Basic Chart Analysis: Trends, trading ranges, and support and

resistance

By Mark Etzkorn

If you've read The Technician's Basic Tool: The Price Chart, you're probably

familiar with the more popular chart types and how they display price information.

But knowing the difference between a bar chart and a candlestick chart is only

the beginning. Obviously, what's important is making sense of the price patterns

that develop over time.

Because price charts are a succinct record of price

action, learning how to analyze them is a logical first

step in the technical analysis journey. Further,

traditional chart patterns are a good first stop on this

trip, because they explain many of the basic principles

of price movement. We'll take a look at the simplest

kinds of chart patterns and what they reveal about

market behavior.

Chart pattern myth vs. reality

To the general public, the terms "technical analysis"

and "chart analysis" usually bring to mind images of

traders poring over price charts, deciphering hidden

patterns in much the same way a fortune teller would read tea leaves.

Actually, despite the sometimes colorful names given to chart patterns, chart

analysis has a very common-sense goal: to locate price trends, congestion

areas, and points where trends are likely to reverse. "Patterns" can consist of a

single price bar or dozens, and can trigger trades that last a few hours or a few

months. To start, we'll focus on a few major price patterns that illustrate the most

important principles of chart analysis.

Keep in mind that many, if not most of the concepts we will discuss here are

equally applicable to intra-day, daily, weekly, or monthly charts. However, certain

patterns, especially those that revolve around the open or closing prices, will be

relevant only on the daily time frame.

To many, the term

"chart analysis"

brings to mind

images of traders

poring over price

charts, deciphering

hidden patterns in

much the same

way a fortune teller

would read tea

leaves

Trends

Trend is one of the most important concepts in

charting and technical analysis. All technical trading

techniques essentially consist of one of the following

approaches:

• Identifying trends after they have developed

and trading in their direction (buying into the

beginning of an uptrend or selling into the

beginning of a downtrend)

• Entering trends after they have begun on corrections (or pullbacks)

• Identifying reversal points where trends seem likely to end and trading in

the opposite direction (selling into the end of an uptrend or buying into

the end of a downtrend)

Of course, catching the precise beginnings and ends of all trends is unrealistic;

fortunately, you don't need to. But as a technical trader interested in finding

profitable price moves, you are always concerned with price trends on a certain

level, whether they last a few hours or several months.

It is easy to intuitively understand what a price trend is: a continuing series of

daily (or hourly, weekly, monthly, and so on) price advances or declines. A

standard definition of a trend is a series of higher price highs and price lows (for

