http://www.iaeme.com/IJM/index.asp 145 editor@iaeme.com

International Journal of Management (IJM)

Volume 7, Issue 6, September–October 2016, pp.145–155, Article ID: IJM_07_06_016

Available online at

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=7&IType=6

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

A STUDY OF INFORMATION AND COMMUNICATION

TECHNOLOGY (ICT) ADOPTION BY SHG’S IN

BANKING ACTIVITIES - DHARWAD DISTRICT

Dr. Vinod N Sambrani

Associate Professor, Kousali Institute of Management Studies,

Karnatak University, Dharwad, India.

ABSTRACT

We all understand that, technology has been playing a major part in our daily lives. And ICT has

established a vast platform for drastic development. Information exchange and information update

is the need of the hour. People need up-to-date information, either for themselves or for their

organization, and this need can only be meet with utilizing ICT platform. On the other hand SHG’s

have been playing a significant role in micro-finance, especially in rural areas empowering the rural

women resulting in better livelihood and lifestyle, where most of the people are illiterates or are with

just primary education. These SHG’s are linked with many banking institution for all their savings.

This article aims to understand the role of technology that can be introduced by banks to ease the

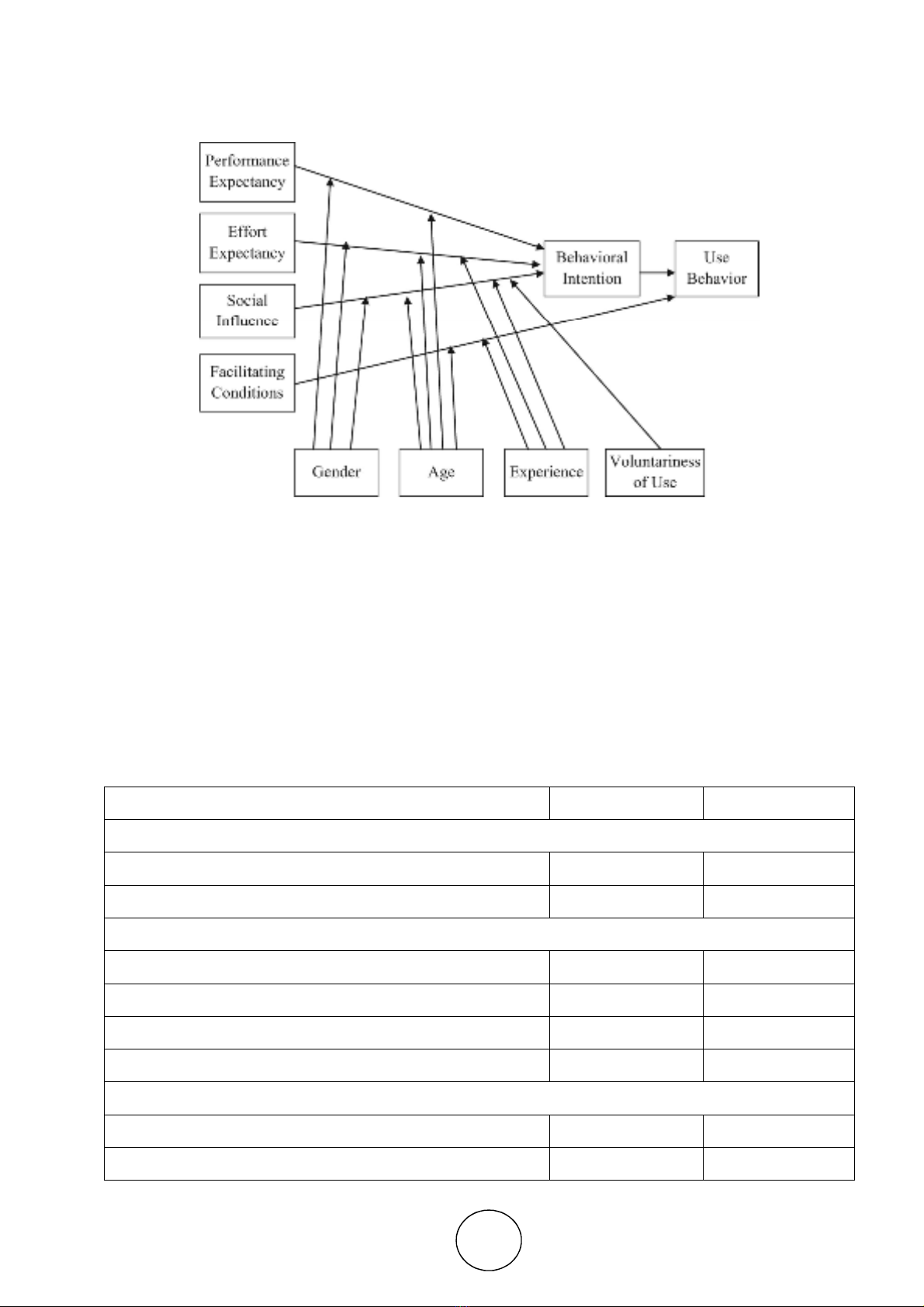

lives of many members of the SHG’s in their banking activities. UTAUT Model developed by

Venkatesh et.al (2003) has been considered and used to ascertain the users acceptance and adoption

of technology in the region of study.

Key words: Information and Communication Technology, UTAUT Model, Self Help groups,

Technology Adoption, Technology Acceptance, Rural Banking, Micro-financial Institutions.

Cite this Article: Dr. Vinod N Sambrani, A Study of Information and Communication Technology

(ICT) Adoption by SHG’s in Banking Activities - Dharwad District. International Journal of

Management, 7(6), 2016, pp. 145–155.

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=7&IType=6

1. INTRODUCTION

Information Technology (IT) plays a significant role in todays’ world, and financial institutions are the

backbone of the any economy. The IT revolution has opened many avenues for Indian Banking sector at

present. Almost all the nationalized banks in India are using technology based solutions to overcome the

