1

CODI3-03

THE TREND OF FOREIGN DIRECT OF FORREIGN DIRECT INVESTMENT

CAPITAL MOVEMENT AND VIETNAM’S POLICY RESPONSE

The fact that the global value chain is broken, difficult to recover due to the heavy impact of the

Covid-19 pandemic, along with the increasing conflicts and trade tensions between major countries,

has had a significant impact on the trend of investment movement around the world. With many

advantages such as a stable economy and politics, a large consumption market and an abundant labor

force with competitive costs compared to other countries in the region, the ability to respond to

epidemics well…, Vietnam is expected to have many opportunities to get foreign investment inflows

in the coming period. However, in the context of fierce competition between countries, in order to

receive this redirected capital flow, we need to be aware of the existing challenges and have a strategy

to effectively attract foreign direct investment (FDI) inflows. In the article, I analyze the trend of

investment capital’s movement in the world, advantages and difficulties when attracting redirected

FDI flows; and propose some solutions for Vietnam to receive this new FDI inflow in the context of

the Covid-19 pandemic.

Keywords: Trends, investment capital movement, policy, foreign direct investment, Vietnam.

XU HƯỚNG DỊCH CHUYỂN VỐN ĐẦU TƯ TRỰC TIẾP NƯỚC NGOÀI VÀ PHẢN

ỨNG CHÍNH SÁCH CỦA VIỆT NAM

Chuỗi giá trị toàn cầu bị đứt gãy, khó hồi phục bởi tác động nặng nề của đại dịch Covid-19,

cùng với những mâu thuẫn, căng thẳng thương mại ngày một gia tăng giữa các nước lớn đã tác động

không nhỏ đến xu hướng dịch chuyển vốn đầu tư trên toàn thế giới. Với nhiều lợi thế như nền kinh tế

và chính trị ổn định, thị trường tiêu thụ lớn và lực lượng lao động dồi dào với chi phí cạnh tranh so

với các nước trong khu vực, khả năng ứng phó với dịch bệnh tốt… Việt Nam được kỳ vọng là một

quốc gia có nhiều cơ hội để đón dòng vốn đầu tư nước ngoài trong giai đoạn tới. Tuy nhiên, trong bối

cảnh các quốc gia cạnh tranh khốc liệt, để đón nhận dòng vốn chuyển hướng này chúng ta cần nhận

thức được những thách thức hiện hữu và có chiến lược nhằm thu hút hiệu quả dòng vốn FDI. Bài viết

phân tích xu hướng dịch chuyển vốn đầu tư trên thế giới; những thuận lợi, khó khăn khi thu hút dòng

vốn FDI chuyển hướng và đề xuất một số giải pháp cho Việt Nam để tiếp nhận dòng vốn FDI mới này

trong bối cảnh đại dịch Covid-19.

Từ khóa: Chính sách, dịch chuyển vốn đầu tư, vốn đầu tư trực tiếp nước ngoài, Việt Nam, xu

hướng.

1. TRENDS IN THE MOVEMENT OF FOREIGN DIRECT INVESTMENT CAPITAL IN

THE WORLD

2

The wave of FDI capital’s movement appeared many years ago due to the tendency to

protect production and the impact of the economic crisis, which led many countries to encourage

enterprises to move capital to the domestic market to solve employment problems. The main changes

to the dynamics of locating production abroad (Offshoring) compared to moving production to nearby

countries (Nearshoring) are happening and will continue to happen in the future due to political

pressures, automation and economic considerations. This will change the way investors choose

investment locations from moving production from one location to another to finding ways to adapt.

Therefore, the global production network will shift from a country with a lot of unskilled labor and

resources to a country with many research centers, more skilled and highly specialized workers and

closer to the consumer market. New production methods are formed that do not require a lot of labor

resources and consume too much energy, resources, even freight...

There have been many signs of the movement of FDI out of the Chinese market in recent years.

