http://www.iaeme.com/IJM/index.asp 382 editor@iaeme.com

International Journal of Management (IJM)

Volume 7, Issue 7, November–December 2016, pp.382–386, Article ID: IJM_07_07_042

Available online at

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=7&IType=7

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

RUPEE DENOMINATED BONDS (MASALA BONDS)

Syamala Devi Challa

Research Scholar, Department of Commerce & Business Administration,

Acharya Nagarjuna University, Andhra Pradesh, India

Dr. A. Kanakadurga

Assistant Professor, Department of Commerce & Business Administration,

Acharya Nagarjuna University, Andhra Pradesh, India

ABSTRACT

Rupee denominated bonds (RDBs) or Masala bonds are becoming more enticing for both

investors and issuers, and with these bonds, India also stands at a profitable position. Normally

Indian corporate issues debt instruments to raise money from the Indian investors. Unlike debt

instruments, masala bonds are innovative type of bonds, which are linked to rupee but issued to

overseas investors. Masala bond is an effort to protect issuers from currency risk and instead

transfer the risk of currency to investors buying these bonds. The Reserve Bank of India (RBI)

issued a circular authorizing the issuance of masala bonds overseas on September 29, 2015.

International Finance Corporation (IFC), a private sector investment arm of the world bank

named, issued and listed masala bonds, on London Stock Exchange (LSE) in need of infrastructure

projects in India. Mortgage lender Housing Development Finance Corporation (HDFC) was the

first Indian company who raised Rs 5000 crore by issuing masala bonds. This article gives an

overview about masala bonds as how it can be issued, its uniqueness, merits, demerits and its

future.

Key words: Rupee denominated bond, External Commercial Borrowing, Overseas investment

Cite this Article: Syamala Devi Challa and Dr. A. Kanakadurga, Rupee Denominated Bonds

(Masala Bonds). International Journal of Management, 7(7), 2016, pp. 382–386.

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=7&IType=7

1. HISTORY AND EVOLUTION OF MASALA BONDS

Masala bonds are creating hype in Indian as well as foreign markets. The recent success of HDFC has

geared so many organizations such as YES bank and the Railways, had also announced their entry into the

overseas market. Before these rupee denominated bonds, the main source for the corporate to raise money

from the foreign market was external commercial borrowings or ECBs. External commercial borrowings

(ECBs) are commercial loans in the form of buyers’ credit, suppliers’ credit, bank loans and securitized

instruments like fixed rate bonds, floating rate notes and preference shares which are non-convertible,

optionally convertible or partially convertible, issued to the non-resident lenders with a minimum average

maturity of 3 years. ECBs can be accessed under automatic and approval routes. Automatic route covers

the borrowings for industrial sector, real estate, infrastructure and some special service sectors. Approval

Rupee Denominated Bonds (Masala Bonds)

http://www.iaeme.com/IJM/index.asp 383 editor@iaeme.com

route covers borrowings for the financial sector. ECBs are dollar denominated bonds which are issued and

repaid in US Dollars. The main threat allied with ECBs is currency risk – if the domestic currency

depreciates, the liability can significantly increase. In ECBs the majority of the risk has borne by the

issuers. While in a rupee denominated bond, an Indian entity issues a bond in foreign markets and the

principal reimbursement and interest payments are articulated in rupees. Masala bonds are issued in rupee

terms and at the maturity time it will be paid in dollar terms leaving the risk of currency to the investors.

In November 2014 International Finance Corporation (IFC) issued the first masala bond in London in

order to increase the foreign investment in India. IFC is the largest global development institution,

established in 1956, owned by 184 member countries. It is mainly focused on financial companies and

private sector companies in developing countries. IFC raised 10 billion Indian rupee bonds ($163 million)

with 10 years of maturity (Nov 2014) to sustain infrastructure developments in India. Masala bonds were

the first rupee denominated bonds listed on the London Stock Exchange (LSE). IFC named masala bonds

as ‘Masala’ to reflect the spiciness and culture of India. The idea was similar to Chinese Dim-Sum Bonds,

which are Yaun-denominated bonds and named after a popular dish in Hong Kong. Another one is

Japanese Samurai bond, which is Yen-denominated bond and named after its country’s warrior. Like any

other off-shore bonds, masala bonds are meant for those overseas investors who want to take experience to

the Indian assets from their locations. But they have been attached to the currency risk or exchange rate

risks since the settlement will be in US dollars. This is because of the limited convertibility of rupee than

the US dollars.

