27 Journal of Economic and Banking Studies

No.7, Vol.4 (1),June 2024 pp. 27 - 38

© Banking Academy of Vietnam

ISSN 2734 - 9853

The impact of digital transformation on credit risk of

commercial banks in Vietnam

Doan, Viet Thang - Hoang, Thi Ngoc Anh - Phung, Trang Linh - Nguyen Thu Huong

Finance Faculty, Banking Academy of Vietnam

* Corresponding Authors

E-mail address: thang.dv509@gmail.com (Doan, V.T.), hnanh12123@gmail.com (Hoang, T.N. A.), tranglinh.

study@gmail.com (Phung, T.L.), ngthhuong8303@gmail.com (Nguyen, T.H.)

1. Introduction

Digital transformation in economic

sectors is an inevitable trend and is

considered one of the most important

characteristics of commercial banks - one of

the strategies to compete in the era of technol-

ogy. Vietnam has been increasing its global

presence and participating in shaping global

policies and initiatives, which makes digital

transformation more accessible and viable. On

May 11, 2021, the Governor of the State Bank

of Vietnam approved the digital transforma-

tion plan until 2025 along with the strategy for

developing the Vietnamese banking industry

(Decision No. 986/QD-TTG dated August 8,

2018) and the Prime Minister’s national digital

transformation program to 2025, orientation

to 2030 (Decision No. 749/QD-TTG dated

June 3, 2020). The research used the informa-

tion technology development and application

readiness index (ICT Index) to evaluate digital

Chronicle Abstract

Article history In Vietnam, digital transformation has been considered as the leading strat-

egy of commercial banks, especially in terms of credit risks. Therefore, they

must identify how their digital transformation affects their credit risks to

maintain effective operation and steady growth in a complex and chang-

ing market environment. Our study takes 29 commercial banks in Vietnam

from 2014 to 2022 as the research object to test the impact of bank digital

transformation on credit risk. In particular, the level of digital transforma-

tion of banks is measured by the ICT Index. The ICT Index is the official

measure that evaluates the level of information technology application na-

tionwide each year, with separate indicators for ministries and branches.

Banks in Vietnam also use the ICT Index to assess their readiness and abil-

ity to apply information technology in the digital transformation process.

Various regression models including Pooled Ordinary Least Squares (OLS),

Fixed Effects Model (FEM), Random Effects Model (REM), Generalized Least

Squares (GLS) are applied using STATA 17. Research results show that credit

risk is affected by 5 factors: the information technology development and

application readiness index (ICT Index), inflation rate (INF), return on equity

(ROE), loans to customers (LOAN), and operational diversification (NIIC).

On that basis, the study proposes recommendations for commercial banks

to promote their digital transformation process. In addition, the state and

policymakers also have appropriate measures to promote digital transfor-

mation in the Vietnamese banking system.

Received

Revised

Accepted

25th Nov 2023

1st Jan 2024

10th May 2024

Keywords

Digital transformation,

Credit risk,

Commercial banks,

ICT Index

DOI:

10.59276/JEBS.2024.06.2628

The impact of digital transformation on credit risk of commercial banks in Vietnam

28

Journal of Economic and Banking Studies- No.7, Vol.4 (1), June 2024

transformation and its effect on credit risk at

commercial banks in Vietnam.

Yao et al. (2020) argue that digital transac-

tions and digitization are necessary for their

economic and financial future with the bank-

ing sector being considered the most important

source of economic growth. economic for a

country. Digital transformation is about using

digital technology to change business models,

providing new facilities to increase income

and create value. Convert some changes af-

fect the way banks operate as well as internal

process structure and design (Garner, 2022).

With positive and potential transformational

effects changing numbers, a few studies have

also been initially analyzed such as Cheng and

Qu (2022), Cao et al. (2023), Li et al. (2022).

The impact of digital transformation in limiting

and controlling bank risk control. These stud-

ies looked at risk below different angles from

credit risk, default risk to capital safety level.

However, these studies section large concentra-

tions in the Chinese market while in Vietnam

there has been only one research related to

digitalization and bank credit risk.

According to research by Quang, N. T. T.

