http://www.iaeme.com/IJMET/index.asp 1758 editor@iaeme.com

International Journal of Mechanical Engineering and Technology (IJMET)

Volume 10, Issue 03, March 2019, pp. 1758-1763, Article ID: IJMET_10_03_177

Available online at http://www.iaeme.com/ijmet/issues.asp?JType=IJMET&VType=10&IType=3

ISSN Print: 0976-6340 and ISSN Online: 0976-6359

© IAEME Publication Scopus Indexed

GENDER HETEROGENEITY AND FINANCIAL

PERFORMANCE OF LISTED NIGERIAN

COMPANIES

Adetula, D.T., Owolabi, F., Egbide, B.C. and Adeyemo, K.

Department of Accounting, Covenant University,

Canaan land, Nigeria

ABSTRACT

This study investigated the economic impact of gender diversity on Board

composition of companies listed on the Nigerian Stock Exchange (NSE). Based on the

grouping of fifty most capitalized companies on the NSE into companies with no female

on board and those with at least one female on the board, the firm performance was

analyzed with Mann Whitney U -test over a three-year period. We also examined

whether there was any significant difference between the performance of boards with

only one female and those with more than one female. The results show no significant

difference in the performance of both groups. This is due to moderately heterogeneous

board composition as a result of few females in top level decision-making. We

recommend a policy mandating listed companies to evaluate their employment and

selection methods regarding nomination and promotion into boards and management

teams.

Key words: Economic Performance, Gender Diversity, Nigerian Stock Exchange

Cite this Article: Adetula, D.T., Owolabi, F., Egbide, B.C. and Adeyemo, K., Gender

Heterogeneity and Financial Performance of Listed Nigerian Companies, International

Journal of Mechanical Engineering and Technology 10(3), 2019, pp. 1758–1763.

http://www.iaeme.com/IJMET/issues.asp?JType=IJMET&VType=10&IType=3

1. INTRODUCTION

Nigeria is the most populous country in Africa with one hundred and seventy three million and

six hundred people [1]. Of this number, women account for 49% but grossly under-represented

on the senior executive and board positions in the one hundred and ninety-two (192) firms listed

on The Nigerian Stock Exchange (NSE) as at 2013 [2]. This is however, contrary to developed

world and a few developing world economies that strive to achieve an increased number of

females’ participation in corporate board rooms [3]. Such countries aim at increasing females’

participation because directors in most boardrooms around the world are substantially males.

In order to achieve increase in females’ participation, a number of capital market regulators

have introduced legislations imposing gender quotas or mandatory disclosure of number of

female for boards of listed companies [4].

Adetula, D.T., Owolabi, F., Egbide, B.C. and Adeyemo, K.

http://www.iaeme.com/IJMET/index.asp 1759 editor@iaeme.com

The motivation for the study was aroused from the empirical results of the previous research

studies which are somewhat mixed [5], [6]. Some researchers claim that gender diversity has

positive impact on company by enhancing growth and monitoring process [5],[6],[7] while

others discovered that board gender heterogeneity has no impact on economic performance of

organization [8],[9]. In spite of the importance of equality policies aimed at breaching the gap

and many research associated with gender diversity in the developed world, there is still limited

research on this area in Nigeria. The study fills this gap by evaluating relationship between

gender heterogeneity and company’s performance of listed companies on the NSE.

The sections of the paper are arranged in this order: section two is on literature review and

theoretical background; section three describes research method and section four focuses on

findings, recommendations and policy implications.

2. LITERATURE REVIEW

In the study carried out by [10] in 2013, they claimed there had been scarcity of women

occupying top positions in Nigerian organizations. This prevents their access to and control

over resources which in turn limit women economic independence. Women comprise of greater

part of informal sector workers in Nigeria [11]. The research on gender heterogeneity in Ghana

and Nigeria banking sectors found a wider gender disparity against women [12]. The study of

[13] revealed that women are under-represented in senior management positions.

The results of examination of whether companies governed by female CEOs show the same

performance as companies led by male CEOs reveal that the gender mix of the CEO is crucial

to financial performance of organizations [14]. In addition, the study investigated whether the

gender heterogeneity of the CEO influences the risk level of the firm and if the incentives given

to female CEOs have reduced risky elements compared to those given to their male

counterparts. They found that companies’ risk level is smaller when the CEO is a female

compared to when the CEO is a male. [15] examined the influence of corporate board

characteristics namely board size, board skill, board nationality, board gender heterogeneity,

board ethnicity and CEO duality on the financial performance of Nigerian listed companies

between 1991 and 2008. The study found that board size, CEO duality and gender heterogeneity

have a negative relationship with firm performance. However, the emphasis of this study was

not specifically on impact of gender heterogeneity and profitability of Kenyan banks.

