© Harry Campbell & Richard Brown

School of Economics

The University of Queensland

BENEFIT-COST ANALYSIS

BENEFIT-COST ANALYSIS

Financial and Economic

Financial and Economic

Appraisal using Spreadsheets

Appraisal using Spreadsheets

Chapter 9: Risk Analysis

In the preceding chapters we assumed all costs and benefits are

known with certainty.

The future is uncertain:

• factors internal to the project

• factors external to the project

Risk and Uncertainty

Where the possible values could have significant impact on project’s

profitability, a decision will involve taking a risk.

In some situations, degree of risk can be objectively determined.

Estimating probability of an event usually involves subjectivity.

Risk and Uncertainty

In risk analysis different forms of subjectivity need to be addressed

in deciding:

• what the degree of uncertainty is;

• whether the uncertainty constitutes a significant risk;

• whether the risk is acceptable.

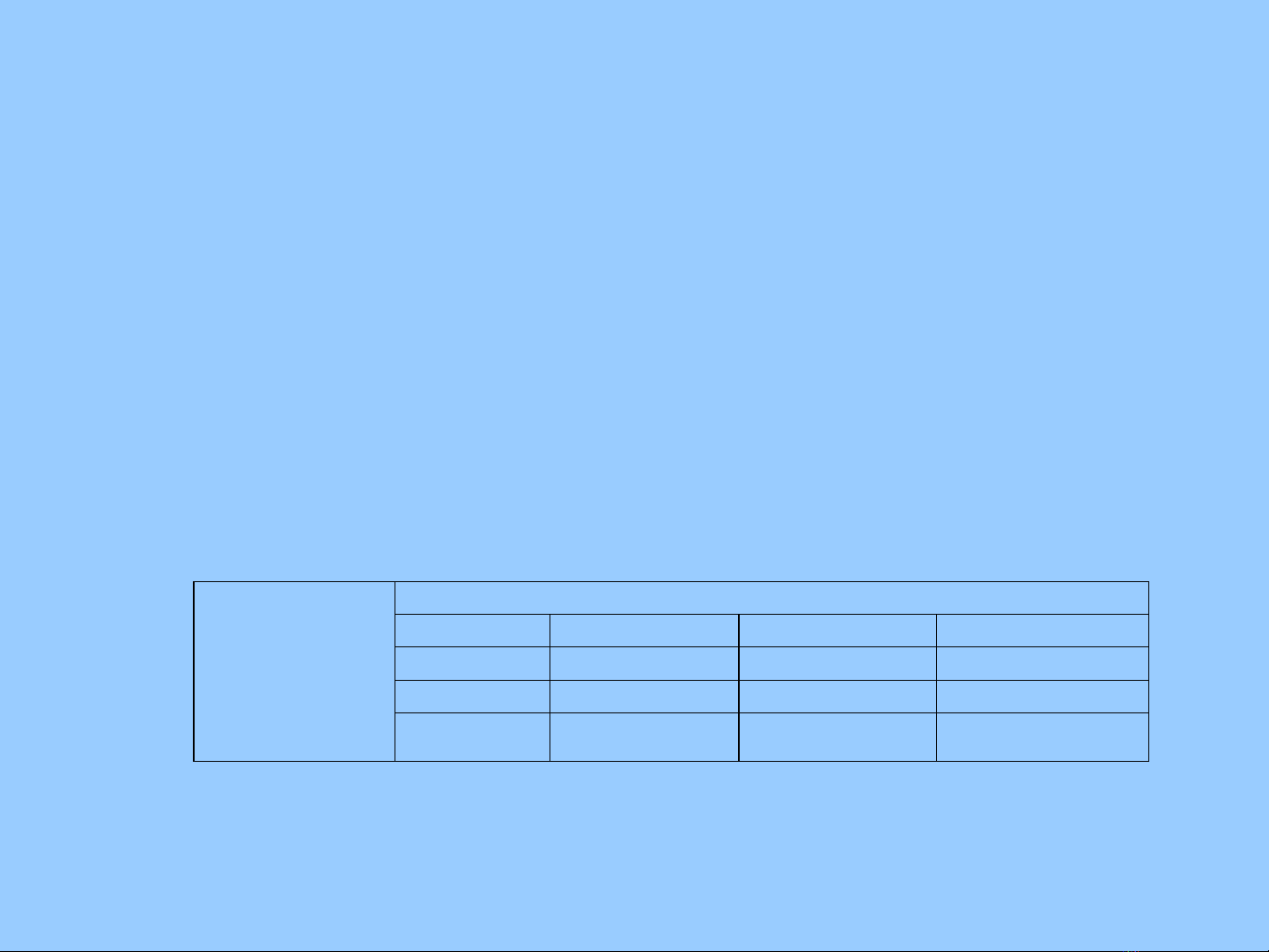

Establishing the extent to which the outcome is sensitive to the

assumed values of the inputs:

• it tells how sensitive the outcome is to changes in input values;

• it doesn’t tell us what the likelihood of an outcome is.

Sensitivity Analysis

Table 9.1: Sensitivity Analysis Results: NPVs for Hypothetical Road Project

($ millions at 10% discount rate)

Construction Costs

75% 100% 125%

High $50 $40 $30

Medium $47 $36 $25

Road

Usage

Benefits Low $43 $32 $20

Risk modeling is the use of discrete probability distributions to

compute expected value of variable rather than point estimate.

Risk Modeling