http://www.iaeme.com/IJM/index.asp 1 editor@iaeme.com

International Journal of Management (IJM)

Volume 9, Issue 4, July–August 2018, pp. 1–9, Article ID: IJM_09_04_001

Available online at

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=9&IType=4

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

THE RELATIONSHIP BETWEEN

MICROFINANCE AND ECONOMIC

DEVELOPMENT IN DEVELOPING NATIONS

Apurva Kumar, Piyush Seth and Harsh Sethi

BBA Student-Jain University-Center for Management Studies, Bangalore, India

Prof Abhishek Venkteshwar

Assistant Professor -Jain University-Center for Management Studies, Bangalore, India

ABSTRACT

Purpose

Research in the field of Economy of developing nations have become a dynamic

study area over the past few decades and is likely to become even more so as the

importance of economic development is rapidly gaining momentum. Therefore

understanding the economy of developing nations will be viewed as increasingly

important. Microcredit is a great way of providing financial aid to the people who do

not have any means to take loans from a traditional bank, and that may have a

positive impact on the economic growth. However on the other hand it is just a

medium to exploit the poor by charging high interest rates and costs for providing

various other services, thus making them poorer.

This article aims at examining the Relationship between Microfinance and

Economic Development in Developing Nations

Key words: Microfinance, microcredit, financial, bank, loan, economic. developing

nations.

Cite this Article: Apurva Kumar, Piyush Seth, Harsh Sethi and Prof Abhishek

Venkteshwar, The Relationship between Microfinance and Economic Development in

Developing Nations. International Journal of Management, 9 (4), 2018, pp. 1–9.

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=9&IType=4

1. INTRODUCTION

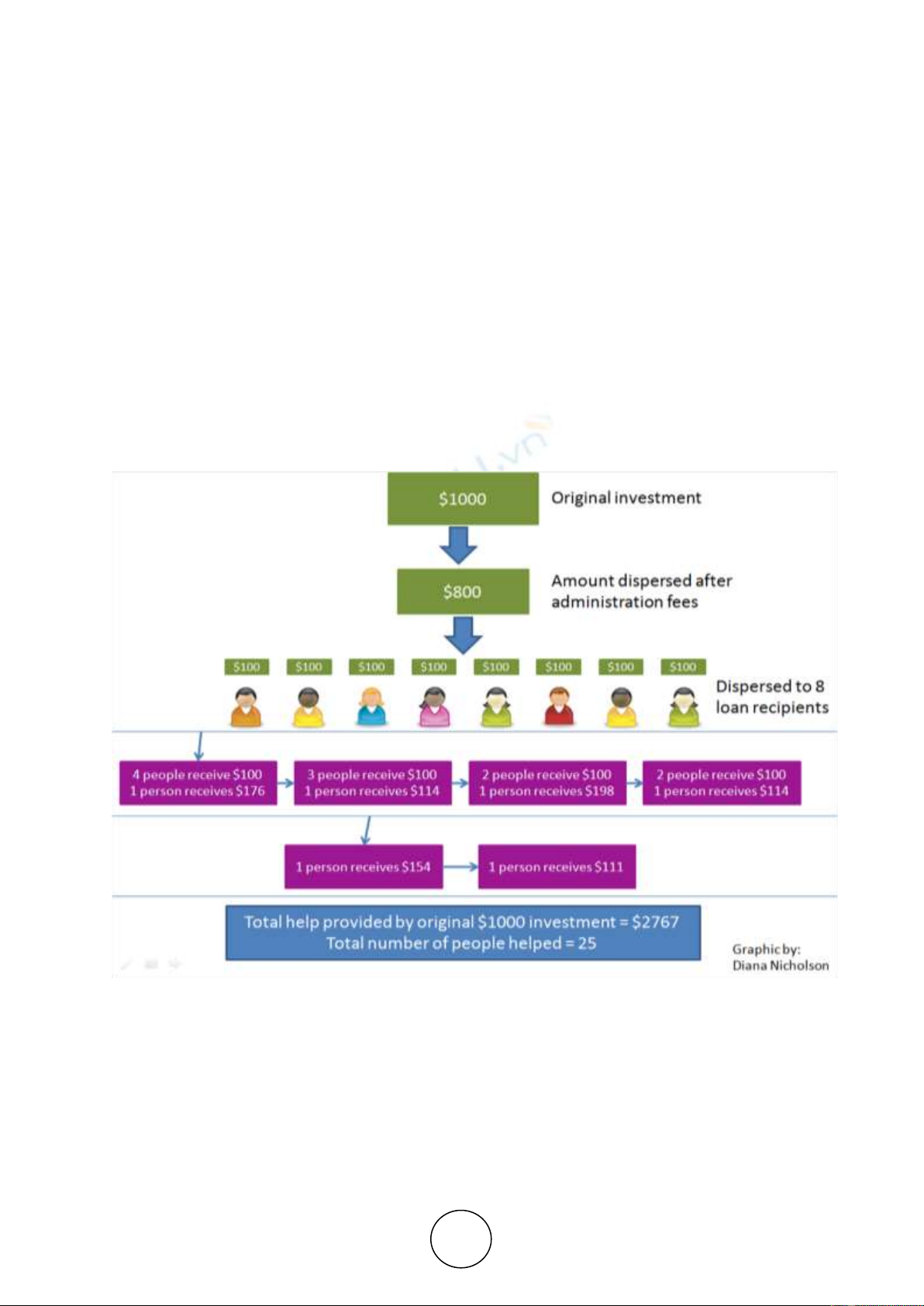

Microfinance is a type of banking service that gives micro loans, savings and insurance to

unemployed or low-income individuals or groups who otherwise have no access to the

common banks or investors. Traditional banks do not give loans to the poor people because

they are not sufficed enough to even give a collateral to the bank for the money they want.

These are the people who seek for micro financing services in order to fund their idea and

grow out of poverty. Microfinance aims to provide micro loans to poor people to work things

out and invest in their businesses and ideas. In short it gives them an opportunity to grow. As