Jour of Adv Research in Dynamical & Control Systems, Vol. 11, No. 2, 2019

ISSN 1943-023X 290

Received: 14 Feb 2018/Accepted: 24 Dec 2018/Published: 20 Feb 2019

Branchless Banking, Third-Party Funds, and

Profitability Evidence Reference to Banking

Sector in Indonesia

Ketut Tanti Kustina, University of National Education (Undiknas) Denpasar, Indonesia.

E-mail: tantikustina@undiknas.ac.id

Gusti Ayu Agung Omika Dewi, University of National Education (Undiknas) Denpasar, Indonesia.

E-mail: omikadewi@undiknas.ac.id

Gine Das Prena, University of National Education (Undiknas) Denpasar, Indonesia.

E-mail: ginedasfrena@undiknas.ac.id

Wayan Suryasa, STIKOM Bali, Department of Computer System, Denpasar, Indonesia. E-mail:

iwayansuryasa@gmail.com

Abstract--- This research was conducted on banking companies in Indonesia. The branchless banking services were

to determine the effect of the branchless banking application to profits with the volume of third-party funds as an

intervening variable or mediation. It was a program of providing banking services through collaboration with other

parties (bank agents) and supported by information technology facilities. With Branchless Banking, the transactions

were not dependent on the bank offices presence, due to the financial services and activities can be done through bank

agents using Electronic Data Capture (EDC) owned by an agent. The research on branchless banking application in

Indonesia was rarely conducted, but the implementation was relatively new. The variable used in the present study

was Branchless Banking application as an independent variable, the profit changes as the dependent variable and

volume of third-party funds as an intervening variable. These variables were obtained through theoretical and empirical

studies. Data processing was conducted in using path analysis. The results of the study were branchless banking

application did not significantly influence the number of third-party funds of banking companies in Indonesia. The

branchless banking application amount of third-party funds have a significant effect on banking company profits in

Indonesia. The branchless banking application did not have a significant direct effect on profits but there was

branchless banking application which has a significant indirect effect on profit through the volume of third-party funds

for the banking companies in Indonesia.

Keywords--- branchless banking, electronic data capture, financial inclusion, profits, third party funds.

I. Introduction

Indonesia is an archipelago with a large population. The bank’s role in Indonesia is very important. It plays a role

in supporting the country’s economy. Bikker & Haaf (2002), the banking industry is a leading indicator or a driver of

the country’s economy. However, a major obstacle for the banking industry in a country that has a large population as

well as a large area unlike Indonesia is to provide financial services in all parts of Indonesia. Iannotta et al., (2007),

the banking industry overcomes these obstacles by opening many branches in every region of Indonesia. However,

this increases the bank’s operating costs, due to it requires a large fee in opening a new branch office. The large

investment costs for opening many new branch offices are an obstacle for banks to be able to expand the service

network to the public in Indonesia.

The development of technology and information along with the banking business that provides banking services

to all Indonesian people by developing services through ATM, mobile banking and internet banking (Kustina, Ayu,

Dewi, Das Prena, & Utari, 2018). This is conducted to expand services for the customers spread across Indonesia and

the features of the transactions developed are more varied. Development of banking products through ATMs, mobile

banking and internet banking has limitations, it can only be utilized by the upper-middle-class community close to the

bank branch office. The Indonesian society condition is dominated by the lower middle-class economy with a low-

level education, asking ATM services, mobile banking, and internet banking still not optimal can be utilized.

The application of officeless banking services (laku pandai) or branchless banking is a solution to overcome

problems in providing banking services in Indonesia. The branchless banking aim at supporting efforts for economic

growth and even development distribution between rural areas and eastern Indonesia by providing access for small

communities to be able to conduct the financial transactions, especially banking wherever the community is located,

Electronic copy available at: https://ssrn.com/abstract=3416428

Jour of Adv Research in Dynamical & Control Systems, Vol. 11, No. 2, 2019

ISSN 1943-023X 291

Received: 14 Feb 2018/Accepted: 24 Dec 2018/Published: 20 Feb 2019

and provide financial products that are simple, easy to understand, and in accordance with the people needs who have

not yet disclosed financial services before. The branchless banking is a solution to reach people living in remote areas,

with various geographical conditions such as difficult access areas by motorized vehicles.

Beck et al., (2006), the business competition in the World Bank requires the banks to continue innovated and can

maintain business continuity. The one innovation form is carried out by implementing branchless banking. The

branchless banking application is expected to capture an increasing number of customers, due to it facilitates public

access in remote areas to banking services. The expanding service network along with banks, it is expected the number

of customers will also increase. The increasing customer’s number can increase the amount of deposit balance (third

party funds). The easy access advantage is to banking services for all parts of Indonesia branchless banking can

increase the public willingness to save their money in banks, which in turn can increase bank profitability.

