© Harry Campbell & Richard Brown

School of Economics

The University of Queensland

BENEFIT-COST ANALYSIS

BENEFIT-COST ANALYSIS

Financial and Economic

Financial and Economic

Appraisal using Spreadsheets

Appraisal using Spreadsheets

Ch 13: Economic Impact Analysis

What is the difference between Net Present Value

and Economic Impact?

Keynes gives the example of land, labour and capital used in two

alternative ways:

1. To dig a hole in the ground;

2. To build a hospital.

The two projects have the same economic impact, in terms of

generating income for factors of production and inducing additional

expenditures, but the hospital has a higher net present value than the

hole in the ground.

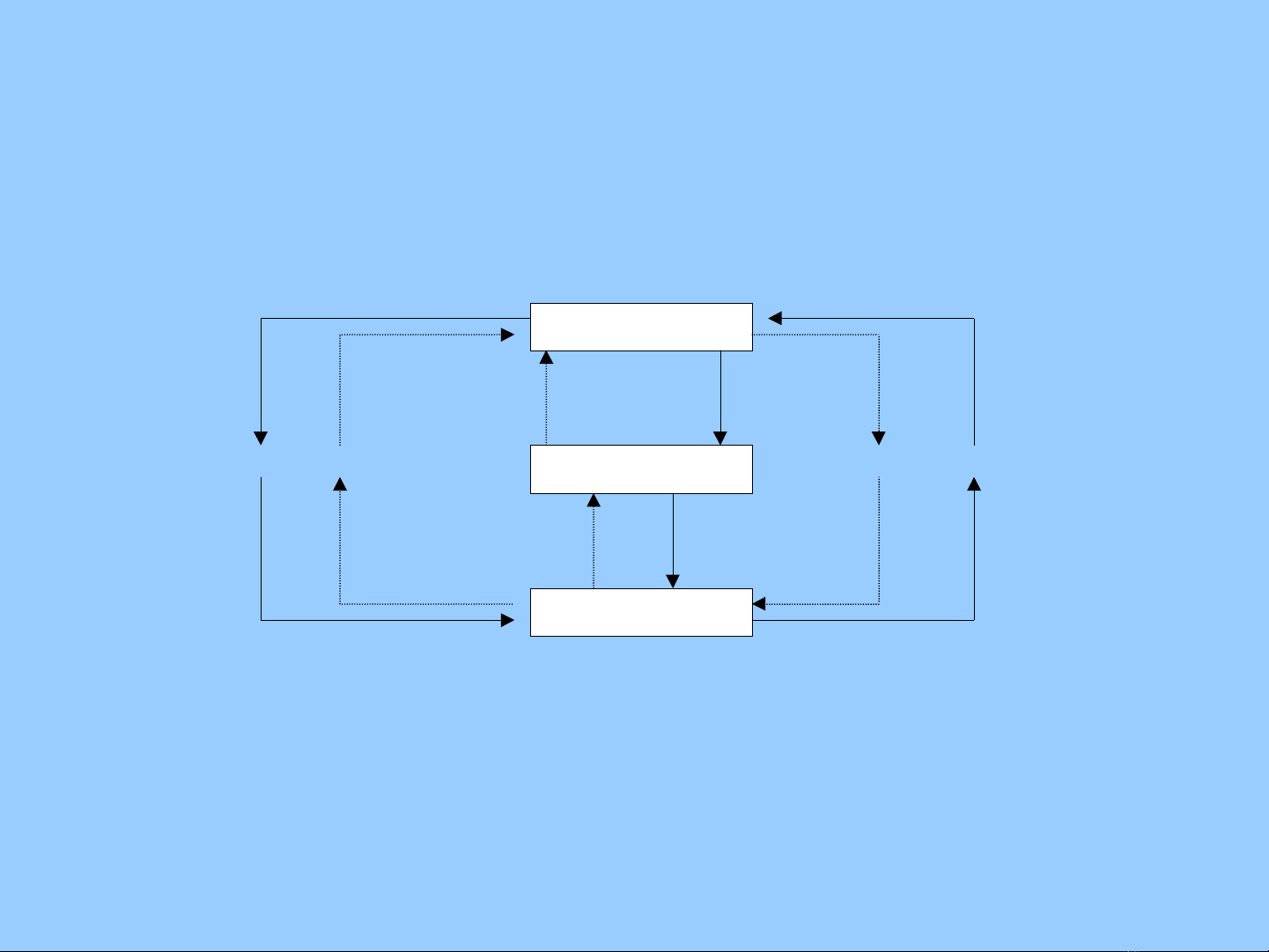

Figure 13.1 The Circular Flow of Income

$ GOODS FACTORS $

GOVERNMENT

HOUSEHOLDS

FIRMS

The Circular Flow of National Income

The National Income Multiplier

Consider three models which can be used to derive the national

income multiplier:

1. A closed economy, no taxes;

2. A closed economy, with exogenous taxes;

3. An open economy, with endogenous taxes.

Symbols:

Y = national income; C = consumption expenditure;

S = Savings; I = investment expenditure;

T = tax revenues; G = government expenditure;

X = value of exports; M = value of imports

Model 1: Closed economy, no taxes

Y = C + I + G

C = A* + bY,

where A* is autonomous consumption expenditure, and

investment and government expenditure are exogenous.

Substitute to get:

Y = A* + bY + I* + G*

where “ * ” indicates a variable which is exogenous to the model

(i.e. is assumed to be constant).

Solve to get:

Y = (1/(1-b))(A* + I* +G*),

where (1/(1-b) is the national income multiplier.

Now dY = (1/(1-b) dG*

![Phân Tích Dự Án Dưới Rủi Ro: [Thêm Mô Tả Chi Tiết Để Tối Ưu SEO]](https://cdn.tailieu.vn/images/document/thumbnail/2013/20130221/muaxuan102/135x160/6881361431722.jpg)