66

Journal of Economic and Banking Studies

No.8, Vol.4 (2), December 2024 pp. 66-78

©

Banking Academy of Vietnam

ISSN 2734 - 9853

Assessing the factors affecting the Vietnamese

intention to invest in cryptocurrency

Pham, Manh Hung1 - Vuong, Linh Nham2 - Nguyen, Thanh Tra3

Banking Academy of Vietnam1,2, National Economic University, Vietnam3

Corresponding Authors.

E-mail address: hungpm@hvnh.edu.vn (Pham, M.H.), linhnham@hvnh.edu.vn (Vuong, L.N.),

thanhtra23114@gmail.com (Nguyen, T.T.)

1. Introduction

The digital era has greatly facilitated the

development of innovative ideas related

to financial activities. Improvements

on the Internet or artificial intelligence, block-

chain, or cloud computing have become impor-

tant factors in reshaping the global economic

structure (Knapp, 2022). Regarding technol-

ogy advancement, financial activities such

as payments, online transactions, and invest-

ments have been revolutionized to give birth

to cryptocurrencies. According to Shoaib et al.

(2013), cryptocurrency is a form of virtual cur-

rency that employs blockchain technology and

encryption to safeguard the financial transac-

tions of its users. The blockchain technology

enables the creation of a unified transaction

ledger, necessitating each cryptocurrency user

to maintain an individualised version of the

ledger. Every new transaction is immediately

recorded as it occurs, and every copy of the

blockchain is simultaneously updated with the

new information. This is done to ensure that all

of the records are accurate and consistent with

one another. European Central Bank (2012) de-

fined cryptocurrency as a form of decentralised

digital currency that operated independently

from any central authority. Participants in a

particular online community are willing to use

this currency, which has been created and gov-

erned by its founders. The defining feature of

cryptocurrency is its lack of physical manifes-

tation, such as coins or cash, and its exclusive

use within the realm of the internet.

Bitcoin is the first cryptocurrency developed,

followed by Ethereum, Litecoin, Ripple, Dash,

and so on. Recently, cryptocurrencies have

Chronicle Abstract

Article history This empirical investigation explores the determinants that influence the

intention to invest in cryptocurrency within the Vietnamese context. Spe-

cifically, this study aimed to investigate the influence of Attitude (A), Sub-

jective Norm (SN), Perceived Usefulness (PU), Perceived Ease of Use (PEU),

and Perceived Risk (PR) as independent variables on the investment inten-

tions of Vietnamese individuals in the context of cryptocurrency during the

Covid-19 pandemic. The results of the study indicate that subjective norm

(SN), perceived usefulness (PU), and perceived ease of use (PEU) are statisti-

cally significant factors that exhibit a positive correlation with the depen-

dent variable of intentions to invest in cryptocurrency (IUC). This investiga-

tion can aid scholars in comprehending the function of cryptocurrency and

discerning its principal impacts on the Vietnamese cryptocurrency market.

Received

Revised

Accepted

12th Apr 2024

15th Jul 2024

08th Nov 2024

Keywords

Cryptocurrencies,

Invest,

Intention,

Vietnam,

Covid-19

DOI:

10.59276/JEBS.2024.12.2675

Pham, Manh Hung - Vuong, Linh Nham - Nguyen, Thanh Tra

67

No.8, Vol.4 (2), December 2024 - Journal of Economic and Banking Studies

undergone significant growth and are now

widely recognized as valuable assets in inter-

national financial markets (Fang et al., 2019).

They have garnered attention from various

stakeholders, including the media, individual

investors, institutional investors, and regula-

tors, and have emerged as a prominent subject

of academic research in multiple fields. The

global cryptocurrency market capitalization is

estimated at $2.26 Trillion (Coingecko, 2024).

Although cryptocurrencies are not legalized in

Vietnam, people in this country still use and

invest in them. A recently published report

by UNCTAD (United Nations Conference on

Trade and Development) indicated that the

global use of cryptocurrencies tends to increase

sharply during the outbreak of the Covid-19

pandemic. In the Top 20 countries with the

highest percentage of population owning cryp-

tocurrencies in 2021, Vietnam ranks 11th with

6.1% of the population, higher than Thailand

with 5.2 %. (An Yen, 2022). Although Viet-

nam does not have a legal framework for the

ownership, trade, and use of cryptocurrencies,

the adoption rate has been among one of the

highest globally. Vietnam’s government has

tasked the State Bank with researching, devel-

oping, and piloting the use of blockchain-based

virtual currency to prevent money laundering

risks in the banking system (Mai Phuong &

Thanh Xuan, 2021). In addition, the govern-

ment has requested the Ministry of Finance to

analyze and finalize the establishment of the

legal framework for regulating the cryptocur-

rency market by May 2025.

