http://www.iaeme.com/IJM/index.asp 65 editor@iaeme.com

International Journal of Management (IJM)

Volume 9, Issue 1, Jan–Feb 2018, pp. 65–71, Article ID: IJM_09_01_011

Available online at

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=9&IType=1

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

IMPACT OF FINANCE BILL 2018 ON SALARIED

PERSON TAX

Dinesh Goyal

Lecturer in Commerce, Department of Commerce,

GSSS KAWI Panipat, India

ABSTRACT

The Finance bill is an important bill in India and the Central Government,

through this bill, gives effect to financial proposals at the beginning of every Financial

Year . Every Finance bill is assented by the President of India after passing in the

both houses of parliament. After it finance bill become Finance Act .This Act applies

to all the States and Union Territories of India unless specified otherwise. Finance Act

thus making this Act one that renews itself each year. All the Governmental financial

policies are included in this Act. The existing policies, new policies, as well as

changes made to existing policies are all included here all the elements included in the

Finance Act associated with a particular Financial Year are of course important.

Even so, there are particular elements that take precedence over the others. The most

important element is the rules laid down in the Act with respect to Income Tax Rates.

Every year, the Act lays down in detail all the associated provisions related to Income

Tax in the country. Since this applies to a large number of taxpayers, it is considered

one of the most important elements. The Finance Act for a particular financial year

also includes the amendments that have been made with respect to Direct Taxes. The

Amendments made under various sections are noted down in this section of the

Finance Act and each amendment of every section is noted down separately it also

included the details of the insertion of new sections, if any This paper will help to

analysis the impact of finance bill 2018 on salaried person tax.

Key words: Finance Bill, Finance Act, Standard deduction, Section, Clause.

Cite this Article: Dinesh Goyal, Impact of Finance Bill 2018 on Salaried Person Tax.

International Journal of Management, 9 (1), 2018, pp. 65–71.

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=9&IType=1

1. INTRODUCTION

As per Section 15, the following incomes are chargeable to Income-tax under the head

„Salaries‟:- any salary due from an employer or a former employer to an assesse in the

previous year whether paid or not; any salary paid or allowed to him in the previous year by

or on behalf of an employer or a former employer though not due or before it becomes due to

him; any arrears of salary paid or allowed to him in the previous year by or on behalf of an

employer or a former employer if not charged to income-tax for any earlier previous year.

Dinesh Goyal

http://www.iaeme.com/IJM/index.asp 66 editor@iaeme.com

Under the provisions of this section the amount of salary due in the year, amount of advance

salary received and the amount of arrears of salary received during the year from the present

or past employer are to be included in this head. in the explanation attached to section 15, it

has been clearly mentioned that for the removal of doubts, it is hereby declared that where any

salary paid in advance is included in the total income of any person for any previous year it

shall not be included again in the total income of the person when the salary becomes due.

The important rule is that income once taxed cannot be taxed again, so any salary paid in

advance (if taxed in a previous year when the advance salary was received) will not be

included again in the total income of the person when the salary becomes due. Advance salary

does not include loans, e.g., loan to purchase a car or a scooter or for building a house etc.

Any salary, bonus, commission or remuneration, by whatever name called due to or received

by a partner of a firm from firm shall not be regarded as salary for the purposes of this

section. According to Section 17(1) salary includes the following amounts received by an

employee from his employer, during the previous year :Wages; any annuity or pension

(Family pension received by heirs of an employee is taxable under income from other

sources); any gratuity; any fees, commission, perquisites or profits in lieu of or in addition to

any salary or wages; any advance of salary(Advance against salary is a loan and hence not

taxable); any payment received by an employee in respect of any period of leave not availed

of by him(Leave encashment or salary in lieu of leave); the annual accretion to the balance at

the credit of an employee participating in a recognized provident fund, to the extent to which

it is chargeable to tax under Rule 6 of part A of the Fourth Schedule; and the aggregate of all

sums that are comprised in the transferred balance as referred to in sub-rule (2) of Rule 1] of

