1

Activity-Based Cost Systems

Nguyen Phong Nguyen

1

•TCS are systems that allow assigning

indirect/overhead costs to cost objects based on

volume-based measures.

•Plant-wide and departmental rates based on direct

labor hours, machine hours, or other volume-based

measures are used successfully by many

organizations.

–However this approach to costing is equivalent to an

averaging approach and may produce distorted, or

inaccurate costs.

Traditional Cost Systems (TCS)

2

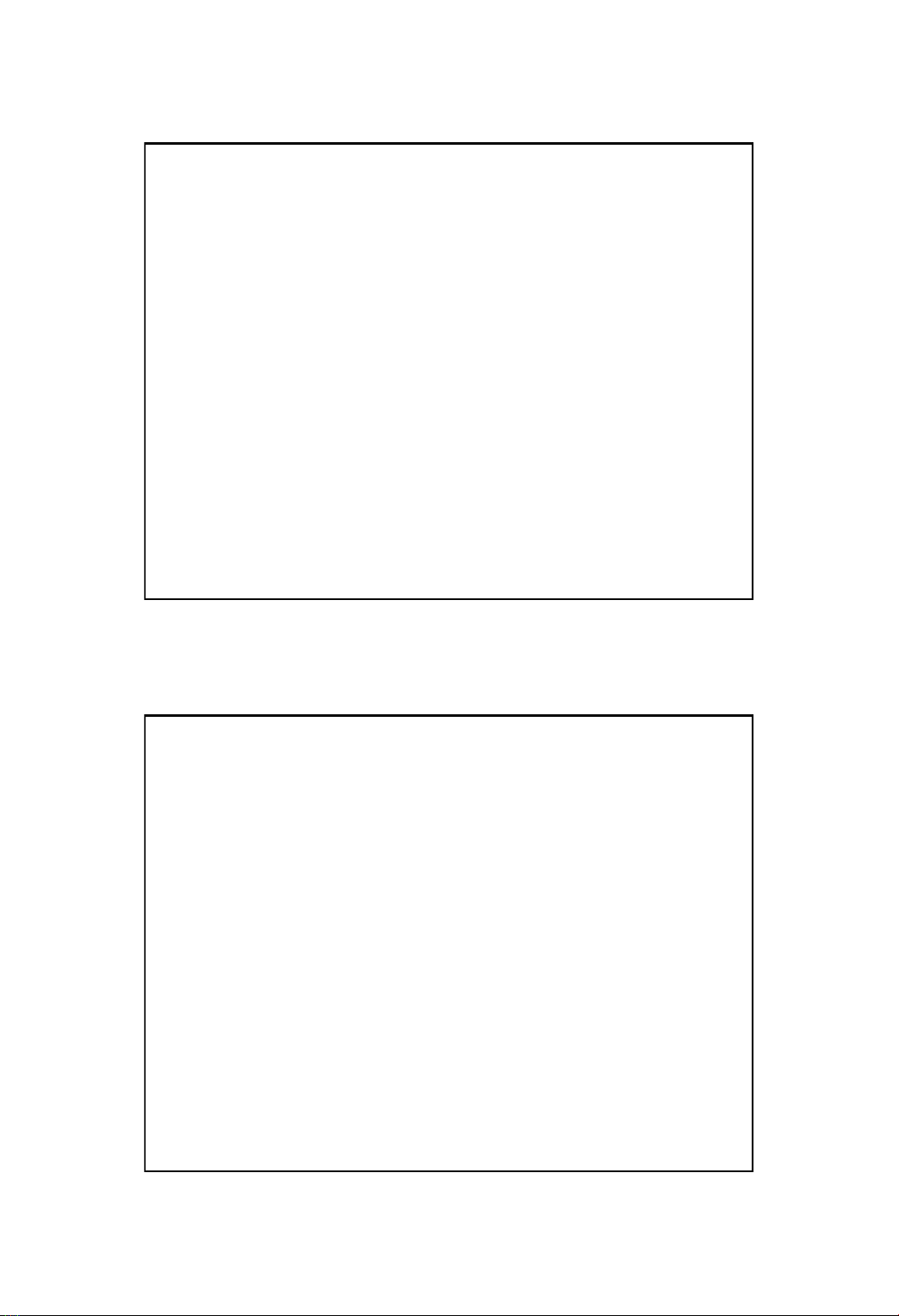

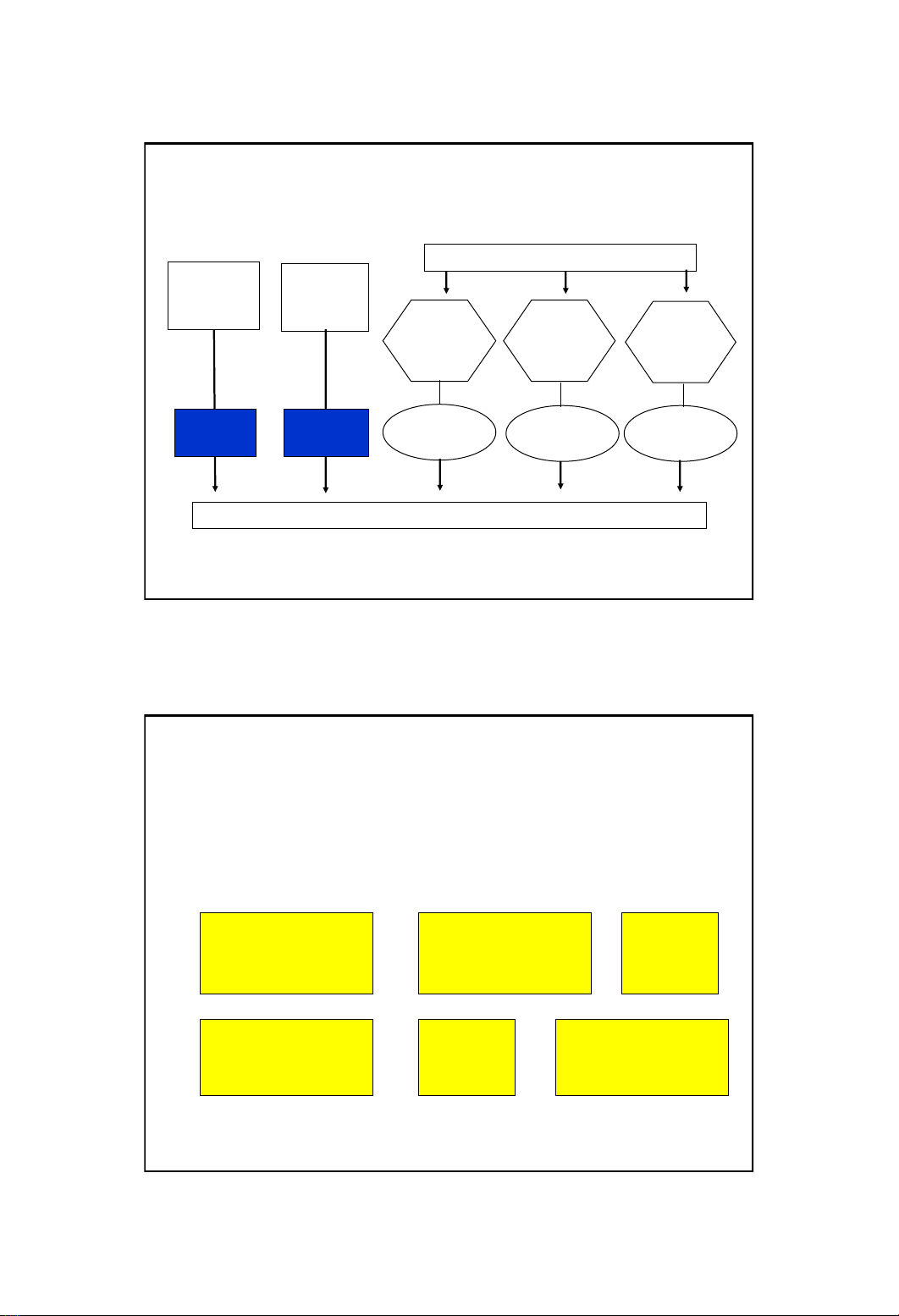

Traditional Cost Systems

Direct

Material

Costs

Direct

Labor

Costs

Overhead

Costs

Direct

Trace

Direct

Trace

DLH

Allocation

Cost objects

Example: Tan Thanh Corporation

Activity Usage Measures

Deluxe Regular

Total

Units produced

10

100

Prime costs

800

8,000

8,800

Direct labor hours

20

80

100

Machine hours

10

40

50

Setup hours

3

1

4

Number of moves

6

4

10

Activity Cost Data (Overhead Activities)

Activity

Activity Cost

Setting up equipment

1,000

Moving goods

1,000

Machining

1,500

Assembly

500

Total

4,000

3

Tan Thanh Corp: Traditional Cost Systems

•Plant-wide overhead rate =…………………

………………............................../DLH

•Overhead cost allocated to

oDeluxe = …………………………………………….

oRegular =…………………………………………….

•Unit cost of

oDeluxe = …………………………………………….

oRegular =…………………………………………….