The authors have chosen the COVID-19 pan-

demic as the context research. Unlike tradition-

al financial markets, where investors view vol-

atility unfavorably, in the crypto market, high

volatility is seen as a chance to generate bigger

returns (Nadler and Guo, 2020). Furthermore,

cryptocurrency investors tend to adopt behav-

ioral trading strategies, concentrating on short-

term trends and executing trades with high

sentiment and high volume at hourly and daily

frequencies. Investors in the cryptocurrency

market are driven by the concept of lottery-like

demand (Grobys and Junttila, 2021). They are

specifically interested in cryptocurrencies that

offer large returns, without being worried about

the possibility of a sudden decline, unlike stock

investors. The study conducted by Pelster et

al. (2019) reveals that the behavior of crypto

investors is influenced by risk seeking behav-

iors. The study of intention to invest in crypto-

currencies during periods of uncertainty such

as COVID-19 pandemic promises interesting

results as the volatility is high and the herding

behavior of crypto investors is frequently pres-

ent (Rubbaniy et al., 2021).

The purpose of this study is to identify vari-

ables that affect Vietnamese people’s inten-

tion to invest in cryptocurrency and evaluate

those factors based on testing hypotheses and

related models. Besides, this study proposes

several solutions for developing cryptocurren-

cies and protecting investors in the future. In

the context of the Covid-19 pandemic, when

the global economy is under extremely serious

threat, Bitcoin in particular, and the crypto-

currency market in general still have positive

flourishes. While the traditional financial

markets and derivatives are constantly exposed

to the effects of the epidemic, Bitcoin still

proves its worth as a solid macro hedge against

the crisis (Almeida and Gonçalves, 2023). This

study has several novelty contributions. First,

this paper contributes to the existing literature

about intention to invest in cryptocurrencies by

examining the influence of attitude, subjective

norm, perceived usefulness, perceived ease

of use, and perceived risk within the context

of the ongoing Covid-19 crisis. Secondly, this

study combines the integrated model to test the

mechanism effects while previous studies have

mostly relied on only one of the research mod-

els, namely the Theory of Reasoned Action

(TRA), Theory of Planned Behavior (TPB), or

Technology Acceptance Model (TAM).

2. Theoretical framework and hypotheses

development

Researchers have explored cryptocurrency

investing using a variety of theoretical frame-

works. The fundamental theoretical frame-

Assessing the factors affecting the Vietnamese intention to invest in cryptocurrency

68

Journal of Economic and Banking Studies- No.8, Vol.4 (2), December 2024

works regarding the intention to invest in

cryptocurrencies include Fishbein’s theory

of reasoned action and technology accep-

tance model. The Theory of Reasoned Action

(TRA) is a theoretical framework that evalu-

ates behavioral intention by considering two

key factors: attitude towards the behavior and

subjective norms. This model is character-

ized by its parsimony, wherein an individual’s

attitude towards a particular behavior, prod-

uct, or service can be dichotomized as either

negative or positive. Subjective norms pertain

to the influence of social pressure, encompass-

ing the degree of conformity or nonconformity

towards a particular behavior, product, or ser-

vice. The utilization of the theory of reasoned

action, or its modified versions, has been ex-

tensively employed to ascertain the behavioral

inclination of individuals towards the intention

to invest in cryptocurrency. The Technology

Acceptance Model (TAM), which was formu-

lated by Davis (1989), has emerged as a highly

efficacious approach for scrutinizing the level

of acceptance of novel technology and eluci-

dating the manner in which users are inclined

to embrace and utilize new technologies. The

concept of technology acceptance pertains to

the willingness of a user or an organization to

adopt a novel technology. This study utilizes

the Technology Acceptance Model to investi-

gate the intention to invest in cryptocurrency.

