VNU Journal of Science: Policy and Management Studies, Vol. 40, No. 3 (2024) 24-39

24

Original Article

Studying the Impact of Selected Listing on NASDAQ Stock

Exchange on Enterprise Profits: Forecasting the Case

of VinFast Manufacturing and Trading Company Limited

Tran Tu Uyen*, Hoang Thi Nhat Linh

Foreign Trade University, 91 Chua Lang, Dong Da, Hanoi, Vietnam

Received 7 June 2024

Revised 6 August 2024; Accepted 20 September 2024

Abstract: Initial Public Offering (IPO) is considered a strategic decision of utmost importance for

every business, especially companies that wish to list on the stock exchange. international. Using

the Wilcoxon non-parametric test method, the study shows that IPO activities have a positive impact

on the profits of businesses listed on the NASDAQ Global Select Market stock exchange in general

and of VinFast in particular. At the same time, the author had proposed a number of solutions to

increase the number of companies in Vietnam conducting IPOs on the international stock market as

well as policies to help increase the profits enterprises listed on the international stock market of

listed businesses.

Keywords: VinFast Company, IPO, corporate profits, NASDAQ international stock exchange.

1. Introduction*

Initial Public Offering (IPO) is one of the

most popular methods to raise capital from the

public that growing companies choose. There are

many reasons why a company wants to be listed

on stock exchanges, especially international

stock exchanges. IPOs provide cash today and

promise more money tomorrow [1]. IPO is also

an opportunity to promote the company's brand

________

* Corresponding author.

E-mail address: uyentt@ftu.edu.vn

https://doi.org/10.25073/2588-1116/vnupam.4480

to more people. Listing a company on a stock

exchange can be considered a successful

marketing and public relations strategy by

increased visibility of the company in the market

through attention from the financial community

and the media. Therefore, companies can receive

a lot of free publicity, which is one of the least

expensive ways to build and strengthen a

company’s brand [2]. Furthermore, an IPO on an

international stock exchange not only positions

https://doi.org/10.25073/2588-1116/vnupam.4263

T. T. Uyen, H. T. N. Linh / VNU Journal of Science: Policy and Management Studies, Vol. 40, No. 3 (2024) 24-39

25

the corporate brand in the international market

but also enhances the position and reputation of

other businesses in the country where the

business is listed.

Rudianto pointed out that initial public

offerings change the ownership status of a

business, from a company held by a few

individuals to a public company. The author

believed that an IPO had great potential in

mobilizing capital in a relatively large amount,

which affected the performance of businesses,

including the financial performance and

financial situation of the company. The company

had also become better since then before the

IPO. In addition, the transformation from a

private company to a public company made the

decisions, strategies and activities of the

business not only affect the company itself but

also a large number of investors. Therefore, post-

IPO operating efficiency of companies is an

issue that not only businesses but also investors

are very concerned about [3].

Up to now, the impact of IPO on business

performance has always been a topic that has

attracted the attention of many authors. Typical

studies include research on the effectiveness of

IPO on initial profits and long-term operating

efficiency at issuing organizations [4-6]. A

company's performance can be assessed through

a number of financial measures such as

profitability, operating efficiency, revenue and

annual employee income. In the short term,

researchers often focus on analyzing the issue of

underpricing of stocks (IPO Underpricing),

typically in the studies of [7-9]. Meanwhile, not

only in the long term but in the short term, profit

is always one of the important factors in

evaluating company operational efficiency.

Furthermore, the performance of businesses

after an IPO is often measured by indicators such

as return on assets (ROA), return on equity

(ROE) or abnormal buy-and-retain return.

However, until now, very few scholars have

specifically researched the change in profits after

the IPO of companies, especially studies in

Vietnam. In addition, there are currently no studies

predicting profits after IPO for practical cases.

Noticed that in Vietnam recently, VinFast

Production and Trading Company Limited, one

of the subsidiaries of VinGroup Corporation

with an ownership ratio of 50.64% (According

to VinGroup's Prospectus 2023), has just

announced its listing on the international stock

exchange NASDAQ Global Select Market in

August 2023. This is a particularly important

event that not only affirms the brand value of

VinFast in the international market but also

motivates companies in Vietnam to join the

international stock market. Because up to now,

VinFast is the only company in Vietnam that has

successfully IPO'd on the NASDAQ stock

market. Therefore, research on the impact of IPO

on the profits of companies listed on

international stock exchanges in general and of

VinFast in particular is necessary.

2. Literature Review and Hypotheses

2.1. Definition of Initial Public Offering

Initial Public Offering (IPO) was the first

time a private company offered common shares

on a stock exchange [10]. IPOs have often been

conducted by small-scale, or newly established

companies looking for capital to expand, but can

also be conducted by large private companies

wishing to conduct public transactions and

mobilize more capital to expand scale [11-13].

