http://www.iaeme.com/IJM/index.asp 89 editor@iaeme.com

International Journal of Management (IJM)

Volume 7, Issue 6, September–October 2016, pp.89–94, Article ID: IJM_07_06_010

Available online at

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=7&IType=6

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

EMPIRICAL ANALYSIS OF LONG RUN EQUILIBRIUM

BETWEEN EXCHANGE RATE AND FOREIGN

EXCHANGE RESERVE – AN INDIAN PERSPECTIVE

Dr. Pritpal Singh Bhullar

Assistant Professor - Department of Humanities & Management Studies,

Giani Zail Singh Campus College of Engineering & Technology, India.

Manika Dhameja

CA (Final), ICAI New Delhi, India

ABSTRACT

The present study makes an effort to find the long run equilibrium between Exchange Rate and

Foreign Exchange Reserve. Fifteen years data of these variables has been extracted from the

official website of Reserve Bank of India and has been analyzed by devising statistical software E –

Views. Regression analysis has been applied through SPSS to evaluate the relationship between

foreign exchange reserve and exchange rate. The statistical output of present research supports the

previous research documents and shows the existence of long run equilibrium between these

foreign exchange reserve and exchange rate. It also supports the influence of foreign exchange

reserve on the exchange rate of country.

Key words: Foreign exchange Reserve, Exchange Rate, Regression. Cointegration Test and Unit

Root Test.

Cite this Article: Dr. Pritpal Singh Bhullar and Manika Dhameja, Empirical Analysis of Long Run

Equilibrium between Exchange Rate and Foreign Exchange Reserve – An Indian Perspective.

International Journal of Management, 7(6), 2016, pp. 89–94.

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=7&IType=6

1. INTRODUCTION

Capital flow acts as the blood in veins of the economy. High capital flow boosts the chances of growth of

economy. The positive global macroeconomic signs are true symbolic representation of rise of capital flow

in any economy. With globalization, the interdependence of economies has been increased. The global

events have significant impact on the capital flow of the economies. The financial recession of 2008 dent

the capital inflow in all the major economies across the globe. With globalization, the financial flow has

been inclined developed countries to developing countries and under developed countries. The manifold

rise has been reported in capital flows in many developing economies. Kohli (2203) supports the fact that

increase in capital flow to any economy boost its liquidity, stock market growth and growth prospects of

corporate. Carderelli et al (2010) analyzed that capital flow has significant effect upon the economic

sectors like real estate, financial sector and manufacturing sectors. Dua and Sen (2013) documents the

Dr. Pritpal Singh Bhullar and Manika Dhameja

http://www.iaeme.com/IJM/index.asp 90 editor@iaeme.com

dependency between capital flow and several macro economic variables like current account deficit,

liquidity, inflation and money supply. Since last one decade, India has been emerged as a global

destination for investment. Major global investors have been attracted to India for their bulk investment as

Indian market has sent positive sentiments to the global investors. The countries maintain their foreign

exchange reserves to meet their international short term and long term payment obligations. These

obligations consists of sovereign debt, import financing, commercial debt, for intervention in the foreign

currency markets during periods of volatility, besides helping to boost the confidence of the market in the

ability of a country to meet its external obligations and to absorb any unforseen external shocks,

contingencies or unexpected capital movements. Foreign exchange reserve comprises of Foreign Currency

Assets, Gold and SDR (Special Drawing Rights) and Reserve Tranch Position in which each member is

allocated a special quota by IMF. These include sovereign bonds, treasury bills and short-term deposits in

top-rated global banks besides cash accounts. with the change in the patterns of global trade and other

developments including several currency crises. Foreign exchange reserves acts as catalyst in maintaining

stability of macro-economy. The accumulation of foreign exchange reserve build the strong platform for

enhancing the control of economy of any country, rise in efficiency in currency intervention and also

avoids the probability of occurring financial crisis and national and international level. The rapid

fluctuations in foreign exchange reserve indicates the weak foreign trade activities and economic policies.

