http://www.iaeme.com/IJM/index.asp 67 editor@iaeme.com

International Journal of Management (IJM)

Volume 8, Issue 5, Sep–Oct 2017, pp. 67–80, Article ID: IJM_08_05_008

Available online at

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=8&IType=5

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

EVOLUTION OF INDIAN MODERN RETAIL

G. Haritha

Research Scholor, Department of Management Studies

Sri Venkateswara University, Tirupati, India

Prof. B. Amarnath

Registrar, Rayalaseema University, Kurnool, India

Dr. M. Sudheer Kumar

Professor, Department of MBA, RGM Engineering College, Nandyal, India

ABSTRACT

Organised retailing refers to trading activities undertaken by licensed retailers,

that is, those who are registered for sales tax, income tax, etc. These include the

corporate-backed hypermarkets and retail chains, and also the privately owned large

retail businesses. In other words, it is a network of similarly branded stores with an

element of self-service.in this paper an attempt is made to study the evolution of

Indian retailing and factors contribution to development of Indian retailing, finally, it

focuses on different retail format exist in the market.

Key words: Organised Retailing, Retail Chains, Retail Format and Retailing.

Cite this Article: G. Haritha, Prof. B. Amarnath and Dr. M.Sudheer Kumar,

Evolution of Indian Modern Retail. International Journal of Management, 8 (5), 2017,

pp. 67–80. http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=8&IType=5

1. INTRODUCTION

Retailing is the largest private sector industry in the world economy with the global industry

size exceeding $6.6 trillion and a latest survey has projected India as the top destination for

retail investors. India is currently the twelfth largest consumer market in the world. A

McKinsey report, “The rise of Indian Consumer Market”, estimates that the Indian consumer

market is likely to grow four times by 2025. A good talent pool, unlimited opportunities, huge

markets and availability of quality raw materials at cheaper costs is expected to make India

overtake the world‟s best retail economies by 2042, according to industry players.

There are exciting times for Indian Retail. Markets in Asian giants like China are getting

saturated, the AT Kearney‟s 2007 Global Retail Development Index (GRDI), for the third

consecutive year placed India the top retail investment destination among the 30 emerging

markets across the world. Commercial real estate services company, CB Richard Ellis‟

findings state that India‟s retail market has moved up to the 39th most preferred retail

destination in the world in 2009, up from 44 last year. The recent growth spurt was achieved

G. Haritha, Prof. B. Amarnath and Dr. M. Sudheer Kumar

http://www.iaeme.com/IJM/index.asp 68 editor@iaeme.com

primarily through a surge in productivity and is sustainable. Similarly, the study undertaken

by ICRIER estimates that the total retail business in India will grow at 13 per cent annually

from US$ 322 billion in 2006-07 to US$ 590 billion in 2011-12.

The Indian retail industry is the fifth largest in the world. With continued economic

expansion and retail growth, India is set to become a US$ 450 billion retail market by 2015,

comparable in size to Italy (US$ 462 billion) and much larger than Brazil (US$ 258 billion)

today. The present value of the Indian retail market is estimated by the India Retail Report to

be around Rs. 12,00,000 crores ($270 billion) and the annual growth rate is 5.7 percent.

Furthermore, around 15 million retail outlets help India win the crown of having the highest

retail outlet density in the world.

Retail sector is the largest source of employment after agriculture, and has deep

penetration into rural India. It is also believed that 21 million people are employed in the retail

sector which is 7 per cent of the total national workforce whereas the global average is around

10-12 per cent. It is estimated that an additional eight million jobs will be generated through

