CHƯƠNG 6: CHI PHÍ VỐN

1. Chi phí vốn và giá trị được tạo ra

2. Chi phí vốn bình quân (WACC)

4. Mô hình CAPM

5. Mô hình ATP

5. Mô hình ATP

86

• A Risk must be rewarded

•

For usual claimants the

hurdle rate

1. Chi phí vốn và giá trị được

tạo ra

87

•

For usual claimants the

hurdle rate

on invested capital must exceed

the return on capital employed

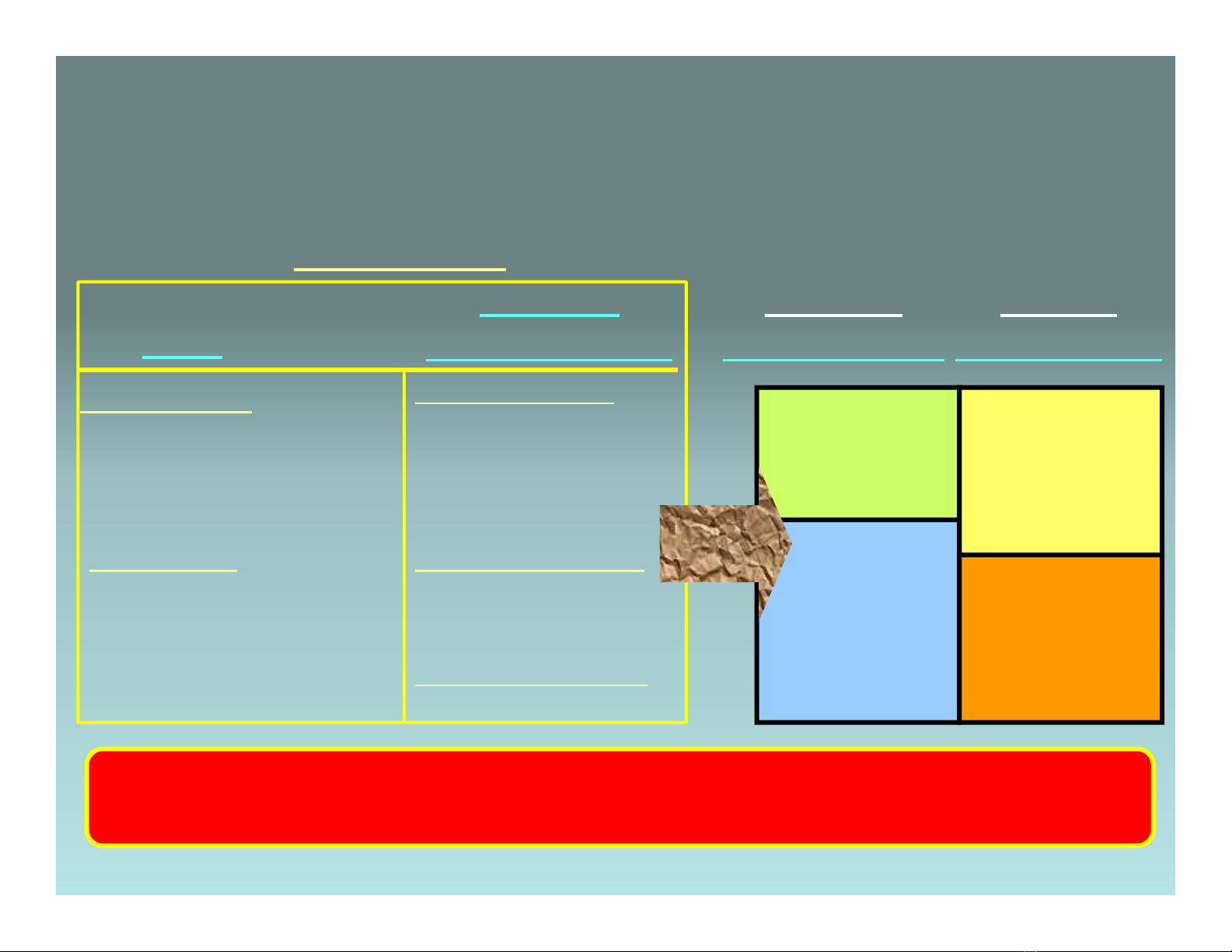

Capital Employed and Invested Capital ?

