http://www.iaeme.com/IJM/index.asp 77 editor@iaeme.com

International Journal of Management (IJM)

Volume 7, Issue 6, September–October 2016, pp.77–88, Article ID: IJM_07_06_009

Available online at

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=7&IType=6

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

CUSTOMER’S PERCEPTION AND SATISFACTION

TOWARDS SERVICES OF PUBLIC & PRIVATE

SECTOR BANKS

Kesari Singh and Nitin Gupta

School of Business Management & Liberal Arts,

Shoolini University of Biotechnology & Management Sciences, Solan, H.P. INDIA.

ABSTRACT

Indian Banking has gone tremendous changes over time and the entry of private sector banks has

transformed the Indian banking both structurally and functionally. In this competitive banking

environment, customer satisfaction is considered as most imperative factor for the success of banks.

To attain the high level of customer satisfaction and to retain the customer base, it is important for

the banks to deliver quality services to its customers. Hence, the study analyzed relative customer

satisfaction levels of private and public sector banks. The issue is of importance to address the often

raised concerns of differences in working and quality of services provided by public and private

sector banks. A sample of 900 customers from the three northern region states viz. Punjab, Haryana

and Himachal Pradesh was selected for the primary survey. Well-structured questionnaire was used

to collect data. Customer perception and satisfaction was studied through various parameters viz.

effectiveness, accessibility, cost, tangibles, reliability and empathy. Association between these

indicators with the socio-economic variables viz. age, gender, occupation, annual income and area

was studied through chi-square test. Public sector banks were more cost effective whereas, private

sector did better in terms of tangibles. Private sector banks were comparatively more reliable due to

proficiency in service delivery.

Key words: customer satisfaction, private sector banks, public sector banks, service quality.

Cite this Article: Kesari Singh and Nitin Gupta, Customer’s Perception and Satisfaction towards

Services of Public & Private Sector Banks. International Journal of Management, 7(6), 2016, pp.

77–88.

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=7&IType=6

1. INTRODUCTION

Indian Banking has gone through enormous changes since independence. Introduction of new technologies,

economic uncertainties, fierce competition and changing demand of customers created a competitive

scenario for banks. In today’s fast moving life and highly competitive environment, the banking sector has

to understand and analyze the customer’s perception and requirements for service quality. To attain the high

level of customer satisfaction and to retain the customer base, it is important for the banks to deliver quality

services to its customers. The term service quality can be termed as a significant determinant of

competitiveness for establishing the sustainable and satisfying relationships with customers. Persuraman

Kesari Singh and Nitin Gupta

http://www.iaeme.com/IJM/index.asp 78 editor@iaeme.com

et.al (1992) defined service quality as the customer’s comparison between service expectation and service

performance. Customer satisfaction is a measure of how products and services provided by any organization

meet the expectation of a customer. The efficiency of the banking sector depends on how it delivers the

services to its existing customers. To survive in this competitive environment, it is important for banks to

provide fast and efficient services to its customers.

However, even after offering wide range of services, there exists a gap between the services offered by

banks and the expectations of the customers. In this fast changing scenario, it is important that banks should

go for customer segmentation and provide reliable, independent, impartial opinion and tailored treatment

that customers now expect. Customer satisfaction is a vague and theoretical concept and actual expression

of the state of satisfaction will vary from person to person and service to service (Kanojia and Yadav, 2012).

Hence, the present study was undertaken with an objective to compare the perception and customer

satisfaction towards quality of services provided by the public and private sector banks.

2. REVIEW OF LITERATURE

Customer satisfaction is one of the major determinants of performance and efficiency of a bank. Profitability

of the bank depends upon the quality of services it can deliver to its customers. Continuous improvement in

the quality of services is also required to survive in the competitive environment. Some of the studies

conducted on customer satisfaction with respect to services provided by the public and private sector banks

in India have been summarized below:

Aurora and Malhotra (1997) in their study titled, “Customer Satisfaction: A Comparative Analysis of

Public and Private Sector Banks” analyzed the level of customer satisfaction and some marketing strategies

in both private and public sector banks in India. On studying the parameters of satisfaction it was found that

routine operations, price, situational, environment, technology and interactive were the six factors of

customer satisfaction among public sector banks. But in private sector banks researcher found seven factors

of satisfaction out of which staff factor was ranked first and situational factor was the lowest ranked among

all seven. It was concluded that public sector banks should develop strategies for proper training and

development of bank staff, regular market surveys, designing customized services, avoiding long queues in

bank and maintaining attractive décor. Only then public sector banks will be able to compete with private

sector banks.

Debashis and Mishra (2005) measured customer satisfaction in branch services provided by public

sector banks in northern India. About 1200 customers were surveyed and it was found out that

computerization, accuracy in transactions, attitude of staff and availability of staff mostly influence

customer satisfaction. Least important factor was promotion of the products and various schemes.