(2023), digital transformation does not reduce

banks’ credit risk, on the contrary it increases

credit risk. The main reason is because digital

transformation in banking activities in Vietnam

is still in the early stages to increase conve-

nience and service experience for customers.

Credit risk arises mainly due to the increase

in loan scale thanks to the positive influence

of digital transformation. In fact, credit risk at

banks is still a huge challenge that has not been

fully resolved. This situation not only affects

the stability of the financial system but also

creates significant pressure on the central bank.

The study highlights the challenges that banks

need to consider during the digital transforma-

tion process, specifically credit risk manage-

ment to be able to take full advantage of the

benefits brought by digital transformation.

Therefore, enhancing credit risk management

is key to ensuring safety and transparency in

banking operations, creating an urgent need for

detailed research on how digital transformation

can affect management credit risk of commer-

cial banks in Vietnam. Commercial banks also

need to accelerate the speed and level of digital

transformation to achieve comprehensive digi-

talization of their operations, thereby enhanc-

ing risk management effectiveness.

In the background of commercial banking in

Vietnam, credit risk is becoming increasingly

important, and digital transformation could not

be more widespread to address these chal-

lenges. Digital transformation not only helps

improve risk assessment and management

processes but also opens new opportunities in

credit management (Quang, N. T. T., 2023).

However, there has not been much research

related to this issue before so there also exist

some gaps in: time effects, accurate measure-

ment methods, industry comprehensiveness,

and specific risk estimates. Although digital

transformation brings with it the expectation

of positive effects on banking operations, it re-

quires a significant amount of time. This digital

transformation process in banking has been

recorded annually by the central, showing the

relationship between time and performance.

There may initially be a period of reduced

productivity due to delays as the bank needs to

gradually adapt to the new system, and staff also

need time to learn and apply new digital skills.

Based on a panel data set from 29 banks in

Vietnam from 2014 to 2022, the study evalu-

ated the impact of digital transformation on

credit risk for Vietnamese commercial banks.

From the results, the study makes some recom-

mendations for Vietnamese commercial banks

in the digital transformation process.

From understanding and updating the recent

research, we have made some recommenda-

tions to help commercial banks anticipate and

manage digital transformation challenges,

while ensuring they can take advantage of the

full potential of digitalization after the initial

difficult period. Taking a closer look at the

digital evolution, this study aims to understand

how technological advancements are affecting

the credit risk landscape of commercial banks

in Vietnam to provide a comprehensive and

detailed view of this issue and how they can

Doan, Viet Thang - Hoang, Thi Ngoc Anh - Phung, Trang Linh - Nguyen Thu Huong

29

No.7, Vol.4 (1), June 2024- Journal of Economic and Banking Studies

be exploited to optimize risk management and

efficiency in the field.

Our article includes the 5 sections as follows:

(1) Introduction; (2) Literature review; (3)

Research method; (4) analyzing and discussing

research results; and the final section is conclu-

sion and recommendations.

2. Literature review

With the development of science and tech-

nology and fierce competition from Fintech

companies, the digital transformation process

in banks is gradually becoming an inevitable

trend. Digital transformation in banking is the

process of bringing technology into banking

operations to increase customer experience,

understand customers and provide personal-

ized products and services to each customer

at any time that customers need to use them

(Thuy, N. V. (2022). According to Ernst and

Young (2017), digital transformation helps

banks improve customer experience on digital

platforms, increasing attractiveness and ability

to reduce transaction costs. When implement-

ing digital transformation, banks need to focus

on promoting improvements in non-customer

contact processes rather than improving direct

customer contact processes. Research by Van

Thuy, N. (2021) has shown that digitalization

has a significant impact on the performance of

banks. Many studies have shown the positive

impact of digital transformation in banking

on limiting and controlling risks. Fuster et al.

(2018) argue that innovations from financial

technology help reduce labor needs, capital

costs and time, increase data accuracy, thereby

reducing operational and system risks. Bank

operations have also become more flexible

and secure due to financial technology innova-

tions that help reduce the risk of information

asymmetry between banks and customers as

well as reduce default risk in lending activities

(Gomber et al., 2017). Increasing the appli-

cation of information technology in lending

activities also helps improve the ability to

evaluate loans before, during and after lending,

thereby reducing the risk (Sutherland, 2018).

