http://www.iaeme.com/IJM/index.asp 265 editor@iaeme.com

International Journal of Management (IJM)

Volume 7, Issue 7, November–December 2016, pp.265–270, Article ID: IJM_07_07_028

Available online at

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=7&IType=7

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

PERSONAL FINANCE IS MORE PERSONAL THAN IT

IS FINANCE: A STUDY ON FACTORS INFLUENCING

INVESTMENT CHOICE ON INVESTMENTS IN

TIRUCHIRAPPALLI CITY CORPORATION,

TAMIL NADU

Dr. I. Francis Gnanasekar

Associate Professor in Commerce, Former Vice-Principal & HOD

St. Joseph’s College (Autonomous), Tiruchirappalli, India

ABSTRACT

This study aims at to know the objectives of investments and also aims at to know the factors

that are considered before investments, i.e., factors influencing in selection of a particular type of

financial instruments and the behaviour of investors. The data has been collected through

structured questionnaire from the loyal, regular, serious, sincere investors. The data has been

tested by different statistical analysis namely; Frequency table, Percentage analysis, Chi-square

test, Descriptive statistics, Friedman rank test and so on. The findings of the study exposes that

regular income is the main objective of investments and investor considering safety as a principal

before investing. The Friedman rank test showed that not much difference between the top four

factors like capital appreciation, to gain a regular return, investment return, and reducing future

risk with regard to factors influence while selecting particular financial instruments.

Key words: Safety of principal, Descriptive statics and Friedman rank test

Cite this Article: Dr. I. Francis Gnanasekar, Personal Finance is more Personal than it is Finance:

A Study on Factors Influencing Investment Choice on Investments in Tiruchirappalli City

Corporation, Tamil Nadu. International Journal of Management, 7(7), 2016, pp. 265–270.

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=7&IType=7

1. INTRODUCTION

Investment may be defined as an activity that commits funds in any financial/physical form in the present

with an expectation of receiving an additional return in the future. The expectation brings with it a

probability that the quantum of return may vary from a minimum to maximum. This possibility of

variation in the actual return is known as investment risk. Thus every investment involves a return and risk.

Investment is an activity that is undertaken by those who our savings. Savings can be defined as the excess

of income over expenditure. However, all savers need not be investors B S Bodla and Karam Pal (2016).

The basic objective of the investors minimizes the risk as well as maximizing the returns from the

investment. In the modern world investments are abundantly available viz., equity shares, preference

shares, debenture/bonds, mutual funds, real estate, postal savings, gold and so on. Similarly, several factors

Dr. I. Francis Gnanasekar

http://www.iaeme.com/IJM/index.asp 266 editor@iaeme.com

influencing the investors while selecting the particular type of financial interments viz., safety, liquidity,

capital appreciation, personal factors, family influence and so on. Hence, the study was carried out to know

the factors influencing the investors while selecting the financial instruments and behaviour of the

investors.

2. OBJECTIVES OF THE STUDY

• to know the objectives of investments and find out the factors that investors consider before investing;

• to identify important factors influencing in selection of a particular type of financial instruments; and

• to study the responses and behaviour of the investors when company announce annual results.

3. HYPOTHESES

• There is no significant difference between age of the investor and their investment behaviour (Buy a Stock)

• There is no significant difference between age of the investor and their investment behaviour (Hold a Stock)

• There is no significant difference between age of the investor and their investment behaviour (Sella Stock)

4. REVIEW OF LITERATURE

Dhiraj Jains and Nakul Dashora (2012) analyzed the rationality of the investors of Udaipur during different

market expectations, dividend and bonus announcements, the impact of age, income levels and other

market-related information on investment decisions of investors from Udaipur. The study exposed that,

investors prefer ‘A wait and watch policy’ for taking their decisions, and are very cautious and their

decisions are influenced by various psychological factors and behavioral dimensions.

Syed Tabassum Sultana and S Pardhasaradhi (2012), examined the factors influencing Indian

individual equity investors. The empirical findings of factor analysis exposed that all the 40 attributes are

reduced to the following ten factors Individual Eccentric, Wealth Maximization, Risk Minimization, Brand

Perception, Social Responsibility, Financial Expectation, Accounting information, Government & Media,

Economic Expectation and Advocate recommendation factors.