an uptrend) or lower price highs and price lows (for a downtrend). The daily bar

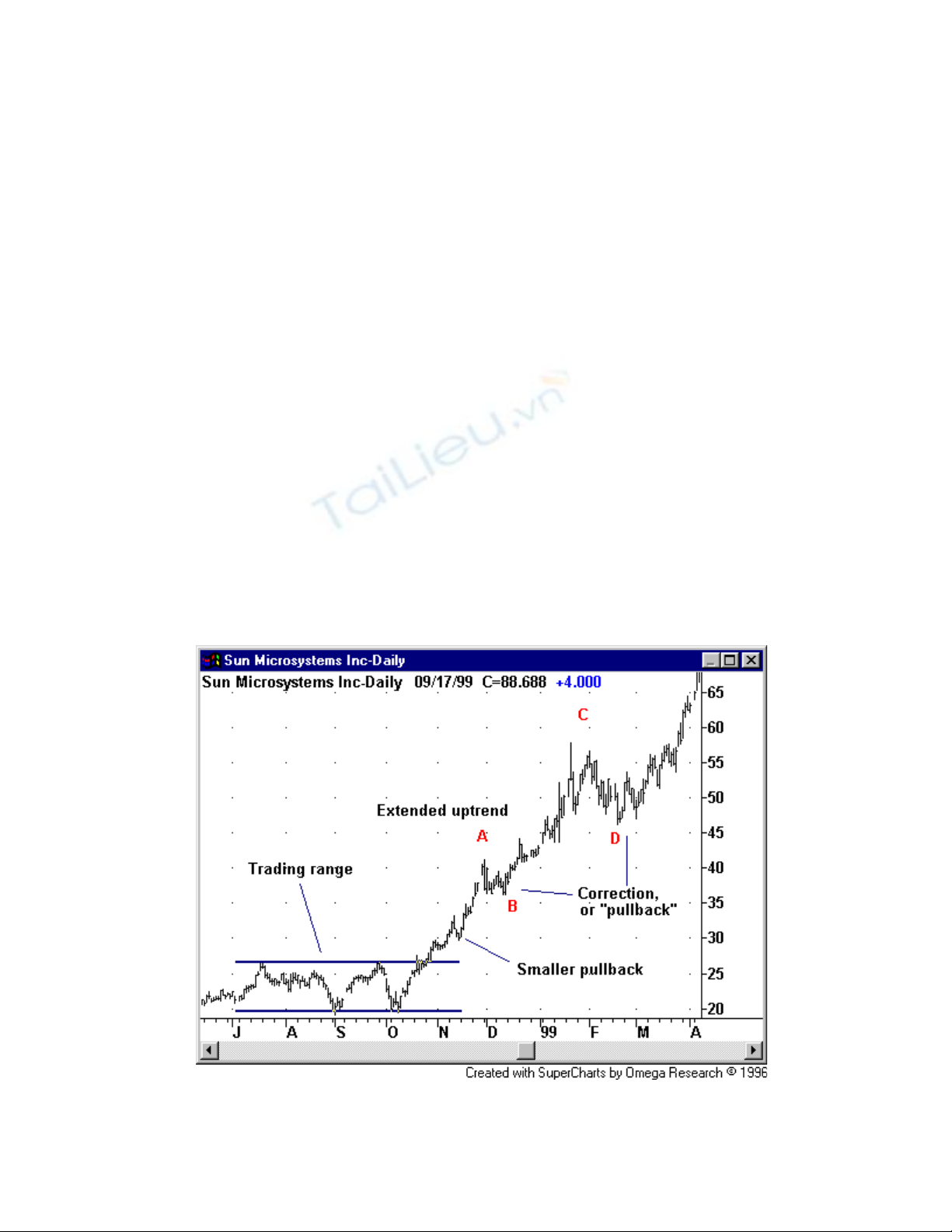

chart in Figure 1 illustrates this definition of an uptrend.

Figure 1. Sun Microsystems (SUNW), daily. Uptrend preceded by trading range and

Catching the

precise beginnings

and ends of all

trends is

unrealistic;

fortunately, you do

not need to

punctuated by corrections, or pullbacks. Source: Omega Research.

It is obvious from this example that even though the market is clearly in a strong

overall uptrend, the rally is punctuated by occasional counter-trend downswings

(corrections, pullbacks--pick your term), the most notable occurring between

January and February 1999. (This correction happened to take the form of a

triangle, a pattern we will discuss in a future article.) A trading range, or

congestion period (see next section) preceded the uptrend.

Points A, B, C and D correspond to some of the more notable highs and lows

throughout this uptrend, the largest of which (C and D) are referred to as relative