The branchless banking is a program of providing financial services by banks through collaboration with other

parties (bank agents) and supported by information technology facilities. It is a distribution network that is used to

provide financial services outside bank branch offices through alternative technology and networks in a costeffective,

efficient, and safe as well as comfortable condition. In banking transactions are not dependent on bank offices

existence, due to the financial services and activities can be conducted out only by using EDC owned by an agent.

Morrison & O’Brien (2001), the branchless banking application can be measured by using the number of agents

(banking agents), namely, the person appointed and verified by the bank provides a place in their home, or business

place is equipped with an EDC machine from the bank.

Honohan (2008), Currie et al., (2008), the branchless banking application through the establishment of banking

agents provides a new view is not only management as an agent receives the delegation duties to manage the company

from owners who can participate in efforts to increase profits, but also the community as bank customers can also be

used as a bank agent in efforts to increase profits. Mwando et al., (2013), stated that the branchless banking application

through the establishment of banking agents has a positive effect on bank financial performance. Mwando et al.,

(2013), the statement is supported by research results from Malaysia, that the branchless banking existence can

improve the bank’s financial performance.

One of the product advantages offered by branchless banking services is savings with the characteristics of Basic

Saving Account (BSA), namely without a minimum limit both balance and cash deposit transactions, but has a

maximum balance of IDR 20 million and a cumulative limit for debiting transactions between accounts other

cumulative cash withdrawals every month amounting to IDR 5 million. The most interesting is BSA savings banking

service product is free from monthly administration fees and is not subject to fees for opening and closing accounts.

This is the main attraction for the community to save their money in the bank, due to BSA savings, the community

can save their money in the bank without worrying that the balance of their savings is reduced by deducting

administrative costs and Merton (1977), Flannery (1991), still profits interest and guaranteed by the Deposit Insurance

Corporation need to go to bank office location but simply visit branchless banking location agent that is close to the

location of their residence. Another advantage of the community being a BSA savings customer for 6 months or less

but deemed feasible by the bank, can apply for micro customer loans.

The BSA savings products in branchless banking, it is expected will be an increase in public enthusiasm in the far

areas from bank branch offices in saving, resulting in an increase in the amount achievement of third-party funding

and increasing profitability. The branchless banking application can increase third-party funds (TPF) as evidenced by

Anggraeni et al., (2015), research results stated that the branchless banking application in BJB Syariah Bank affects

the growth of the TPF, namely the average TPF experienced an increase of 60.67%. This happened due to the

branchless banking provided a lot of convenience to the community, so that, it could attract the public to become the

bank’s customers. Diniz et al., (2012), stated different things that the application of branchless banking at Bank Jabar

Banten Syariah, although it was proven to significantly influence the number of customers, but did not have a

significant effect on the increase in TPF volume.

Regarding the differences of the research results on branchless banking implementation of TPF and the profit

changes above, this study developed a research model examine the direct influence of the branchless banking on the

volume of TPF and the profit changes.

The indirect influence of the branchless banking on profit changes through the volume of TPF. The novelty of the

study is the use of profit change variables as the dependent variable, which in the previous research used is the profit

variable, and profitability, as well as the volume of TPF as an intervening variable or predictor variable on profit

changes. This is conducted due to the influence of TPF as a mediating variable the effect of the branchless banking

application to profit changes has not received much attention from previous researchers. The research is conducted in

banks that actively implement branchless banking, this is based on the consideration that not all banks in Indonesia

Electronic copy available at: https://ssrn.com/abstract=3416428

Jour of Adv Research in Dynamical & Control Systems, Vol. 11, No. 2, 2019

ISSN 1943-023X 292

Received: 14 Feb 2018/Accepted: 24 Dec 2018/Published: 20 Feb 2019

apply branchless banking considering the Financial Services Authority (FSA) officially announced its application since

March 26th, 2015.

Research Question

Based on the above description, a research question is how the determination of branchless banking services

towards profit changes for the banking companies increased the volume of TPF as intervening variables in Indonesia?".

The research question can be formulated as follows:

1. What branchless banking application has a significant effect on third-party funds in banking companies in

Indonesia?

2. What third-party funds have a significant effect on profits in banking companies in Indonesia?

3. What branchless banking application has a significant effect on profit in banking companies in Indonesia?

4. What branchless banking application has a significant effect on profit indirectly through third-party funds in

banking companies in Indonesia?

