http://www.iaeme.com/IJM/index.asp 129 editor@iaeme.com

International Journal of Management (IJM)

Volume 9, Issue 3, May–June 2018, pp. 129–138, Article ID: IJM_09_03_014

Available online at http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=9&IType=3

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

AN ANALYSIS INTO FUNDING OF CROP LOAN

SCHEMES BY DCC BANK IN PUNE

Purvi Shah

Assistant Professor, Indira Institute of Management, Pune, India

Prof. Dr. Medha Dubhashi

HOC, Vaikunth Mehta National Institute of Co-operative Management, Pune, India

ABSTRACT

Agriculture has been the mainstay of India’s economy. More than 60% of Indian

population depends upon agriculture for their livelihood. Agriculture is a way of life, a

tradition and will continue to be central to all the strategies for socio-economic

development of the country. Rapid growth of agriculture will not only ensure continued

food security but also aid growth in industry and GDP. To sustain the growth in

agriculture, credit plays a crucial role. The quantum of agriculture credit provided by

the banking system increased from year to year. The cooperative sector has played a

key role in the economy of the country and always recognized as an integral part of our

national economy. The cooperative banks have more reach to the rural India, through

their huge network of credit societies in the institutional credit structure.

This paper examines the concerns and issues in agricultural funding in Pune

District. It analyses the awareness and usage of agricultural credit by Marginal and

small farmers in Pune district. The analysis states that the demand and supply of

agriculture credit continues to be insufficient.

Cite this Article: Purvi Shah and Dr. Medha Dubhashi, An Analysis Into Funding of

Crop Loan Schemes by DCC Bank In Pune, International Journal of Management, 9

(3), 2018, pp. 129–138.