Francis Gnanasekar and Arul (2014), has stated that investors are of different categories. In this study,

the researchers found out various types of investors like a conservative, moderately conservative,

Aggressive and moderately aggressive. Moreover, investor’s risk tolerance varies on the basis of age, sex,

income; financial goals and so on.

Khoa Cuong Phan and Jian Zhou (2014), examined that factors influencing individuals’ investment

behavioral intention in the Vietnamese stock market. The empirical findings of the study exposed that

existence of psychological factors which supports the hypothesis that four psychological factors

(overconfidence, excessive optimism, a psychology of risk and herd behavior) do have a significant impact

on the individuals' attitude towards investment. Concurrently, the study has also brought out that gender

has a strong moderation affect in the relations between the psychological factors and the attitude towards

investments, between the attitude and behavioral intention, between subjective norms and behavioral

intention as well as between perceived behavioral control and behavioral intention of Vietnamese

individual investors.

Francis Gnanasekar and Arul (2015), Portfolio investment covers a range of securities, such as stocks

and bonds, as well as other types of investment vehicles. A diversified portfolio helps spread the risk of

possible loss due to the below-expectations performance of one or a few of them. They are categorized in

two major parts foreign institutional investment and investments by non-residents.

Personal Finance is more Personal than it is Finance: A Study on Factors Influencing Investment Choice on

Investments in Tiruchirappalli City Corporation, Tamil Nadu

http://www.iaeme.com/IJM/index.asp 267 editor@iaeme.com

5. METHODOLOGY

5.1. DATA

The researcher attempts to collect the information regarding investment detail and investment pattern of

the investors. For this purpose, the researcher identifies a number of stock broking agencies through survey

and internet. By referring to the addresses of the stock broking agencies, it is found that most of them

mainly in Thillainagar, Railway Junction area, Chattram Bus Stand, Palakarai, Woraiyur and Thennur.

From these areas, there are 23 stock broking agencies exist. Among 23 stock broking agencies, six agents

are not permited to collect the data from their clients; three stock broking agencies are closed due to some

reasons. Rests of the 14 stock broking agencies are allowed to collect data. The researcher contacted the

branch managers of 14 branches through phone and got the appointment for discussion. The researcher had

several rounds of talks, discussion with the branch managers. The researcher collected the names and

address of the regular customers of the stock broking agencies. The branch managers of the stock broking

agencies selected 50 loyal, regular, serious, sincerely investors. The stock broking branch managers felt

that only the above selected 50 respondents have been selected from each broking agencies. From the 14

agencies, 50 respondents were selected. Thus, 700 questionnaires were distributed and collected back.

Then, the researcher conducted data validity test viz., Chrona Alpha Test. The test reveals 0.809. i.e., 80.9

per cent as its result.

5.2. Tools and Techniques Used for this Study

The researcher collected primary data through a questionnaire from the loyal investors in Tiruchirappalli

city area and used Statistical Packages for Social Sciences (SPSS) with appropriate coding for the drawing

inferences. Tools are used in this study namely; Frequency table, Percentage analysis, Cross table,

Friedman rank test and Chi-Square test are applied to analyze the data.

