http://www.iaeme.com/IJM/index.asp 94 editor@iaeme.com

International Journal of Management (IJM)

Volume 10, Issue 1, January-February 2019, pp. 94-103, Article ID: IJM_10_01_013

Available online at http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=10&IType=1

Journal Impact Factor (2019): 9.6780 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

STUDY AND ANALYSIS OF PROJECT RISK,

MARKET RISK AND FIRM RISK

Dr. Giriraj Kiradoo

Associate Professor in MBA,

Government Engineering College Bikaner, Bikaner Area, India

ABSTRACT

This work aimed to study and analysis the various risk associated with different

environment. The selected method consists of market risks and operating risks. The

approach used in this paper is proved to be practical and useful in the decision-making

process of capital budgeting and investment because each value corresponds to a

specific risk measures, so that a specific risk component can be managed to an

acceptable risk level.

Keywords: Project Risk, Market Risk and Firm Risk

Cite this Article: Dr. Giriraj Kiradoo, Study and Analysis of Project Risk, Market

Risk and Firm Risk, International Journal of Management, 10 (1), 2019, pp. 94-103.

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=10&IType=1

1. INTRODUCTION

It is a well-established undeniable fact that each project involves risk. Moreover, it's a observe

to incorporate a brief outline of project risks within the project appraisal report. There are sure

projects that economic advantages are often quantified whereas, for others, such quantification

isn't doable. The firm risk stems from a technological modification in production method,

managerial unskillfulness, the availability of raw material, labor issues and changes in