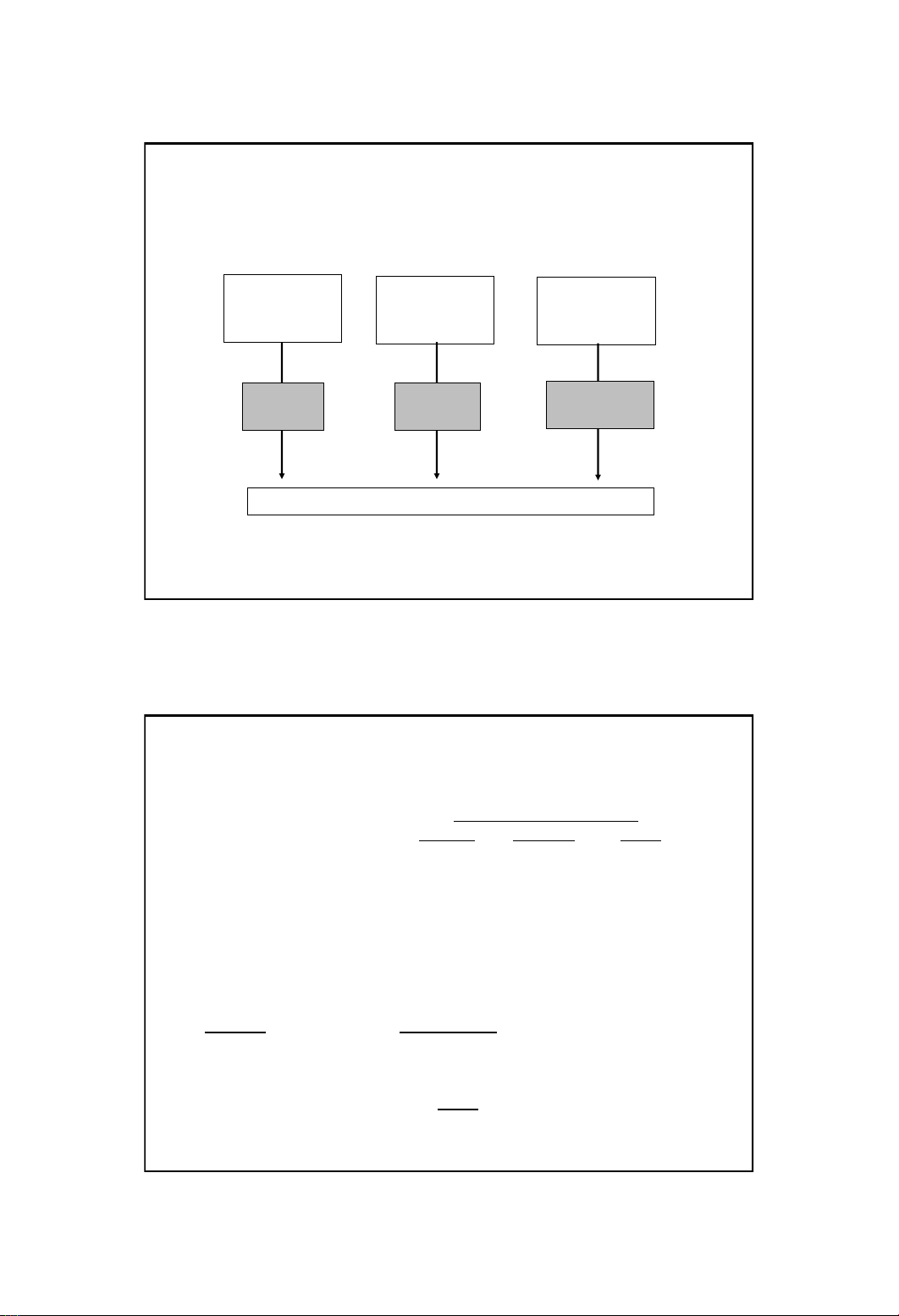

Continuous

Improvement Total Quality

Management

Product cost distortions

can be damaging,

particularly for those

firms whose business

environment is

characterized by:

Limitations of Traditional

Cost Systems

4

Limitations of Traditional

Cost Systems (continued)

•The need for more accurate product costs has

forced many companies to take a look at their

costing procedures.

•Two major factors impair the ability of unit-

based plant-wide and departmental rates to

assign overhead costs accurately:

–The proportion of nonunit-related overhead costs

to total overhead costs is large.

–The degree of product diversity is great.