competition and address the needs of the customer in a more befitting manner. The manual operations in

traditional banking have drastically been reduced with the use of IT applications, thus creating a centralized

environment from distributed environment. This impact of IT in banking sector has revolutionized the

process being done with a faster, effective and efficient pace. Bankers are offering customized products and

services to their customers using new tools and techniques, which help in understanding the consumer needs.

IT impact in this sector is very difficult to be measured.

Dr. Vinod N Sambrani

http://www.iaeme.com/IJM/index.asp 146 editor@iaeme.com

On the other hand, the Indian rural consumption pattern has changed drastically and is growing at a faster

rate, compared to towns and cities, according to a report by credit rating agency CRISIL Ltd. The non-

agricultural job opportunities and government initiatives of employment generation schemes have

contributed in large for such a growth in terms of raise in house hold incomes. However, technologies for

rural communities are being developed by many voluntary organizations. But, the fact remains that these

technologies have barely touched the rural population. Rural development is in place and happening in terms

of improvement in infrastructures, access to better resources, education, health and hygiene. It is most

common to have access to at least one mobile phone in every rural households.

A sustaining livelihood in these fast growing villages and cities can only be achieved through a most

important driver “Information Exchange”. ICT has been playing a vital role in the development of rural

India, increasing its growth in a drastic manner. Technology has largely been playing a dynamic role in our

day to day life, need it be a community radio or mobile phone based farmer information services or health

related technological solutions. It is clearly evident that, most of this current fast growth is only because of

the technology dissemination in small to medium and large scales across India.

Opportunities are still abundant to scale and integrate these technologies amongst the rural population,

with consistent effort to simplify the processes and finding better ways to make them affordable to improve

the lives of people in India.

