Macroeconomic Analysis of Countries Selected for Tesla Model 3

Global Expansion

Background

Developing countries depend heavily on imports of foreign oil and heavy oil consumption is widely

unregulated that cause extreme air pollution. Electric cars can reduce dependency on oil fuel

consumption and greenhouse gas emission. Despite higher initial costs, electric vehicles have the

potential to save money and help communities become healthier and more energy independent.

Electric vehicles are making much more economic sense, and their environmental benefits will soon see

them become widely adopted. Forward thinking governments started to provide additional incentives

at the time of purchase,

Although initially electric vehicles by Tesla were very expensive and targeted for customers less sensitive

to price , the company business strategy more recently has also been focused on bringing down the cost

of battery, which in turn allow them to offer cheaper and higher volume cars. The most recent Model 3

and the Model Y, are priced much lower, and aimed at a higher volume market, selling over 100,000

vehicles each quarter. Tesla continuously updates the hardware of its cars rather than waiting for a new

model year, as opposed to nearly every other car manufacturer. Outside United States, Tesla opened its

first "Gigafactory" in China and Germany between 2019- 2020 and aim to expand market share in Asia,

Mideast and Europe.

Purpose

The purpose of this analysis is to leverage the macroeconomic indicator extract from public data source

that impact countries that can help inform decisions on choosing final candidate for Tesla Model 3

global expansion and investment project.

The analysis compares top 2 countries selected in previous assignment based on indexing and ranking.

Looking at both dynamic economic indicators trend over past 5 years as well as static indicator of most

recent year will help decide which one is best fit for investment project.

Data Source

GDP per capita, Inflation and unemployment, trade openness were extracted from The World Bank. The

World Bank

Corruption was extracted from Transparency International, Corruption Perceptions Index 2018 (CPI-