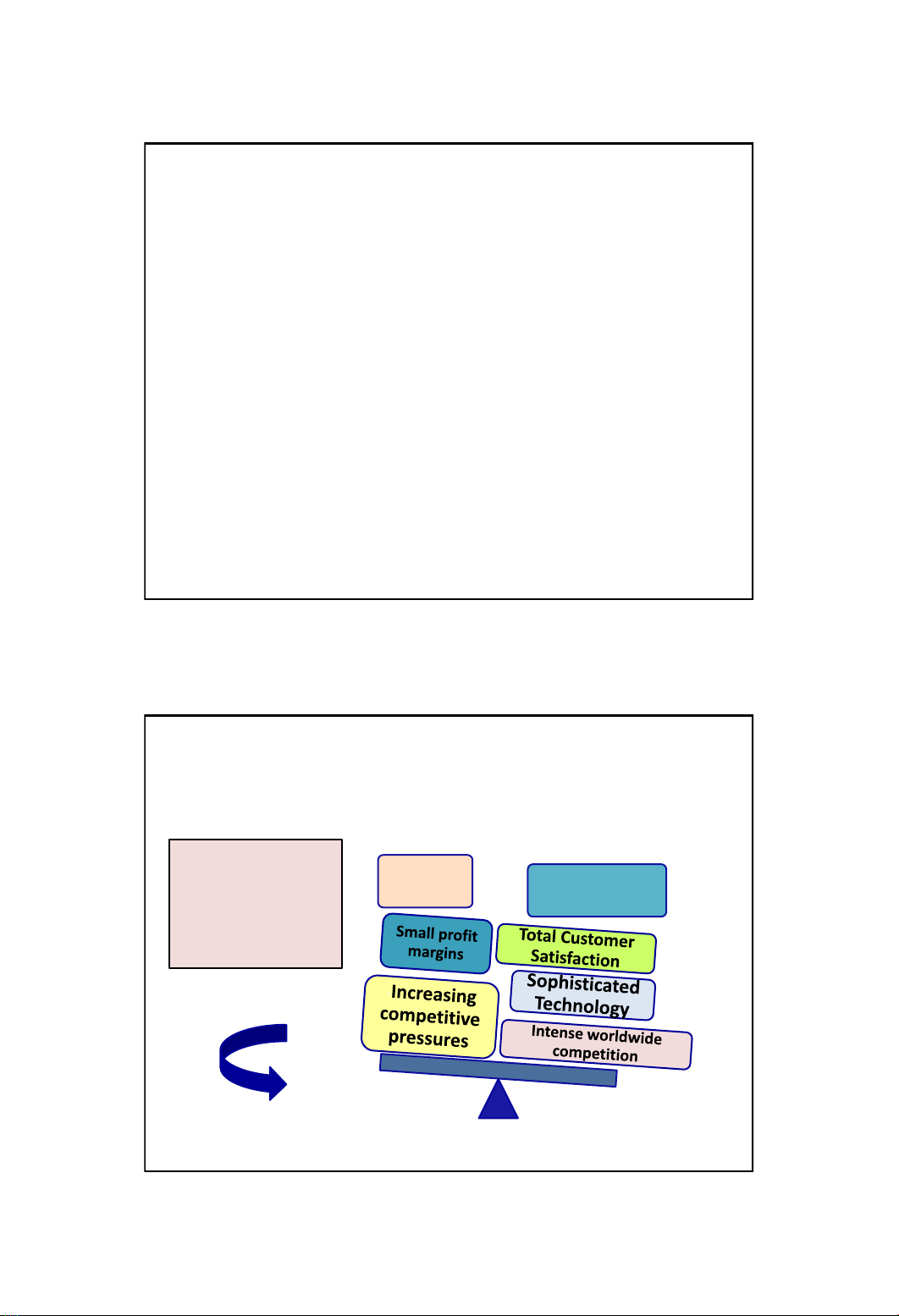

Activity-based Costing: the basic idea

8

Resource: Indirect labor

Inspect

incoming

materials

Activity: Move

materials

Maintain

machines

Set up

machines

Prepare

tooling

Activity

cost driver:

Cost driver

rate

Product,

Customers

# receipts

# moves

# maint. hrs.

# setup hrs.

# setups

5

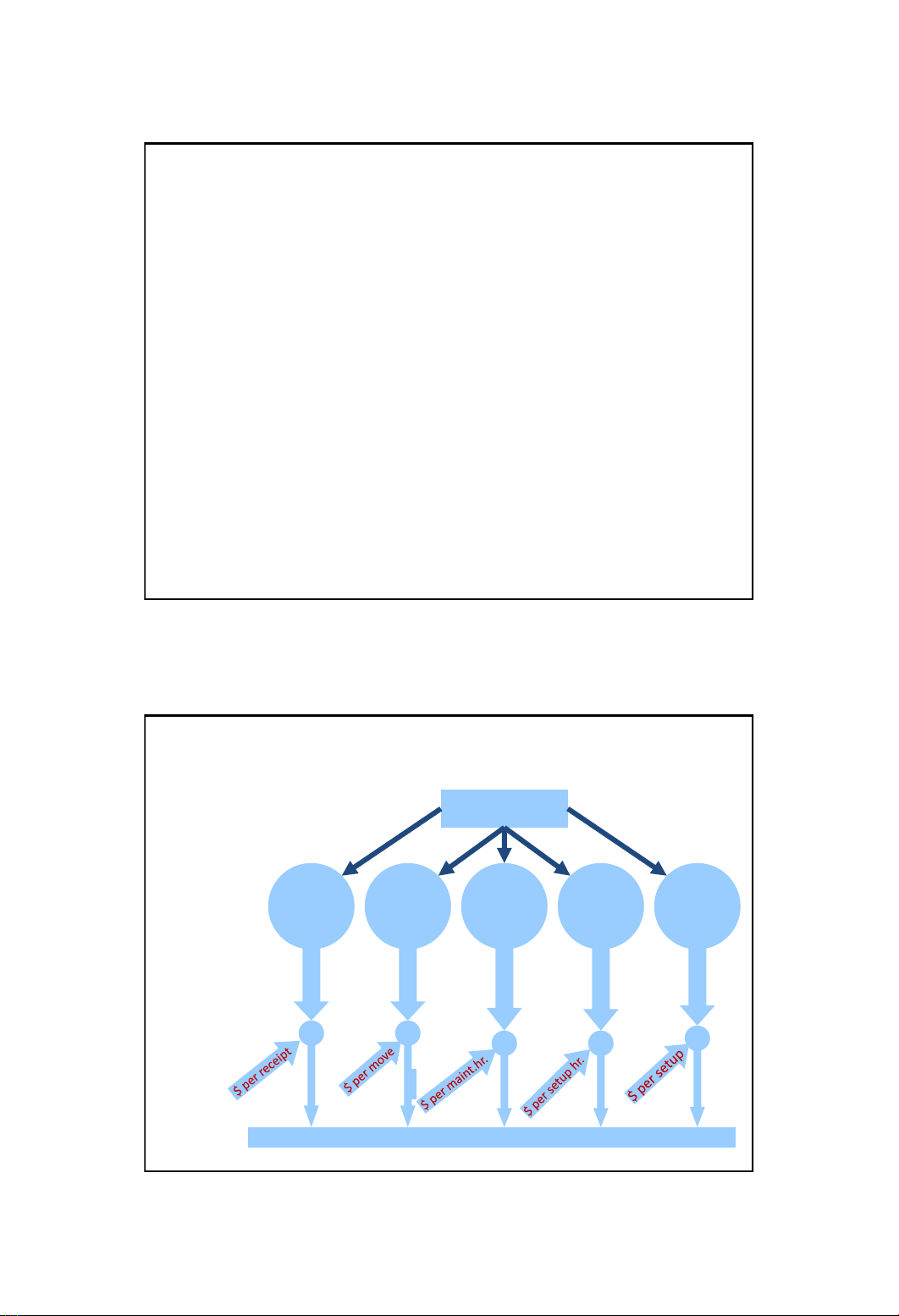

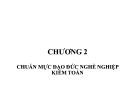

ABC Cost Systems

Direct

Material

Costs

Direct

Labor

Costs

Overhead Costs

Direct

Trace

Direct

Trace

Cost objects

Machining

activity

costs

Assembly

activity

costs

Inspection

activity

costs

# of parts

Processing

Hours

# of

inspections

10

ABC systems refine costing systems by focusing on individual

activities as the fundamental cost object

they measure utilization of each activity by cost objects and assign

the cost of the activity accordingly

total cost of activity

per period

(“cost pool”)

÷ total utilization of

activity per period

= Cost driver

rate

cost driver units

used by cost object

× Cost driver

rate

= overhead cost

assigned

to cost object

ABC Cost System

![Bài giảng Chuẩn mực kiểm toán Việt Nam [mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2022/20220606/charaznable/135x160/2241654490097.jpg)

![Bài giảng Kế toán quốc tế: Chuẩn mực TSCĐ (Tài sản cố định) - [Nội dung chi tiết]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20251020/vitobirama/135x160/32311768303697.jpg)

![Bài tập Tổ chức công tác kế toán doanh nghiệp [chuẩn nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20250613/laphong0906/135x160/69341768292575.jpg)

![Bài tập Kế toán quản trị: Tổng hợp 89 câu [kèm đáp án]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20250612/minhquan0690/135x160/41641768201852.jpg)

![Tài liệu ôn tập Kế toán quản trị và chi phí [mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20250612/minhquan0690/135x160/26871768201854.jpg)