According to [16] who examined the relationship between board gender diversity and

performance of commercial banks in Kenya, both variables have no relationship using banks in

Kenya. The reason attributed to the result was because in the Kenyan banking sector, out of a

typical board size female directors are only a mere 12.5% of the entire board.

In Nigeria, the highest number of female representation on board is in the Alternative

Security Market (ASeM) sector of the NSE classification and this is just estimated at 20% based

on the NSE fact book of 2012/2013 reporting period. The next two sectors are the financial

services and construction/real sector with just 13% women representation each which are

moderately heterogeneous boards. The moderately heterogeneous board composition as a result

of few females in top level decision-making may be one of the reasons for Nigeria’s

underdeveloped stock market. The evidence from the research of team structures confirm that

in a team setting, “highly heterogeneous teams will be more impactful than moderately

heterogeneous ones” [17]. Applying this to gender diversity implies that an independent group

of males or females or a team of an almost equal number of both sexes will have a better firm

performance than just merely having a domination of one sex with just a few of the other.

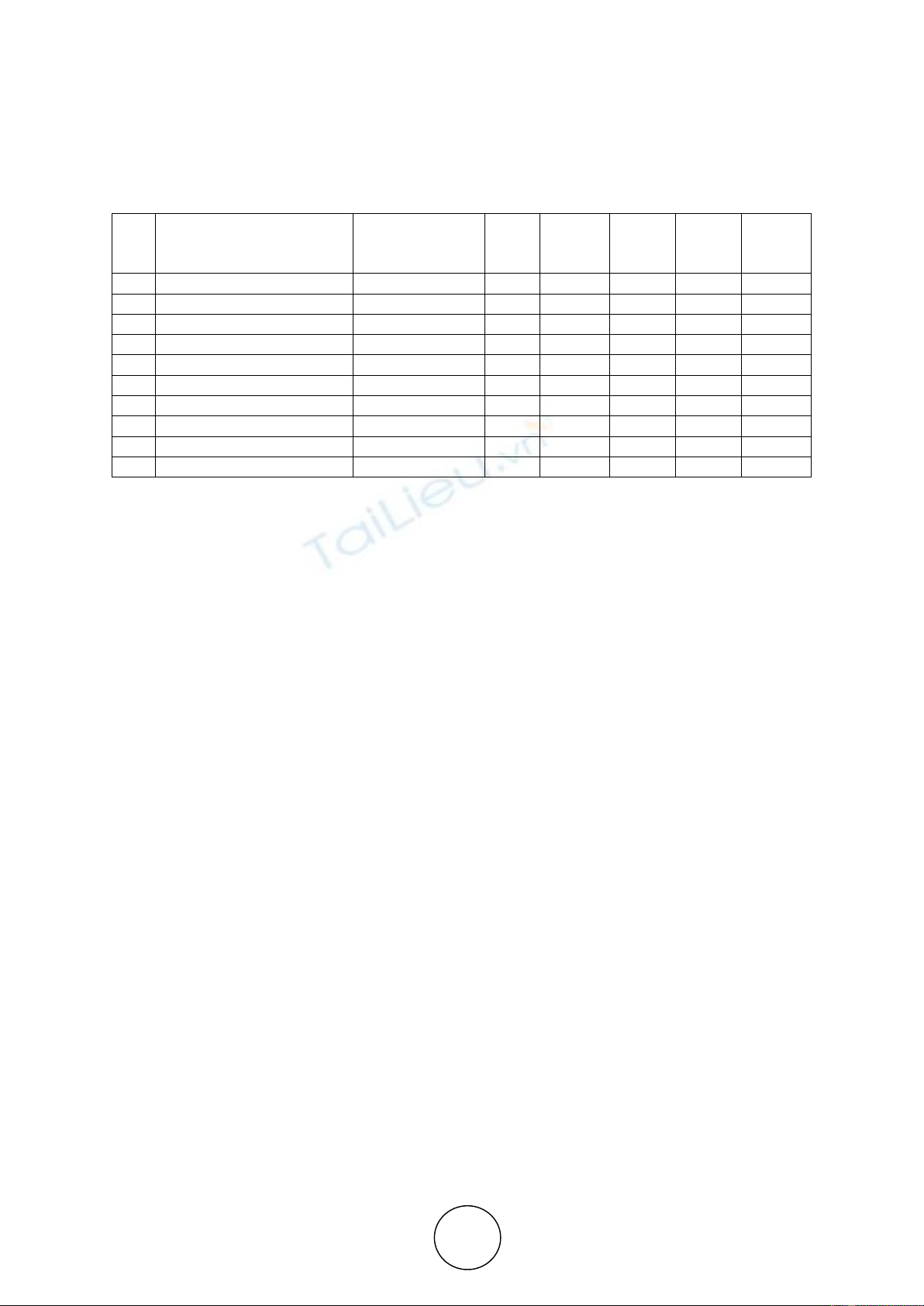

Thus, increasing percentage of women at top level management should be of paramount

interest if Nigeria would not fall behind in an ever increasingly competitive world. The table

below buttresses that women are grossly underrepresented in boards of quoted companies on