Current Assets :

-Cash

-Marketable Securities

-

Accounts & Notes Receivable

Assets

Liabilities &

Stockholder’s Equity

Current Liabilities :

-Accounts Payable

-Notes Payable

-

Accrued Tax

Balance Sheet

Current

Working Capital

Net cash

[Long

-

term bank loans

Operational

(Capital employed)

Financing

(Invested Capital)

88

-

Accounts & Notes Receivable

-Inventory

Fixed Assets :

-Equipment

-Building

-Land

-

Accrued Tax

Long-term Liabilities :

-Long-term bank loans

-Bonds

Stockholder’s Equity :

Working Capital

Fixed Assets

[Long

-

term bank loans

- cash]

Equity

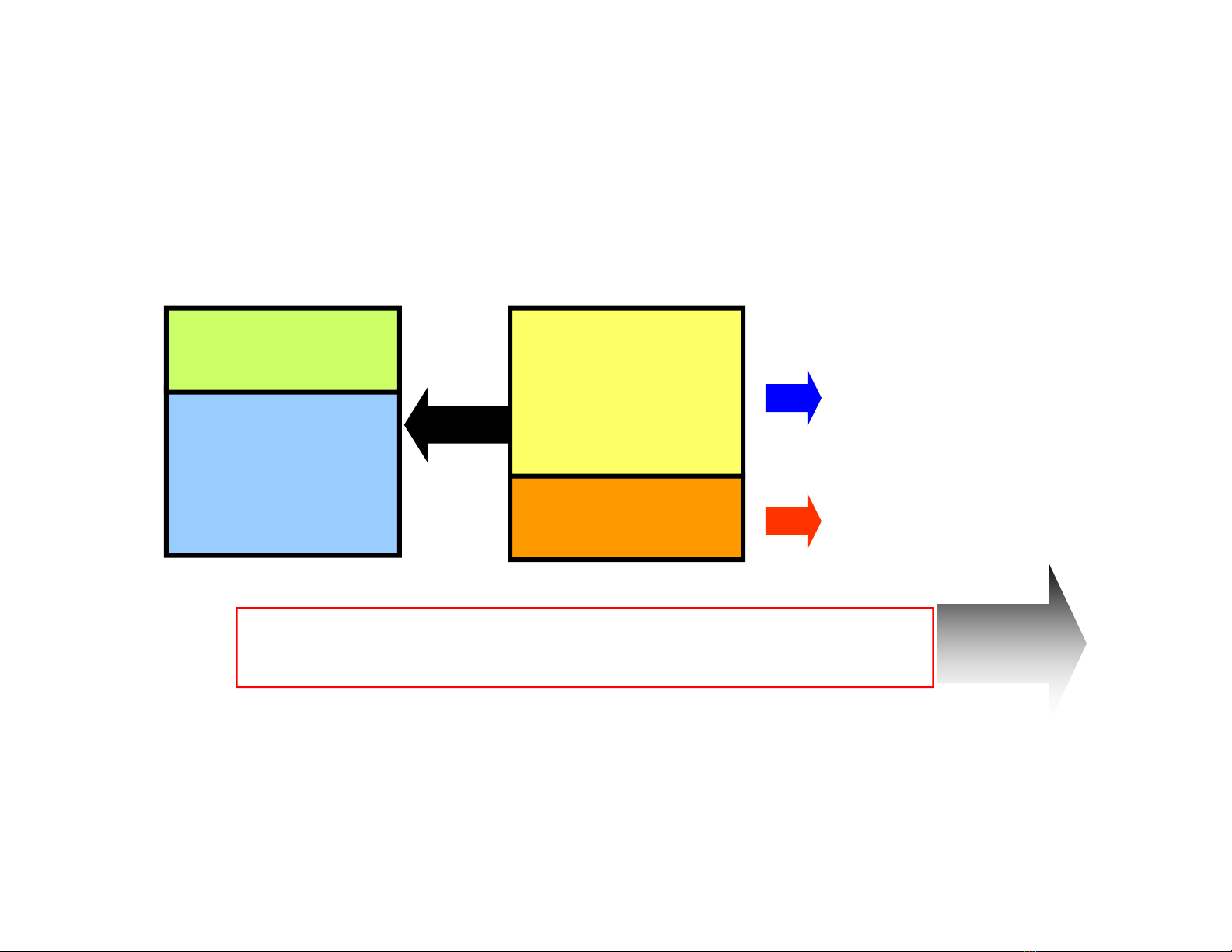

Value Added when

Return on Capital Employed > (Hurdle) Return on invested Capital

Capital Employed Capital Invested

Fixed Assets

Current

Working Capital Net cash Debt Cost

kd

Hurdle Rate on Invested Capital

= the Cost of Capital

Fixed Assets

Equity Equity Cost

ke

Value is created when a company is able to get a

return on its assets higher than its WACC

2. Chi

phí

vốn

bình

quân

-

(WACC)