2018. Transparency International CPI

Dynamic Variables Analysis

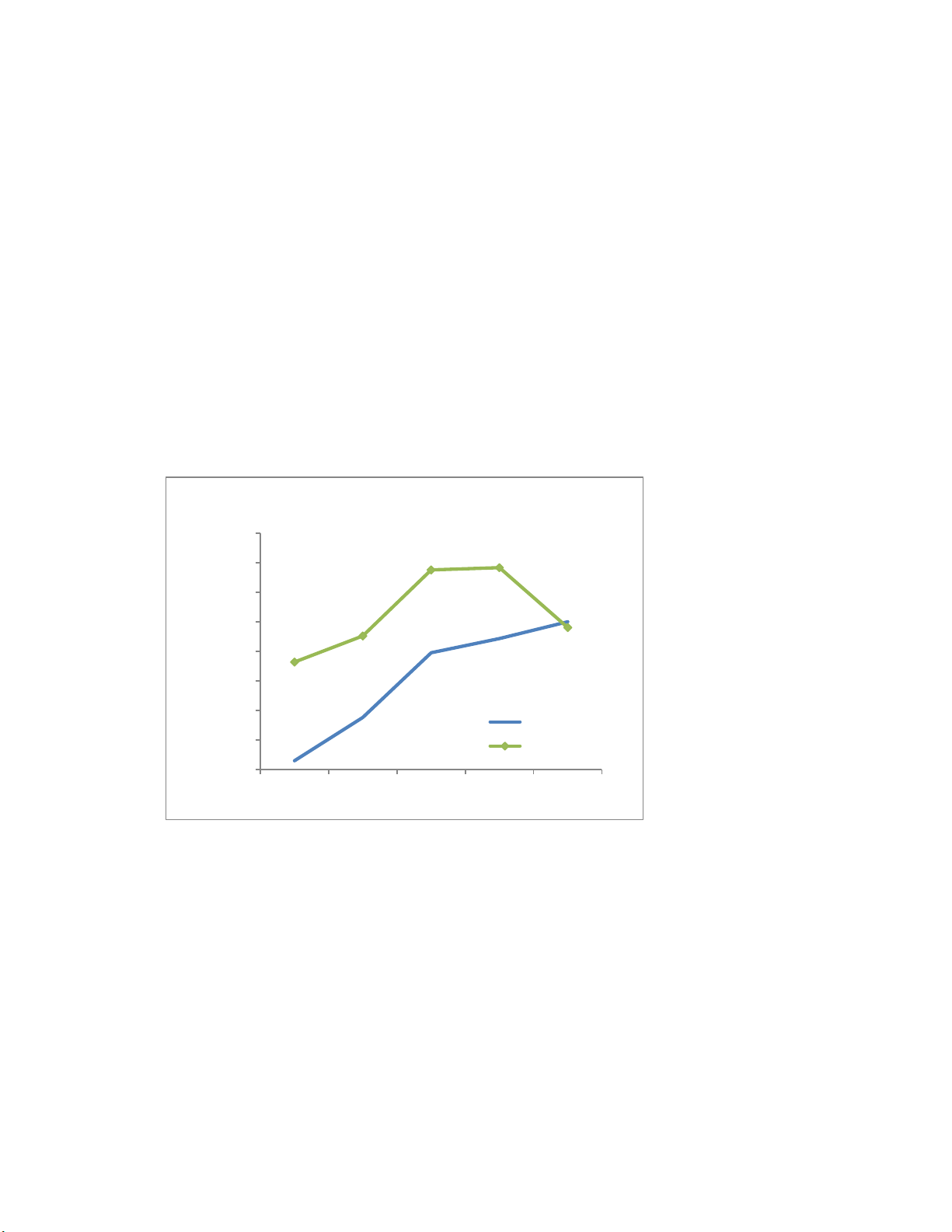

1. GDP per Capita Trend over 5 years

Gross Domestic Product (GDP) per capita shows a country's GDP divided by its total population.

Global analysis of per capita GDP helps provide comparable insight on economic prosperity and

economic developments across the globe.

Malaysia had higher GDP per capita than China (9,818 vs. 8,148) back to 2016. After 2016, Malaysia

growth started to slow down, plateau at ~11K in 2019 and dropped to ~10K in 2020. China however,

is shown to be continuously growing and reached similar level ~10K as Malaysia in 2020. If the

historical trend continues, we would expect to see more growth in China and exceed Malaysia in

next a few years.

With fast growth in GDP per capita, China consumer purchasing power will likely surplus Malaysia

and generates more demand for goods in near future.