Gender Heterogeneity and Financial Performance of Listed Nigerian Companies

http://www.iaeme.com/IJMET/index.asp 1760 editor@iaeme.com

the NSE. Table 1 presents the summary of board composition of the fifty (50) most capitalized

companies as at the end of year 2013 as used in this study.

Table 1 Gender Composition of Fifty Most Capitalized Companies in 2012/2013 Reporting Period

Source: Compiled from Factbook, 2012/2013

2.1. Theoretical background

Economic performance is crucial to the stakeholders of companies because it could be used to

attach value to the companies. Among the ways of measuring economic performance of firms

are Return on Assets (ROA) and Tobin’s Q. ROA is a measure of the overall efficiency of

management in generating returns to investors with its available total assets [18],[19]. The study

used ROA to gauge company performance because ROA is the most commonly used proxy to

test firm’s economic performance [20], [21]. Also, it may represent the interests of shareholders

and measure performance better than other method in line with Signaling theory.

Signaling theory states that those charged with day-to-day running of the organization have

tendency to maintain dividend policy at desired level. This is because the dividend will be

reacted to by foreign investors as a signal delivered by the company. Hence, the expectation

would be that a high dividend rate brings about an increased future cash flow. By this, ROA

can indicate improved future cash flow to attract external investors. ROA is obtained from the

net profit after tax and issued as the basis for calculating net cash flow. Conversely, Tobin’s Q

which is the ratio of market value to the total assets of a firm is used to measure the firm’s value

[21], [22], [23].

3. RESEARCH METHOD

This study investigated the economic impact of gender diversity on the board of companies

listed on the Nigerian Stock Exchange. The companies investigated were the fifty most

capitalized quoted companies on The NSE. The companies were grouped into two independent

groups. The first group was made up of companies with no female on board while the other

comprised of at least one female on board. The study also examined whether there is a

significant difference between the performance of companies with only one female on board

and those with more than one female on board. The performances of the groups were evaluated

using the Return on Assets (ROA) and Tobin’s Q ratio. The data were analyzed with Mann-

Whitney U test. This method of test was used because the study investigated whether or not

there is a difference in the performance of two independent groups and to overcome the

problems associated with t-test.

S/N

Sector

No Of

Companies

Male

Female

Total

Male

%

Female

%

1

Agriculture

2

19

1

20

95

5

2

Conglomerates

2

16

3

19

84

16

3

Construction/Real Estate

3

28

2

30

93

7

4

Consumer Goods

14

127

15

142

89

11

5

Financial Services

16

193

31

224

86

14

6

Healthcare

1

9

1

10

90

10

7

Industrial Goods

5

31

3

34

91

9

8

Oil&Gas

6

49

6

55

89

11

9

Services

1

8

1

9

89

11

TOTAL

50

480

63

543

88

12

Adetula, D.T., Owolabi, F., Egbide, B.C. and Adeyemo, K.

http://www.iaeme.com/IJMET/index.asp 1761 editor@iaeme.com

The period covered by the study was from 2011 to 2013. The choice of this period is

necessitated by amendment in Corporate Governance codes in 2010 by some advanced

countries requiring public companies to integrate gender diversity, among other factors, with

board composition. Examples of such countries are Australia, Belgium, France, Germany and

United Kingdom [4]. The year 2011 was the first full year after this amendment.