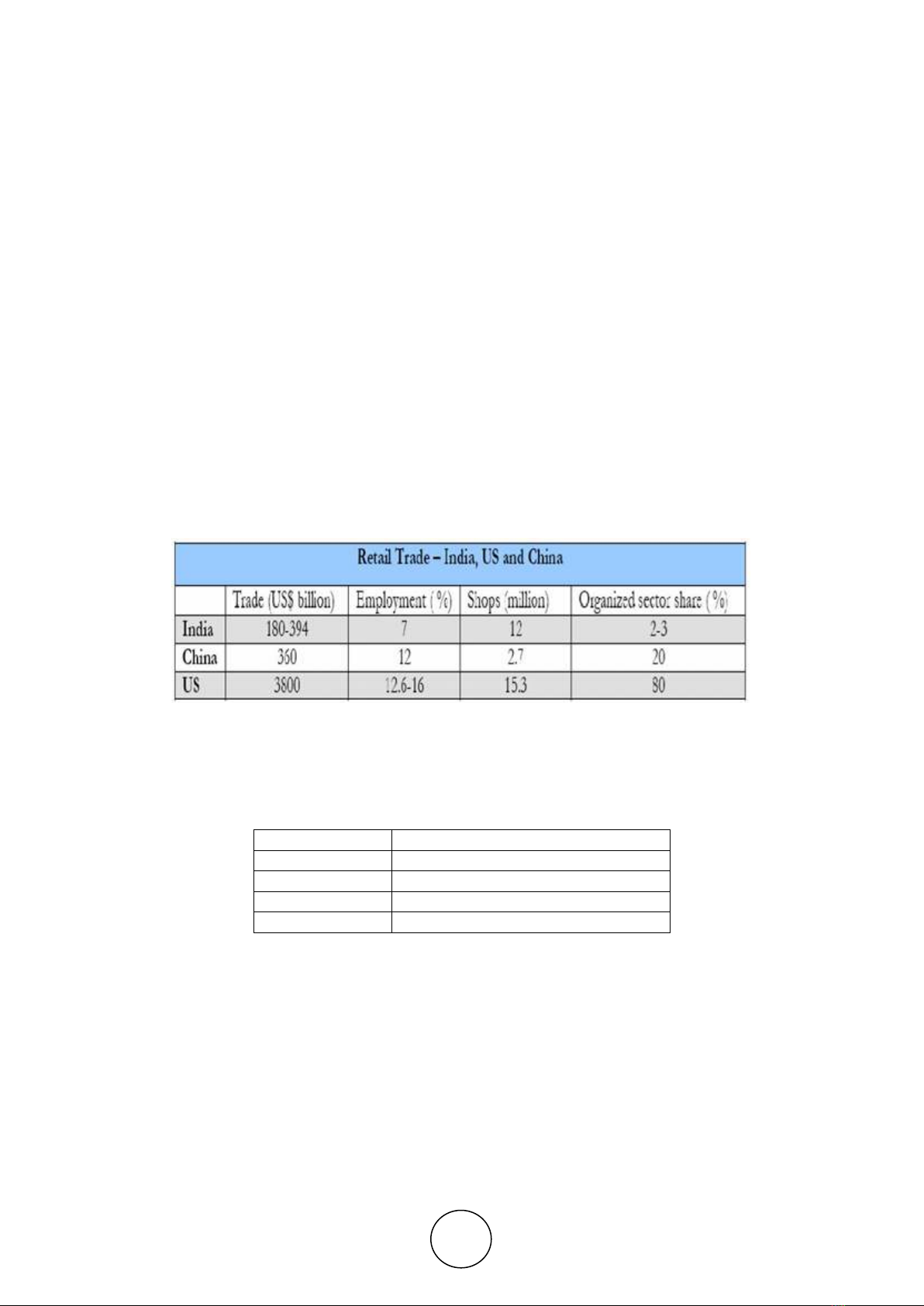

direct and indirect employment related to the retail sector. Table 1 gives the picture of India‟s

retail trade as compared to the US and China.

Table 1 Retail Trade- India, Us and China

According to AT Kearney “Retail Study” the contribution of retail sector to Indian GDP

was 10 per cent, while the contribution of retail sector in USA, China and Brazil was 10 per

cent, 8 per cent and 6 per cent respectively, which was manifested below:

Table 2 Country Retail Sector‟s Share in GDP

COUNTRY

RETAIL SHARE IN GDP (%)

India

10

USA

10

China

8

Brazil

6

The above table states clearly that retailing in India is superior than those of its

contenders. Retail sector is a sunrise industry in India and the prospect for growth is simply

huge. The India Retail Industry is gradually inching its way towards becoming the next boom

industry.