After issuing an IPO, in most cases, a company

changed from private ownership to public

ownership, and the process of issuing and offering

shares was often called "going public" [14].

Companies were divided into two main types

of businesses including private companies and

public companies. A private company has fewer

shareholders and the company's owner is not

obligated to disclose business-related

information to the outside world. Most small

businesses were privately owned (existed as

joint stock companies), and almost without

exception large companies were also privately

owned. Shares of private companies could only

be accessed through the owners and were subject

to the decisions of the company. In contrast,

T. T. Uyen, H. T. N. Linh / VNU Journal of Science: Policy and Management Studies, Vol. 40, No. 3 (2024) 24-39

26

public companies are companies that have sold

at least part of the ownership of the business to

the public and the sold shares will be traded on

stock exchanges [15].

There are many benefits for businesses after

an IPO, especially IPOs on large exchanges.

First, IPOs make it easier for companies to raise

more money in the future through secondary

offerings. Furthermore, public companies can

issue additional shares at any time the need

arises. Second, being listed on a stock exchange

makes companies more visible to the public,

thereby expanding the number of potential

customers, suppliers and employees.

Furthermore, listing on international markets

helps the company enhance its reputation and

trust from foreign investors, thereby attracting

more foreign capital from foreign individuals

and organizations. Diversifying ownership helps

businesses have large, experienced shareholders

who can contribute to the process of improving

governance quality and improving the

company's competitiveness. In addition, the

business will enhance its position and image

when listed on global stock markets. Finally,

public companies will often be more closely

monitored by the market, so these companies

will receive better interest rates when borrowing.

However, the IPO process on international

exchanges is often complicated, causing

problems for some businesses. In addition, after

the IPO, the company also faces a number of

pressures including: short-term growth pressure,

pressure to disclose information to the public,

limited company management and loss of

business. some personal advantages in business.

2.2. Profitability

Profit is one of the most important indicators

in financial analysis that shows the level of

effectiveness in cost management and revenue

growth of a business. Profit is the primary goal

of all business activities. To grow prosperously

and sustainably, a company must be profitable or

have positive profits. If it cannot make a profit,

the company will not be able to survive long

term. From an accounting perspective, some

researchers proposed using information on

financial statements to build measurement

indicators that reflect the effectiveness of profits,

for example return on assets (ROA), return on

sales (ROS), and return on equity (ROE) [16].

Return on assets (ROA) represents a

company's ability to generate profits through

effective use of economic resources and

management, and this index is used as a

dependent variable in the analysis. economic

efficiency assessment. The rate of return on

assets tends to increase, confirming the

increasingly effective use of the company's

economic resources (assets) compared to the

profits earned.

Return on sales (ROS) presents economic

efficiency from a business perspective. The

higher this index shows the more effective the

business's ability to convert net revenue into

profit. If the ROS rate increases significantly

from year to year, it proves that the company's

business activities are growing.

Return on equity (ROE) is reviewed as a

measure of a company's ability to generate net

profit per dollar of equity. This index is

considered one of the most important financial

indicators and profit measures and is applied in

financial analysis practice because it shows the

net amount of shareholders. received, thus

assisting investors in guiding strategic decisions

for the company.

2.3. Impact of IPO on Operational Efficiency

and Profits

Initial public offering (IPO) is one of the

strategic decisions in the company's

development process and is made by the owner

of the business for many different reasons. These

are benefits in terms of capital mobilization,

business promotion and a number of other

reasons. However, regardless of the reason, this

decision always has an impact on the results of

financial and accounting activities. Meanwhile,

profit is one of the most important factors

contributing to company development. The topic

related to the impacts of IPO on corporate profits

has attracted the attention of many authors.

T. T. Uyen, H. T. N. Linh / VNU Journal of Science: Policy and Management Studies, Vol. 40, No. 3 (2024) 24-39

27

Research results show that at different times in

different markets, the impact of IPO on

corporate profits is different. Table 1 states a

summary of previous studies with topics related

to the impact of IPO on corporate profits.