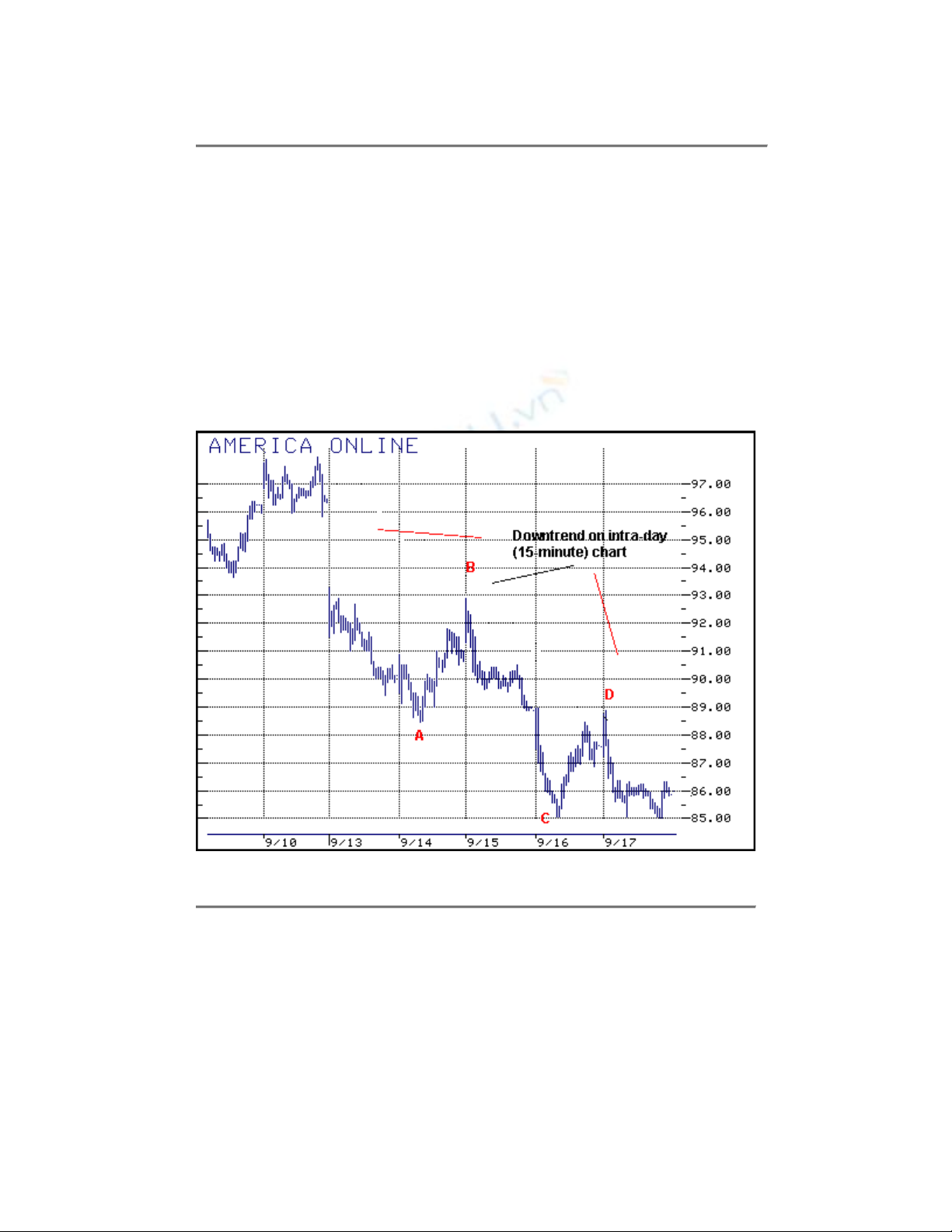

(or "reaction," or "swing") highs and lows. Figure 2 shows a downtrend on a 15-

minute chart. A, B, C and D mark some of the relative highs and lows on this

chart.

Figure 2. America Online (AOL), 15-minute. Downtrend and relative highs and

lows. Source: Quote.com.