People with common mindsets have all the time come together to either to overcome their difficulties or

for betterment of their lives. When compared to such groups, Self-Help Groups (SHGs) have unique

characteristics, and different working patterns. In late 1980’s community development discipline was

established sharing the concepts of empowerment. In a couple of decades the concept of SHGs have deep

rooted drastically in India.

In most cases, the people in SHGs are the ones who are most affected by a specific issue, who come

together and support each other to overcome such issues affecting their lives. Activities that groups do

include community education, information sharing, mutual support etc.

Definition: Self-Help Group

“Self Help group (SHG) is a self-governed, peer-controlled small and informal association of the poor,

usually from socio-economically homogeneous families who are organized around savings and credit

activities.”

Most of the funding for such activities comes from the group members regular saving deposited on

weekly basis. During their interactions/ meetings they discuss on common issues and plan to overcome them

with solutions through consultation. They also share vital information across the group and make diligent

efforts to improve their literacy as well as health. SHG’s are not charity or simply community based groups.

Although the work is usually unpaid, members work to change their own economic and financial conditions

and the support is mutual. The knowledge base of self-help mutual support groups is experiential,

indigenous, and rooted in the wisdom that comes from struggling with problems in concrete, shared ways.

2. LITERATURE REVIEW

Most of the SHGs are linked with NGO’s active in their respective areas for assistance of any kind or

dependent on the co-operative banks or societies or micro-financial institutions for their financial aids. SHGs

have another very important role to play particularly in the transfer of technology to user group population.

Until mid-1960’s, the Co-operative banking sector was entrusted the responsibility of fulfilling the credit

needs of the rural people in India. With the advancement in technology, commercial banks started to

penetrate by expanding their branches and direct lending in the rural areas, especially for the agricultural

sector. The massive branch proliferation of nationalized banks helped the people in farthest areas to have

access to financial services. According to Bell, 1990 the growth and extension of rural credit banished village

financiers to a substantial extent and led to modest increases in comprehensive crop output, strident increase

in the use of fertilizers/ pesticides and in investments in tangible assets like tractors, pump sets and animal

A Study of Information and Communication Technology (ICT) Adoption by SHG’s in Banking Activities -

Dharwad District

http://www.iaeme.com/IJM/index.asp 147 editor@iaeme.com

stocks. Binswanger and Khandker, 1992 noted that, a substantial positive effect is seen in non-farm

employment.

The Information Technology (IT) saga in Indian Banking sector commenced from the mid-eighties when

the Reserve Bank of India (RBI) took upon itself the task of promoting computerisation in banking to

improve customer services, book keeping, Management Information System (MIS) to enhance productivity.

RBI has played the guiding role which helped banks in achieving various objectives such as the introduction

of MICR based cheque processing, Implementation of the electronic payment system such as RTGS (Real

Time Gross Settlement), Electronic Clearing Service (ECS), Electronic Funds Transfer (NEFT), Cheque

Truncation System (CTS), Mobile Banking System etc. The Payment and Settlement Systems Act, 2007

(effective from August 12, 2008) designates the RBI as the authority for regulation and supervision of

payment systems in India.

Electronic Banking as referred by Suoranta & Mattila (2004); Laforet & Li (2005); Laukkanen (2007);

Sripalawat et al. (2011) are all related to the use of Internet Banking and Mobile Banking. As we understand,

both internet banking and mobile banking are two different aspects for banks to deliver their services.

Scornavacca & Hoehle (2007) also refer in their article that, customers also acquire these services for all

their banking activities. Riquelme & Rios (2010) state that, customers in order to use Internet Banking are

required use this service through computers connected to Internet, whereas for mobile banking, they are

using through wireless devices. Suoranta & Mattila (2004), and Singh et.al, (2010) found that, time-critical

customers preferred mobility as their first choice with the use of mobile banking. Koenig-Lewis et al. (2010)

also found that, online banking was the only cheapest mode of delivering banking services.

Despite of having many studies been carried out with respect to technology usage in banking sector. And

relevant developments and advancements have already taken place. Still there is a lot need to study and

improvise with the current scenarios.