Specifically, the study focuses on the inde-

pendent factors of Perceived Ease of Use and

Perceived Usefulness as consistent predictors

that yield significant and verifiable results.

2.1. Attitude (A)

The Theory of Reasoned Action (TRA) posits

that an individual’s inclination to engage in a

particular behaviour is positively influenced by

their attitude towards that behaviour. As per the

research conducted on behavioural decisions,

it has been established that attitude is the most

potent factor that exerts influence as it propels

behaviour (Trafimow, 1996). Attitude has been

identified as a key determinant of the intention

to utilise cryptocurrency, as noted by Gazali et

al. (2019) and Albayati et al. (2020). Schaupp

and Festa (2018) have demonstrated a robust

correlation between attitude and the intention

to utilise cryptocurrencies in their research.

According to Zamzami’s (2020) research

conducted in Indonesia, it was concluded that

the sole determinant of investment intention in

cryptocurrencies is attitude. This means that

if a person believes that investing in crypto-

currency does not necessarily include risk or

that the repercussions will not be too severe,

then that person is more likely to make a high

investment decision. On the other hand, if an

individual believes that investing in cryptocur-

rencies carries a high level of risk or that doing

so will result in significant repercussions,

then the individual is more inclined to make

investment decisions with a low level of risk

(Ajzen, 1991). Investors perceive high volatil-

ity in the cryptocurrency market as an oppor-

tunity to generate greater profits (Nadler and

Guo, 2020). During the period of high level of

uncertainty such as the COVID-19 pandemic,

investors might perceive cryptocurrency posi-

tively. Consistent results from previous studies

have led to hypothesis H1:

H1: Attitude has a positive influence on an in-

dividual’s intention to invest in cryptocurrency

in Vietnam during the Covid-19 pandemic.

2.2. Subjective Norm (SN)

Subjective norm is regarded as the belief

to which a person’s investment decision is

supported or encouraged by an important

individual or a group of people (Ham et al.,

2015). Based on the TRA model, Walton

and Johnston (2018) indicated that when an

individual believed that friends, family, and

society had a positive view of technology, the

person’s tendency to adopt technology would

increase. Gazali et al. (2018) contend that

people would have increased feelings of safety

if they conform their behavior to accepted

social standards. Therefore, if important people

have a favorable perspective toward cryptocur-

rency investment, the investment intention will

be higher (Schaupp and Festa, 2018). Subject

Pham, Manh Hung - Vuong, Linh Nham - Nguyen, Thanh Tra

69

No.8, Vol.4 (2), December 2024 - Journal of Economic and Banking Studies

norm was identified as a crucial component for

the future adoption of cryptocurrencies in an

interview-based study looking into the per-

ceptions of cryptocurrency users (Baur et al.,

2015). Kim (2021) examined the intention to

use Bitcoin during the COVID-19 pandemic in

the United States, and concluded that subjec-

tive norms significantly affected intention to

use Bitcoin, through the mediating effect of

power-prestige, retention-time, and distrust.

Therefore, hypothesis H2 is established as fol-

lows:

H2: Subjective Norm has a positive influence

on the intention to invest in cryptocurrency

in Vietnam during the Covid-19 pandemic.

2.3 Perceived Usefulness (PU)

According to Albayati et al. (2020), perceived

usefulness is a factor in the TAM model and

it is considered a strong predictor of people’s

intention to use cryptocurrencies. There are

a few studies surveying that an individual

believes that using cryptocurrencies in elec-

tronic payments can improve his or her work

performance. Cryptocurrencies provide a fast,

low-cost, and no-intermediate payment op-

tion, they can save a lot of time and can be

done anywhere. Research in the United States

(Schaupp & Festa, 2018), and China (Nadeem

et al., 2021) all show a positive effect of use-

fulness concerning the desire to make use of

cryptocurrency across countries.

H3: Perceived Usefulness has a positive im-

pact on the intention to invest in cryptocurren-

cy in Vietnam during the Covid-19 pandemic.

2.3. Perceived Ease of Use (PEU)

As the perceived usefulness develops, users

will continue to emphasize perceived ease of

use. This factor means that if cryptocurrencies

are easy to use and investors have no diffi-

culty in trading, they will be more inclined to

use them. Based on TAM, according to Davis

(1989), user beliefs about perceived ease of use

have a significant impact on the user’s attitude

toward adopting a specific information system.