6. DATA ANALYSIS AND INTERPRETATION

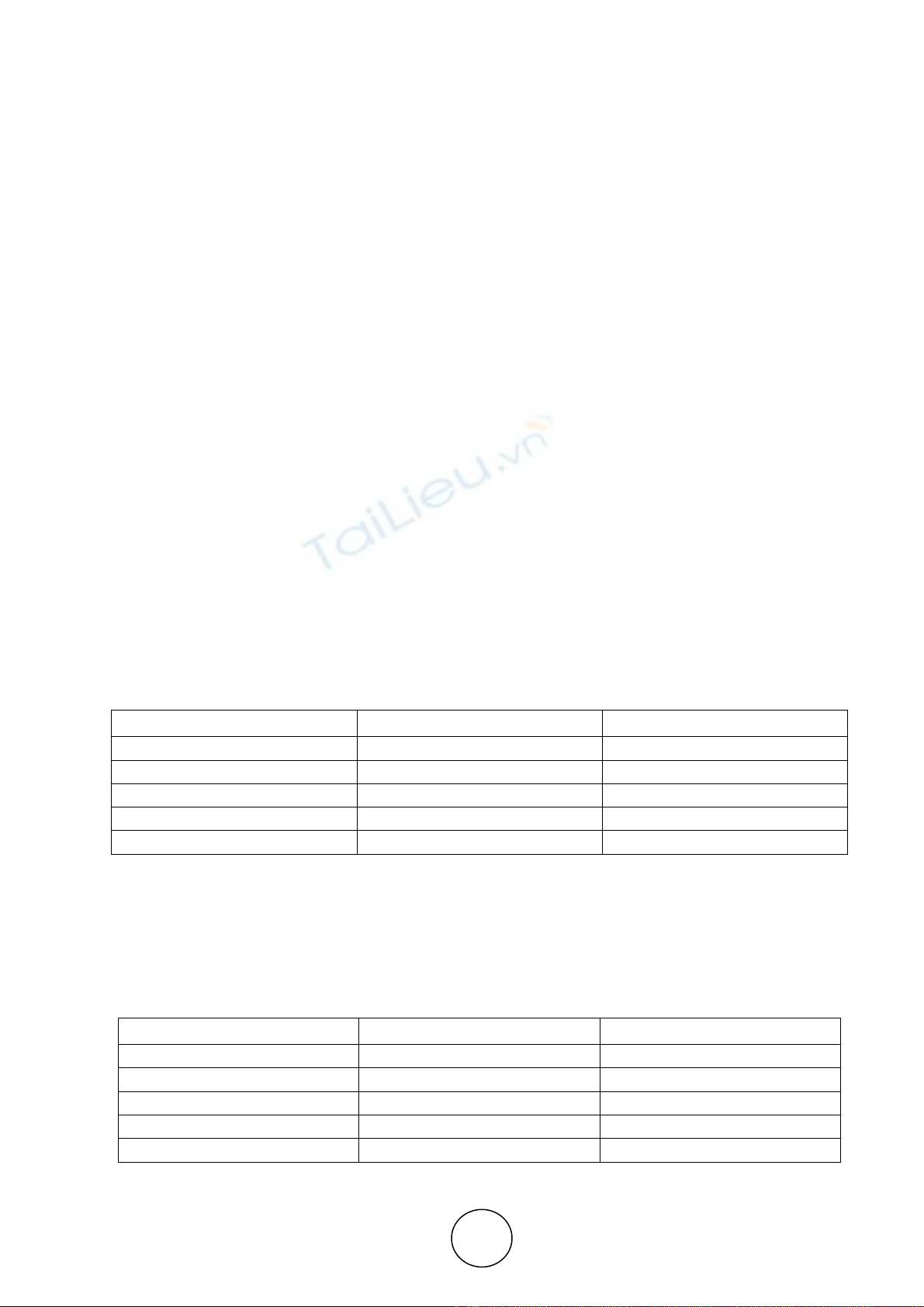

Table 1

Objectives of Investment

Objectives No. of the Respondents Per cent

High Returns 176 25.1

Tax benefits 94 13.4

Regular Income 313 44.7

Capital appreciation 117 16.7

Total 700 100.0

Source: primary data

It is clear that from the table 1, among the 700 respondents, 176 respondents say High returns are their

main investment objective, 94 respondents say Tax benefits are their investment objective, 313

respondents say Regular income is their investment objective and 117 respondents say Capital appreciation

is their investment objective.

Table 2

Factor to be considered before Investments

Factor No. of the Respondents Percent

Safety principal 234 33.4

Low risk 216 30.9

High returns 226 32.3

Maturity period 24 3.4

Total 700 100.0

Source: primary data

Dr. I. Francis Gnanasekar

http://www.iaeme.com/IJM/index.asp 268 editor@iaeme.com

It is clear that from the table 2, among the 700 respondents, 234 respondents consider the ‘safety

principal’ is the factor to be considered before their investment plan, 216 respondents felt that ‘Low risk’ is

the factor to be considered before their investment plan, 226 respondents considered ‘High returns’ is the

factor to be considered before their investment plan and 24 respondents planned Maturity period is the

factor to be considered before their investment plan.