3. OBJECTIVES OF THE STUDY

• To ascertain the technology adoption by the members of SHG’s.

• To know and understand the need of technology by SHG members in banking activities.

• To understand the Bank roles in disseminating ICT initiatives to the SHG’s.

4. RESEARCH METHODOLOGY

The study conducted is quite exploratory in nature, because no known hypothesis was developed. Hence the

objective called for an exploratory research instead of a conclusive one.

The information needed were not available from secondary sources hence involves primary data

collection. Primary data was collected after using structured questionnaire developed in reference with the

UTAUT model mentioned below.

Sampling Technique: Random Sampling

Sampling Unit: Member or Leader of SHG’s

Sample Size: 150 SHG’s

Population of Study: SHG’s in Dharwad District

4.1. Model Used

After analysing various other literature on technology acceptance, the use of Unified Theory of acceptance

and Use of technology (UTAUT) model is found to be suitable for the said study.

Dr. Vinod N Sambrani

http://www.iaeme.com/IJM/index.asp 148 editor@iaeme.com

The model is as follows:

Figure 1 Source: Venkatesh et.al., (2003)

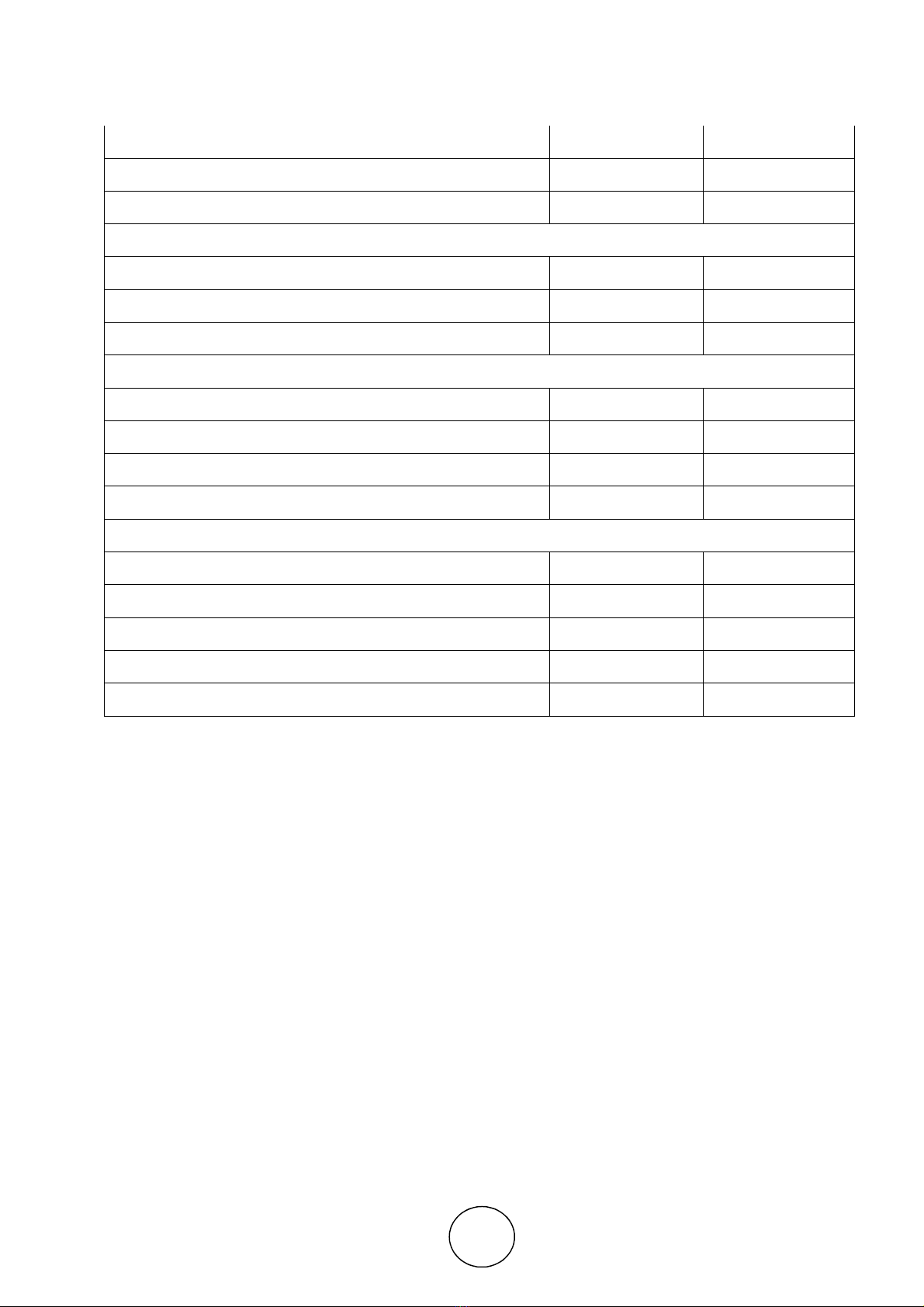

5. FINDINGS

A pilot study using the earlier questionnaire was done to validate the investigation mechanism. Feedback

about the layout of the questionnaire and question ambiguity was obtained. Relevant changes were done to

the questionnaires as considered suitable. The revised questionnaires were circulated across all the talukas

and villages in the district. The data collected using the questionnaire was tabulated, analyzed and presented

in tables and descriptions. The demographic profile of respondents were also collected. Table 1 exhibits the

sample characteristics, usage and awareness.

5.1. Demographic Profile of the Respondents

Items/Parameters Frequency Percentage

Gender

Male 11 7.3

Female 139 92.7

Age Group

18-23 9 6.0