2. RBI’S GUIDELINES ON RDB’S

According to the guidelines issued by Reserve Bank of India (RBI) in September 2015 and modified policy

in August 2016, the money borrowed under masala bonds can only be used for infrastructure funding

purposes. In order to achieve the capital needs and to accumulate fund for the infrastructure projects, RBI

allowed banks to issue masala bonds or RDBs in August 2016. The overall guidelines underlying for rupee

denominated bonds will be similar to that for External Commercial Borrowings (ECBs)

1

.

2.1. Issuers of RDBs

Any corporate body or corporate (an entity registered under Companies Act as a company) formed with a

specific Parliament Act is eligible to issue Masala bonds overseas. According to the September 2015

regulation Infrastructure Investment Trusts (InvITs), Real Estate Investment Trusts (REITs) coming under

SEBIs jurisdiction are also eligible. From the recent August 2016 regulation, banks are also permitted to

borrow such bonds in order to finance their tier 1, tier 2 and infrastructure funding.

2.2. Corporate Issuers and Maturity Period

Indian corporate who is entitled to raise External Commercial Borrowings (ECBs) is also allowed to issue

off-shore Rupee denominated bonds. The RDBs borrowing procedure pursues the same guidelines as the

corporate follows to issue ECBs. The corporate need RBI permission to avail masala bonds if they issue

ECBs under approval route, whereas under automatic route of ECBs issue, RBI approval is not needed.

The payments of coupon and redemptions are settled in foreign currency. The amount to be issued, the

average maturity period (minimum of 3 years) and end use protection (the reason for which these masala

bonds are issued) also consider as per the guidelines under External Commercial Borrowings (ECB)

1

.

2.3. Interest Payments and Maximum Amount

The payments of interest (coupon payment) should not be more than 500 basis points that means under

consequent maturity it shouldn’t be above the superior yield of the Indian Government’s security. For

instance, if the interest rate of a G Sec five-year bond is 6%, then the rate of interest for rupee denominated

bond should not be above 11%. For the conversion of USD-INR, the reference rate of the Reserve Bank on

that date of issue will be pertinent. An eligible issuer can raise a maximum of INR 50 billion or its

Syamala Devi Challa and Dr. A. Kanakadurga

http://www.iaeme.com/IJM/index.asp 384 editor@iaeme.com

equivalent through RDBs under automatic route during a financial year. This limit may be more than the

permitted amount under automatic route of ECB. The fund collected from rupee denominated bonds must

not be used for some restricted areas of FDI and for real estate activities (except for the development of

housing projects and townships).