Mishra and Jain (2007) conducted a study of nationalized and private sector banks to know the

constituent dimensions of customer satisfaction. Two stage factor analyses technique was used to arrive at

the dimensions of customer satisfaction. On analyzing it was found that vigilance, competence, advancement

in services, reliability, vision, responsiveness, reach, cost effectiveness and efficient process were the

constituent factors of customer satisfaction for nationalized banks, whereas service quality, reliability,

competence, efficient process, customization, ATM facility, vision, vigilance, simplicity of system and

brand image were the essential factors for private sector banks.

Mengi (2009) conducted an empirical study to evaluate and compare the service quality offered to the

customers by public and private sector banks of Jammu. SERVQUAL (service quality) scale was used to

determine different dimensions of service quality and chi-square test was performed to understand the impact

of SERVPERF (service performance) dimensions (tangibility, reliability, responsiveness, assurance and

empathy) on customer satisfaction. Study revealed that the customers of public sector banks were more

satisfied with the service quality offered as compared to those of private sector banks.

Rao and Lakew (2011) in their study on “Service Quality Perceptions of Customers: A Study of the

Customers’ of Public Sector and Private Sector Commercial Banks in India”, examined the service quality

perceptions of customers of public and private sector banks in the city of Visakhapatnam. Total 300

Customer’s Perception and Satisfaction towards Services of Public & Private Sector Banks

http://www.iaeme.com/IJM/index.asp 79 editor@iaeme.com

respondents were surveyed using the universally accepted SERVQUAL model in which 42 quality

measuring parameters were used under the five dimensions of service quality i.e. tangibles, reliability,

assurance, responsiveness and empathy. It was concluded that out of all variables reliability and assurance

were rated highest while the tangibles dimension got the lowest score. Moreover, the study revealed that

there was the strong dissimilarity in service quality perceptions between customers of private sector and

public sector banks.

Dharmalingam and Kannan (2011) carried out an empirical study to evaluate the service quality of

new private sector banks in Tamilnadu. Data was collected from 240 respondents from three private sector

banks i.e. ICICI Bank, AXIS Bank and HDFC Bank. On analyzing it was judged that from all selected

variables of customer perception, tangibles were rated highest and product variety area was rated lowest

among all.

Bilamge (2011) in “A Comparative Study of Customer Perception Towards Services Rendered by

Public Sector and Private Sector Banks”, evaluated and compared the customer satisfaction level in ICICI

bank and State Bank of India. The results of the study revealed that behavior of the ICICI Bank staff was

friendlier than that of State Bank of India. As compared to SBI, token system and upholding of ATMs in

ICICI Bank was highly treasured by all the customers. It was concluded that vital services were lacking in

both the banks.

Virk and Mahal (2012) analyzed the customer satisfaction level of Public and Private Sector Banks by

conducting a comparative study in Chandigarh City. The study revealed that branch facilities were positively

correlated with teller services, relationship with managers, mutual fund services and telephone enquiry which

contribute in large extent towards customer satisfaction. Further it was concluded that private sector banks

emphasize more upon building their clients and are better equipped with modern infrastructure as compared

to public sector banks.

Gupta et.al (2013) compared the customers’ perception of service quality of public and private

banks of Delhi and NCR using SERVQUAL method. The questionnaire consisting five key dimensions

namely tangibles, reliability, responsiveness, assurance and empathy was circulated among 200 respondents

using simple random sampling technique. Study revealed that private banks satisfied their customers with

good services and they had successfully implemented tangible factors like modern equipments,

infrastructural facilities, quality of materials used etc. Further, it was explored that most of the respondents

felt that the employees of private banks were very keen to satisfy their customers whereas on other hand

customers of nationalized banks felt that the employees were least bothered about their customers.

Gill and Arora (2013) conducted a comparative analysis of level of customer satisfaction towards

services provided by public and private sector banks. Two public sector banks selected for the study include

Punjab and Sind Bank and Union Bank of India and the private banks include HDFC bank and IDBI bank.

Primary survey of 200 customers was conducted using convenient sampling method in three major cities of

Punjab namely Amritsar, Jalandhar and Ludhiana. It was analyzed that private banks need to work on gaining

faith of customers as customers still don’t feel secured while dealing with terms and conditions given by

private banks whereas public banks enjoy the hierarchical trust as they are older in Indian financial system.

Further study revealed that public banks need to work more on technology and overall décor to survive in

the market.

The literature highlighted various factors which determine the customer perception and satisfaction

towards the service quality. However, the evidences of association between socio-economic variables and

customer satisfaction with respect to public and private sector banks are limited. Hence, the study was

undertaken to get a broader view on the variation in the perception and level of satisfaction of customers

across socio-economic variables.