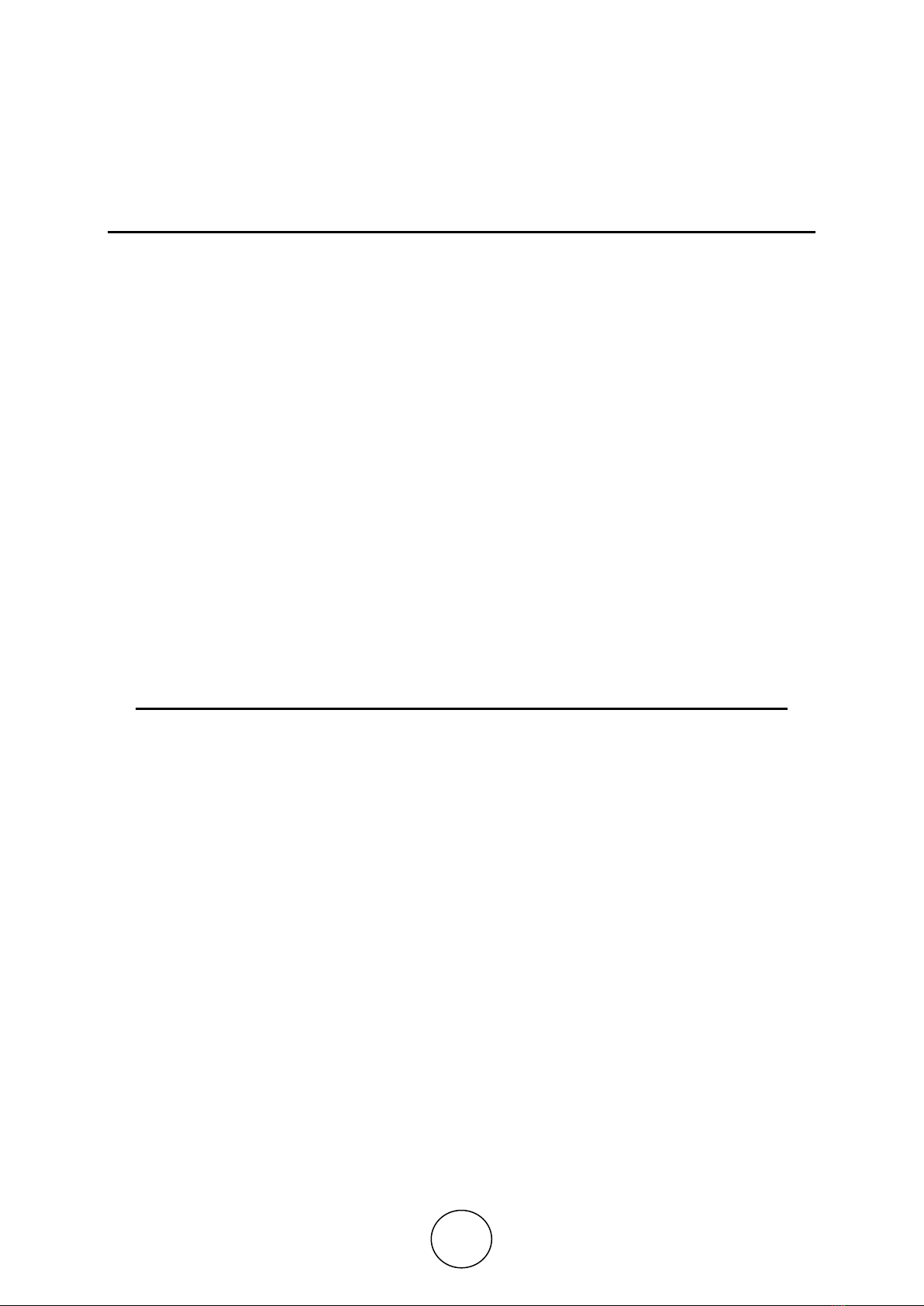

consumer preferences. The financial risk considers the distinction between EBIT (Earnings

before Interest and Taxes) and EBT (Earnings before Tax) whereas business risk causes the

variations between revenue and EBIT. These are ways that and suggests that to scale back the

project risks.

Study and Analysis of Project Risk, Market Risk and Firm Risk

http://www.iaeme.com/IJM/index.asp 95 editor@iaeme.com

Table 1 EBT and EBIT

2. ANALYSIS OF PROJECT RISKS

It is the traditional observe to incorporate a brief outline of project risks in every appraisal

report. The aim of this chapter is to produce an outline of project risks so as to assist guarantee

uniformity and consistency in appraisal reports.

• Relates to comes that economic advantages may be quantified and

• Deals with comes that such quantification isn't potential.