In addition, Cheng et al. (2020) investigated

the impact of bank fintech on credit risk in

Chinese commercial banks. The research con-

cludes that bank fintech significantly reduces

credit risk across Chinese commercial banks.

Furthermore, their analysis suggests a weaker

negative association between bank fintech and

credit risk for large banks, state-owned banks,

and listed banks.

As for credit risk, it could be understood as the

risk that the bank faces when the borrowers

(customers) cannot fulfill the debt obligation

on the due date or at maturity. According to

Giesecke (2004), credit risk is by far the most

significant risk that banks face and the success

of their business depends on the accurate mea-

surement and effective management of risk.

This is to a greater extent than any other risk.

Similarly, Coyle (2000) defines credit risk as

loss due to credit customers’ refusal or inability

to pay the debt in full and on time.

Many factors affect the credit risk of banks,

as indicated by the research of Hang, H. T. T.

(2020), and Quynh, N. T. N. (2018). Specifi-

cally, in their study, Hoang Thi Thanh Hang et

al. (2020) built a model of 8 variables affecting

credit risk, but the research results showed that

only 5 of them were accepted and directly had

an impact on bad debt. Similarly, Quynh, N.

T. N. (2018) also pointed out that, at a statisti-

cal significance level of 1%, economic growth

rate, bank credit growth, and unemployment

rate had an inverse relationship with the bad

debt ratio. In addition, the inflation rate and the

previous year’s bad debt ratio were positively

correlated with the current bad debt ratio. In

contrast, the relationship between bank size

and profitability and the bad debt ratio had not

been found. Baselga-Pascual et al. (2015) also

employ a panel data approach spanning 2005

to 2011 to analyze the determinants of credit

risk in the Eurozone. The study finds that less

competitive markets, lower interest rates, and

economic crisis (falling GDP and rising infla-

tion) all contribute to heightened credit risk.

The robustness of these findings is confirmed

through various checks, including alternative

statistical methods and different risk measures.

The impact of digital transformation on credit risk of commercial banks in Vietnam

30

Journal of Economic and Banking Studies- No.7, Vol.4 (1), June 2024

One noteworthy exception is bank size, which

exhibits ambiguous effects across the tests.

This inconsistency, coupled with the high

significance levels and ongoing debate sur-

rounding size’s impact on risk, warrants further

investigation.

According to the research mentioned above,

they have initially analyzed the impact of

digital transformation on bank risks. Regarding

the relationship between digital transformation

and credit risk in the banking sector, Bahillo et

al. (2016) clarified that digital transformation

in credit risk management brings more trans-

parency for risk reports. On the contrary, some

scholars argue that banking digitalization could

have a negative impact on banking operations

and thus credit risk. For example, Starodubtse-

va et al. (2021) point out that digitalization has

negative consequences, especially in current

scenarios, such as commercial banks spending

more money on developing technologies, train-

ing employees, information security, workforce

issues, which may negatively impact credit

risk. Similarly, Quang, N. T. T. (2023) also

believes that digital transformation does not

reduce banks’ credit risks.

Overall, while there have been numerous studies

globally examining the relationship between

digital transformation and credit risk, in Viet-

nam, there is a paucity of research on this issue.

Furthermore, previous studies have primarily

focused on data from earlier periods, leading

to a lack of updated information. Additionally,

the majority of research papers do not provide

specific solutions for banking organizations.

This has created the objective for our research

team. Based on data from banking organizations

and available datasets on ICT readiness and

development (ICT Index), this study conducts

an empirical assessment of the impact of digital

transformation on the competitive advantage in

credit risk of commercial banks in Vietnam dur-

ing the period of 2014-2022.

3. Methodology and data

3.1. Methodology

In Vietnam, digital transformation has been

considered as the leading strategy of com-

mercial banks. This study aims to experiment

the relationship between digital transformation

and the credit risk of Vietnamese commercial

banks. To examine this issue, our study uses

panel data and proposes a model to test the

relationship based on the results of previous

studies. Within the scope of this study, com-

mercial banks’ credit risk is measured through

the ratio of bad loans.