Anita (2014) in her research article presented the customer satisfaction level between public and private

sector banks to get a bird’s eye view of customer satisfaction practices being adopted by selected banks. It

was also analyzed that customers were more satisfied with the private sector banks than public sector banks

Kesari Singh and Nitin Gupta

http://www.iaeme.com/IJM/index.asp 80 editor@iaeme.com

and customer satisfaction is largely dependent upon products availability in the banks rather than locations

of the bank.

3. MATERIAL AND METHODS

The study was carried out in three states viz. Punjab, Haryana and Himachal Pradesh in northern region of

India. One city was purposively chosen from each selected state. Major consideration in selecting these cities

for detailed survey was taken as the availability of all the chosen banks in the selected city. Thus, three cities

viz., Shimla in Himachal Pradesh, Panchkula in Haryana and Mohali in Punjab were taken for the purpose

of survey for customer satisfaction. Finally, a sample of 300 customers of the selected banks (150 private +

150 public) from each state was interviewed using convenience sampling method. In this process, total

sample of 900 customers was studied to fulfill the objective of customer satisfaction.

For the selection of banks, two separate lists of public and private sector banks operating in the selected

states were prepared, using the relevant data published by Indian Banks Association. Public and private

sector banks were arranged on the basis of their total assets. A random sample of three banks each were

selected from the lists of public and private sector banks for conducting the survey for analyzing the customer

satisfaction of the services provided by the two groups of banks. The banks so selected for the detailed study

included Bank of India, Union Bank of India, Punjab & Sind Bank in the category of public sector banks

and ICICI Bank, Axis Bank, Indus Ind Bank in private sector bank category.

A well-structured questionnaire was used during the surveys to collect data from the selected customers.

Responses were collected by using likert scale. Parameters taken to study the customer satisfaction included

effectiveness, accessibility, cost, tangibles, reliability and empathy. These parameters were further evaluated

on the basis of different indicators and the association between customer satisfaction indicators and socio-

economic variables was studied to get a clear picture of the customer satisfaction towards selected services

provided by the banks. The questionnaire consisted of the questions related to each selected parameters of

different indicators of satisfaction towards banking services used by the customers and about the suggestions

of the customers for possible improvement in these services. Data collected was analyzed using chi square

test.

4. RESULTS AND DISCUSSIONS

The present study attempted to measure the customer’s satisfaction with respect to the services provided by

public and private sector banks. Various parameters viz. service effectiveness, accessibility, cost, tangibility

and bank reliability were used to measure the customer satisfaction. These parameters were further evaluated

by recording the customer responses towards various service quality indicators. Responses were collected

by using likert scale. The association between selected indicators and the socio-economic variables viz. age,

gender, educational qualification, occupation annual income and area, was studied by using chi-square test

to get a clear picture of the customer satisfaction with regard to banking services. The results of chi square

test have been presented below.

4.1. Effectiveness Indicators and Customer Satisfaction

The customer responses towards effectiveness indicators were studied to know the level of customer

satisfaction with respect to the service quality of both public and private sector banks. Results of the study

have been given in the table 4.1 below.

H

0

; 1: There is no significant relationship between socio-economic variables and effectiveness indicators.

Customer’s Perception and Satisfaction towards Services of Public & Private Sector Banks

