Homework 6 - COST ANALYSIS

Multiple Choice

1 In deciding between two actions, the manager needs to consider the

a. Differential revenues and differential costs between the options.

b. Total costs of the options.

c. Fixed costs that do not vary between the options.

d. Comparative revenues of the options.

e. Variable costs of the options.

2 The opportunity cost of pursuing a full-time MBA degree is the

a. Cost of tuition, textbooks, and other fees.

b. Job wages (and advancement) forgone during the two years of study.

c. Opportunity of receiving a higher salary after graduation.

d. Cost of tuition plus room and board.

e. Estimated cost of professors’ salaries.

3 The basic difference between economic cost and accounting cost is due to

a. Explicit costs.

b. Opportunity costs.

c. Intangible costs.

d. The allocation of fixed costs.

e. Selling costs.

4 When valuing opportunity costs, managers generally rely on

a. Imputed prices, based on best judgments.

b. Tax-assessed prices (assuming the item is taxed).

c. Market prices (assuming markets exist).

d. Historic accounting prices.

e. All of the answers above are correct.

5 When computing economic profit, we assume that capital earns a

a. Zero rate of return.

b. Normal rate of return.

c. Risk-free rate of return.

d. Positive rate of return.

e. None of the answers above is correct.

6 In the short run, as a result of diminishing returns,

a. Total output decreases.

b. Both marginal product and marginal cost decrease.

c. Marginal product increases and marginal cost decreases.

d. Marginal product remains constant.

e. Marginal product decreases and marginal cost increases.

Managerial Economics – MBA – HSB

7 Specialization and division of labor lead to

a. Diseconomies of scale.

b. Economies of scale.

c. Decreasing returns to scale.

d. Diminishing returns.

e. Increasing LAC.

8 The minimum efficient scale is

a. The lowest output at which the firm can break even.

b. The lowest output at which minimum long-run average cost can be achieved.

c. The lowest fixed cost under which the firm can operate.

d. The lowest variable cost for that level of production.

e. The lowest output at which minimum short-run average cost can be achieved.

9 A firm experiences economies of scope when

a. The cost of producing multiple goods is less than the aggregate cost of

producing each item separately.

b. The cost of producing an additional unit of output is falling.

c. The cost of producing multiple goods is more than the cost of combining output in

one production facility.

d. The cost of producing an additional line of goods is less than the cost of the

previous additional line of goods.

e. All of the above answers are correct.

10 Allocating shared fixed costs among multiple products

a. Justifies higher prices according to the optimal markup rule.

b. Ensures that each product bears its fair share of fixed costs.

c. Means a product should be discontinued if it fails to cover its allocated fixed cost.

d. Is misleading and can lead to sub-optimal pricing and output decisions.

e. Answers a, b, and c are all correct.

Short Problems and Questions

1 Given the total cost equation: C = 32 + 2Q2, derive equations for

a. Average total cost.

b. Average variable cost.

c. Marginal cost.

d. Average fixed cost

e. What level of Q yields the minimum level of total average cost of production?

Answer:

a. AC = C/Q = 32/Q + 2Q.

b. AVC = VC/Q = 2Q.

c. MC = dC/dQ = 4Q.

d. AFC = 32/Q.

e. We find the point of minimum AC by setting (dAC)/dQ = 0. The result is:

-32/Q2 + 2 = 0, implying, Q2 = 16, or Q = 4.

2 A high-tech firm produces a data processing service according to the production function

Q = 2K + L. If the cost per hour of labor (L) and of machine time (K) is the same, what is

the least-cost way to complete 100 data processing jobs? Will the firm ever use both

inputs to complete processing jobs?

Answer:

If the prices of K and L are the same then the cheapest way to produce 100 jobs is to use

50 hours of K (machines). Labor will not be used at all. More productive machines

(automation) will completely displace labor. Here, the inputs are perfect substitutes. One

machine hour exactly substitutes for 2 labor hours. Notice that labor will only be used if

its cost falls to half (or less) the cost of machines.

Longer Problems and Discussion Questions

1 A producer of mobile phones has costs given by: C = 100,000 + 80Q, and faces the

inverse demand curve: P = $160 - .01Q, where Q denotes weekly output and sales.

a. Find the firm’s optimal output, price, and profit.

b. A key component of the phone is its specialized memory chip, which the firm

produces for its own use and also sells to outside buyers. The chip’s selling price

is $40 and its marginal cost is $20. In fact, the firm can produce and sell all (i.e.,

its full capacity) of its chips to outside buyers. What is the opportunity cost

associated with chips? What is the true marginal cost of each cell phone? What

are the firm’s optimal output and price?