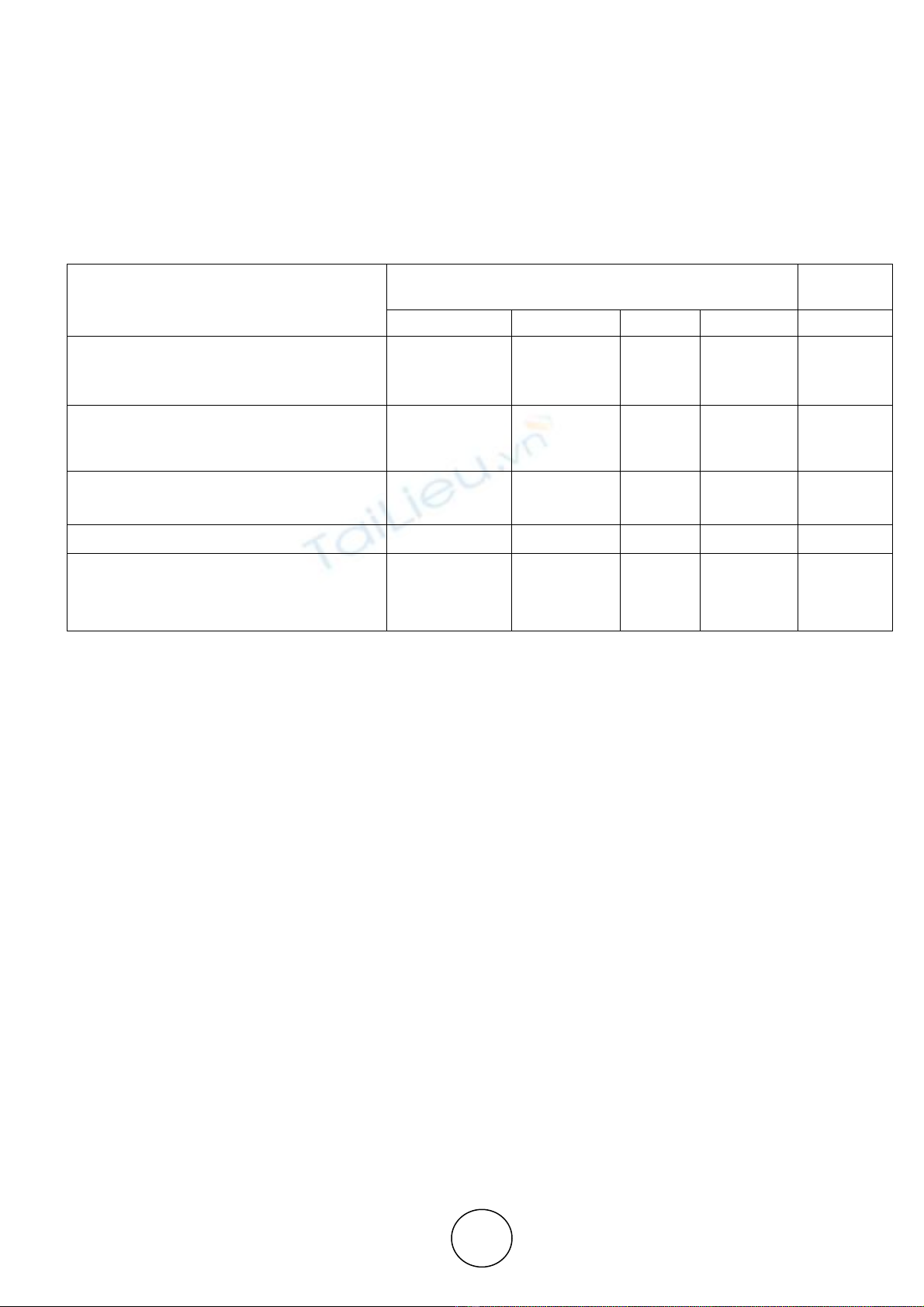

Table 1 Recent Masala Bond issuers in London Stock Exchange (As on October 2016)

Source: London Stock Exchange

3. INTERPRETATION

3.1. International Finance Corporation (IFC)

• IFC is one of the world’s prime investors for developing countries, mainly investing about $11 billion over

the last decade in long-term financing for climate-smart projects like energy efficiency, green buildings,

sustainable agriculture, private sector adaptation to climate change and renewable power.

• IFC issued INR 2bn in 15 year masala bond in March, 2016 marking as a historic longest-dated overseas

bond.

• The proceeds of the bonds will be used to progress private sector development in India.

3.2. National Thermal Power Corporation (NTPC)

• NTPC is India’s biggest power utility company and its head quarters are located in New Delhi. NTPC was

established by Government of India in 1975 and it was awarded Maharatna status in May 2010.

• The company’s core business entails producing and selling electricity to State Electricity Boards and state-

owned power distribution companies in India.

• NTPC initiated a green bond

2

structure which has been certified by Climate Bonds, an associate of London

Stock Exchange independently.

• The proceeds of the bond will be invested to support solar and wind projects supplementing Indian

Government goal to produce 175 GW of renewable energy by 2022.

3.3. Housing Development Finance Corporation (HDFC)

• HDFC founded in 1977, is a foremost provider of Housing Finance and it is established as the first

specialized Mortgage Company in India.

Issuers of Rupee denominated bond in

London Stock Exchange (LSE)

Transaction Details Issuer

profile

Issue Date Issue Size Coupo

3

Maturity Rating

International Finance Corporation (IFC) 21 Mar 2016

10 Aug 2015

18 Nov 2014

INR 2bn

INR 3.15bn

INR 10bn

7.1%

6.45%

6.3%

15 year

5 year

10 year

AAA/Aaa

National Thermal Power Corporation

(NTPC)

10 Aug 2016 INR 20 bn 7.375% 5 year BBB-

(emr)*

Housing Development Finance Corporation

(HDFC)

12 Oct 2016

21 July 2016

INR 20 bn

INR 30 bn

7.25%

7.875%

40 months

37 months

AAA/

A1+**

British Columbia 09 Sep 2016 INR 5bn 6.6% 40 months AAA/Aaa

European Bank for Reconstruction and

Development (EBRD)

4 Mar 2016 INR 5 bn 6.4% 3 year AAA/Aaa

Rupee Denominated Bonds (Masala Bonds)

http://www.iaeme.com/IJM/index.asp 385 editor@iaeme.com

• HDFC stand for the world’s first Indian corporate issued Masala bond.