Part A of the Fourth Schedule, of an employee participating in a recognized provident fund, to

the extent to which it is chargeable to tax, under sub-rule (4) there, i.e., taxable portion of

transferred balance from unrecognized provident fund to recognized provident fund; the

contribution made by the Central Government or any other employer in the previous year, to

the account of an employee under a pension scheme referred to in Section 80CCD. The above

definition of word „salary‟ U/s 17(1) includes the above mentioned items. These can be

explained in following manner Wages—any amount received by a person for work done or

job rendered is called wages. It may be received under the name of „Pay‟, „Basic Pay‟, „Salary‟,

„Basic salary‟ or „Remuneration‟. It may be for actual work or leave salary or actually received

or due during the relevant previous year. It is fully taxable u/s 15 if received during the

relevant previous year. Any Annuity or Pension—Any amount received by employee from

past employer after attaining the age of retirement or superannuation is fully taxable. It may

be received direct as pension or out of a superannuation fund created by employer; in both

cases it is taxable. Any Gratuity—Any sum received by employee from his past employer as a

token of gratitude for services rendered in past is called gratuity. This amount is exempted up

to certain limits given u/s 10(10). Any amount received from employer under the name of fee

is also fully taxable, any commissions given by employer to employee is fully taxable. Any

commission received by a director for standing guarantee for repayment of loan, and if he is

not employee of the company, shall be taxable under “Income from other sources”. In case

commission is given to an employee and it is paid as a fixed percentage of turnover achieved

by such employee, such commission shall also be treated as part of the salary .Bonus is fully

taxable under the head „Salaries‟ on receipt basis. In case arrears of bonus are received in a

previous year, these are fully taxable. Bonus can be of two types, Statutory Bonus—It is

received under some legal or contractual obligation and is fully taxable. Gratuitous Bonus—It

is a casual benefit and is taxable as a receipt from employer and having no other

implication.any Perquisite means Any benefit or amenity allowed by employer to employee.

These are explained in detail u/s 17(2). any cash payment received by employee from

employer is called profit in lieu of salary and these are explained u/s 17(3) of income tax act.

Impact of Finance Bill 2018 on Salaried Person Tax

http://www.iaeme.com/IJM/index.asp 67 editor@iaeme.com

any salary in lieu of leave received during service is fully taxable. any advance salary—In

case an assessee receives some salary in advance in a previous year and which was actually

not due in that year shall be taxable in the year of receipt. It does not include any loan or

advance taken from employer

2. RULE TO TAX SALARY INCOME IN INDIA

Due and receipt whichever is earlier

3. REVIEW OF SECTION 16

Section 16 of the Income Tax Act provides allowable deductions from Salary Income. There

are total three deductions (now two) under section 16, provided in 3 different clauses. Clause

(i) of Section 16 allows a Standard Deduction, (omitted recently). Clause (ii) of Section 16

allows deduction for Entertainment Allowance. Clause (iii) of Section 16 allows Deduction

for Professional Tax. In India, it last existed during the financial year 2004-05 and allowed a

salaried employee to claim a flat deduction from his or her salary income of 30,000 or 40% of

salary (if salary did not exceed 5 Lakhs) or a deduction of 20,000 (if salary exceeded 5

Lakhs). After 2005 when standard deduction was withdrawn, employees used to hope before

every Budget it would be brought back. Their hope has been fulfilled this time. Finance

Minister has announced a standard deduction of 40,000 and said medical allowances,

however, would continue.Standard deduction will allow for a flat deduction from salary

income, to make up for some of the expenses which an employee would typically incur in

relation to his employment. The following amounts shall be deducted in order to arrive at the

chargeable income under the head „Salaries‟. Section 16(A) Standard deduction: Omitted by