According to the provisions of Article 10 of

Circular 02/2013/TT-NHNN, as amended

by Article 1 of Circular 09/2014/TT-NHNN,

credit institutions shall classify debts into 05

groups including: (1) standard, (2) special

mention, (3) substandard, (4) doubtful, and

(5) loss. According to Clause 8 Article 3 of

Circular 11/2021/TT-NHNN, non-performing

loan (NPL) including on balance sheet debts

classified into group 3, 4 and 5.

Following previous studies such as Yao, Li,

Wu, and Wang (2020), Garner (2022), (Thủy,

N. V. (2022), Fuster et al. (2018), Gomber et al.

(2017), Sutherland (2018), Cheng et al. (2020),

Giesecke (2004), Coyle (2000), Hang, H. T. T.

(2020), Baselga-Pascual et al. (2015), Tru-

jillo‐Ponce (2013), Nguyen, V. T. H. (2015),

Nguyen, K. T., & Dinh, P. H. (2016), Quỳnh,

N. T. N. (2018), Horobet et al. (2021), Jilenga

and Luanda (2021), Koroleva et al. (2021),

Van Thuy, N. (2021), Quang, N. T. T. (2023),

Nguyễn, A. Đ. T. et al. (2023), this article

examines the impact of digital transformation

on credit risk of commercial banks in Vietnam

based on regression model as follows:

BDRi,t = β0 + β1ICTi,t-1 + βmBANKi,t,m +

βkMACROi,t,k + ϵi,t

where, i and t denote for the commercial-

bank i in year t, ϵi,t is the residual, BDR is the

bad debt ratio of the commercial bank. ICT

represents the readiness for information and

communication technology development and

application of a commercial bank. BANK is

the characteristics of a bank and MACRO is

the impact of macroeconomic conditions. The

formation and description of the variables are

presented in the data section below.

Doan, Viet Thang - Hoang, Thi Ngoc Anh - Phung, Trang Linh - Nguyen Thu Huong

31

No.7, Vol.4 (1), June 2024- Journal of Economic and Banking Studies

Utilizing a panel dataset, we apply the Pooled

Ordinary Least Squares (OLS) model, Fixed

Effects Model (FEM), and Random Effects

Model (REM) as outlined by Wooldridge

(2002) and run these models in STATA 17

software. The F-test selects between Pooled

OLS and FEM, and if Pooled OLS is rejected,

the Hausman test chooses between FEM and

REM. Additionally, tests ensure research valid-

ity: VIF for multicollinearity, Breusch-Pagan

LM for heteroskedasticity, and Wooldridge for

autocorrelation. Multicollinearity is addressed

by sub model decomposition, while hetero-

skedasticity and autocorrelation are corrected

using Feasible Generalized Least Squares

(FGLS).

Additionally, ICT Index in our research is a

lagged variable because the benefits of banks’