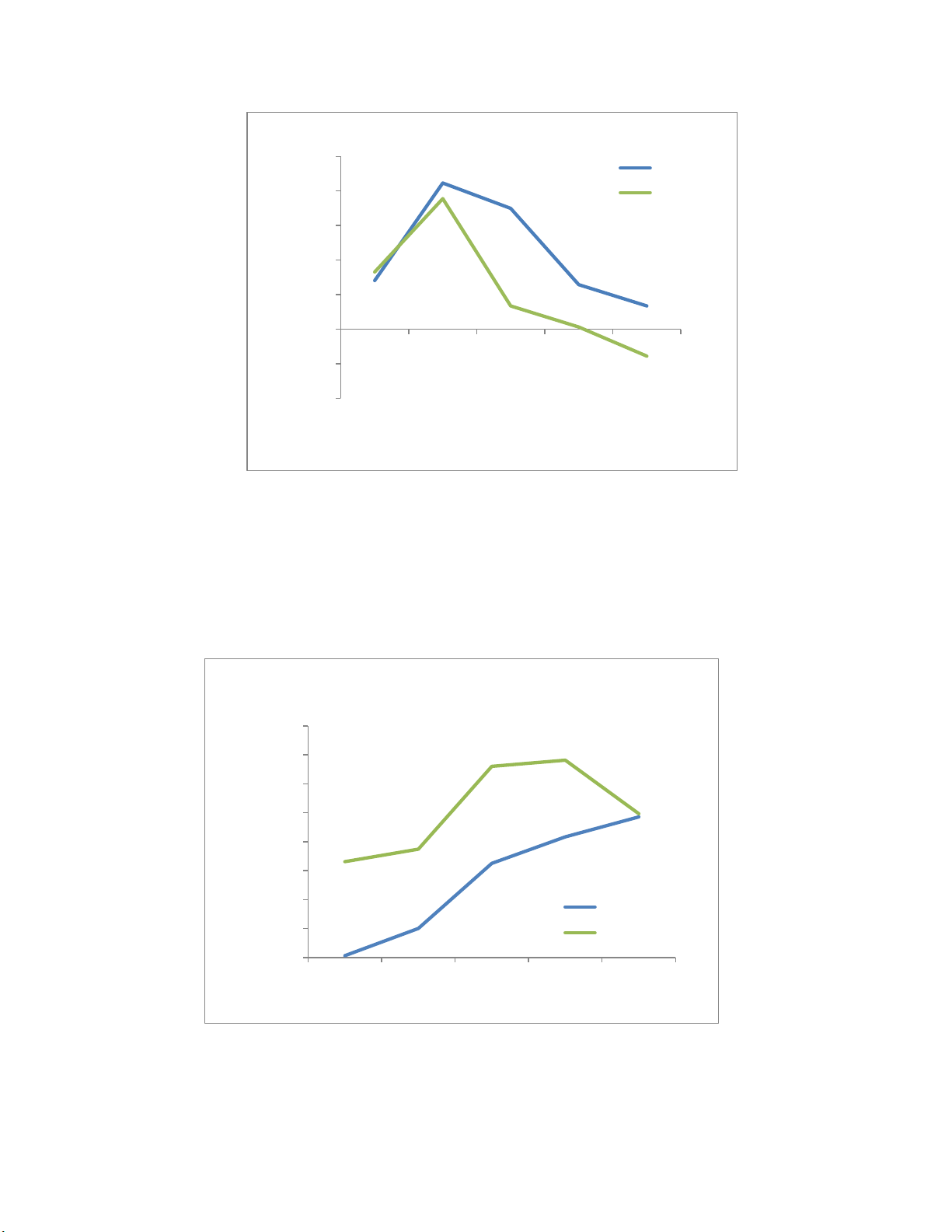

2. Inflation, GDP deflator (annual %)

The GDP price deflator, also known as the GDP deflator or the implicit price deflator, measures the

changes in prices for all of the goods and services produced in an economy. Using the GDP price deflator

helps economists compare the levels of real economic activity from one year to another. When looking

at inflation trend of China and Malaysia over the past 5 years, both countries show similar pattern that

inflation increased from ~1% to 4% in 2107 and then started to decline and below 1% in 2020, although

Malaysia we saw slightly stronger dampen.

9,818

10,259

11,378 11,414

10,402

8,148

8,879

9,977

10,217

10,500

8000

8500

9000

9500

10000

10500

11000

11500

12000

2016 2017 2018 2019 2020

GDP per capita (current US$)

Year

GDP per Capita Trend over 5 Years

China

Malaysia

If correcting GDP per capita with inflation rate as shown below, we still see similar trend that Malaysia

GDP growth slows down, while China is growing and expected to exceed Malaysia in next few year if

historical trend continues.

1.4

4.2

3.5

1.3

0.7

1.7

3.8

0.7

0.1

-0.8

-2.0

-1.0

0.0

1.0

2.0

3.0

4.0

5.0

2016 2017 2018 2019 2020

Inflation, GDP deflator (annual %)

Year

Inflation, GDP deflator Trend over 5 Years

China

Malaysia

8,033

8,504

9,628

10,085

10,430

9,655 9,872

11,301 11,407

10,483

8000

8500

9000

9500

10000

10500

11000

11500

12000

2016 2017 2018 2019 2020

Real GDP per capita (current US$)