India has the highest number of retail outlets in the world at over 15 million retail outlets,

and the average size of one store is 50-100 square feet. It also has the highest number of

outlets (11,903) per million inhabitants. The per capita retail space in India is among the

lowest in the world, though the per capita retail store is the highest. Majority of these stores

are located in rural areas.

Evolution of Indian Modern Retail

http://www.iaeme.com/IJM/index.asp 69 editor@iaeme.com

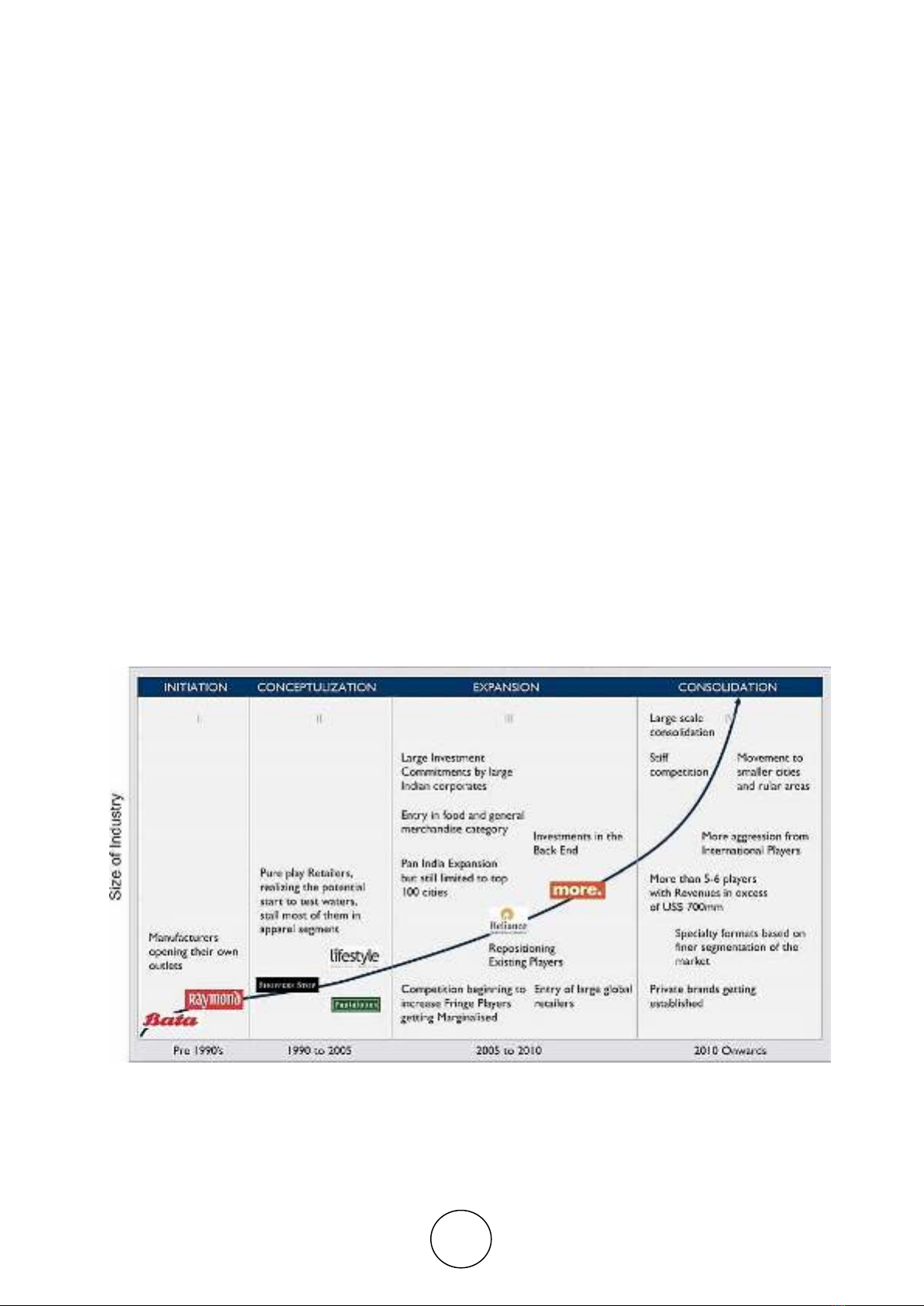

2. EVOLUTION OF INDIAN MODERN RETAIL

Traditionally, retail sector comprised of small retailers (kirana stores), with their shops being