II. Materials and Methods

Agency Theory

Noreen (1988), agency theory is a theory that stated agency relations with a discipline in which agents act for the

interests of principals/owners and for their actions agents get certain rewards (Soewardjono, 2005). The management

team is authorized to make decisions and actions on behalf of principals, related to operations, and company strategy

in the hope that the decisions and actions are taken will maximize company profits. Berger & Di Patti (2006), Ness &

Mirza (1991), Jensen & Meckling (1976), the problem in the relationship between the management and the owner in

the agency theory is the existence of the information asymmetry, wherein the management has more information about

the company than the owners who only invest. the existence of officeless banking services (laku pandai) or branchless

banking through the establishment of agent banking provides a new view that not only does the management act as an

agent (who receives delegation of tasks in managing the company from the owner) who plays an active role in efforts

to increase profitability, but the community as bank customers can also be used as a bank/company agent in an effort

to increase profitability.

Signalling Theory

Hartono (2005), stated signaling theory good quality companies will intentionally give a signal to the market, thus,

the market is expected to distinguish good and bad quality companies. Signaling theory is based on the assumption

that the information received by each party is not the same. In other words, Casper & Harris (2008), Spence (1978),

signaling theory is related to information asymmetry. Signal theory shows the information asymmetry between the

management of the company and those with an interest in the information. For this reason, the managers need to

provide information to interested parties through the issuance of the financial statements.

Levy & Lazarovich-Porat (1995), Suazo et al., (2009), signaling theory suggested how a company should give a

signal to users of the financial statements. This signal is in the form of information about what has been conducted by

management to realize the owner wishes. The information received by the investor is first translated as a good signal

(good news) or bad signal (bad news). If the profit reported by the company increases, then, the information can be

categorized as a good signal, due to it indicates a good company condition. Conversely, if the reported profit decreases,

then, the company is in a bad condition, so that, Mavlanova et al., (2012), Ma & Weiss (1993), is considered as a bad

signal. Based on this, the bank seeks to increase its profitability through the branchless banking application, therefore,

the information from banks is categorized as a good signal.

Managerial Efficiency Theory of Profit

According to the managerial efficiency theory of profit proposed by Aghion & Howitt (2006), a company can

achieve profits above normal if it succeeds in doing efficiency in various fields and can meet the desires of its

consumers.

In the application of the office less banking services (laku pandai) or branchless banking companies based in

Indonesia strive to make operational costs more efficient. Due to DeCanio (1998), Leibenstein (1987), the

implementation of branchless banking systems will reduce investment costs in opening new branch offices.

It is included the costs for the operation of the new branch office. The use of bank agents spread across Indonesia

to be able to provide banking services at a lower cost and wider reach provides a great potential for banking companies

to increase their profitability. Seyhun (1986), Das & Ghosh (2009), the branchless banking implementation, banking

companies have the opportunity to issue broader banking products such as saving basic accounts, microfinance, and

microinsurance to meet the needs of the community as consumers or customers.

Electronic copy available at: https://ssrn.com/abstract=3416428

Jour of Adv Research in Dynamical & Control Systems, Vol. 11, No. 2, 2019

ISSN 1943-023X 293

Received: 14 Feb 2018/Accepted: 24 Dec 2018/Published: 20 Feb 2019

Definition of Branchless Banking

Branchless Banking is a distribution network that is used to provide financial services outside bank branch offices

through alternative technology and networks in a cost-effective, efficient as well as safe, and comfortable condition.

Banking transactions are not dependent on the bank offices existence because the financial services and activities can

be carried out only by using cell phones or other forms (Rosenbloom, 2006).

Branchless banking is a payment system and limited financial services activities conducted out not through the

bank’s physical office, but by using technology facilities such as Electronic Data Capture (EDC) and cellular

telephones, as well as third-party services primarily to serve unbanked (Reinganum, 1989). Its application is very

suitable for regions such as Indonesia, which consists of islands. It is one reason why banking access still feels so

difficult. Branchless banking is a solution to reach people living in remote areas, with various geographical conditions.

In Indonesia, many areas are difficult to access by motorized vehicles. Not a few people who have to travel long

distances, to come to the bank branch office.

There are three elements related to branchless banking, namely: (1) Banking agents function as the spearhead of

banking can take the form of cooperatives, shops, or financial institutions other than banks, (2) Telecommunication

providers in mobile banking, (3) Communities outside banking customers who have future Financial Identity Number

(FIN) will be synergized with the resident identity card issued by the Ministry of Home Affairs.