According to Riquelme and Rios (2010), tech-

nology services are more likely to be adopted

by users if they are perceived as being practi-

cal, enjoyable, and easy to use. Therefore, the

study proposes the following hypothesis H4:

H4: Perceived Ease of Use has a positive im-

pact on the intention to invest in cryptocurren-

cy in Vietnam during the Covid-19 pandemic.

2.4. Perceived Risk (PR)

According to Abramova and Bohme (2016)

and Sun et al. (2020) related to cryptocur-

rency investment decisions, perceived risk is a

distinguishing factor that influences investment

decisions significantly. It is understood that if

an individual perceives many problems when

using cryptocurrency, they will tend to limit or

not accept the use of this currency. According

to Zhao and Zhang (2021), perceived risk has

a negative impact on the decision to invest in

cryptocurrencies, meaning that the feeling of

insecurity towards this currency has become a

factor hindering their decision to use it. Also

according to Abramova and Bohme (2016),

their research indicates that some potential

investors expressed concern about the security

and risk of information leakage of cryptocur-

rencies. For this reason, PR has become an

increasingly important factor in people’s crypto

adoption. Hypothesis H5 is stated:

H5: Perceived risk has a negative effect on

the intention to invest in cryptocurrency in

Vietnam during the Covid-19 pandemic.

3. Methodology

Data collection

The study employes primary data collection

methods, specifically through the use of an

empirical questionnaire administered online to

participants. The first step is to identify con-

cepts related to the research topic. Step two,

build a questionnaire based on research factors,

then review and adjust. Step three, create an

online questionnaire via Google Forms and

post it on social media Facebook, specifically

cryptocurrency investment groups. The survey

was conducted during the period September

Assessing the factors affecting the Vietnamese intention to invest in cryptocurrency