Answer:

a. We use the condition MR = MC to find the firm’s optimal output. Therefore, we

have: MR = 160 - .02Q = 80, implying Q* = 4,000 units. In turn, P* = 160 –

(.01)(4,000) = $120, and = 480,000 – 320,00 – 100,00 = $60,000 per week.

b. The opportunity cost is the foregone profit: 40 – 20 = $20 per chip. Thus, the full

marginal cost of producing each additional cell phone is: 80 + 20 = $100. Setting

MR = MC = $100, we find: Q* = 3,000 and P* = $130.

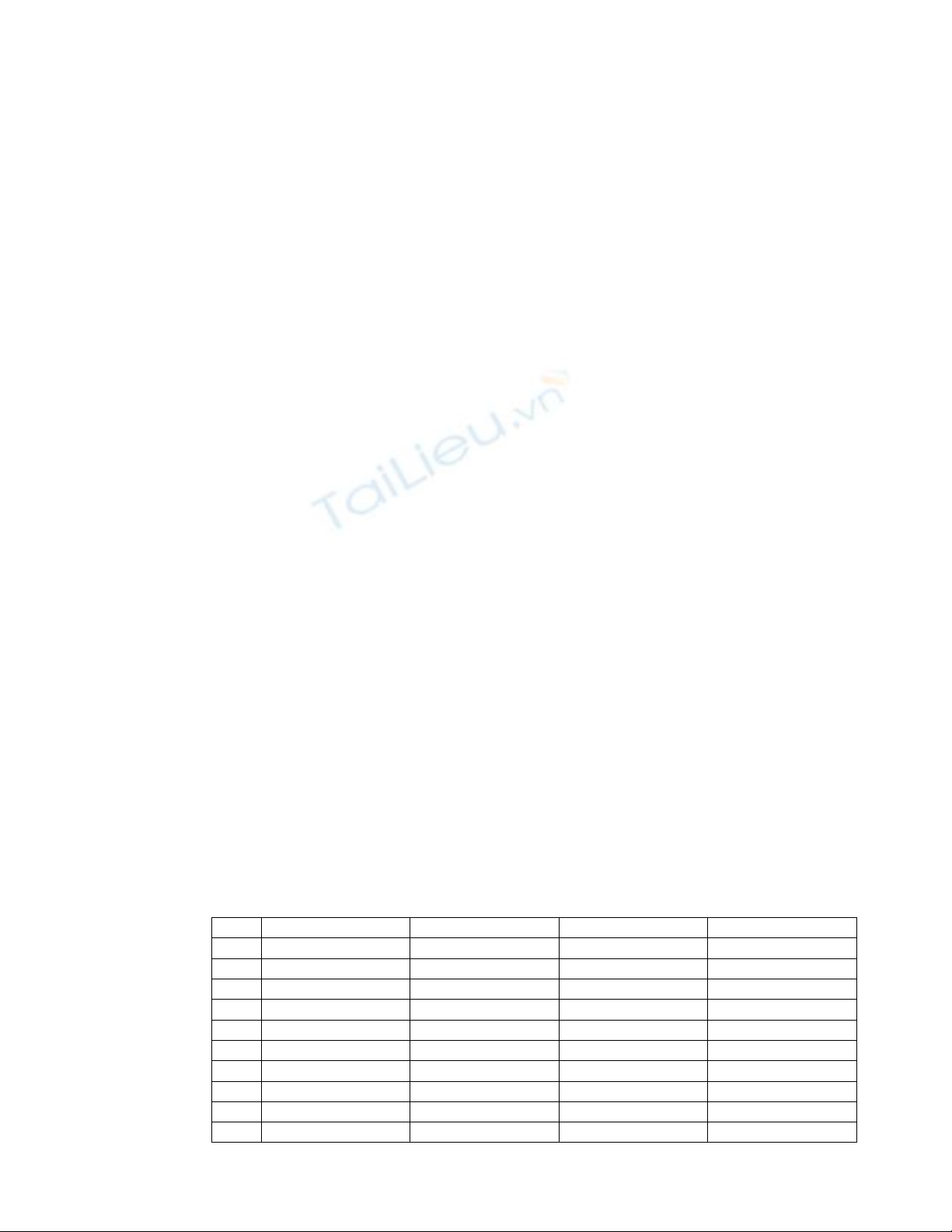

2 You are the production manager of a large plant, and are preparing a report for your

superiors. Unfortunately, you have lost some of the numbers you wish to report. You

have the data below. Complete the following table by computing the missing numbers

from those that are given.