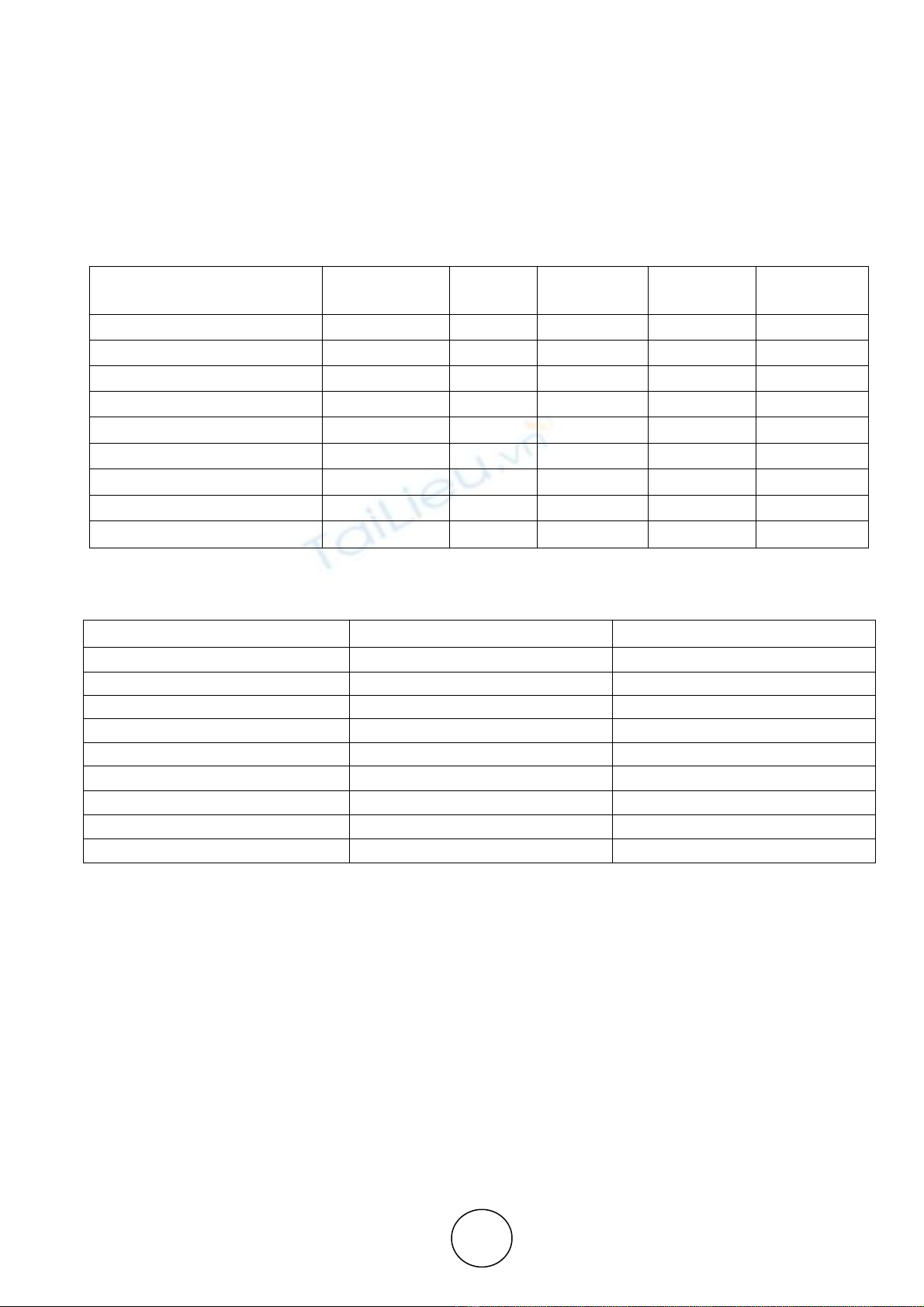

Table 3 Descriptive Statistics

Factors No of

respondents Mean Std.