2.1. Projects with quantified benefits

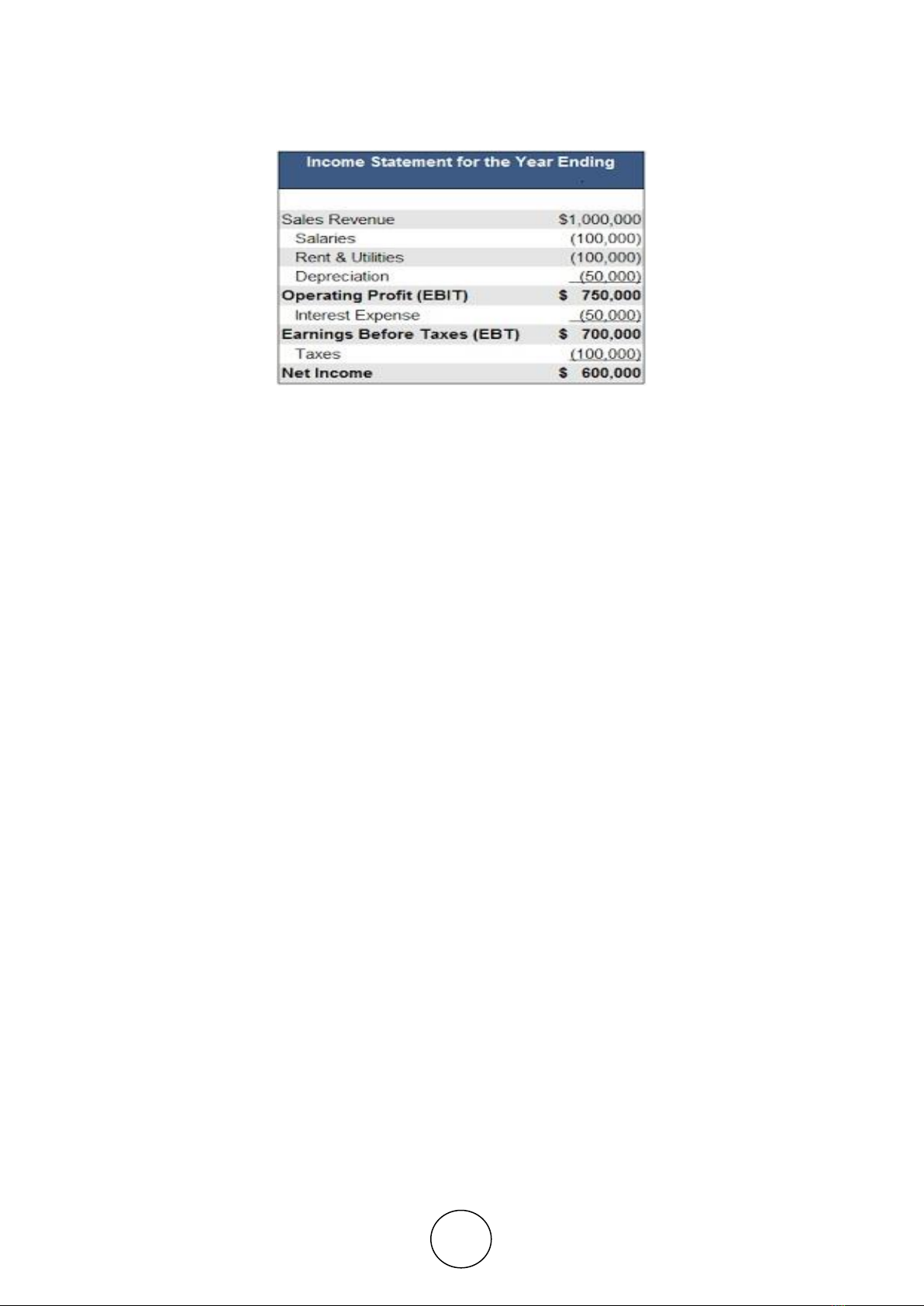

The economic internal rate of return (EIRR) is that the measure most frequently accustomed

indicates the economic viability of financed projects. Calculation of the EIRR needs a collection

of assumptions concerning the conditions faced by the project that within the judgment of the

appraisal mission ar presumably to prevail throughout its life. However, since bank-financed

projects ordinarily have an awfully long life, the conditions faced by the project could

amendment for a spread of reasons. Sensitivity analysis is, therefore, allotted to work out the

results of attainable changes within the values of key variables (costs, yields, and value of inputs

and outputs) on the project's EIRR

The number of risks facing a project may be massive, and it's neither attainable nor

fascinating to spot all attainable risks related to a project. The risks mentioned within the

appraisal report should basically be those that entail major economic consequences. These

should be known from the sensitivity analysis and represented in descendant order of

importance with reference to their impact on the EIRR

Dr. Giriraj Kiradoo

http://www.iaeme.com/IJM/index.asp 96 editor@iaeme.com

Figure 1 Economic internal rate of return (EIRR)

Particular attention should be paid to risks that might considerably cut back the project's

EIRR or render the project uneconomic by reducing its EIRR below the chance price of capital.

During this context, each of the base-case EIRR and also the sensitivity indicators are relevant.

