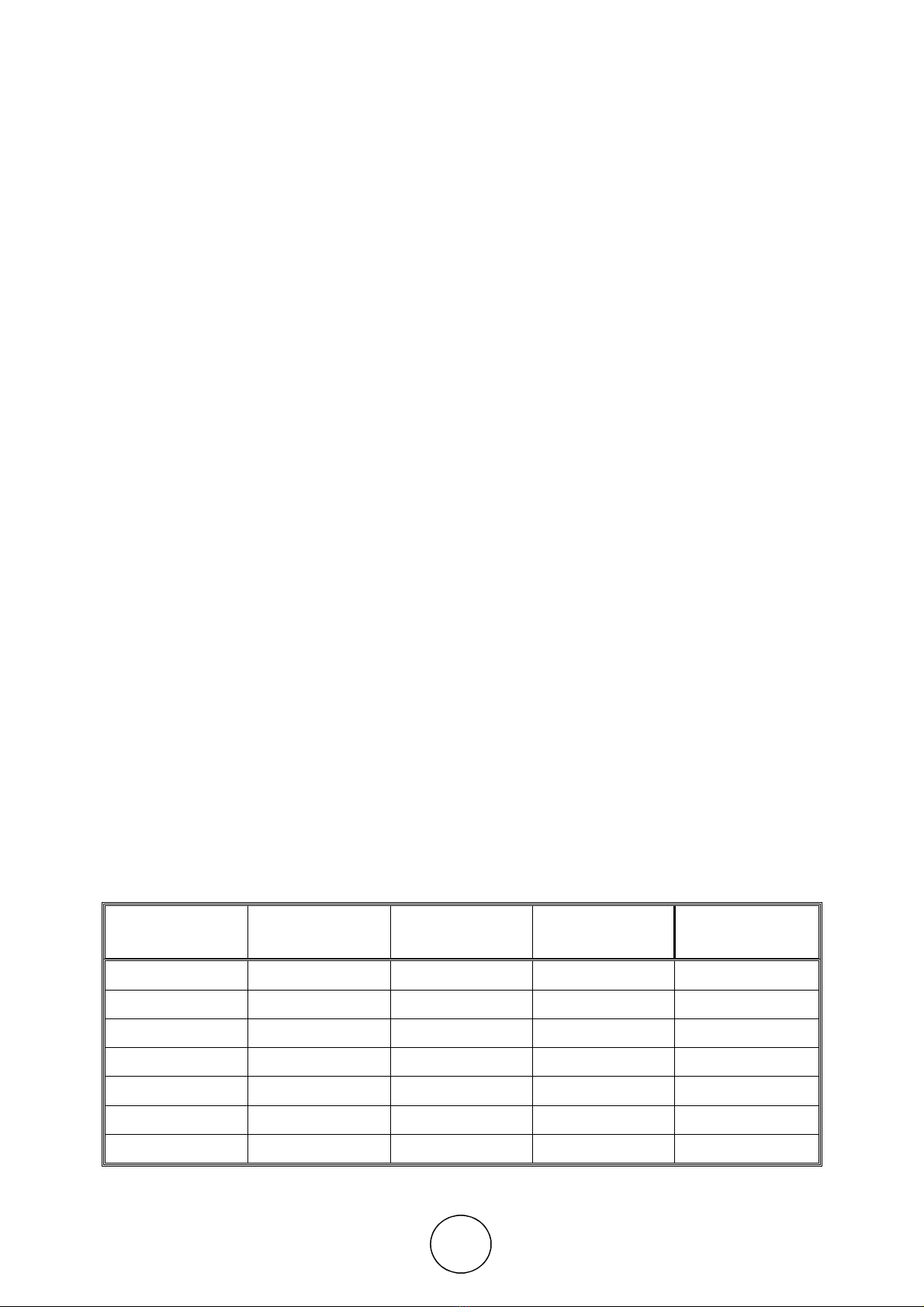

Table 1 Summary Statistics, using the observations from 2014:06 to 2016:12

Variables Mean Median Minimum Maximum

FPI 6608.84 12225.0 -39396.0 36046.0

ER 64.6295 65.0723 59.7307 68.2377

CPI 150.218 151.210 139.840 159.170

IIP 179.245 179.300 165.100 198.700

SENSEX 26945.2 26668.0 23002.0 29361.5

NIFTY 8183.53 8185.80 6987.05 8901.85

FER 97198.7 96172.1 75052.1 122982

![Câu hỏi trắc nghiệm và bài tập Thị trường chứng khoán [mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2026/20260127/hoahongcam0906/135x160/57691769497618.jpg)