According to investment consulting firm AT Kearney (2019), China has been relegated from 3rd (in

2017) to 7th (in 2019) among the world's best FDI investment locations (the lowest ever); reflects the

decline of China's attractiveness to investors. According to Nomura Group (2019), from the beginning

of 2018 to August 2019, there were 56 international enterprises leaving China to manufacture in other

countries; in which, 26 enterprises chose Vietnam, 11 went to Taiwan, 11 went to Thailand, 3 went to

India... A 2019 survey by the American Chamber of Commerce in China in May 2019 also showed

that about 40 % of companies surveyed have moved production facilities outside of China or are

considering moving. Among 40% of companies that have or intend to move, Southeast Asia is selected

as the top alternative location, with nearly 25% of surveyed companies choosing this region (See Table

1.1).

Table 1.1. Survey results of the American Chamber of Commerce and Industry in

Shanghai (May 2019) on plans to move production out of China

Choices

No. of

companies

Percentage

(%)

South East Asia

59

24,7%

Mexico

25

10,5%

Indian subcontinent (including India, Bangladesh,

Pakistan, Sri Lanka)

20

8,4%

USA

14

5,9%

East Asia

10

4,2%

Europe

9

3,8%

3

No plans to move production facilities

144

60,3%

Other places

15

6,3%

Source: Survey of the American Chamber of Commerce and Industry in May 2019 (Note: A

company can choose multiple locations to relocate its production facilities).

According to research results published by Bank of America in 2020, about 67% of companies

surveyed think that companies’ bringing supply chains from China to their homeland or to other

markets will be the biggest change in the post-Covid-19 era. The above changes are evidence that FDI

inflows are tending to withdraw from China and look for more attractive investment locations.

The trend of shifting production chains out of China appeared due to a number of reasons such

as: (i) The escalating trade and technology tensions between the US and China made investors tend to

look for a more stable, less risky manufacturing (export-oriented) investment address and at the same

time avoidable the imposition of high taxes in the US; (ii) The Covid -19 pandemic has disrupted the

global production and supply chain, and at the same time showed the great dependence of the global

production and supply chain on China, causing many TNCs to "rethink" their global trade and

investment strategy, changing to diversifying supply to reduce risks instead of relying mainly on

China. Therefore, in order to diversify the supply chain, which is for the purpose of spreading the risk

of over-depending on a few markets as well as minimizing the impact of shocks when a broken

stitch/link in the chain occurs, the multinational corporations want to find and partially relocate to a

new investment location, while keeping and utilizing its already invested facilities in China and

shifting investment to other Asian countries such as Indonesia, Malaysia, India, Vietnam, Thailand,

Philippines…. For example, FDI enterprises from Korea, Taiwan, and Japan implement the Southern

Advancement Policy/Strategy (new) from their native country and from China to new investment

locations, in which, Vietnam is one of strategic locations. In order to reduce risks, some American

and Japanese enterprises have accelerated the trend of moving FDI enterprises from China to home

country; (iii) The increasing trade tension with the US-China war has created a trend to shift the

manufacturing industry to countries with low labor costs. Meanwhile, China is losing its advantages

to attract FDI due to rising labor costs and gradually phasing out investment incentives…

Manufacturing wages in China have increased from 2.0 USD/hour in 2010 to 3.9 USD/hour in 2016.

This salary is quite high when compared to the average production wage in Vietnam, which is only

close to 1 - 1.4 USD/hour. The cost of industrial real estate in China has also increased sharply after

the continuous development of the economy and living standards of the population. Large cities like

Shanghai recorded an increase in the price of industrial land to $180/m2, higher than other Southeast

Asian cities, while Vietnam has a relatively competitive land price, only at 100 - 140 USD/m2. As a

corollary, foreign investors seek more cost-effective investment locations as an alternative in effort to

cut costs. Besides, after a long time with a high growth rate of over 8%, China is moving up in the

4

value chain and restructuring the economy towards increasing domestic consumption, focusing on

developing services and export of higher value goods. This has re-directed FDI flows in industries

based on labor, land and other factors.