Reza, Ostry and Sheehy (2011) quote that foreign exchange reserve acts as external assets that assists in

maintaining Balance of Payments (BOP) and controlling exchange rate with other countries. The exchange

rate intervention also have significant effect upon the foreign exchange reserve of any country. Kasman

and Ayman (2008) examines short term and long term unidirectional flow of causality from foreign

exchange rate to real exchange rate as well as from nominal exchange rate to foreign exchange reserve.

2. REVIEW OF LITERATURE

Emmanuel (2013) study the effect of foreign exchange reserve on exchange rate in Nigeria and finds that

foreign exchange reserve has significant effect upon the exchange rate of Nigeria. Hoshikawa (2012)

analyzed the existence of long term rerelationship between foreign exchange reserve and exchange rate.

Romero (2011) perform a comparative analysis of factors affecting foreign exchange reserve on India and

China and find that an inverse relationship between exchange rate and foreign reserve. They find that with

rise in exchange rate the foreign exchange reserve falls down. Prasad and Raju (2010) find an inverse

relationship between foreign exchange international reserve and exchange rate. They explore that an

inverse relation between foreign exchange reserve and exchange rate when the currency of home country

depreciates. Kasman and Ayan (2008) study the relationship between foreign exchange reserve and

exchange rate in Turkey and finds that long run relationship exist between them. Elhiraika and Ndikumana

(2007) examine that countries maintain foreign exchange reserve to lower the inflation and foreign

exchange rate in home country. Bachhante et al. (2006) confirms the harmful effect of volatile exchange

rate and foreign exchange reserve on the economic growth of any economy. Dua and Sen (2006) analyse

empirically from financial year 1993 to financial year 2004 and finds that Cointegration exist between

capital flow level, volatility in capital flow and real exchange rate. Aizenman and Lee (2005) confirms that

countries reserve foreign exchange reserve to maintain low exchange rate and enhance economic growth

3. OBJECTIVES OF STUDY

The present study is aimed at fulfil the following objectives from Indian prospective:

• To analyze the existence of long run equilibrium between foreign exchange reserve and exchange rate

• To analyze the existence of causal relationship between foreign exchange reserve and exchange ratio

4. RESEARCH METHODOLOGY

To achieve the objectives stated in the present research paper, statistical techniques have been devised.

Causal relationship between foreign exchange reserve and exchange reserve has been measured by Unit

Empirical Analysis of Long Run Equilibrium between Exchange Rate and Foreign Exchange Reserve – An

Indian Perspective

http://www.iaeme.com/IJM/index.asp 91 editor@iaeme.com

Root Test, Johansson Co -integration Test and Vector Auto Regression (VAR) test. E-views Statistical

software has been used to devised these tests for the statistical interference. Foreign exchange reserve data

and exchange rate have been used as the variables. The data of Indian foreign exchange reserve and

exchange rate from FY 2005 to FY 2016 has been collected from the official website of Reserve Bank of

India. The influence of foreign exchange reserve and exchange rate has been examined by the regression

analysis by applying SPSS software.

5. HYPOTHESIS

• Hypothesis I – A long run relationship does not exist between foreign exchange reserve and foreign

exchange rate

• Hypothesis II – Foreign Exchange Reserve has no significant affect on Exchange rate.

6. DATA ANALYSIS

6.1. Unit Root Test at Levels (Augmented Dickey - Fuller Test)

Unit Root Test has been performed to analyze whether the data is stationary of not.