In Indonesia there are two models of branchless banking that are used, namely: (1) Mobile banking that uses a

handheld is installed by the application and connected to a bank server through a cellular operator and (2) Banking

agent is the person appointed and verified by the bank, called bank agent which is the bank extension. The agents

provide a place in their home that is equipped with an EDC machine from the bank. The EDC machine is used to read

customer fingerprints as transaction data verification.

Diniz et al., (2012), Jayo et al., (2012), the financial services authority determines that there are three products

served in branchless banking, namely basic savings accounts (BSA), microfinance, and micro insurance. The BSA is

different from other types of savings because it does not have a minimum balance and transaction. However, it has a

maximum balance of IDR 20 million and a transaction of IDR 5 million per month, become a regular savings account.

The bank will not charge fees when opening or BSA closing and does not incur fees for cash deposits and book-entry.

The interest is still calculated as in ordinary savings. The BSA’s customers are Indonesian citizens and have no savings.

If they want microfinance products, prospective borrowers have at least become branchless banking customers for at

least six months and after getting consideration from the bank. Kurila et al., (2016), the microcredit aims to finance

productive business or other basic needs fulfilment activities.

Definition of Third-party Funds

According to Bank Indonesia Regulation No. 10/19/PBI/2008 explained the bank third-party funds, hereinafter

referred to as TPF, Le Blanc et al., (2004), Spicer & Johnson (2004), the bank liabilities was to residents in rupiah and

foreign exchange. Generally, the funds collected by banks from the public will be used to fund real sector activities

through lending. Third-party funds consist of several types, namely: (1) Saving is third-party deposits at banks wherein

withdrawals can only be made according to certain conditions. (2). Deposits are third-party deposits at banks where

withdrawals can only be made according to certain conditions. (3) Demand deposits are third-party deposits at banks

wherein withdrawals can be made at any time by using checks, giro-bilyet, and other payment orders or by way of

book-entry. In the execution, von der Schulenburg (1994), the demand deposit is administered by the bank in an

account called a checking account. This type of checking account can be:

a. Account in the name of an individual,

b. Account in the name of a business entity/institution, and

c. Joint/ merger account.