3. FINDINGS, RECOMMENDATIONS AND POLICY IMPLICATIONS

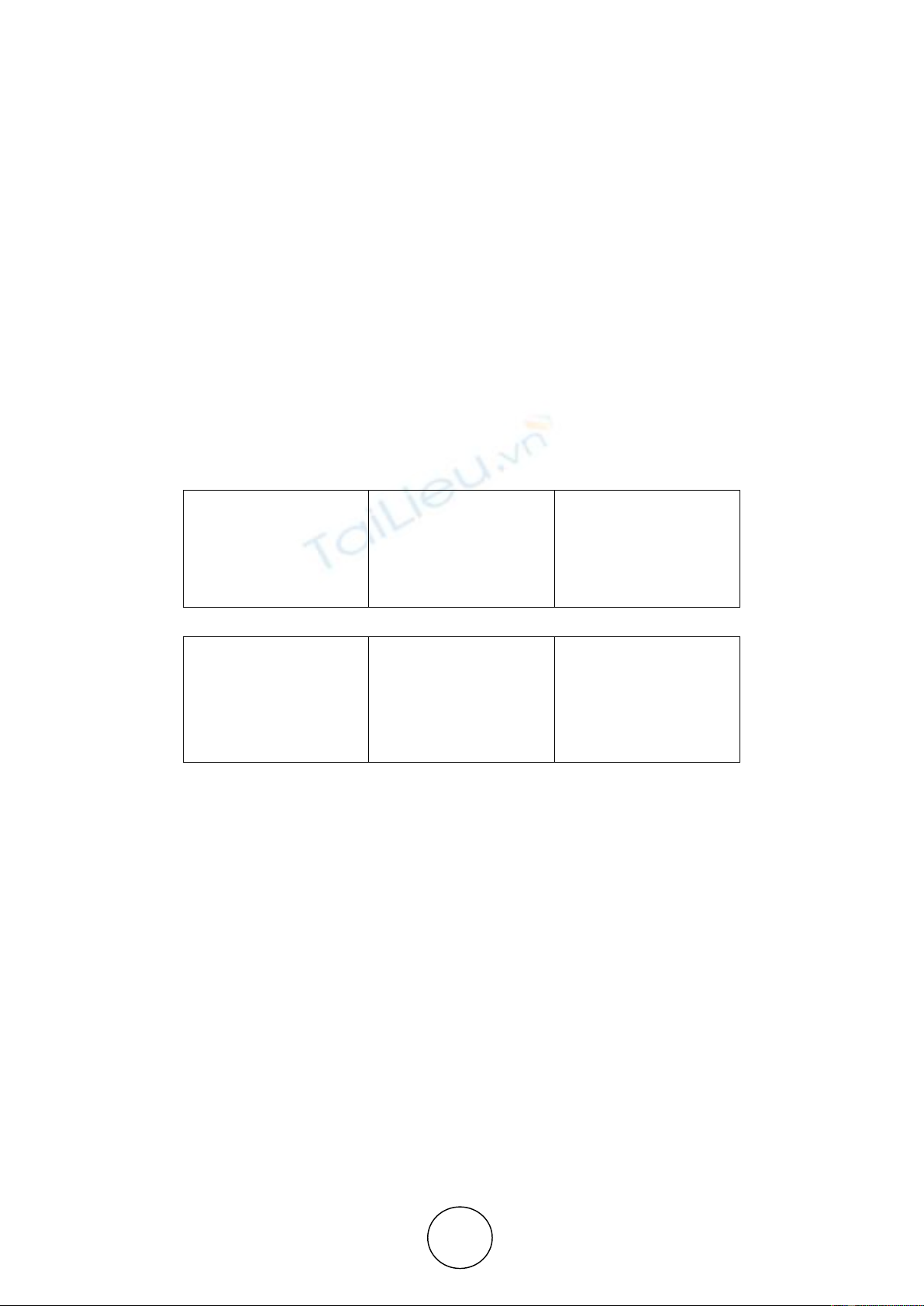

Based on the results of the test which was conducted to compare the ROA and Tobin’s Q of

quoted companies with no female on board and those with at least one female on board, the

study found no significant difference between the performances of firms in the independent

groups. The result of the statistics is presented in table 2.

Furthermore, the study also found a non-significant difference between ROA and Tobin’s

Q of firms with only one woman on board versus those with more than one woman on board

for the period studied. The result is presented in table 3. These results are in line with results of

research conducted by [24].

Table 2 Result of Analysis for no Female on Board Vs At Least One Female on Board

U

z

p

r

ROA

1623

-0.819

0.413

0.07

Tobin’s Q

1598

-0.945

0.345

0.08

Table 3 Result of Analysis for Only One Female on Board Vs More than One Female on Board

U

z

p

r

ROA

859

-1.853

0.064

0.19

Tobin’s Q

922

-1.377

0.169

0.14

The z values are -0.819 and -0.945 with a significance level of p=0.413 and p = 0.345 for

ROA and Tobin’s Q respectively from table 1. Since the p values are not less than 0.05, it

implies no statistical significant difference in the performance of boards with or without

women. In addition, from table 2, the z values are -1.853 and -1.377 with significance level of

p = 0.064 and 0.169 for ROA and Tobin’s Q respectively. The result also shows an insignificant

difference in the performance of boards with only one female and those with more than one

female. This may be as a result of gross under-representation of females on the senior executive

and board positions of listed firms on the NSE [2]. This can be implied from the findings of

[17], that in a team setting, heterogeneous teams will be more effective than moderately

heterogeneous ones. Table 1 shows that listed firms on the NSE are moderately heterogeneous

which may be the reason why the results are not significant. Consequently, qualified women

should be given equal opportunities to sit on board positions as their male counterparts.