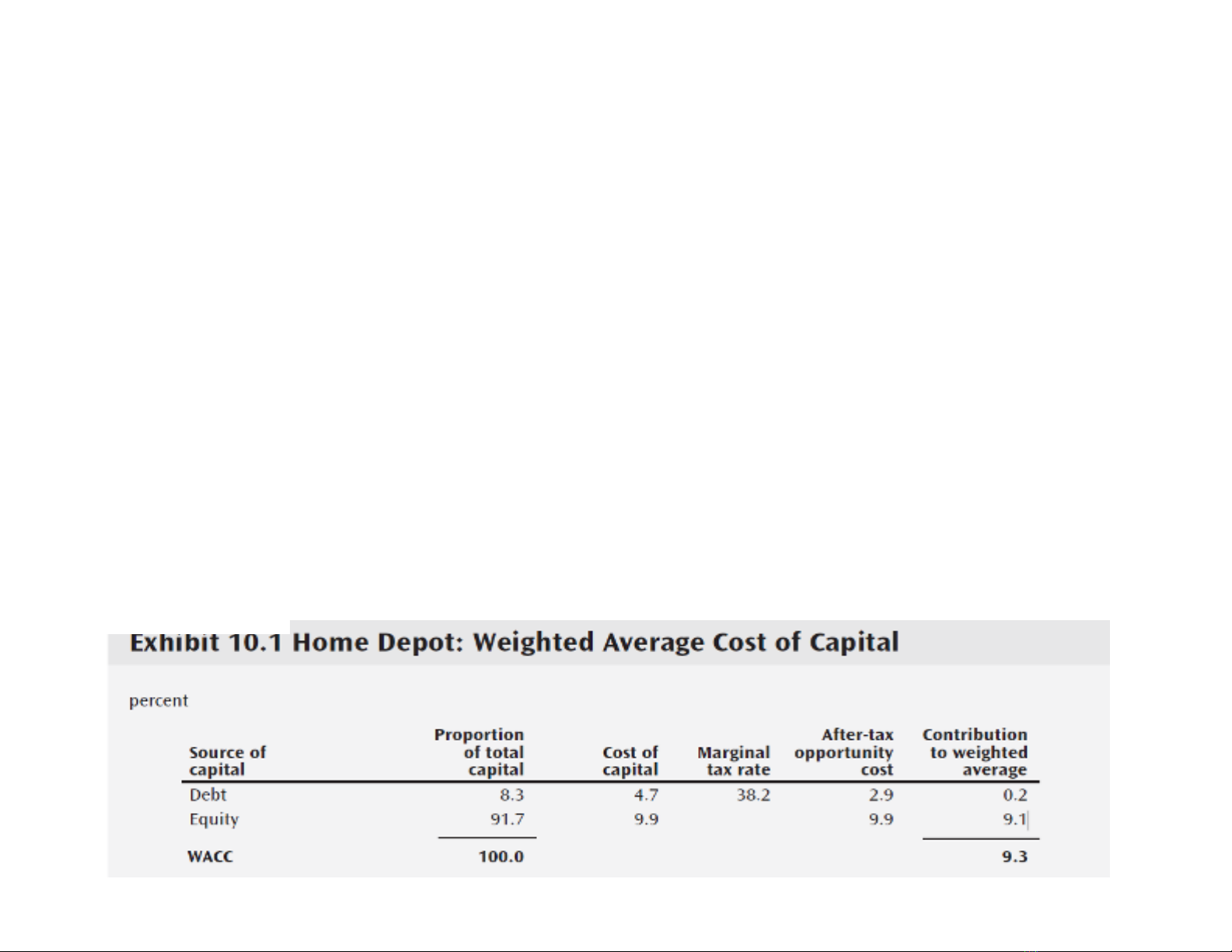

The weighted

average cost of capital

• The weighted average cost of capital is the market-based weighted average of

the after-tax cost of debt and cost of equity :

WACC = D/V*kd(1 − Tm)+ E/V*ke

• where

–D/V = Target level of debt to enterprise value using market-based values

–E/V = Target level of equity to enterprise value using market-based values

–kd= Cost of debt

–ke= Cost of equity

–Tm= Company’s marginal income tax rate

90

![Bài giảng Marketing căn bản Trường CĐ Phương Đông Quảng Nam [chuẩn nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2026/20260124/lionelmessi01/135x160/30531769270692.jpg)

![Câu hỏi trắc nghiệm Nguyên lý Marketing: Tổng hợp [Mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2026/20260124/hoahongxanh0906/135x160/37491769228050.jpg)