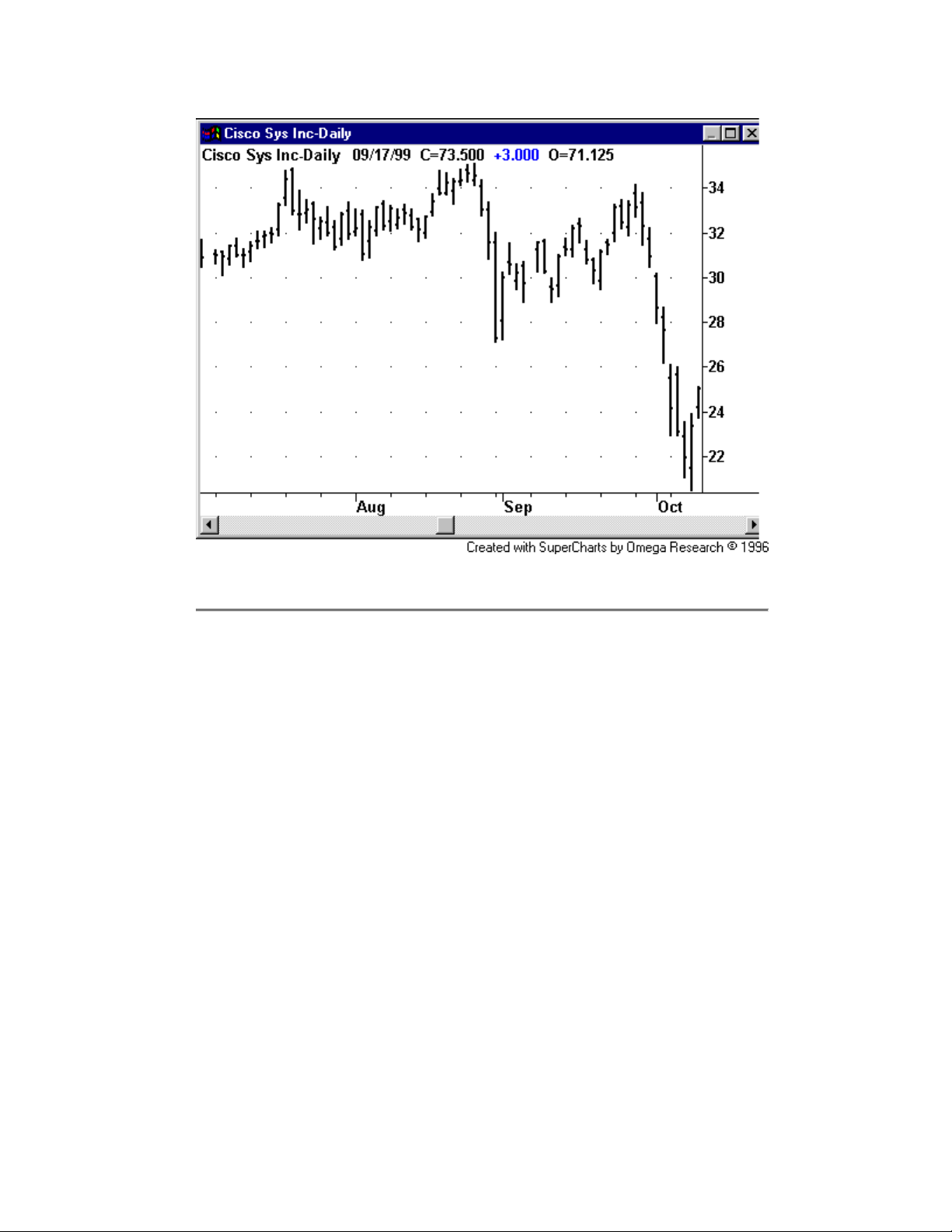

Of course, trends are relative, depending on the time frame you consider. Figure

3 shows a somewhat random market that drops dramatically toward the end of a

roughly three-month period on a daily chart. While this might not qualify as a

downtrending market (until the steep sell-off at the end), it is definitely not an

uptrend.

Figure 3. Cisco (CSCO), daily. Sideways price action ending with sharp break. Source:

Omega Research.

This underscores the importance of putting market action in context by consulting

different time frame charts. Price action on a weekly or monthly chart may

determine whether or not you establish a position on a daily chart; behavior on a

daily chart will similarly influence your choices on an intraday basis.

Copyright © 2001 by TradingMarkets.com, Inc.

![Câu hỏi trắc nghiệm và bài tập Thị trường chứng khoán [mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20251001/kimphuong1001/135x160/75961759303872.jpg)

![Quỹ đầu tư chứng khoán: Đề tài thuyết trình [Mới Nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20250912/truongmy050404@gmail.com/135x160/80601757732705.jpg)

![Đề thi Đầu tư quốc tế học kì 1 năm 2024-2025 có đáp án (Đề 2) - [kèm đáp án chi tiết]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20250822/kimphuong1001/135x160/84781755852396.jpg)