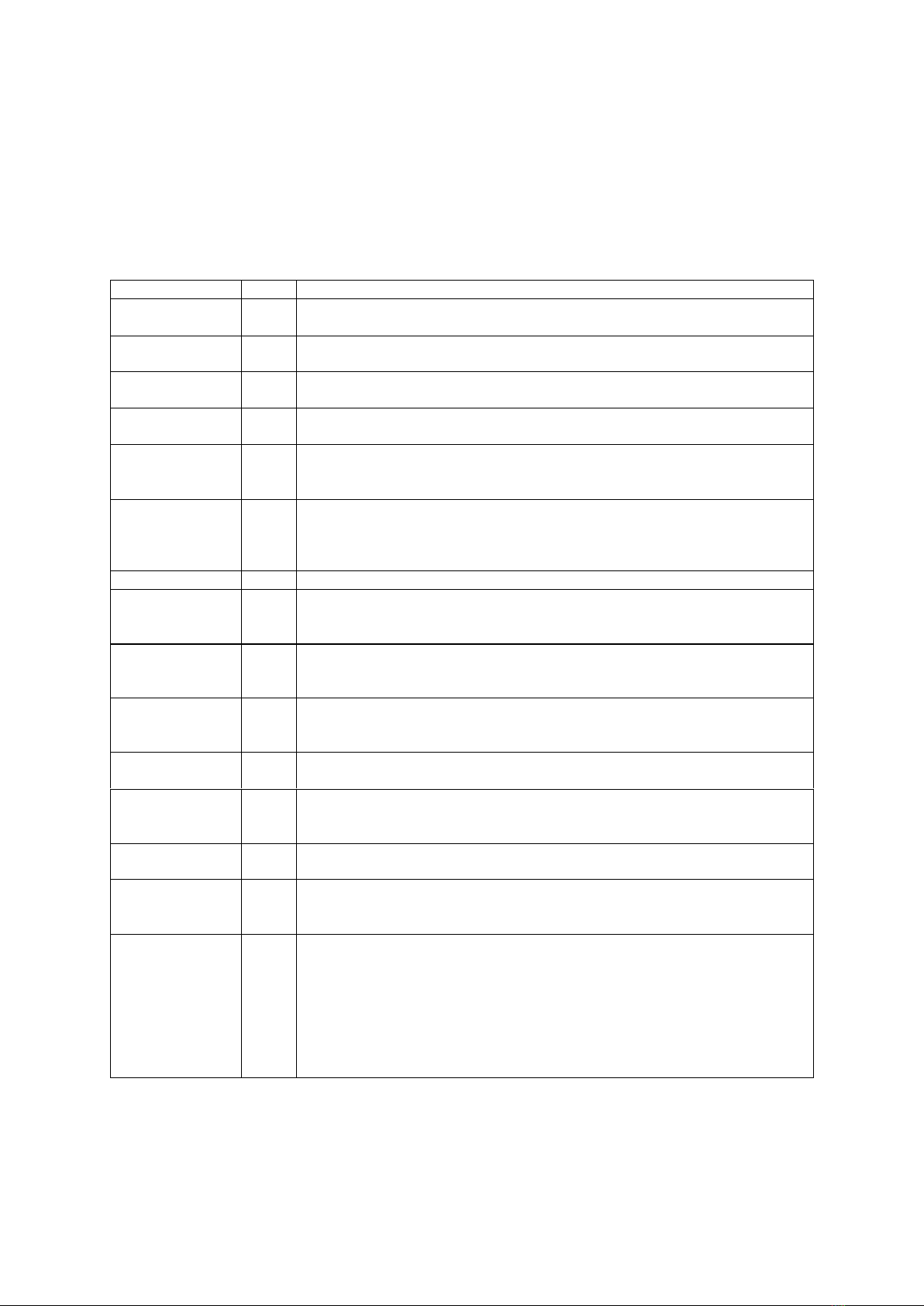

Table 1. Related Studies to the impact of IPO on corporate profits

Author

Year

Research results

Pagano et al.,

1998

Issuing shares to the public had a positive relationship with business profitability.

This positive relationship was significant across all time periods [17].

Aharony et al.,

2000

The average ROA of companies listed on Chinese stock exchanges reached its

highest level in the year of the IPO, then decreased [18].

Report by Boston

Consulting Group

2000

From the perspective of investors, after IPO, Europe's most dynamic businesses not

only increased in revenue but also rose in profit and create outstanding value [19].

Eije

2000

IPOs caused changes within the company and could contribute positively to the

company's profits [20].

Kim et al.,

2004

After the IPO, companies' operating activities were less efficient than before

entering the market. Revenue mostly increased but not enough to improve

business results after the IPO [21].

Peristani and

Hong

2004

ROA of companies participating in the US stock market was lower than the pre-

IPO period. However, the deterioration in the financial condition of companies

participating in the stock market was not a result of weaker economic conditions but

indicated that stock exchanges are facilitating companies “young” was listed [22].

Ahmad and Lim

2005

Operating performance clearly declined after the IPO in the Malaysian market [23].

Wai-yan Cheng

2005

Level Pre-listing earnings of companies did not guarantee good long-term IPO

performance, and pre-listing earnings of new issues were not an effective screen

for “poor” IPO performers [24].

Wang

2005

Through the results of analyzing more than 700 companies on the Chinese stock

market, the author concluded that there was a decline in the value of ROA of

companies after IPO [25].