in the front and house at the back, where they would run their retail business to earn the

family‟s livelihood. The emergence of organized retail in India dates back to the pre-

independence era when the country‟s established business houses, mostly textile majors,

ventured into the retail arena through company-owned or franchisee outlets. As such the on-

going journey of organized retail in India can be broadly classified into four main phases

(Cushman & Wakefield, 2010) (Figure 1.1):

Initiation (Pre-1990s)

Conceptualization (1990-2005)

Expansion (2005-2010)

Consolidation (2010 onwards)

2.1. Retail Initiation

The initial evolution of modern retail in India primarily transpired through established textile

majors‟ forward integration in retail. The key players during this era include Bombay Dyeing,

the Raymond Group, the S Kumars Group and Bata to name a few. Central and State

Government departments and co-operative bodies such as the Public Distribution System,

Mother Dairy, Kendriya Bhandar, Super Bazaar, etc., played a key role as prominent retailers

in the Indian Market. These early years also saw the emergence of regional chains, like

Nilgiri‟s and Foodworld, primarily in the southern region and some of these chains later

established a nationwide presence. These remained the only organized retailers in the country

for quite a long period, till the post 1990 period saw a fresh wave of entrants in the retailing

business.

Figure 1 Evolution of India's Organized Retail

Source: Cushman & Wakefield

G. Haritha, Prof. B. Amarnath and Dr. M. Sudheer Kumar

http://www.iaeme.com/IJM/index.asp 70 editor@iaeme.com

2.2. Retail Conceptualization

This phase saw the entry of pure-play retailers, and not the manufacturers, expanding pan-

India rather than operate regionally. It is interesting to note that most new retailers like

Pantaloons, Shoppers‟ Stop and Lifestyle, of this era focused mainly on apparel and other

related fashion categories. With the opening of Indian economy during this phase, first

generation international brands like Nike, Reebok, Adidas, Levi Strauss and McDonald‟s to

name a few, made the Indian entry.

2.3. Retail Expansion

As the name suggests, this is perhaps the most active phase in the Indian retail industry, in

terms of growth, entry of new players and development of new entrants. A growing middle

class, increasing disposable incomes as well as a large and young consumer market led to

rapid growth in the Indian retail industry. Having realized the vast potential of the relatively

untapped domestic market, large industrial conglomerates like Mahindra and Mahindra,

Reliance, Tata, Aditya Birla and Essar entered the Pan-India retail arena during this period.

Their success brought in global retailers such as Metro AG, Max Retail, Hypercity, etc. The

period saw the emergence of new formats like cash and carry, large format discounters, food

courts, multiplexes, children‟s play zones and gaming zones. On the real estate front, there

was frenetic activity with a large number of malls were proposed/developed across major

metros and upcoming tier-II cities. The size of the malls also went through rapid

transformation from an average size of 150,000-200,000 sq. ft. to 500,000-1,000,000 sq. ft.

The rapid growth soon attracted the luxury product segment in an environment of the

economic liberalization along with rising purchasing power parity (PPP) index of domestic

consumers. With the FDI policy 2005-2006 allowing single–brand foreign retailers to take up

to 51 per cent stake in joint venture with a local firm, the intervening years saw the entry of

several premium brands (Giogio Armani, Versace, Gucci, etc.) mostly through joint ventures.

2.4. Retail consolidation

Considering the challenges faced by the industry at present, retail chains are likely to focus on

consolidations to cut costs and survive in the market. In the present scenario, companies are

increasingly concentrating on strengthening existing operations while assessing growth

options through consolidation.