Financial Act, 2005 w.e.f. 1.4.2006.Section 16 (ii) Where the employee is in receipt of

entertainment allowance, the amount so received shall first be included in the salary income

and thereafter the following deduction shall be made under Section 16(ii) A deduction in

respect of any allowance in the nature of an entertainment allowance specifically granted by

an employer to the assessee who is in receipt of a salary from the Government, a sum equal to

one fifth of his salary (exclusive of any allowance, benefit or other perquisite) or five

thousand rupees, whichever is less. W.e.f. April 1, 2002 entertainment allowance will be

allowed in computing income from salary only in case of employees of the Government and

will cease to be allowable for persons other than those employed in Government i.e.

entertainment allowance deduction will not be allowed to other employees.For this purpose

„Salary‟ excludes any allowance, benefit or other perquisites: Where an employee, not entitled

to claim deduction under this clause, spends some money on the entertainment of customers

of the concern, the amount so spent cannot be deducted from the salary income. The condition

makes exemption well-nigh impossible for the employees of private sector. For them, the

better course would be to get the entertainment expenses reimbursed. Section 16 (iii) Tax on

employment or Professional Tax: From the assessment year 1990-91, deduction shall be

allowed in respect of any sum paid by the assessee on account of a tax on employment within

the meaning of clause (2) of article 276 of the Constitution, leviable by a State under any law

passed by its legislature. Where Professional/Employment tax is paid by the employer on

behalf of the employee, it will first be included in his gross salary as a perquisite, being a

monetary obligation of the employee discharged by the employer. Thereafter, a deduction on

account of such professional tax shall be allowed to the employee from his gross salary.

Professional tax due but not paid shall not be allowed as deduction.

Dinesh Goyal

http://www.iaeme.com/IJM/index.asp 68 editor@iaeme.com

4. AMENDMENT IN SECTION 16

In section 16 of the Income-tax Act, after clause (i) [as omitted by section 6 of the Finance

Act, 2005 the following clause shall be inserted with effect from the 1st day of April, 2019,

namely(ia) a deduction of forty thousand rupees or the amount of the salary, whichever is less.

Clause 7 of the Bill seeks to amend section 16 of the Income-tax Act relating to deductions

from salaries. The existing provisions of the said section, inter alia, provide that the income

chargeable under the head "Salaries" shall be computed after making certain deductions

specified therein.It is proposed to insert a new clause (ia) in the said section so as to provide

for deduction of forty thousand rupees or the amount of the salary whichever is less,for the

purpose of computing the income chargeable under the head salary.This amendment will take

effect from 1st April, 2019 and will, accordingly, apply in relation to the assessment year