Deviation Minimum Maximum

Tax benefits 700 4.77 2.889 1 9

To gain Regular returns 700 3.90 2.296 1 9

Reducing Future Risk 700 4.53 2.305 1 9

Capital appreciation 700 3.48 2.183 1 9

Reputations of the firm 700 5.68 2.164 1 9

Investment return 700 4.03 2.306 1 9

Time horizon 700 6.17 2.188 1 9

Investment goals 700 5.51 2.559 1 9

Risk tolerance 700 6.92 2.126 1 9

Source: primary data

Table 3 (A) Friedman Rank Test

Factors Mean value Rank

Tax benefits 4.77 5

To gain Regular returns 3.90 2

Reducing Future Risk 4.53 4

Capital appreciation 3.48 1

Reputations of the firm 5.68 7

Investment return 4.03 3

Time horizon 6.17 8

Investment goals 5.51 6

Risk tolerance 6.92 9

Source: primary data

In order to study the important factors influencing in selection of a particular type of financial

instrument by the investors, an attempt have been made to compute their mean influencing factors. The

mean influencing factors reflect the overall influenced factors for the investors while selecting financial

instruments. The lower mean value represents higher influenced factors and vice-versa. The table 3 shows

that among the nine importance factors capital appreciation is ahead of others in factors influencing. It is

closely followed by to gain a regular return. The investment return is the third important factors

influencing the investors. The important factors influence depends upon the type of financial instruments.

In order to verify the above-mentioned fact, Friedman Rank test is used. The result of the test furnished

in the Table 3 (A). It is understood that capital appreciation stands first rank and it is the most important

factors influencing the investors. The second influencing factor is to gain regular returns and it is closely

followed by investment return. The least influencing factor is a risk tolerance. From the above analysis it is

clear that the basic factors influencing the investors, is the capital appreciation from their financial

instruments, followed by gain as a regular return.

Personal Finance is more Personal than it is Finance: A Study on Factors Influencing Investment Choice on

Investments in Tiruchirappalli City Corporation, Tamil Nadu

http://www.iaeme.com/IJM/index.asp 269 editor@iaeme.com

Table 4 Cross Table of Relationship between Age of the Investors and their Investment Behavior

Age Buy a Stock

Above expectation As per expectation Below expectation Total

Up to 30 180 69 31 280

31- 40 119 55 13 187

41-50 79 17 18 114

51 and above 63 34 22 119

Total 441 175 84 700

Age Hold a Stock

Above expectation As per expectation Below expectation Total

Up to 30 50 217 13 280

31- 40 39 131 17 187

41-50 4 96 14 114

51 and above 34 73 12 119

Total 127 517 56 700

Sell a Stock

Age Above expectation As per expectation Below expectation Total

Up to 30 65 66 149 280

31- 40 50 30 107 187

41-50 22 10 82 114

51 and above 57 12 50 119

Total 194 118 388 700

Source: primary data

Table 4 (A) Chi-Square Test

Value d.f Asymp. Sig. (2-sided)

Buy the

stock

Hold the

stock

Sell the

stock Buy the

stock

Hold the

stock

Sell the

stock

Pearson Chi-Square 19.142

a

33.888

a

47.557

a

6 .004 .000 .000

Likelihood Ratio 19.915 39.903 45.408 6 .003 .000 .000

Linear-by-Linear

Association 4.312 .489 5.152 1 .038 .484 .023

N of Valid Cases 700 700 700

Source: primary data

The table 4 exhibits the correlation between age of the investors and their investment behaviour. The

behaviour of the investors namely ‘Buy a Stock’, ‘Hold a Stock’ and ‘Sell a Stock’ when the companies

announce the annual results. The ‘F’ test carried out to know the association between age of the investors

and their behaviour.From the table 4 observed that F Pearson chi-square has the probability of 0.004 which

is lower than 0.05 (0.00 <0.05), here null hypothesis is rejected and research hypothesis is accepted, so it is

clear that there is a strong relationship between age of the investor and their investment behaviour (Buy the

Stock).From the table 4 observed that F Pearson chi-square has the probability of 0.000 which is lower

than 0.05 (0.00 <0.05), here null hypothesis is rejected and research hypothesis is accepted, so it is clear

that there is a strong relationship between age of the investor and their investment behaviour (Hold the

Stock).From the table 4 observed that F Pearson chi-square has the probability of 0.000 which is lower

than 0.05 (0.00 <0.05), here null hypothesis is rejected and research hypothesis is accepted, so it is clear

![Ngân hàng câu hỏi trắc nghiệm Lý thuyết Tài chính - Tiền tệ: Học phần [Mô tả thêm về nội dung học phần nếu có]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20251003/kimphuong1001/135x160/26991759476043.jpg)

![Bài tập Tài chính doanh nghiệp có đáp án [kèm lời giải chi tiết]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20250927/aimy1105nd@gmail.com/135x160/92021759119232.jpg)