3. INDIAN UNORGANISED RETAIL MARKET

According to the National Accounts Statistics of India the „unorganised sector‟ includes units

whose activity is not regulated by any statute or legal provision and/or those, which do not

maintain regular accounts. Thus, unorganised retailing refers to the traditional formats of low-

cost retailing, for example, the local kirana shops, owner managed general stores, paan/beedi

shops, convenience stores, hand cart and pavement vendors, etc. Unorganised retailing is

characterized as unstructured and high degree of fragmentation with street markets constitutes

form peddlers, vegetable vendors, neighbourhood stores and consumer durable stores to

manufacturer owned retail outlets.

Unorganised retail sector covers all those forms of trade which sell an assortment of

products and services ranging from fruits and vegetables to shoe repair. These products and

services may be sold or offered out of a fixed or a mobile location and the number of people

employed could range between 10-20 people. Thus, the neighbourhood baniya, the paanwala,

the cobbler, the vegetable, fruit vendor, etc. would be termed as the unorganized sector.

Traditionally three factors have plagued the Indian retail industry:

Evolution of Indian Modern Retail

http://www.iaeme.com/IJM/index.asp 71 editor@iaeme.com

Unorganized: India is known as nation of shopkeepers where vast majority of the retail stores

are small “father and son” outlets. Traditionally it is a family‟s livelihood, with their shop in

the front and house at the back, while they run the retail business.

Fragmented: India has some 15 million retail outlets; however, a disturbing point is that 96

per cent of them are smaller than 500 square feet in area. This means that India per capita

retailing space is about 2 square feet (compared to 16 square feet in the United States). India‟s

per capita retailing space is thus the lowest in the world.

Rural bias: Nearly two thirds of the stores are located in rural areas. Rural retail industry has

typically two forms: “Haats” and “Melas”. Haats are the weekly markets: serve groups of

1050 villages and sell day-to-day necessities. Melas are larger in size and more sophisticated

in terms of the goods sold (like TVs).

The unorganized retail sector is expected to grow at approximately 10 per cent per annum

with sales rising from US$ 309 billion in 2006-07 to US$ 496 billion in 2011-12. It is a low-

cost structure, mostly owner-operated, has negligible real estate and labor costs and little or

no taxes to pay. According to a survey by AT Kearney, an overwhelming proportion of the

Rs. 4,00,000 crore retail markets are UNORGANISED. Consumer familiarity that runs from

generation to generation is one big advantage for the traditional retailing sector.

4. INDIAN ORGANISED RETAIL MARKET

Organised retailing refers to trading activities undertaken by licensed retailers, that is, those

who are registered for sales tax, income tax, etc. These include the corporate-backed

hypermarkets and retail chains, and also the privately owned large retail businesses. In other

words, it is a network of similarly branded stores with an element of self-service.

Organised retail in India today holds only a fraction of the market share potential in India.

In 2001, organized retail trade in India was worth Rs 11,228.7 billion. It has risen from ZERO

to 6 per cent in a very short period mainly on volumes and not a value-driven growth. The

organized retail sector is catching up very fast and by the year 2013, it is expected to grow at

a CAGR of 40 per cent.

Associated Chambers of Commerce and Industry (ASSOCHAM) reported that the

organized retail sector is recording phenomenal growth and will completely revolutionize

retailing over next 3-4 years. As per estimates made by ASSOCHAM, the organized retail in

urban market is expected to grow at the rate of 50 percent to reach a value of 30 percent of the

total retail market in India. It added that currently, the rural organized retail in India, which is

at nascent stage at present with hardly a value of 2 percent of total organized retail, is

expected to grow over 10 percent by 2013.

According to McKinsey & Company report titled „The Great Indian Bazaar: Organised

Retail Comes of Age in India‟, organised retail in India is expected to increase from 5 per cent

of the total market in 2008 to 14 - 18 per cent of the total retail market and reach US$ 450

billion by 2015 (figure 2).

![Phát triển kinh tế ban đêm: Tổng quan vấn đề lý luận và thực tiễn [Mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20250123/tuetuebinhan000/135x160/5551737632567.jpg)