Ch1

Chapter 1

Chapter 1

Strategic Management and

Strategic Management and

Strategic Competitiveness

Strategic Competitiveness

Michael A. Hitt

Michael A. Hitt

R. Duane Ireland

R. Duane Ireland

Robert E. Hoskisson

Robert E. Hoskisson

©2000 South-Western College Publishing

Ch1

Sustained Competitive Advantage

Sustained Competitive Advantage

Above-Average Returns

Above-Average Returns

Returns in excess of what an investor expects to

Returns in excess of what an investor expects to

earn from other investments with similar risk

earn from other investments with similar risk

Occurs when a firm develops a strategy that

Occurs when a firm develops a strategy that

competitors are not simultaneously implementing

competitors are not simultaneously implementing

Provides benefits which current and potential

Provides benefits which current and potential

competitors are unable to duplicate

competitors are unable to duplicate

Strategic Competitiveness

Strategic Competitiveness

Achieved when a firm successfully formulates

Achieved when a firm successfully formulates

and implements a value-creating strategy

and implements a value-creating strategy

Ch1

which are required for firms to achieve:

which are required for firms to achieve:

Above-Average Returns

Above-Average Returns

Strategic Competitiveness

Strategic Competitiveness

Sustained Competitive Advantage

Sustained Competitive Advantage

The Strategic Management Process

The Strategic Management Process

Involves the full set of:

Involves the full set of:

Actions

Actions

Commitments

Commitments Decisions

Decisions

Ch1

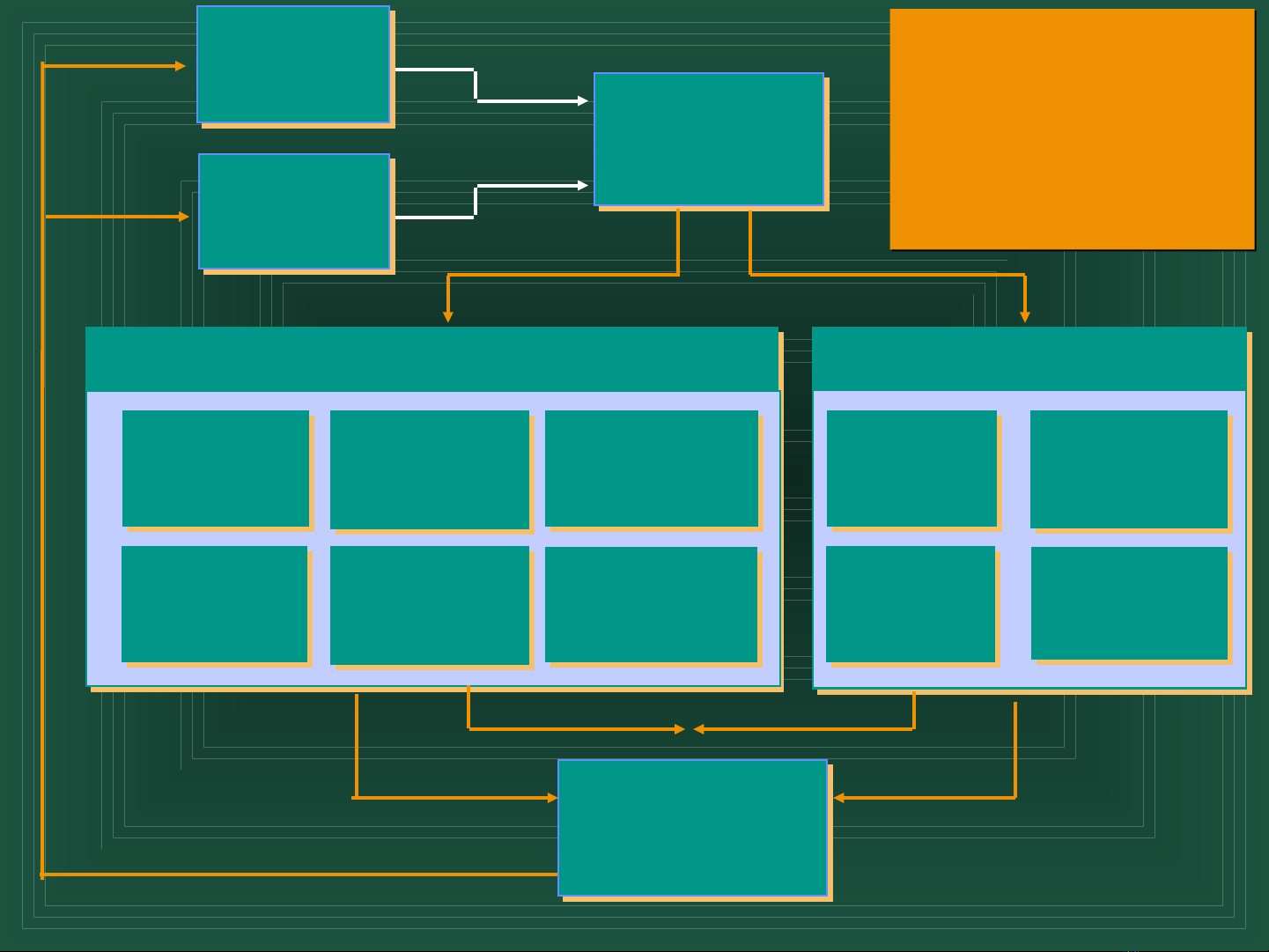

The Strategic

The Strategic

Management

Management

Process

Process

The Strategic

The Strategic

Management

Management

Process

Process

Chapter 3

Internal

Environment

Chapter 2

External

Environment

Strategic Intent

Strategic Mission

Strategy Formulation Strategy Implementation

Chapter 4

Business-Level

Strategy

Chapter 5

Competitive

Dynamics

Chapter 6

Corporate-Level

Strategy

Chapter 8

International

Strategy

Chapter 9

Cooperative

Strategies

Chapter 7

Acquisitions &

Restructuring

Chapter 10

Corporate

Governance

Chapter 11

Structure

& Control

Chapter 12

Strategic

Leadership

Chapter 13

Entrepreneurship

& Innovation

Strategic

Inputs

Feedback

Strategic

Outcomes

Strategic

Strategic

Actions

Actions

Strategic

Competitiveness

Above Average

Returns

Ch1

Chapter One: Key Themes

Chapter One: Key Themes

•Industrial Organization Model

Industrial Organization Model

•Resource-Based Model

Resource-Based Model

Challenge of Strategic Management

Challenge of Strategic Management

Changing Competitive Landscape

Changing Competitive Landscape

Two Models of Superior Profitability

Two Models of Superior Profitability

Key Stakeholder Groups