Table 1 Unit Root Test at Level

Variables

Level

No Trend With Trend

t –

statisti

c

Critical Values p

value

t-

statisti

c

Critical Values p

value

1% 5% 10%

1% 5% 10%

LNEXRATE -2.221 -3.438 -2.865 -2.568 0.199

1 -1.66 -

3.969 -3.415 -3.130 0.767

3

LNFRXCRAT

E 3.000 -3.438 -2.865 -2.568 1.000 -0.201 -

3.969 -3.415 -3.130 0.993

6.2. Unit Root Test at First Difference (Augmented Dickey - Fuller Test)

Table 2 Unit Root Test at First Difference

Variables

First Difference

No Trend With Trend

t -

statistic Critical Values

p

valu

e

t-

statisti

c

Critical Values

p

valu

e

1% 5% 10%

1% 5% 10%

LNEXRATE -

23.7980 -3.438 -2.865 -2.568 0.000 -23.861 -3.969 -3.415 -3.130 0.000

LNFRXRAT

E -10.893 -3.438 -2.865 -2.568 0.000 -11.500 -3.969 -3.415 -3.130 0.000

Dr. Pritpal Singh Bhullar and Manika Dhameja

http://www.iaeme.com/IJM/index.asp 92 editor@iaeme.com

The above statistics shows that series is not stationary in both the cases but it become stationary after

taking first difference. The p value for both the variables becomes lower than 0.05 that shows the

stationarity of series.

6.3. Johansen Juselius (J-J) Cointegration Test

Johansen and Juselius Cointegration test (1990) has been performed to analyze the long run relationship

between variables

Table 3 J-J Cointegration Test

Hypothesized No.

of CEs

Trace Max-Eigen Critical Values (5% )

p - Values

Statistics Statistics Trace Max-Eigen Trace Max -

Eigen

r = 0 13.30554 11.79033 15.49471 14.26460 0.1041 0.1188

r ≤ 1 1.515210 1.515210 3.841466 3.841466 0.2183 0.2183

The above Trace test statistics and Max – Eigen statistics shows that no Cointegration exists between

the variables as the p values in both the cases is higher than 0.05. Higher the p – values more than its

significant vale (5%) leads to rejection of null hypothesis at this level. The non - existence of Cointegration

supports the existence of long run equilibrium in both the variables.

6.4. Pairwise Granger - Casuality Test

The Granger Causality test indicates a causality run from foreign exchange reserve to exchange rate

Table 4 Granger Causality Test

Null Hypothesis: A variable does not Granger cause the other

S. No Null Hypothesis F-

statistics

p -

value

p value &

Significant level Decision

1

LNEXRATE does not Granger

Cause LNFOREXCRESERVE 3.80371 0.0227

0.022 < 0.05

Reject Null

Hypothesis.

LNFOREXCRESERVE does not

Granger Cause LNEXRATE

0.63018 0.5328 0.532 > 0.05 Can’t Reject

Null Hypothesis

The above statistical table depicts a causal relationship between Exchange rate and foreign exchange

reserve. The p values (0.02 < 0.05) show that Foreign Exchange Reserve cause changes in change in

Exchange Rate.

Empirical Analysis of Long Run Equilibrium between Exchange Rate and Foreign Exchange Reserve – An

