FOREIGN TRADE UNIVERSITY

HO CHI MINH CITY CAMPUS

---------***--------

ENGLISH PRESENTATION REPORT

TOPIC:

FINANCING IN FOREIGN TRADE

GROUP 19

Member Student ID

Nguy n Văn Thànhễ1501015494

Tr n Quy n Linhầ ề 1501015273

Nguy n Tr ng Nguyênễ ườ 1501015373

Tr n Hoàng S nầ ơ 1501015470

Ph m Hoàng Phúcạ1501015428

Nguy n Minh Th ngễ ắ 1501015488

Nguy n Thanh Ph ngễ ươ 1501015436

Tr n Ng c Thu Linhầ ọ ỳ 1501015271

2

TABLE OF CONTENTS

TOPIC:

FINANCING FOREIGN TRADE

Group 19

1. Payment Terms in Foreign Trade

* Four Principle Means:

- Cash - in - advance

With cash-in-advance payment terms, an exporter can avoid credit risk because payment is

received before the ownership of the goods is transferred.

- Letter of Credit (LC)

3

Letters of credit (LCs) are one of the most secure instruments available to international

traders. An LC is a commitment by a bank on behalf of the buyer that payment will be made

to the exporter, provided that the terms and conditions stated in the LC have been met, as

verified through the presentation of all required documents.

- Drafts

A draft may be written with virtually any term or condition agreeable to both parties. A draft

is a check that is drawn on a bank’s funds and guaranteed by the bank that issues it.

- Open account

An open account transaction is a sale where the goods are shipped and delivered before

payment is due, which in international sales is typically in 30, 60 or 90 days.

1.1 . Cash in advance

The seller requires receipt of payment from the buyer before shipping goods. Payment may be

made by wire-fund transfer from the buyer’s bank to the seller’s bank, or by company check,

credit card, or other agreed upon means.

4

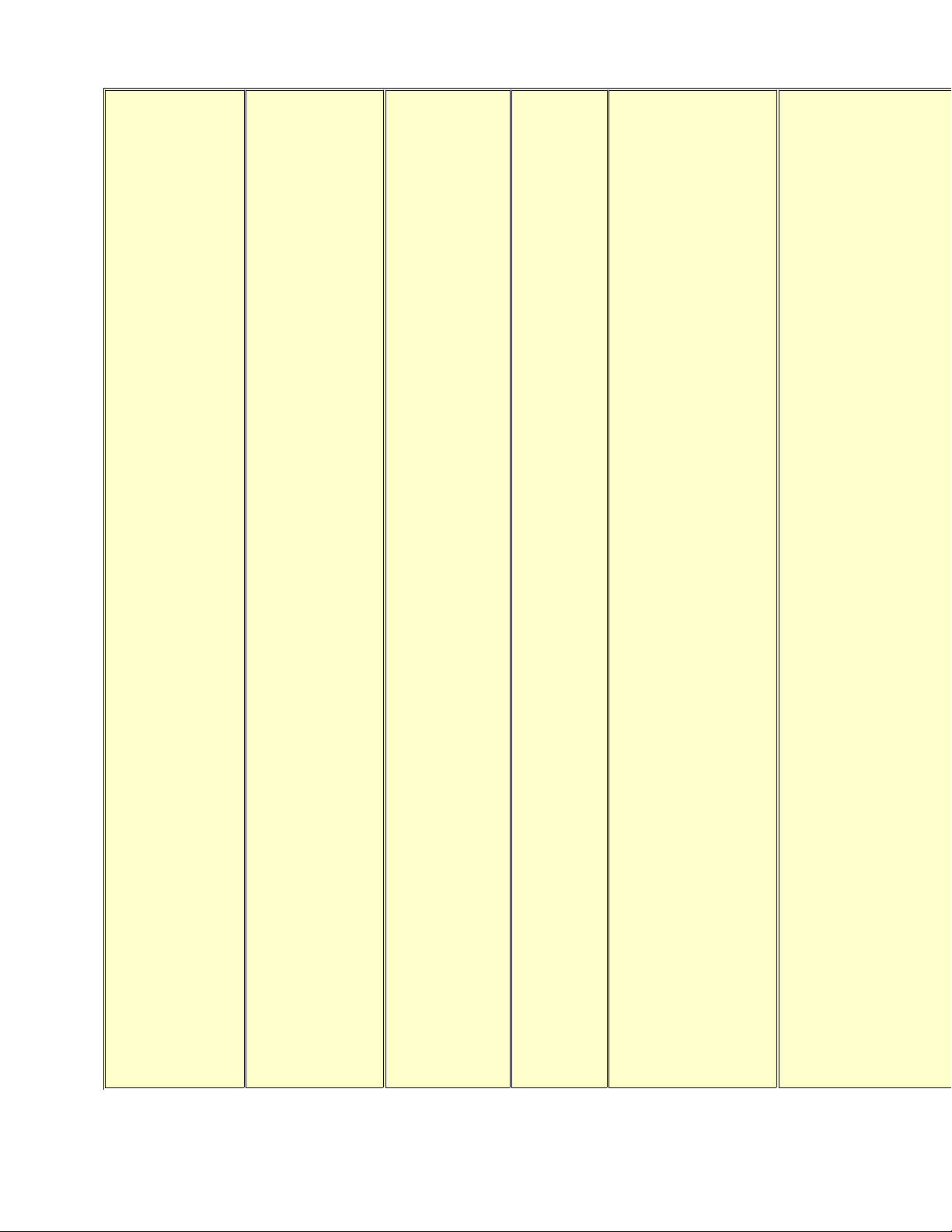

Method Usual Time

of Payment

Goods

Available

To Buyer

Risk

to

Seller

Risk to Buyer Comments

5

![Thẩm định dự án đầu tư Ngân hàng BIDV: Bài tiểu luận [chuẩn nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20251018/kimphuong1001/135x160/7231760775689.jpg)