It can be seen that the impact of the US-China trade war along with the disruption of the global

supply chain due to the Covid-19 pandemic has become a catalyst for the faster movement of FDI out

of China. However, in fact, in 2020, FDI into China still increased by 4% to US$163 billion, putting

the country ahead of the US in the ranking of countries receiving the most FDI. This reconfirms many

previous comments of economic experts who said that FDI flows moving out of China will be unlikely

in the short term, the process of moving will not be immediate, but often has a roadmap of about 2-5

years, because the global supply chains have been completed, it cannot be quickly shifted. The

production network and supply chain in China are interconnected, highly dependent, even

"inseparable", so if moved, investors may have to calculate the significant opportunity costs. FDI

flows will not immediately move out of China, but are restructuring in the direction of "China + 1".

This shift is market diversification, only shifting a part of the supply chain instead of completely

relocating from China because it is still a very large market, an important destination thank to the fact

that China has a stable political system, abundant and high-quality human resources, and a skilled

workforce; low tariffs, extensive logistics system integration with the global supply chain; good

infrastructure and supporting industries; large-scale production as well as a CNC supply ecosystem

that meets the quality standards of the US and Europe... In addition, China itself has had very fast

"response CS" to retain foreign investors such as announcing the Law on Foreign Investment in

August 2020 with incentives for CIT exemption and reduction for up to 10 years for electronic

enterprises, especially chip manufacturing enterprises. This makes the process of moving FDI out of

the Chinese market tend to slow down in the coming time. According to Bloomberg, there will be no

country that can replace China in the role of the world's factory, instead, there may be just "mini"

China.