70

Journal of Economic and Banking Studies- No.8, Vol.4 (2), December 2024

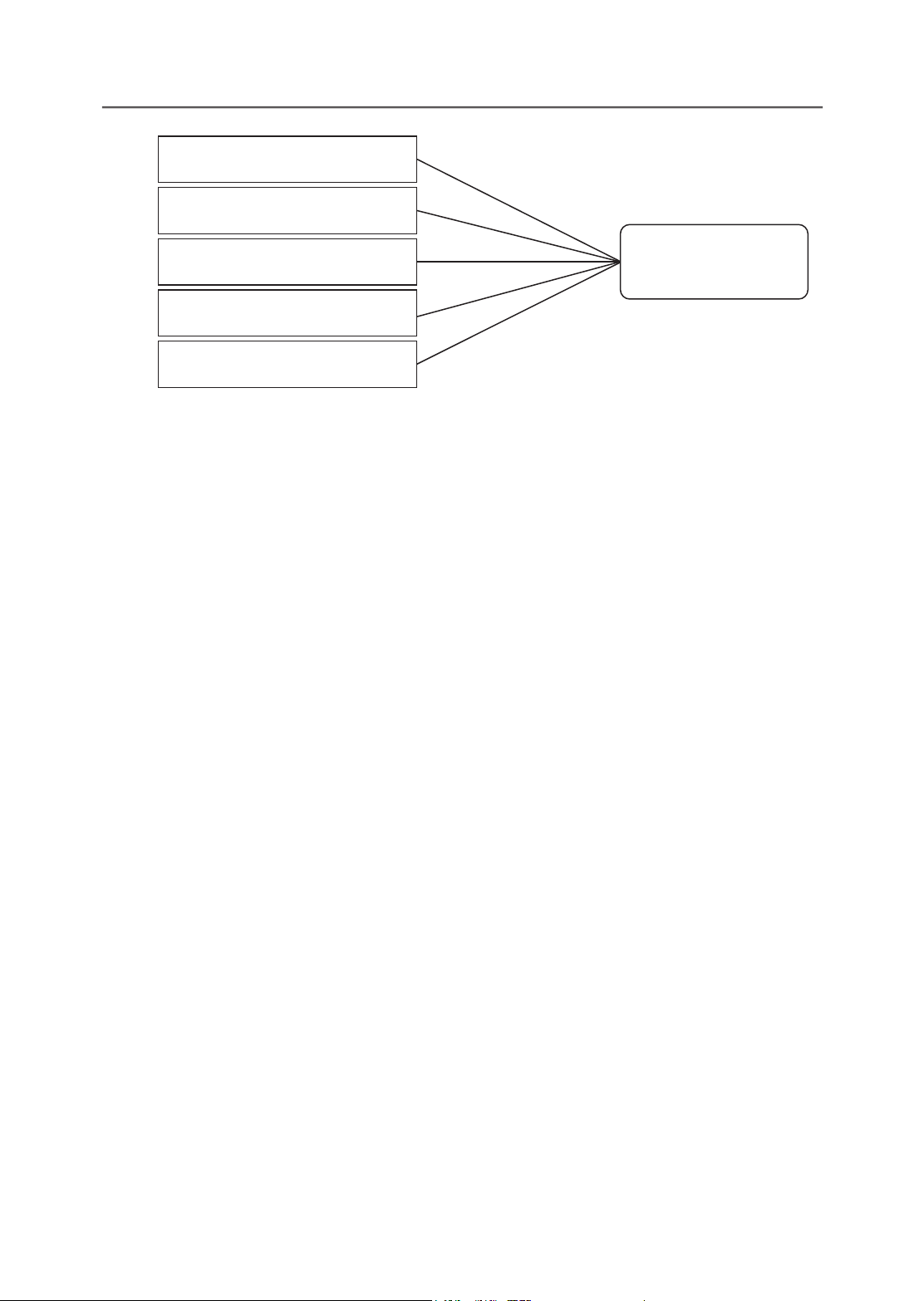

Attitude (A) - H1

Subjective Norm (SN) - H2

Perceived Usefulness (PU) - H3

Perceived Ease of Use (PEU) - H4

Perceived Risk (PR) - H5

Intention to invest in

cryptocurrency (IUC)

+

+

+

+

-

Source: Authors’ summary

Figure 1. Research framework

2022 to December 2022. Since 70.1% of

Vietnam’s population uses Facebook, it is very

useful to use this social network to collect data

because it can reach more Vietnamese people

(Hai Ninh, 2020). Survey participants are in-

vestors who have crypto investments and have

basic knowledge about this type of investment.

Finally, data collection was obtained after sur-

veying, processing, and analyzing data through

Excel and Smart PLS software.

The questionnaire includes five major factors in

order to assess the degree to which these factors

influence the intention to invest in cryptocur-

rency in Vietnam: (1) Attitude, (2) Subjective

Norm, (3) Perceived Usefulness, (4) Perceived

Ease of Use, (5) Perceived Risk. These questions

are designed according to the Likert scale with 5

levels specified as follows: 1 = Totally disagree;

2 = Disagree; 3 = Neutral; 4 = Agree; 5 = To-

tally agree. Survey participants were informed

about the research objectives before filling out

the questionnaire and they had the full right to

choose whether or not to participate. To prevent

revealing information about survey respondents,

responses will be recorded and kept private.

Hair (2014) emphasises the significance of

determining the suitable sample size by con-

sidering both the minimum sample size and the

quantity of variables that will be employed in the

observed model. As per the findings of Hair et

al. (2016), it is suggested that a minimum sample

size of 200 respondents is advisable for conduct-

ing Structural Equation Modelling (SEM). In

fact, 348 people participated in the survey.

The present study utilises the Partial Least

Squares Structural Equation Modelling (PLS-

SEM) analytical framework to analyse the data

collected from the chosen sample. PLS-SEM has

outstanding advantages: (1) It avoids problems

related to small sample sizes and non-normally

distributed data; (2) Can estimate complex re-

search models with many intermediate, latent, and

observed variables, especially structural models;

(3) Suitable for predictive-oriented research.

4. Findings

4.1. Demographic profile of the respondents

Table 2 shows that 32.2% of survey participants

are female, while the number of males is twice as

high, accounting for 67.8%. The survey respon-

dents are crypto investors, and understandably,

men invest more in crypto than women from this

questionnaire. The age group accounts for the

highest percentages are 20-25 and 26-30, which

shows that investors are mostly students and

people of working age, which can be understood

as the young generation. Only 30 out of 348

respondents were under 20 years old. Table 2 also

shows the income of respondents. The highest is

10-20 million VND (34%), and ranked second

is 5-10 million VND, accounting for 30.2%. The

lowest percentage in the sample is those with an

income of less than 3 million VND.