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=9&IType=3

1. INTRODUCTION

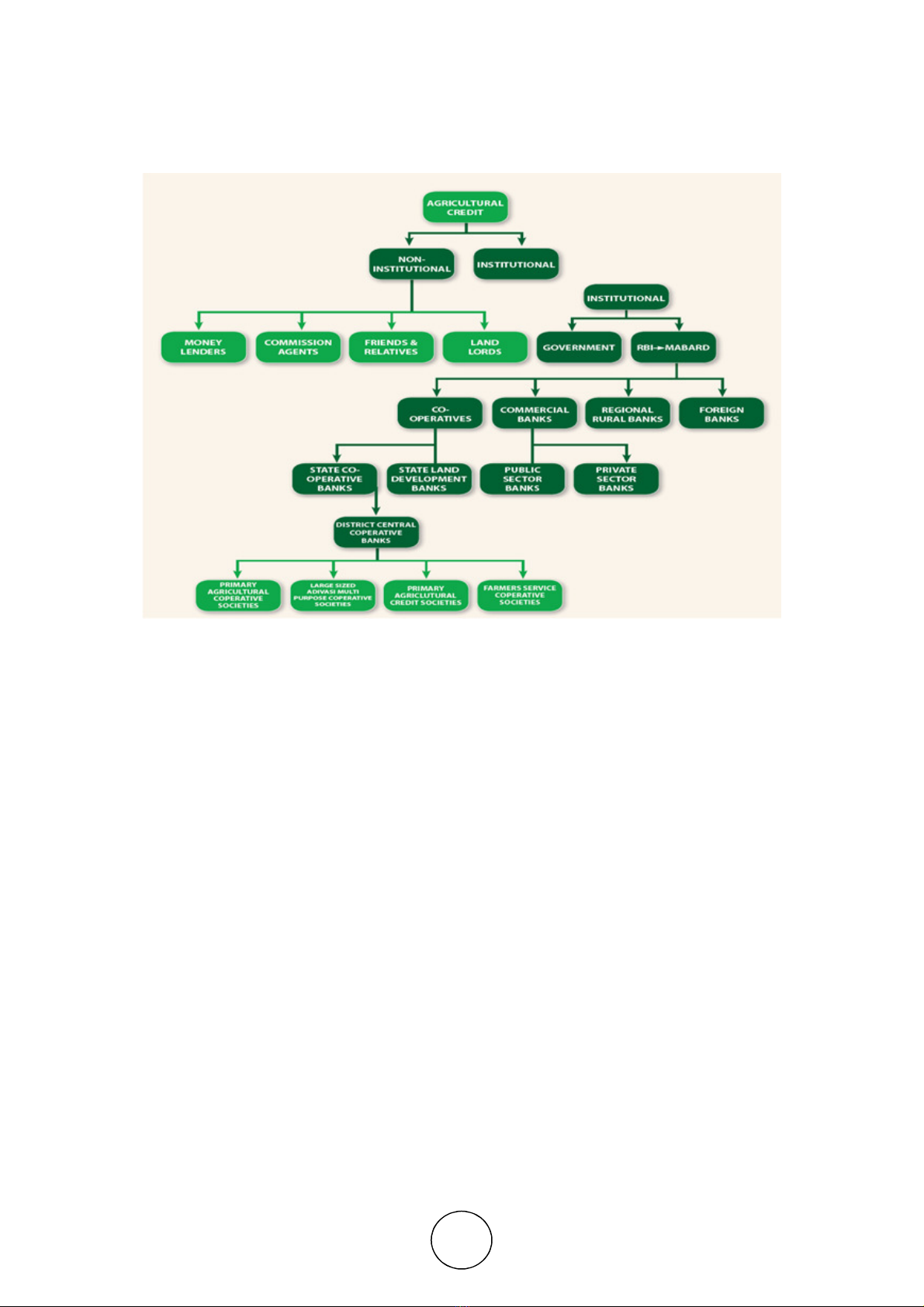

The Governments’ various credit policies have ensured the flow of bank credit to finance a

range of farm related activities in the form of short- term/long-term credit loans. The agriculture

credit system in Maharashtra is similar to that of other parts of the country. Though there are

many sources of credit available to farmers in Maharashtra, the general source of borrowing

(for short-term credit) for an annual crop is through co-operatives, which falls under

institutional credit. State level Co- operative banks disburse loans to Primary Agricultural Co-

operative Credit Societies (PACS) through District Central Co-operative Banks (DCC). Hence,

the entire flow of credit to farmers depends on PACS that are linked to DCC banks, which are

federated to State Co-operatives banks. The State Co- operative Banks, in turn get funds for

An Analysis Into Funding of Crop Loan Schemes by DCC Bank In Pune

http://www.iaeme.com/IJM/index.asp 130 editor@iaeme.com

agricultural credit from the National Bank for Agricultural and Rural Development

(NABARD).

2. AGRICULTURAL CREDIT: RECENT TRENDS AND

DEVELOPMENT

Agricultural Credit Cards are not new concept in the field of agricultural banking in India. The

scheme had already been introduced by number of public sector banks in few states much

earlier. These schemes were niche marketed and were exclusively preserved for the privileged

class of farmers. Similarly cash credit facility was being extended by several public sector bank

and co-operative banks to farmers with the view to improving their access to credit. Again this

scheme was used only selectively.

Kisan Credit Card Scheme (KCC) scheme was introduced in 1998-99 to provide farmers

with timely credit for their agricultural operation. The main objectives of the Scheme is to meet

the short term credit requirements for cultivation of crops, post-harvest expenses, provide loan

for marketing of crop, consumption requirements of farmer, working capital for maintenance

of farm assets and allied activities to agriculture like dairy, animals, poultry, inland fishery etc.

The revolving cash credit facility allows any number of withdrawals and repayments within the

limit. This limit is fixed on the basis of operational land holding, cropping pattern and the scale

of finance. Sub-limits may be fixed at the discretion of banks. In this scheme eligible farmers

are provided with a Kisan Credit Card and a passbook.

KCCs have now been converted into Smart Card cum Debit Cards to facilitate its operation

through ATMs. The cumulative number of live KCCs issued by Commercial Banks,

Cooperative Banks & Regional Rural Banks as on 31 March, 2016 was 752.72 lakh with

outstanding loan amount of Rs.530034.58 crore. Some of the major features of revised KCC

Scheme are:

• Assessment of crop loan component based on the scale of finance for the crop plus insurance

premium x Extent of area cultivated + 10% of the limit towards post -harvest/ household/

consumption requirements + 20% of limit towards maintenance expenses of farm assets.