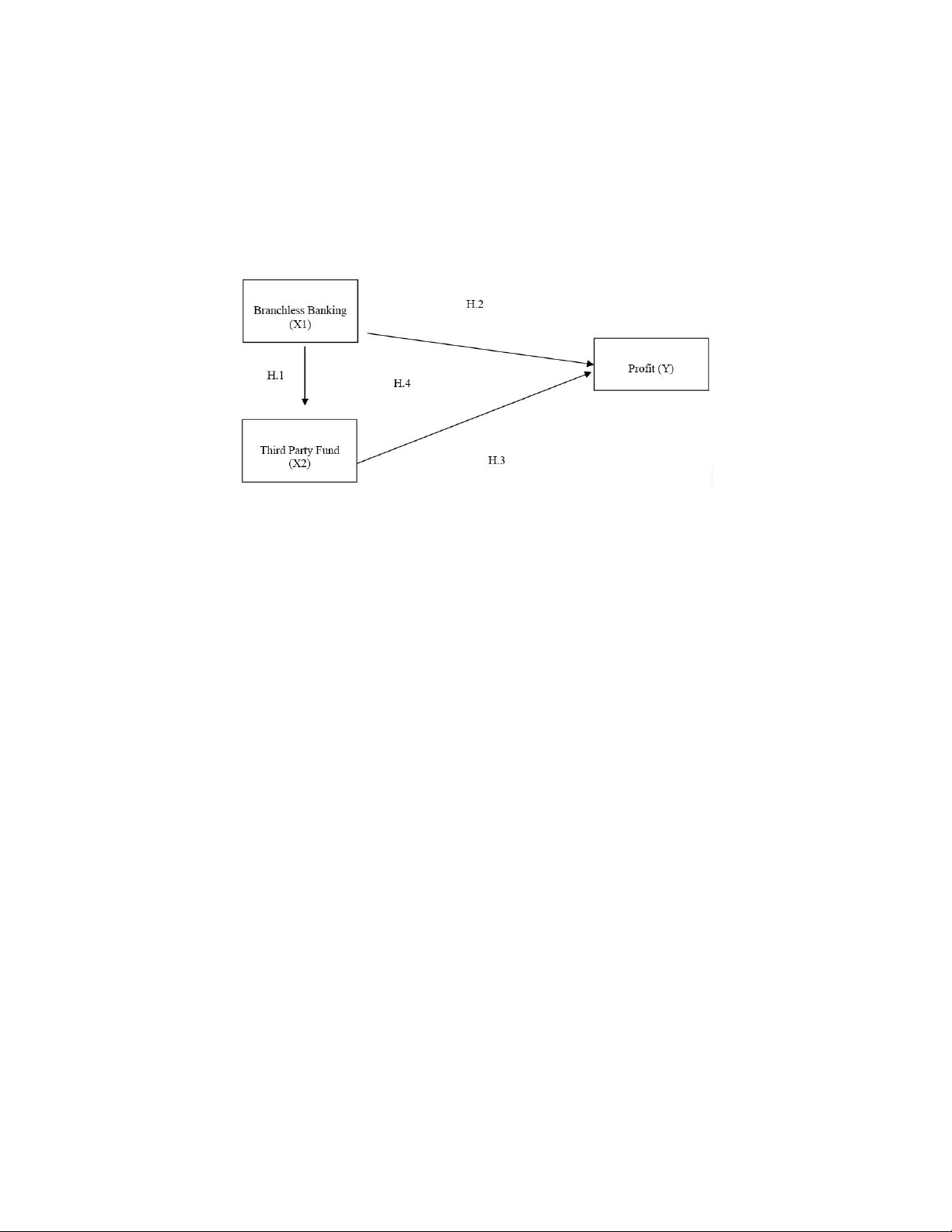

Concept and Hypothesis Framework

a. Research Concept Framework

The existence of office less banking services (laku pandai) or branchless banking through the establishment of

banking agents provides a new view not only does the management act as an agent (who receives delegation of tasks

in managing the company from the owner) who is active in efforts to increase profitability, but also people as bank

customers can also be utilized as corporate agents/banks in an effort to increase profitability.

Electronic copy available at: https://ssrn.com/abstract=3416428

Jour of Adv Research in Dynamical & Control Systems, Vol. 11, No. 2, 2019

ISSN 1943-023X 294

Received: 14 Feb 2018/Accepted: 24 Dec 2018/Published: 20 Feb 2019

The branchless banking application is expected to capture an increasing number of customers. Due to it facilitates

public access in remote areas to banking services. The expanding service network along with of banks, it is expected

that the number of customers will also increase. Regarding the increase in the number of customers can increase the

amount of deposit balance (third-party funds). Anggraini (2015), revealed that the branchless banking application has

a significant effect on the growth of third-party funds, this is because branchless banking provides a lot of convenience

to the public. It, therefore, can attract the public to become a customer of third-party funds by the bank channelled

back to the community in the form of loans or credit and the bank obtains interest from the credit service. The greater

the third-party funds that are collected, the greater the profit that the bank will get, the research concept model can be

put forward as follows:

Figure 1: Research Concept Framework

b. Research Hypothesis

Based on the research model framework in figure 1, which is built on the basis of theoretical studies and empirical

research, the following hypotheses can be formulated:

1. The Influence of Branchless Banking Implementation on the Volume of Third-Party Funds (TPF)

For the banks, the branchless banking implementation provides benefits in terms of transaction growth, which

means increasing the volume of third-party funds, facilitating the development of banking networks, increasing

efficiency, and increasing customer loyalty (Diniz et al., 2012), Anggraeni et al., (2015), found that there were

differences in the growth of third-party funds before and after the branchless banking implementation, where thirdparty

funds increased after the branchless banking implementation. Based on the previous studies results, the first hypothesis

can be proposed, namely:

H1: The branchless banking application has a significant influence on third-party funds in banking companies in

Indonesia

2. The Influence of Third-Party Funds on Profit

Khairul & Muhd (2013), stated that there is a strong relationship between third-party fund deposits and operating

profit. Sudiyatno & Suroso (2010), stated third-party funds have a positive and significant effect on the company’s

ability to generate profits. Based on the previous studies results, the first hypothesis can be proposed, namely: H2:

Third-party funds have a significant influence on profits in banking companies in Indonesia

3. The Influence of Branchless Banking on Profit

Mwando et al., (2013), stated banking agency was regulated by the central bank in Kenya had a positive influence

on the financial performance of commercial banks in Kenya. There was an increase in market share from banks in

Kenya had a positive effect on financial performance banking, because increasing market share means increasing the

ability to generate profit or profitability of the bank. Khairul & Muhd (2013), suggested that branchless banking

improves financial performance as measured by the increase in profits from the company. In this case, the formulation

of the proposed hypothesis is:

H3: The branchless banking application has a significant influence on profit in banking companies in Indonesia

4. The Influence of Branchless Banking Application on Profits Indirectly Through Third-Party Funds (TPF)

The branchless banking application to banks is a way to obtain third-party funds cheaply. Becoming the bank agent,

the agent must deposit funds in the form of savings to serve bank service transactions. The greater and the higher

Electronic copy available at: https://ssrn.com/abstract=3416428