http://www.iaeme.com/IJM/index.asp 81 editor@iaeme.com

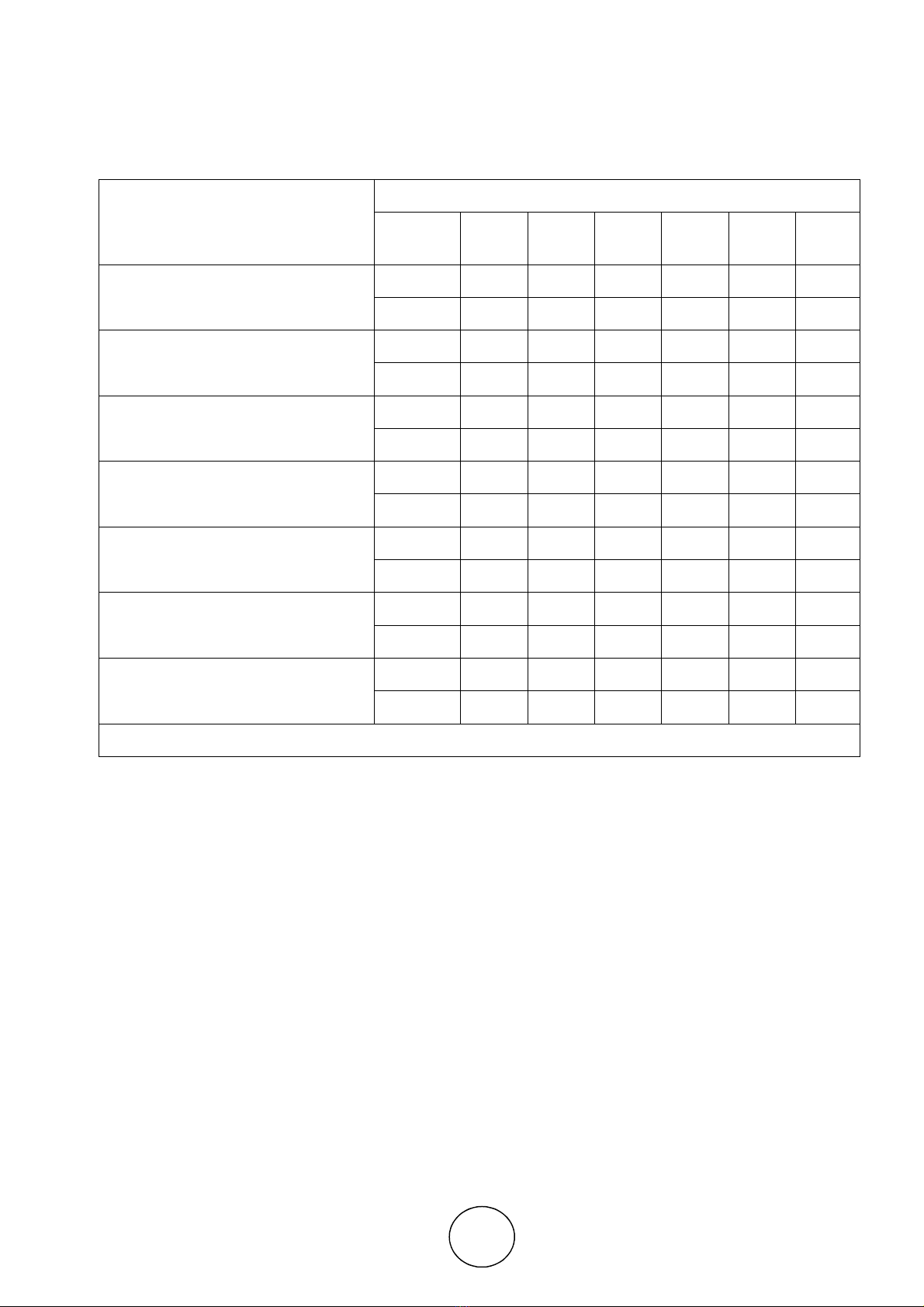

Table 4.1 Association between Socio-Economic Variables and Effectiveness Indicators

(Chi Square Analysis)

Effectiveness Indicators

Socio-economic Variables

Bank

Group Age Gen EQ OCC AI Area

Courteous and friendly employee

behavior

Public .029* Ns ns .027* ns ns

Private ns Ns ns ns .003* ns

Recognition as a valued customer

Public .029* Ns ns ns ns ns

Private ns Ns ns ns .007* ns

Bank maintains customer

confidentiality

Public .011* Ns ns .038* ns ns

Private ns Ns ns ns ns ns

Bank provides fast and efficient

services

Public ns .035* ns ns ns ns

Private ns Ns ns ns .002* ns

Trained and knowledgeable bank

personnel

Public ns ns ns ns ns ns

Private ns ns .005* ns ns ns

Bank have good reputation

Public ns .049* Ns .025* ns ns

Private ns ns ns ns ns ns

Feeling of security in bank

transactions

Public .011* ns ns .007* ns ns

Private ns ns ns ns .035* ns

Note: Gen-Gender, EQ-Educational Qualification, OCC-Occupation, AI-Annual Income

**; non-significant, p>0.05, *; significant, p<0.0

Chi square test was applied to study the association between socio-economic variables and effectiveness

indicators of customer satisfaction in public and private sector banks and the results have been presented in

table 4.1. It was hypothesized that there is significant association between the socio-economic variables and

the effectiveness indicators. The results depicted that in case of public sector banks, a significant relationship

was found between the socio-economic variables viz. age and occupation with behavior of the bank

employees. It implies that customers of higher age group found the behavior of the bank employees courteous

and friendly because the senior citizens were given special attention by the bank employees. Whereas, in

case of private sector banks, income of the respondents and the behavior of the bank employees were found

to be significantly related which indicates that the higher income group customers were provided better

treatment by the private bank employees. Similarly, higher age group customers of public banks believed

that they were recognized as valuable customers whereas, in case of the private sector banks, higher income

group customers were recognized as valuable customers due to their regular heavy transactions with the

banks.

Table 4.1 further highlights that none of the socio-economic variables was found to have a significant

relationship with the bank confidentiality in case of private sector banks. In case of public sector banks, age

and occupation had significant relationship with bank confidentiality which indicates that higher age group

customers believed that their bank was maintaining the customer confidentiality. Similarly, female

customers of the public sector banks found the services provided by their bank to be fast and efficient as the