Heena Sunil Oza

http://www.iaeme.com/IJM/index.asp 131 editor@iaeme.com

• Flexi KCC with simple assessment prescribed for marginal farmers.

• Validity of KCC for 5 years

• For crop loans, no separate margin need to be insisted as the margin is in-built in scale of

finance.

• No withdrawal in the account to remain outstanding for more than 12 months; no need to bring

the debit balance in the account to zero at any point of time.

• Interest subvention /incentive for prompt repayment to be available as per the Government of

India and / or State Government norms.

• No processing fee up to a limit of Rs.3.00 lakh.

• One time documentation at the time of availing the loan for the first time and thereafter simple

declaration (about crops raised/ proposed) by farmer.

• KCC cum SB account instead of farmers having two separate accounts. The credit balance in

KCC cum SB accounts to be allowed to fetch interest at saving bank rate.

• Disbursement through various delivery channels, including ICT driven channels like ATM/

POS/ Mobile handsets

KCC has ability to provide aid to Farmers and give benefits to the Bank also. Some of the

benefits are as follows:

To Farmers

• Access to adequate and timely credit to farmers.

• Full year’s credit requirement of the borrower taken care of.

• Minimum paperwork and simplification of documentation for withdrawal of funds from the

bank.

• Flexibility to draw cash and buy inputs.

• Assured availability of credit at any time enabling reduced interest burden for the farmers.

• Sanction of facility for 5 years subject to annual review and satisfactory operation and provision

of enhancement.

• Flexibility of withdrawals from a branch other than issuing branch at the discretion of the bank.

• Assured availability of credit any time enabling reduced interest burden for the farmers

To the Bank

• Reduction in work load for branch staff by avoidance of repeat appraisal and processing of loan

papers under taken KCC scheme.

• Improvement in recycling of funds and recovery of loan.

• Reduction in transaction cost to the banks.

• Better banker-client relationship.

3. OBJECTIVES OF THE STUDY

• To study the Pune District Credit Co-operative Bank’s (PDCC Bank) initiative towards

agricultural credit for small and marginal farmers in Mulshi Taluka, Pune.

• To analyze the awareness and usage of agricultural credit for marginal and small farmers.

4. REVIEW OF LITERATURE

Various studies have been conducted and numerous suggestions were sought to bring

effectiveness in the working and operations of financial institutions. Narsimham Committee

(1991) emphasized on capital adequacy and liquidity, Padamanabhan Committee (1995)

suggested CAMEL rating (in the form of ratios) to evaluate financial and operational efficiency,

An Analysis Into Funding of Crop Loan Schemes by DCC Bank In Pune

http://www.iaeme.com/IJM/index.asp 132 editor@iaeme.com

Tarapore Committee (1997) talked about Non -performing assets and asset quality, Kannan

Committee (1998) opined about working capital and lending methods, Basel committee (1998

and revised in 2001) recommended capital adequacy norms and risk management measures.

Kapoor Committee (1998) recommended for credit delivery system and credit guarantee and

Verma Committee (1999) recommended seven parameters (ratios) to judge financial

performance and several other committees constituted by Reserve Bank of India to bring

reforms in the banking sector by emphasizing on the improvement in the financial health of the

banks.

Some studies related to the various issues of agriculture credit are: Sharma and Prasad

(1971) stated that the introduction of latest technology without credit facilities would not have

significance influence on the income of the farmers. Agriculture credit has direct relationship

with the income level farm productivity and agriculture development.

Naryanan (1987) Studied most of villagers who took loan were small and marginal farmers

and agricultural labourers. He further observed that due to inadequate credit given to them,

there was no increment in the income of beneficiaries.

Prasad (2005) in his research paper titled, "Co-operative Banking in a Competitive Business

Environment" stated that the technology had made tremendous impact on entire banking sector,

which had thrown new challenges, and exposed co-operative banks competition and risk

management. Therefore, they needed a combination of- new technologies and better processes

of credit and risk appraisal, treasury management, product diversification, internal control and

external regulation along with infusion of professionalism. He emphasised on need for

transformation in the identity, business operations, governance and systems & procedures of

the co-operative banks to face the environmental challenges

Golait (2007) examined the issues in agricultural credit in India. The analysis revealed that

the credit delivery to the agriculture sector continues to be inadequate. His study revealed that

the banking system is still hesitant on various grounds to provide credit to small and marginal

farmers. It was suggested that concerted efforts were required to expand the flow of credit to

agriculture, along with exploring new innovations in product design and methods of delivery,

through better use of technology and related processes. Facilitating credit through processors,

input dealers, NGOs, etc. that was vertically integrated with the farmers could increase the

credit flow to agriculture significantly.