2019-2020 and subsequent years

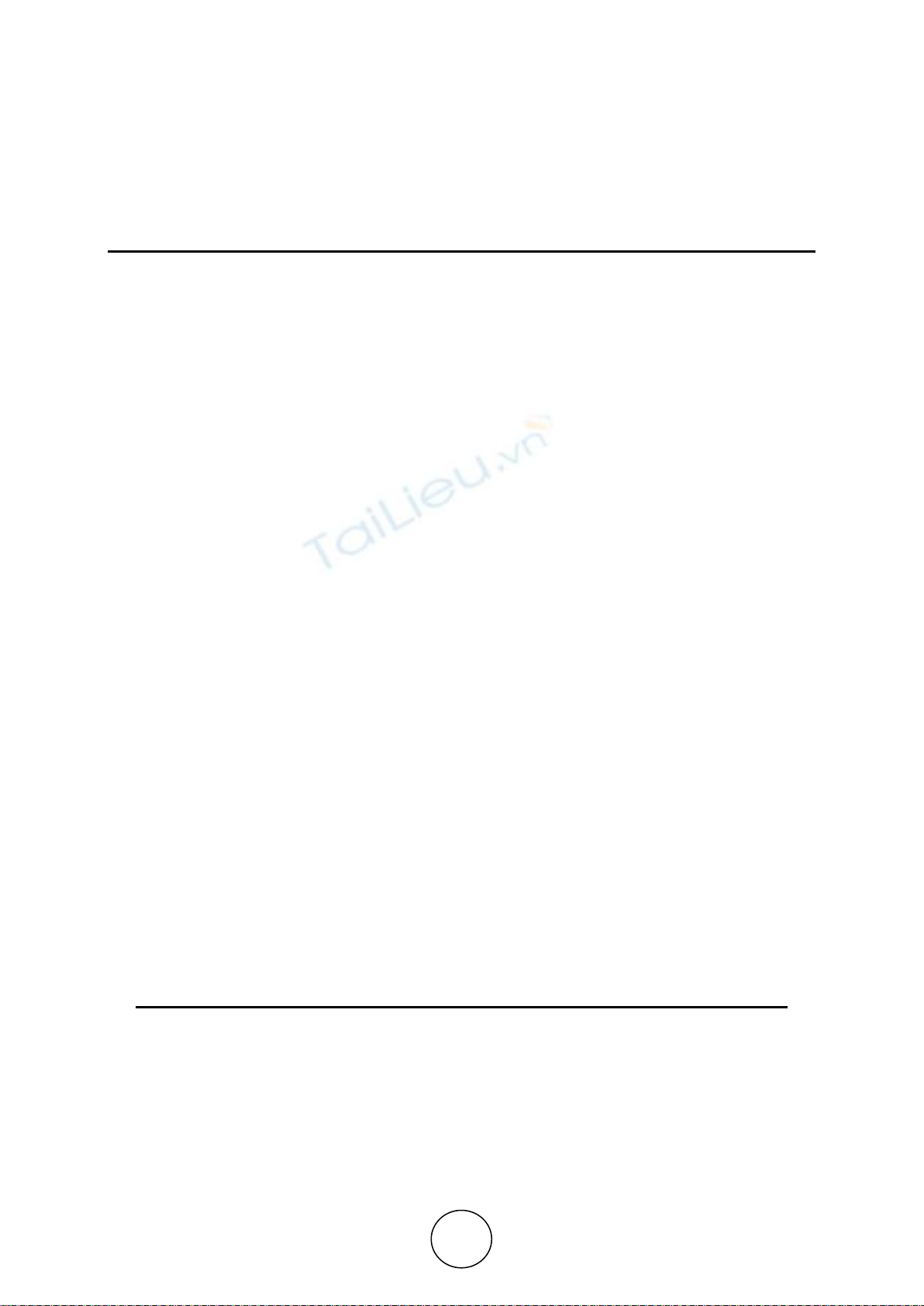

Table 1 Example

Gross Salary after disallowed

transport allowance and medical

reimbursement

Standard Deduction as per

Finance Bill 2018

Net Salary

30000

30000

Nil

50000

40000

10000

100000

40000

60000

200000

40000

160000

5. AMENDMENT IN SECTION 17

In section 17 of the Income-tax Act, in clause (2), in the proviso occurring after sub-clause

(viii), clause (v) shall be omitted with effect from the 1st day of April, 2019.Clause 8 of the

Bill seeks to amend section 17 of the Income-tax Act relating to "Salary", "perquisite" and

"profits in lieu of salary" defined. Clause (v) of the proviso occurring after sub-clause (viii) of

clause (2) of the said section provides that any sum paid by the employer in respect of any

expenditure actually incurred by the employee on his medical treatment or treatment of any

member of his family not exceeding fifteen thousand rupees in the previous year shall not be

treated as perquisite in the hands of the employee. It is proposed to omit the said clause

(v).This amendment will take effect from 1st April, 2019 and will, accordingly, apply in

relation to the assessment year 2019-2020 and subsequent years. From memorandum

explaining bill Standard deduction on salary income Section 16, inter-alia, provides for

certain deduction in computing income chargeable under the head “Salaries”. it is proposed to

allow a standard deduction up to ₹40,000/- or the amount of salary received, whichever is

less. Consequently the present exemption in respect of Transport Allowance (except in case of

differently abled persons) and reimbursement of medical expenses is proposed to be

withdrawn. These amendments will take effect from 1st April, 2019 and will, accordingly,

apply in relation to the assessment year 2019-20 and subsequent assessment years.