If the base-case EIRR is high, the discussion of project risks should usually embrace risks to

that the project is extremely sensitive. For instance, the EIRR of most projects is extremely

sensitive to changes in project output, which can successively rely upon a variety of factors. A

discussion of the safeguards employed to reduce the risk of the outputs falling considerably

below the extent expected should thus be enclosed. For instance, in an irrigation project,

excluding the supply of water, the output could rely upon the availability of different inputs,

provision of extension services, and the effectiveness of water management by farmer's teams,

and accessibility of adequate infrastructure and storage facilities. Measures taken to confirm

adequate and timely accessibility of every should be in brief explained

Risks are clearly larger in projects that the base-case EIRR is simply marginally above the

chance cost of capital. These larger risks are even larger if the EIRR is extremely sensitive to

changes in key variables since even a little reduction within the EIRR would render the project

unviable. Even once the EIRR is comparatively insensitive to changes in key variables, combos

of adverse changes would possibly simply have an effect on the project's viability. Thus, in

such cases, the remedial action planned or adopted should be totally explained

If the project output is listed internationally, one risk could also be future changes within

the value of the output, notably if the share of a project or the country's output is little relative

to the global market. In such cases, a review of the world demands and provide forecasts for

the nice in question should be enclosed.

By their terribly nature, bound kinds of projects like gas and oil exploration involve terribly

high risks. For such projects, it's necessary to supplement the sensitivity analysis with a chance

analysis. The latter provides a spread of attainable outcomes in terms of a chance distribution

and supported that project connected call may be created a lot of showing intelligence.

However, the analysis is a lot of advanced and needs a lot of data concerning events touching

the project. thanks to the appreciable work due to, chance analysis of risks is typically

undertaken just for project carrying a high degree of risk or for giant comes wherever

miscalculations could lead on to a significant loss to the economy. For such comes, the nature

of the risks concerned and also the measures are taken or counselled to reduce the risks, at the

side of the results of the analyses, should be mentioned within the appraisal report.

Study and Analysis of Project Risk, Market Risk and Firm Risk

http://www.iaeme.com/IJM/index.asp 97 editor@iaeme.com

2.2. Projects for which benefits are not quantifiable

For projects in certain sectors or sub-sectors like education, health, sanitation, and family

planning, project benefits can't be quantified and also the risks can't be measured by sensitivity

analysis. In such cases, the connection of project risks to the project's objectives should be

explained. The eventualities that may impede the conclusion of the objectives should be

mentioned in relation to the project price and output, and also in relation to the socio-economic

objectives sought-after by the project

In such projects, the risks are larger on the profit facet than on the value facet. as an example,

in education projects, college buildings and instrumentation are provided to assist accomplish

a prescribed annual output of graduates with a certain talent level. However, the supply of the

facilities alone might not make sure the achievement of the project objectives. Their

achievement might rely additional upon the availability of trained lecturers, provision of spare

funds for the recurring expenditures of the institutions, syllabus and admission standards, and

motivation of the scholars.

While it's unattainable to eliminate all such risks, it's essential to attenuate them. Major risks

of this kind should be known and explained together with the remedial measures planned within

the section within which project risks are mentioned.

The real benefits of this kind of project associated with broad socio-economic goals. For

education projects, these might embrace raised financial gain levels for the trainees and the next

level of commercial and agriculturally production. For birth prevention comes, the broad goals

could also be a raised variety of acceptors and a consequent reduction within the rate of

increment. The success of those projects depends not just on the facilities provided, however

conjointly on the continuing favorable conditions assumed by the appraisal mission. For such

comes, the assumptions created concerning the connection between the facilities provided and

also the project's long objectives should be clearly explained. The conditions or facilities

necessary however external to the project should even be known, together with relevant

assurances received from the govt. For projects like these, this is often one among the foremost

necessary aspects to be mentioned within the section managing project risks.