2. OVERVIEW OF THE CURRENT SITUATION OF ATTRACTING FDI OF VIETNAM

2.1. Size of investment capital

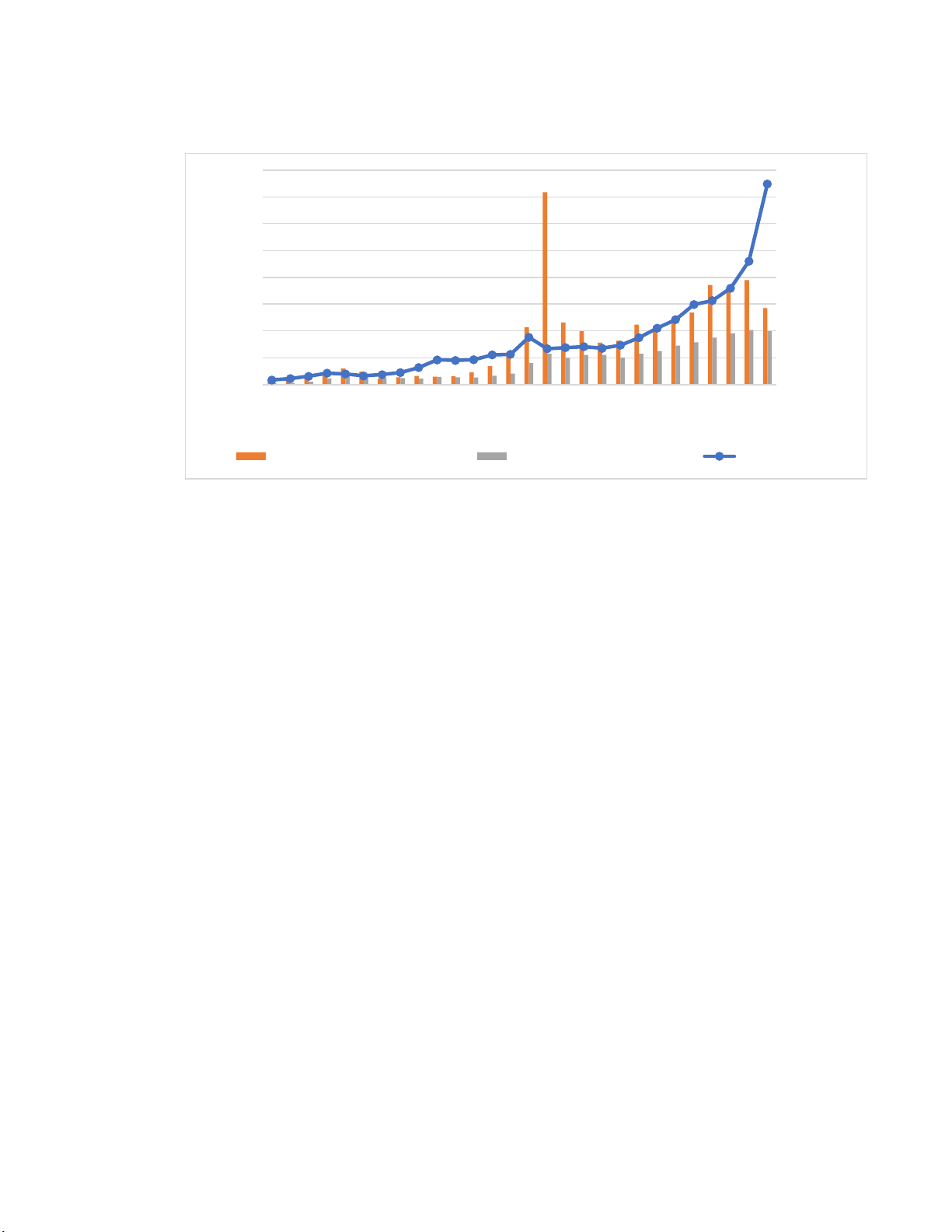

The reality of foreign investment capital in Vietnam over the past 30 years shows the constant

fluctuations in the size of investment capital over time. From 1988 to the end of 2020, the total

registered capital reached over 400 billion USD, the realized capital is estimated at 234 billion USD,

equaling 58.5% of the total registered capital. In which, although the period 2011 - 2020 had 4 years

from 2011 to 2014 and in 2020 that FDI did not increase, in 5 years from 2015 to 2019 it continuously

increased in new investment as well as investment expansion and especially shares bought by foreign

investors. The total registered capital, additional capital and share purchase reached 270 billion USD,

equaling 67.5%, realized capital reached 156 billion USD, equaling 66% of more than 30 years of

5

FDI attraction of Vietnam. In the period 2011 - 2020, the average annual realized FDI capital accounts

for about 22-23% of social investment capital. (See Figure 1)

Figure 1. Number of projects, registered capital and realized capital in Vietnam

Source: Author's compilation based on data of General Statistics Office (1991-2020)

By the end of 2020, the total newly registered capital, adjusted and contributed capital, bought

shares of foreign investors reached 28.53 billion USD, 75% compared to the same period in 2019.

The realized capital of the FDI project is estimated at 19.98 billion USD, 98% compared to the same

period in 2019. Due to the impact of the Covid-19 pandemic, production and business activities were

affected, and the realized capital of foreign investment projects in 2020 is down compared to 2019

(down 2% compared to 2019). However, the reduction level has improved. Many foreign-invested

enterprises are gradually recovering and maintaining good production and business activities and

expanding projects. The highlight in 2020 was that the adjusted investment capital was over $6.4

billion, up 10.6% over the same period in 2019, there were 1,140 projects registered to adjust the

investment capital, down 17.5% over the same period. Regarding new registered capital, there were

2,523 new projects granted investment registration certificates, down 35% over the same period, the

total registered capital reached 14.65 billion USD, down 12.5% over the same period in 2019. In 2021,

according to just announced report of The Ministry of Planning and Investment, from the beginning

of the year to April 20, 2021, the total foreign direct investment (FDI) registered for new, adjusted

and contributed capital, and purchased shares in Vietnam equal to 99.3% over the same period in

2020. In which, realized FDI capital was estimated at 5.5 billion USD, up 6.8% over the same period

last year. In the first four months of the year, the whole country had 451 new FDI projects granted

investment registration certificates, down 54.2% over the same period, but the total registered capital

reached nearly 8.5 billion USD, an increase of 24.7% over the same period in 2020. The scale of FDI

projects in the first months of 2021 has improved compared to the same period in 2020.

0

1000

2000

3000

4000

5000

6000

7000

0.00

10,000.00

20,000.00

30,000.00

40,000.00

50,000.00

60,000.00

70,000.00

80,000.00

1991

1992

1993

1994

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Total Registered Capital (mil USD) Total Realized Capital (mil USD) No. of projects