J.P. Bhosale (2005), in his study on “A Study of PACS in Junnar, Ambegaon and Khed

Talukas of Pune District” examined working of PACS to improve the efficiency of the societies

for the benefit of the members. His study was focused on the role of PACS in rural development

loan advancement, various services provided, organization and management of PACS.

Dr. T. G. Gite (2005 in his thesis titled, “An Economic Analysis of Mechanization of

Agriculture in Pune District, Maharashtra state” to University of Pune emphasised on the broad

objectives : 1. To Review of overall farm mechanization of agriculture at global, national level

and in State of Maharashtra. 2. To study the trends of Mechanization in the State of Maharashtra

in general and Pune district in particular. 3. To study the impact of mechanization on cropping

pattern and yield and returns and employment. 4. To suggest measures for improvement in the

present stage of farm mechanization in the context of changed scenario after emergence of

WTO. His observations include: In India the farm mechanization is limited to use of tractors

and implements which are used along with the tractor. Special purpose modern farm equipment

is beyond the reach of the common Indian agriculturists as it involves high capital investment.

The use of farm equipment can allow farmers to increase their yields and reduce their

consumption of water, seed, fertilizers, and pesticides. Farming being a time and climate

sensitive process, critical farm operations such as land preparation, sowing and crop protection

need to be completed within a short span of time.

Heena Sunil Oza

http://www.iaeme.com/IJM/index.asp 133 editor@iaeme.com

Pawar A.M. (2006)in his study of “Review of Agricultural Credit Provided by DCCB in

Pune District”, found that the Pune District Central Co-operative Bank (PDCCB) has adopted

Kisan Credit Card (KCC) method for advancing the crop loans to the farmers. The state of

Maharashtra has been implementing National Agricultural Insurance Scheme since 1999.

PDCC bank has also implemented this scheme for some crops. It was observed that PDCC bank

provided maximum amount of short-term credit to agriculture as compared to medium-term

and long-term credit. The PDCC bank has also provided other types of loans but proportion of

other types of total loan decreased, whereas the proportion of agricultural loans to total loans

increased during 1996-97 to 2003-04. Thus it was found that the production and productivity

of agriculture as well as income and standard of living of the farmers has increased due to

agricultural credit provided by sample branches of PDCC bank to the farmers in Pune district.

It was found that overdues of loans were due to drought, irregular electricity supply and natural

calamities.

5. RESEARCH METHODOLOGY

Present Study has been conducted on the basis of Primary data as well as Secondary data.

50 Marginal and Small farmers having account with PDCC bank from Mulshi Taluka of

Pune has been selected. For the study 35 Marginal farmers, 15 Small farmers were interviewed.

Marginal Farmers means a farmer cultivating (as owner or tenant or share cropper)

agricultural land upto 1 hector (2.5 acres). Small farmers means a farmer cultivating (as owner

or tenant or share cropper) agricultural land of more than 1 hectare and upto 2 hectares (5 acres).

The questionnaire was administered and got filled up through direct interview as well as

indirect interview. Secondary data was collected from internet, various journals, books and

newspapers etc.

5.1. Type of Research: Analytical research is used to study the awareness and usage of Finance

loan products by Small and Marginal Farmers and initiatives taken by PDDC bank to provide

various agricultural credits.

5.2. Collection of data

5.2.1 Primary Data

a. Observation Method

b. Interview Method

c. Structured Questionnaire

5.2.2 Secondary Data

a. Annual reports of the bank

b. Manual of instructions on loans and advances of DCC bank

c. Books

d. Articles and Research Papers

e. Internet

5.3 Sampling Unit

The Study population includes marginal and small farmers having account with DCC bank.

5.4 Sampling Size

Marginal farmers 35 and Small farmers 15.