3. MARKET RISK

The market risk affects all the projects within the trade and not a selected project. During this

section, the construct of market risk has been explained with relevancy factors that are beyond

the management of individual corporates. The market risk is more sub-divided into:

• Security market risk

• Interest rate risk

• Purchasing Power Risk

3.1. Security market risk

Often we have a tendency to read within the newspaper that the exchange is within the bear hug

or within the bull grip. This means that the complete market is taking possession in a specific

direction either downward or upward. The economic conditions, political things and also the

sociological changes have an effect on the security market. The recession within the economy

affects the profit prospect of the business and also the exchange. The 1998 recession

experienced by developed and developing countries has affected the stock markets everywhere

the globe. The Southeast Asian crisis has affected the exchange worldwide. Their factors are

on the far side of the control of the company and also the capitalist. Theycannot be entirely

avoided by the capitalist. It drives home the point that the market risk is inevitable.

Dr. Giriraj Kiradoo

http://www.iaeme.com/IJM/index.asp 98 editor@iaeme.com

Jack Clark Francis has outlined market risk as that portion of the entire variability of a return

caused by the alternating forces of bull and bear markets. Once the protection index moves

upward haltingly for a major period of your time, it's referred to as a bull market. Within the

bull market, the index moves from a low level to the height. A market is simply reverse to the

bull market; the index declines not fluently from the height to a market low point known as a

trough for a significant amount of your time. Throughout the bull and market, over eighty p.c

of the securities’ costs rise or fall together with the exchange indices.

The forces that have an effect on the exchange are tangible and intangible events. The

tangible events are real events like earthquakes, war, political uncertainty and fall within the

price of a currency. Another example that may be cited is that thePokhran blast on might

thirteen, 1998, and therefore the fall of BSESensex by 162 points. At hand sanctions, dampened

sentiments and FIIs mercantilism of stocks set a bear section. Many examples like fall within

the price of rupee and post-budget blue may be cited for triggering the bear section.

Intangible events are associated with market scientific discipline. The market scientific

discipline is littered with real events. However, reactions to tangible events become

overreactions and that they push the market in a specific direction. Consider instance, the Bull

Run in 1994 FII’s investment and relaxation policies gave buoyancy to the market. The market

scientific discipline was positive. Little investors entered the market and the costs of stocks

while not adequate validator basic factors soared up. In 1996, the political turmoil and recession

within the economy resulted in the fall of share costs and therefore the little investors lost faith

within the market. There was a rush to sell the shares and therefore the stocks that were floated

within the primary market weren't received well.

Thus, any untoward political or economic event would lead to a fall within the worth of the

security which might be further accentuated by the overreactions and therefore the herd-like

behavior of the investors. If some financial establishments begin disposing of the stocks, the

concern grips in and spread to different investors. This leads to a rush to sell the stocks. The

actions of the financial establishments would have a snowballing result. This sort of

overreaction affects the market adversely and therefore the costs of the scraps fall below their

intrinsic values. This can be on the far side the control of the company

3.2. Interest rate risk

Interest rate risk is that the variation within the single period rates of coming back caused by

the fluctuations in the market interest rate. Most typically interest rate risk affects the value of

bonds, debentures, and stocks. The fluctuations in the interest rates square measure caused by

the changes within the government financial policy and also the changes that occur in the

interest rates of treasury bills and also the government bonds. The bonds issued by the govt.

and quasi-government are thought-about to be risk-free. If higher interest rates are offered, the

capitalist would really like to change his investments from private sector bonds to public sector

bonds. If the govt. to serve the deficit in the budget floats a replacement loan/bond of a better

rate of interest, there would be a precise shift in the funds from low yielding bonds to high

yielding bonds and from stocks to bonds.

The rise of the fall in the interest rate affects the value of borrowing. Once the decision

when rating changes. Most of the stock traders trade the stock exchange with the borrowed

funds. the rise in the value of margin affects the profitableness of the traders. This could dampen

the spirit of the speculative traders who use the borrowed funds. The autumn in the demand for

securities would lead to a fall in the price of the stock index.

Interest rates not only have an effect on the security traders however additionally the

company bodies who carry their business with borrowed funds. The value of borrowing would

increase and an important outflow of profit would occur in the type of interest the capital