digital transformation, such as improved lend-

ing services, enhanced risk management, and

greater operational efficiency, materialize over

time. This delayed impact stems from the time

required to integrate new technologies, train

staff, and adjust organizational culture and

processes to fully leverage the advantages of

digital transformation. This perspective aligns

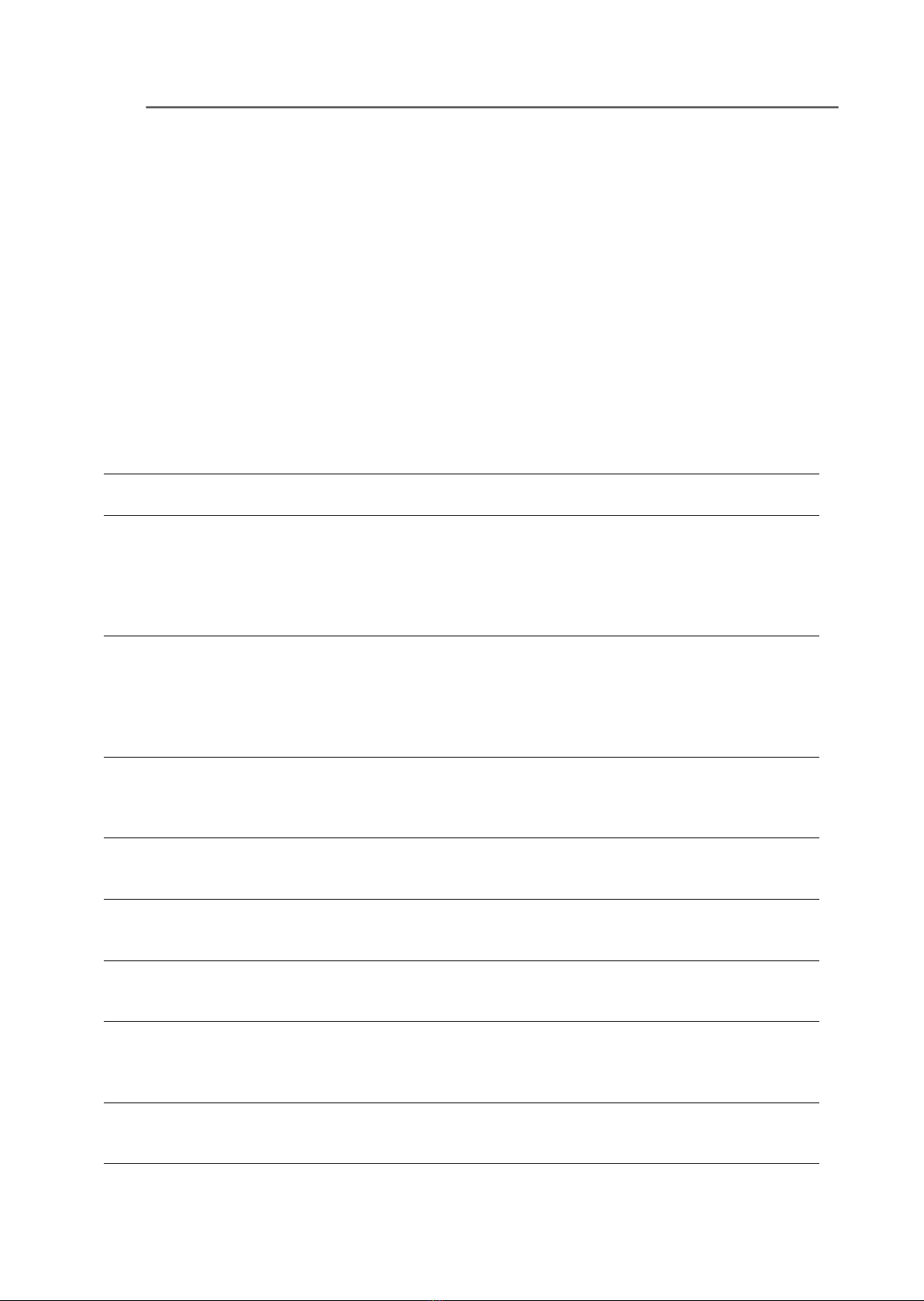

Table 1. Definition of variables

Variable Description Measurement

Expected

impact

Previous papers

BDRi,t

Dependent variable - Bad debt

ratio measured by non-performing

loan which include sub-standard

debts (group 3), doubtful

debts (group 4) and potentially

irrecoverable debts (group 5)

Non-

performing

loan / Total

debt

Quỳnh, N. T. N.

(2018), Horobet et

al. (2021), Jilenga

and Luanda (2021),

Koroleva et al. (2021)

ICTi,t-1

Independent variable - Digital

transformation index reflecting

readiness for information and

communication technology

development and application of

bank i in the previous year.

From the

Vietnam ICT

Index report

+Van Thuy, N. (2021)

AGE Control variable - Age of bank

Number of

years from the

establishment

of banks

- Authors’ suggestion

LOAN

Control variable - Loans to

customers

Loan to

customers /

Total assets

-Quang, N. T. T. (2023)

NIIC

Control variable - Operational

diversification

Net fee and

commision /

Gross income

+Quang, N. T. T. (2023)

ROE

Control variable - Return on

equity

Net income /

Shareholder's

equity

+ Trujillo-Ponce (2013)

GDP

Control variable - GDP growth

rate

Change in the

volume of the

output

-

Nguyen, V. T. H.

(2015), Nguyen, K. T.,

& Dinh, P. H. (2016),

Quang, N. T. T. (2023)

INF Control variable - Inflation rate From the S&P

Global website +

Nguyen, K. T., & Dinh,

P. H. (2016), Nguyễn,

A. Đ. T. et al. (2023)

Source: Authors’ compilation