• The corporation has raised a total amount of Rs 5,000 crore through the issue of Rupee denominated bonds

(as on October 14, 2016).

3.4. British Columbia

• British Columbia, a Canadian Province was the first foreign government unit to issue a rupee denominated

bond.

• The income from the bond will be utilized by HDFC (one of India’s leading financial services and banking

companies) in India’s housing industry.

3.5. European Bank for Reconstruction and Development (EBRD)

• EBRD was founded in 1991, is a multilateral international financial institution which uses investments as a

device to build market economies. It is owned by two governmental institutions (EU and EIB) and 65

countries.

• The European Bank for Reconstruction and Development has been an important issuer of Indian Masala

bonds in London.

4. MERITS OF MASALA BONDS

4.1. To Corporate

• It helps the Indian corporate to diversify their bond portfolio. While the bond issue is in off-shore market, it

facilitates Indian companies to valve a large number of investor base.

• As interest rates in developed countries are much lower compared to India, Corporate can borrow from

overseas market at low interest rates.

• Being an issuer, Indian entity do not have to bear the risk of currency. That means there is any fluctuation in

the currencies, the risk is totally lies with the off-shore investor.

4.2. To Investors

• An investor in overseas can earn better returns through masala bonds compared to the investment returns

from his home country (In US the bond yield

3

is only just 3% whereas in masala bond it ranges from 5% to

8%).

• An investor benefits from the masala bond if the rupee appreciates at the time of maturity.

• Rupee denominated bonds are building interest in the investors who are even unwilling to invest in the off-

shore market.

• In order to attract and benefit more foreign investors, the Ministry of Finance has cut the withholding tax (a

deducted tax at source on populace outside the country) on interest proceeds of bonds from 20% to 5%. And

capital gains from appreciation of rupee are also exempted from tax.

4.3. To India

• As India has ambitious with few many goals like digital India, developing smart cities, Make in India etc, it

will need around INR 26 lakh crore in next five years. Rupee denominated masala bond is an efficient way

to tap foreign capital.

• Masala bonds help in rising up the off-shore investor’s confidence and knowledge about Indian economy.

• In India many long term projects like infrastructure and power are hindered due to shortage of capital. Long-

term Rupee denominated bond is the best solution for road, power and infrastructure companies.

Syamala Devi Challa and Dr. A. Kanakadurga

http://www.iaeme.com/IJM/index.asp 386 editor@iaeme.com

5. DEMERITS OF MASALA BONDS

Along with the benefits of the masala bonds there are some risks involved with rapid shifts in capital

flows, financial candidness, and the risk that overseas market may portray liquidity away from the

domestic market.

6. FUTURE OF RDB

The issuance of masala bonds by the RBI could be the major advancement for the Indian economy. The

recent opportunity for Indian banks to raise foreign currency through RDBs is also an enlightening step

towards the growth. Depending on the masala bonds for getting foreign investment is good for some extent

but too much dependence will lead to a negative exposure and ultimately it affect the investments to India.

REFERENCE

[1] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=10153&Mode=0

[2] Dr. Sonali N. Parchure, Influence of the Financial Literacy on the Investor Profile of the Individual

Investors. International Journal of Management (IJM), 7(5), 2016, pp. 141–153.

[3] http://www.investopedia.com/terms/g/green-bond.asp

[4] http://www.investopedia.com/ask/answers/020215/what-difference-between-yield-maturity-and-coupon-

rate.asp

[5] http://www.londonstockexchange.com/specialist-issuers/debts-bonds/masala/masala-presentation.pdf

[6] Prof. Suresh Kumar S, Dr. Joseph James V and Dr. Shehnaz S R, The Single Index Model – An Exoteric

Choice of Investors In Imbroglio – An Empirical Study of Banking Sector in India. International

Journal of Management (IJM), 7(5), 2016, pp. 210–222.

[7] https://www.rbi.org.in/Scripts/FAQView.aspx?Id=113

![Câu hỏi về thị trường chứng khoán phái sinh tại Việt Nam: Tổng hợp [Năm]](https://cdn.tailieu.vn/images/document/thumbnail/2017/20171004/kloiroong88/135x160/3391507084557.jpg)