Year

Real GDP per Capita Corrected with Inflation

Trend over 5 Years

China

Malaysia

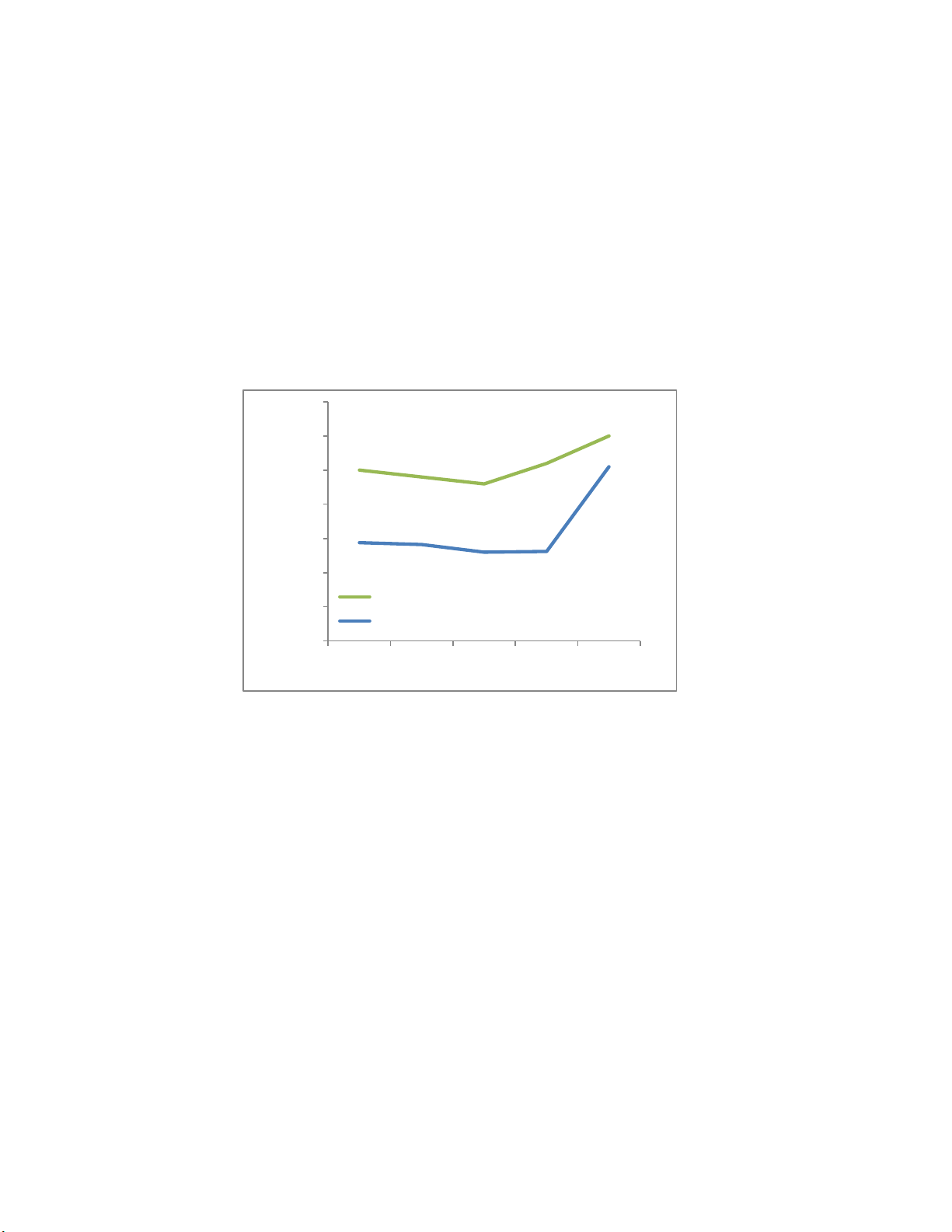

3. Unemployment

Unemployment refers to the share of the labor force that is without work but available for and seeking

employment. When the economy is in poor shape and jobs are scarce, the unemployment rate can be

expected to rise. When the economy is growing at a healthy rate and jobs are relatively plentiful, it can

be expected to fall.

When comparing unemployment between China and Malaysia, China’s rate has been relatively steady

around 4-5%, while Malaysia rate was lower around 3% before 2019 and increased to 4.5% in 2020.

Overall, the trend of both countries is steady with small fluctuation.

Static Variable Analysis

1. Corruption

The index, which ranks 180 countries and territories by their perceived levels of public sector corruption

according to experts and businesspeople, uses a scale of 0 to 100, where 0 is highly corrupt and 100 is

very clean. More than two-thirds of countries score below 50 on this year’s [2018] CPI, with an average

score of just 43." This indicator typically matters, because it is risky and expensive to do business in

corrupt countries.

When comparing China to Malaysia, China is scored as 42, similar to the global average 43, while

Malaysia is scored higher with less corruption and slightly better for foreigner business.

4.5 4.4 4.3

4.6

5

3.44 3.41 3.3 3.31

4.55

2

2.5

3

3.5

4

4.5

5

5.5

2016 2017 2018 2019 2020

Unemployment (% of total labor

force)

Year

Unemployment Rate Trend over 5

Years

China

Malaysia

2. Trade Openness (%GDP)

Trade is the sum of exports and imports of goods and services measured as a share of gross domestic

product. We will use trade expressed as percentage of GDP as a proxy for country's openness to trade.

This indicator matters because countries that are more open to trade are generally more hospitable to

foreign direct investment.

Malaysia has much higher rate as 117% comparing to China with 35%, indicating large influence of trade

on its domestic activities.

42

51

0

10

20

30

40

50

60

China Malaysia

Corruption

Corruption Index 2020

35%

117%

0%

20%

40%

60%

80%

100%

120%

140%

China Malaysia

Trade Openness (Trade, %GDP)

Trade Openness (%GDP) 2020

![240 câu hỏi trắc nghiệm Kinh tế vĩ mô [chuẩn nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2026/20260126/hoaphuong0906/135x160/51471769415801.jpg)

![Câu hỏi ôn tập Kinh tế môi trường: Tổng hợp [mới nhất/chuẩn nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20251223/hoaphuong0906/135x160/56451769158974.jpg)

![Giáo trình Kinh tế quản lý [Chuẩn Nhất/Tốt Nhất/Chi Tiết]](https://cdn.tailieu.vn/images/document/thumbnail/2026/20260122/lionelmessi01/135x160/91721769078167.jpg)