6. IMPACT OF FINANCE BILL 2018 ON SALARIED PERSON

Finance Bill 2018 has proposed to provide a standard deduction up to ₹40,000 from salary

income to employees instead of a deduction for transport allowance ₹19200 and

reimbursement of medical expenses of up to ₹15000. Standard deduction is essentially a flat

amount subtracted from the salary income before calculation of taxable income. The standard

deduction was a part of the Income-tax Act until former finance minister, P. Chidambaram,

withdrew it in the Union budget of 2005-06 .As per finance bill 2018 there is no change in tax

rates however cess increased to 4% from earlier 3%. Prima facie income exempted from tax

Impact of Finance Bill 2018 on Salaried Person Tax

http://www.iaeme.com/IJM/index.asp 69 editor@iaeme.com

after setting off the gain and loss comes to only ₹5800(40000-19200-15000). The tax saved

for each employee on this income would depend on the tax slab that income falls into. The

saving in tax would be ₹290 for those currently paying 5% tax on this income; ₹1160 for

those paying 20% as tax on this income; and ₹1740 for those paying 30% tax on this income.

However, these savings would be nullified in most cases, except in the case of income up to

₹5 lakh, due to increase incess.

6.1. Analysis the tax of employee Age <60 with financial year 2017-18 and

financial 2018-19

Gross Total Income

(it is assumed that

after deduction of

transport allowance

19200 and

reimbursement of

15000 under the head

salary)