Indian Perspective

http://www.iaeme.com/IJM/index.asp 93 editor@iaeme.com

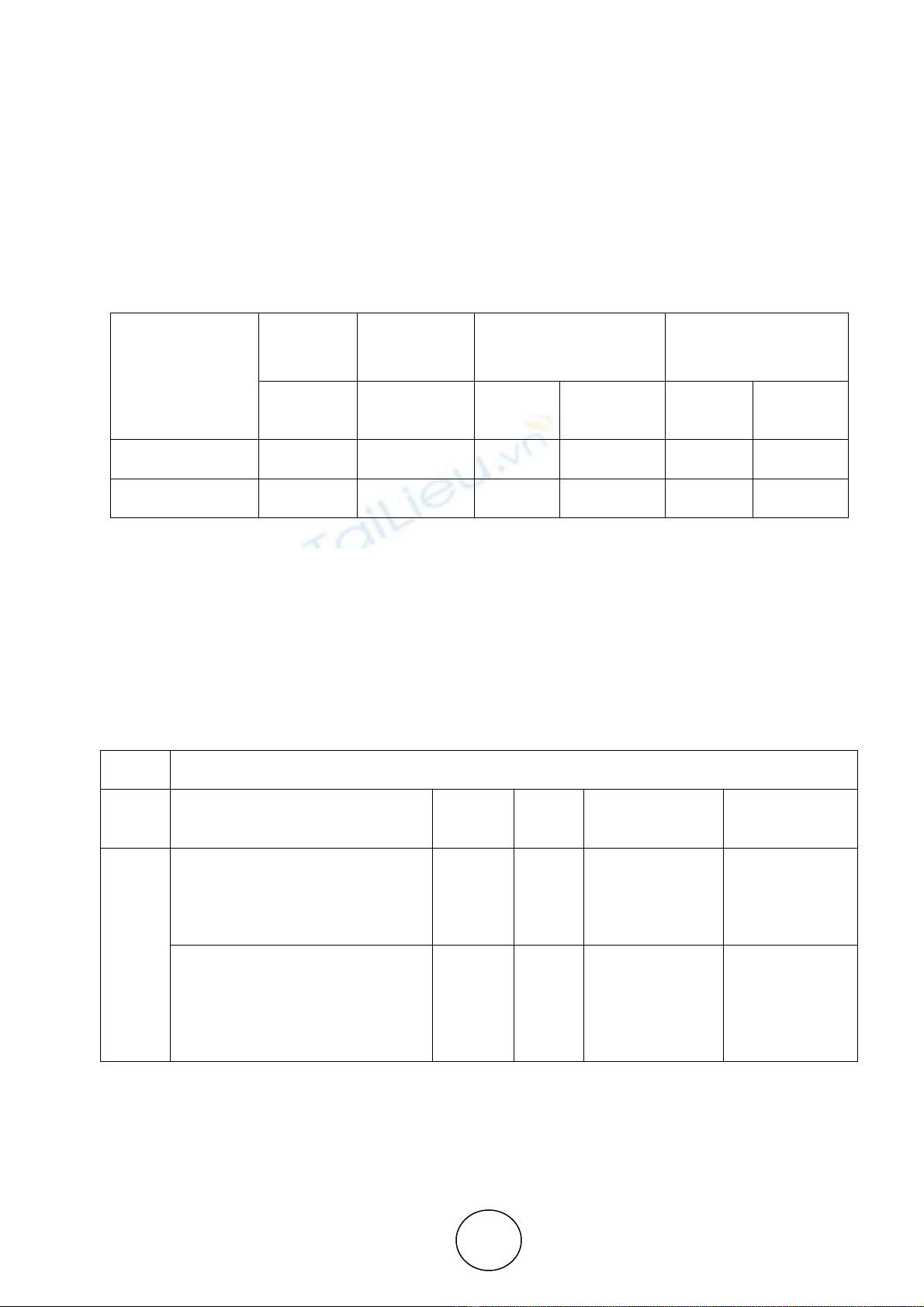

7. RESIDUAL GRAPH

The residual graphs show that no autocorrelation exists between residuals

8. REGRESSION ANALYSIS

Model Summary

b

Model

R

R

Square

Adjusted

R

Square

Std. Error

of the

Estimate

Change Statistics

Durbin-

Watson

R

Square

Change

F Change

df1

df2

Sig. F

Change

dimension0

1 .563

a

.453 .448

.12881 .448 111.253

1 784

.000 .005

a. Predictors: (Constant), LNFOREXCRESERVE

b. Dependent Variable: LNEXRATE

Coefficients

a

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig. B Std. Error Beta

1 (Constant) 2.953 .089

33.010

.000

LNFOREXCRESERV

E

.078 .007 .353 10.548

.000

a. Dependent Variable: LNEXRATE

-.06

-.04

-.02

.00

.02

.04

.06

100 200 300 400 500 600 700

LNEXRATE Residuals

-.06

-.04

-.02

.00

.02

.04

.06

100 200 300 400 500 600 700

LNFOREXCRESERVE Residuals

![Câu hỏi ôn tập Tài chính tiền tệ: Tổng hợp [Mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20251230/phuongnguyen2005/135x160/49071768806381.jpg)

![Câu hỏi ôn tập Tài chính Tiền tệ: Tổng hợp [mới nhất/chuẩn nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20251015/khanhchi0906/135x160/49491768553584.jpg)