We therefore recommend a policy that will mandate companies listed on the NSE to

evaluate their employment and selection methods regarding nomination and promotion into

boards and management teams so as to remove any gender bias, reduce male dominance in

board composition and achieve a highly heterogeneous board composition for enhanced

performance. Furthermore, the code of Corporate Governance should require that the

appointment process of members of the board be gender sensitive and a statement must be given

Gender Heterogeneity and Financial Performance of Listed Nigerian Companies

http://www.iaeme.com/IJMET/index.asp 1762 editor@iaeme.com

in the annual report justifying their claims. This is expected to breach the identified gap,

improve the performance of the listed firms and by extension the NSE.

REFERENCES

[1] World Bank, “Country at a glance,”, Retrieved from

http://data.worldbank.org/country/Nigeria, 2013

[2] The Nigerian Stock Exchange Factbook, 2012/2013

[3] Chimhowu, A. and Dada, O.A. “Improving the lives of girls in Nigeria,” Gender in Nigeria

report, 2012, 2nd Edition.

[4] Mordi, C. and Obanya, S. “Gender diversity on boards of publicly quoted companies,”

Nigerian Observatory on Corporate Governance, 2014, 5, pp. 2-23

[5] Molero, E. “Are workplaces with many female in management run differently,” Journal of

Business Research, 2011, 64, pp. 385–393.

[6] Krishnan, G. and Parsons, L.” Getting to the bottom line: An exploration of gender and

earnings quality,” Journal of Business Ethics, 2008,78, p.65-76.

[7] Dwyera, S. , Richard, O. and Chadwick, K.“Gender diversity in management and firm

performance: The influence of growth orientation and organizational culture,” Journal of

Business Research, 2003,56, pp.1009–1019.

[8] Chapple, L. and Humphrey, J.E. “Does Board Gender Diversity have a financial impact?

Evidence using stock portfolio Performance,” Journal of Business Ethics, 2014, 122,

pp.709-723.

[9] Karayel, M. and Dogan, M. “Relationship between board gender diversity and financial

performance,” The Journal of Faculty of Economics and Administrative Sciences,

2014,19(2),pp 75-88.

[10] Adetula, D. Nwobu, O. and Owolabi, F. “Career Advancement of Female Accountants in

Accounting Professional Practice in Nigeria,” IOSR Journal of Business and Management,

2014, 16(2), pp.14-18.

[11] Gender in Nigeria Report, “Improving the lives of girls and women in Nigeria, ukaid, from

the Department for International Development,” 2012

[12] Akomea, S. Y. and Adusei, M.“Gender Imbalance in Bank Governance: Some Evidence

from Ghana and Nigeria,” Proceedings of the 14th Annual Conference of IAABD,

Retrieved from

http://www.iaabd.org/sites/default/files/Past%20Confrence/2013%20IAABD%20Proceedi

ngs.pdf, 2013

[13] Liff, S. and Ward, K. (2001). “Distorted Views Through the Glass Ceiling: The

Construction of Women’s Understandings of Promotion and Senior Management

Positions.” Gender, Work and Organization, 8(1), pp.19-34.

[14] Khan, W.A. and Vieito, J. P. “CEO gender and firm performance,’’ Journal ofEconomics

and Business, 2013, 67, pp.55- 66

[15] Ujunwa, A.” Board characteristics and the financial performance of Nigerian quoted firms,"

Corporate Governance: The international journal of business in society, 2012 12(5), pp.656

– 674.

[16] Wachudi, E. and Mboya, J. “Effect of board gender diversity on the performance of

commercial banks in Kenya,” European Scientific Journal, 2009, 8(7),pp 128-148.

[17] Earley, C. and Mosakowski, E. “Creating hybrid team cultures: an empirical test of

transnational team functioning,” Academy of Management Journal, 2000, 43(1).

![Bài giảng Đổi mới sáng tạo tài chính Phần 2: [Thêm thông tin chi tiết để tối ưu SEO]](https://cdn.tailieu.vn/images/document/thumbnail/2026/20260127/hoahongcam0906/135x160/48231769499983.jpg)