24-28 11 7.3

29-34 59 39.3

Above 35 71 47.3

Education Level

Primary 56 37.3

Secondary 52 34.7

A Study of Information and Communication Technology (ICT) Adoption by SHG’s in Banking Activities -

Dharwad District

http://www.iaeme.com/IJM/index.asp 149 editor@iaeme.com

Technical or Vocational 5 3.3

University 20 13.3

No formal Education 17 11.3

Duration of Bank operations

1 Year 7 4.7

2 Years 16 10.7

Above 2 Years 127 84.7

Frequency of ICT Enabled Banking Services usage

Never 119 79.3

Once in a week 4 2.7

Once a month 24 16.0

Many times in a month 3 2.0

ICT enabled Banking services awareness

No Awareness 119 79.3

Mobile Banking and ATM 1 .7

Mobile Banking and SmartPhone App 4 2.7

Internet Banking 2 1.3

ATM/ E-Kiosk 24 16.0

Table 1 Demographic Profile of Respondents

Table 1 exhibits that, 92.7% of the respondents were females, as compared to males. This is quite obvious

because, most of the established SHG’s are created to empower women in these areas. Very few male SHGs

are active and functional. 47.3% of the respondents are above 35 in age, and either leader(s) or second

leader(s) member in the groups. 88.7% of the respondents are literates with at least primary schooling

(37.3%). About 84.7% of the respondents are directly involved in banking transactions.

6. ASSESSMENT OF VALIDITY

Construct power is a concern of seriousness between the constructs. For the current research, 19 different

items are selected, classified into five different constructs in the UTAUT model. The renamed abbreviation

and descriptive figures of each construct and item are presented in Table 2:

![Hệ thống quản lý cửa hàng bán thức ăn nhanh: Bài tập lớn [chuẩn nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20251112/nguyenhuan6724@gmail.com/135x160/54361762936114.jpg)

![Bộ câu hỏi trắc nghiệm Nhập môn Công nghệ phần mềm [mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20251111/nguyenhoangkhang07207@gmail.com/135x160/20831762916734.jpg)