Tax as per Finance Act

2017(With cess 3%and

after deduction of

transport allowance

19200 ,reimbursement

of 15000 and 80C

deduction 150000

Tax as per Finance Bill

2018(With cess 4% and

standard deduction up to

40000 and 80C deduction

150000 after disallowance

of transport allowance

19200, reimbursement of

15000

Difference

3

NIL

NIL

NIL

4

NIL

NIL

NIL

5

2575

2299

+276

10

84975

84594

+381

15

224025

224391

-633

20

378525

380391

-6633

25

533025

536391

-6633

30

687525

692391

-6633

50

1305525

1316391

-66633

80

2455778

2477630

-26612

100

3135578

3164030

-26612

150

5054854

5101849

-63661

200

6831604

6895849

-36261

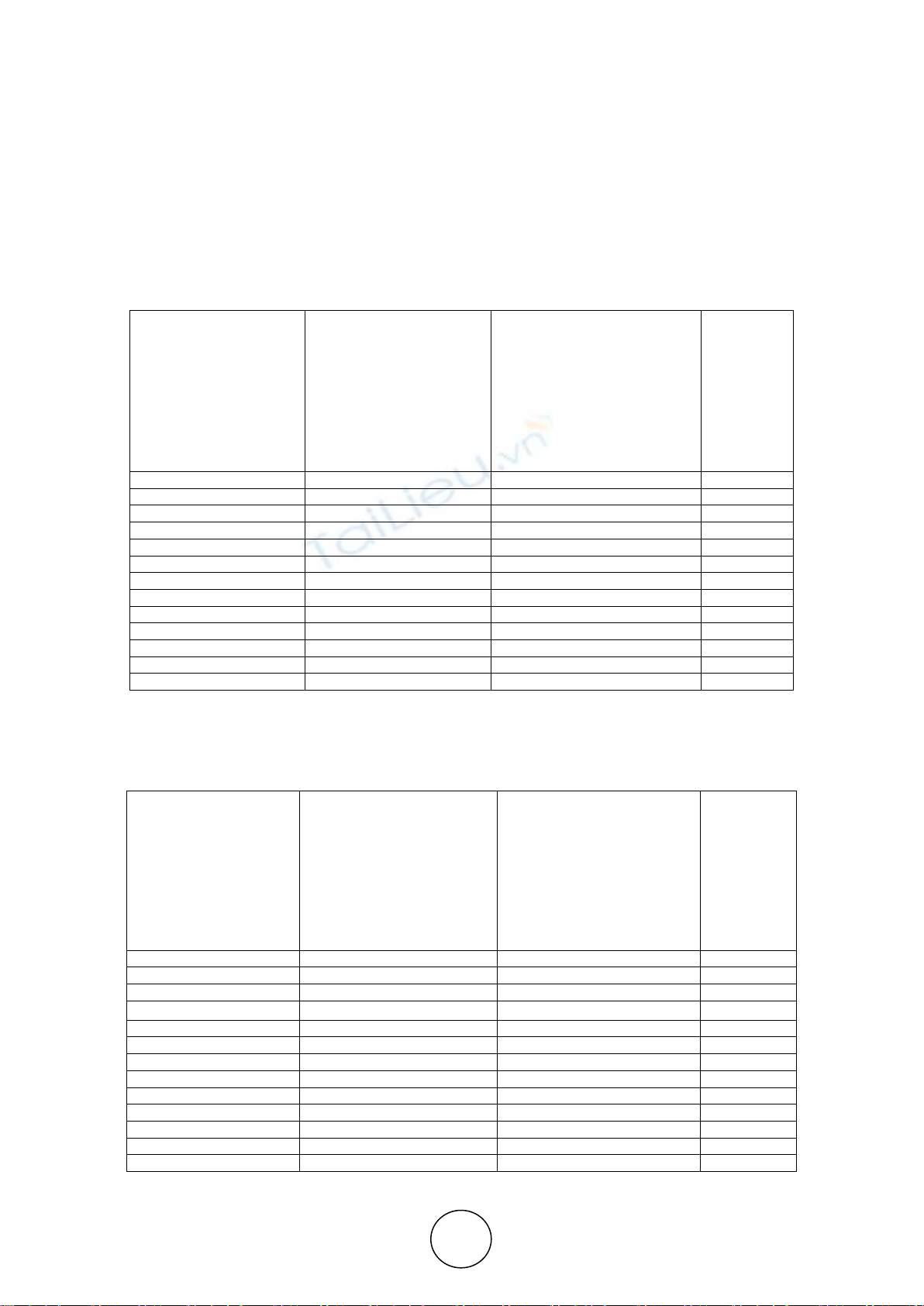

6.2. Analysis the tax of employee Age >60 but <80 with financial year 2017-18 and

financial 2018-19

Gross Total Income(

it is assumed that

after deduction of

transport allowance

19200 and

reimbursement of

15000)

Tax as per Finance Act

2017(With cess 3%and

after deduction of

transport allowance

19200 ,reimbursement

of 15000 and 80C

deduction 150000

Tax as per Finance Bill

2018(With cess 4% and

standard deduction up to

40000 and 80C deduction

150000 after

disallowance of transport

allowance 19200,

reimbursement of 15000

Difference

3

NIL

NIL

NIL

4

NIL

NIL

NIL

5

NIL

NIL

NIL

10

82400

81994

+406

15

221450

221791

-341

20

375950

377791

-1841

25

530450

533791

-3341

30

684950

689791

-4841

50

1302950

1313791

-10841

80

2452945

2474770

-21825

100

3132745

3161170

-28425

150

5051893

5098859

-46966

200

6828643

6892859

-64216

![Nội dung ôn tập môn Thuế 2 [năm]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20250311/tinhtamdacy000/135x160/1821272738.jpg)

![Bộ câu hỏi trắc nghiệm về Hóa đơn và Thuế [Mới Nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2026/20260130/hoaphuong0906/135x160/74081769745075.jpg)

![Giáo trình Hành chính nhân sự [chuẩn nhất/mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2026/20260127/cristianoronaldo02/135x160/85511769548188.jpg)

![Bài giảng Kế toán thực hành [Chuẩn nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2026/20260127/cristianoronaldo02/135x160/14601769548189.jpg)