Manas and Manoj

2007

Companies with large scale and high profits had a greater probability of issuing

shares to the public than for Indian companies IPOed in the period from 1999 to

2005 [26].

Ron Chuen Yeh

and Tran Tu Uyen

2009

IPO has a positive impact on the return on assets (PTBA) of listed Vietnamese

enterprises in the period 2000 – 2006 [27].

Wu et al.

2009

In general, banks in China listed on the exchange had worse results than unlisted

banks and the IPO had a significant positive impact on ROA and ROE growth at

the time before listing and during the IPO process [28].

Radosław

Pastusiak et al.,

2016

The profitability of companies one year before IPO was better than one year after

the IPO [29].

Sulaksana,

RDIZF and

Supriatna, N.

2019

There was no difference in the rate of return of companies listed on the Indonesian

market in 2014 after IPO [30].

Adiputra, A. K.,

Christmawan, P.

E. E., & Tlonaen,

A. C. A.

2023

The results of the T-test method show that there is a negative impact of ROA on

stock underpricing in companies that issue shares to the public or companies that

issue IPOs on the Indonesia Stock Exchange during the period 2010-2022. These

results show that investors always evaluate the performance of the company well

before investing and will buy shares of companies with better performance and

increase the stock price. This is because investors want to earn profits in the

future, both in the form of dividends and profits from the difference between the

selling price of shares and the buying price of shares [31].

Source: Author's own preparation.

T. T. Uyen, H. T. N. Linh / VNU Journal of Science: Policy and Management Studies, Vol. 40, No. 3 (2024) 24-39

28

In the previous period, some studies

demonstrated that IPOs had a positive impact on

the profits of companies in the United States

[4, 26, 32]. In contrast, recently, Pastusiak et al.,

found that there was a decline in post-IPO profits

in companies listed on Asian markets [29].

Another study on Indonesian companies showed

that the ratios measuring company profitability

increased after IPO, but the level of significance

when the Wilcoxon test is greater than 0.05,

meaning that the impact of IPO on corporate

profits was not statistically significant [30].

Therefore, the desire of this topic is to

conduct similar research on companies listed on

the international stock market NASDAQ Global

Select Market in the period 2019 – 2022, and

especially analyze in depth the impact of the IPO

to the profits of VinFast company. An equally

important reason is that in Vietnam this topic is

being researched deeply by very few scholars.

Based on the above documents, the study

proposes the following hypotheses:

Hypothesis H1: Return on assets (ROA) of

companies increases one year after IPO on

international stock exchanges

Hypothesis H2: Return on sales (ROS) of

companies increases one year after IPO on

international stock exchangess

Hypothesis H3: Return on equity (ROE) of

companies increases one year after IPO on

international stock exchanges

3. Research Methodology

3.1. Research Procedure

With the purpose of reviewing changes in

profitability ratios (ROA, ROS and ROE), the

article used quantitative methods for analysis. As

follows:

i) Descriptive statistics

Descriptive statistical methods are used to

describe the characteristics of variables. After

calculating the variables before and after the

IPO, the author used SPSS version 20 software

to calculate the minimum value (Min),

maximum value (Max), average value,

deviation. standard, median value and

interquartile ranges of the variables. Thereby,

there is an overview of the changing trends of

variables after the IPO;

ii) Wilcoxon non-parametric test

The purpose of this test is to test whether the

hypothesis about the post-IPO profit change of

the sample companies is statistically valid or not.

This method is suitable when it allows direct

examination and comparison of companies with

diverse industries across many countries and

over different time periods because it does not

require normally distributed data. Furthermore,

each company is compared to itself in previous

years, so this method is suitable because it allows

testing two different independent variables on

the same dependent variable. In fact, this method

was first used by [10] to analyze the impact of

privatization on performance. After that, a

number of other studies such as [33, 34]

continued to conduct and use the test method.

Wilcoxon determination is a key method while

evaluating company performance at the time

before and after the IPO.

3.2. Sampling Design

Research and select secondary data

collection methods to serve the research process

of the topic. The biggest advantage of this

method is that the data is collected in advance,

and has been published on the official

information pages of the enterprise, or reputable

stock forums, so the collection is easy, less

costly and less time consuming in the collection

process.

The study selected a sample of 100

businesses listed on the US stock exchange with

some sampling bases as follows:

i) The company must have complete

financial information for at least three

consecutive years, from one year before the IPO

(year -1), the year of the IPO (year 0) and one

year after the IPO (year 1). Therefore, to have

enough research data, the author chose

companies that had IPOs in the period 2019 -

2022 on the international stock exchange

NASDAQ Global Select Market;

![Câu hỏi trắc nghiệm và bài tập Thị trường chứng khoán [mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2026/20260127/hoahongcam0906/135x160/57691769497618.jpg)