Q

Total Cost

Variable Cost

Average Cost

Marginal Cost

0

$35

1

$5

2

$9

3

$15.67

4

$3

5

$4

6

$24

7

$30

8

$9

9

$8.89

Managerial Economics – MBA – HSB

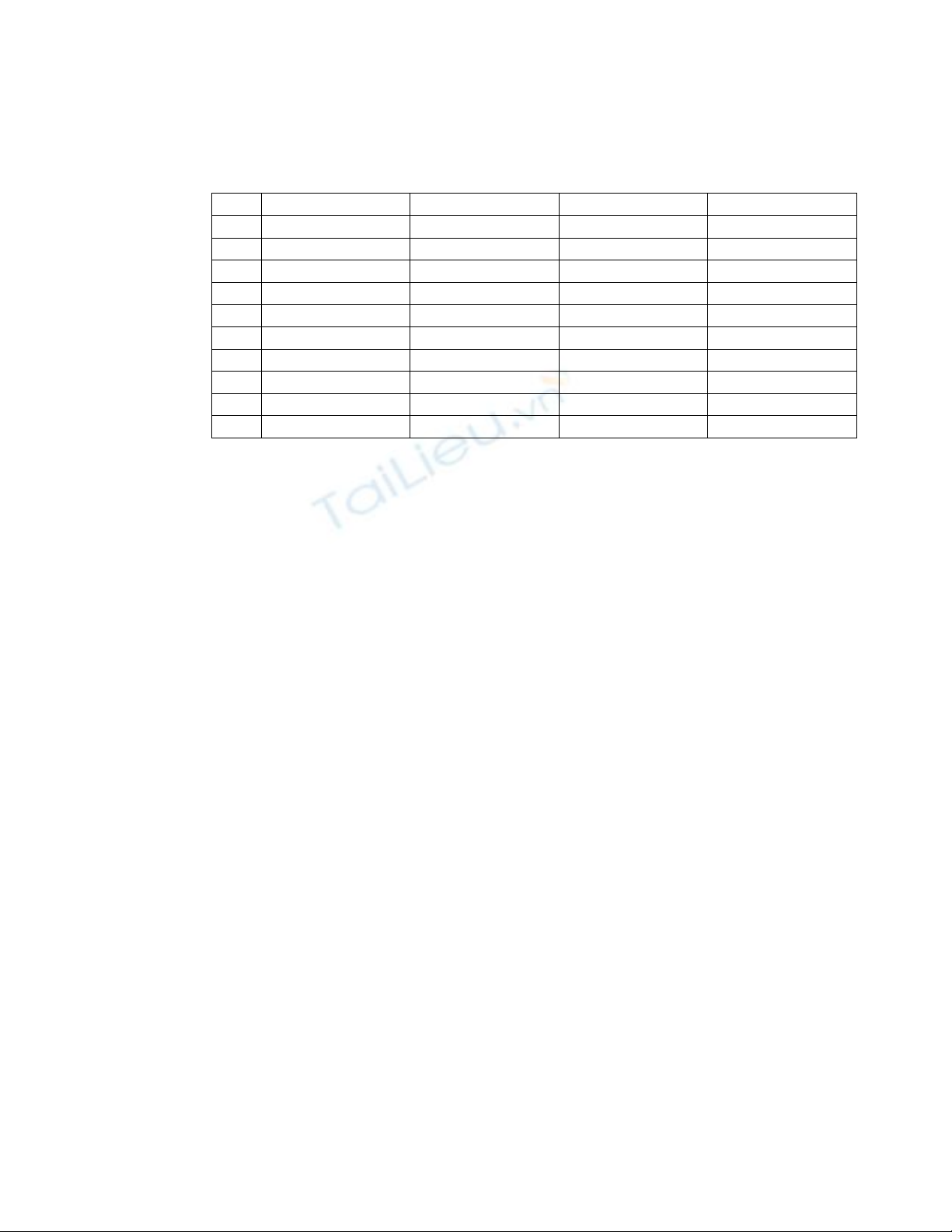

Answer:

Here is the completed table.

Q

Total Cost

Variable Cost

Average Cost

Marginal Cost

0

$35

1

$40

$5

$40

$5

2

$44

$9

$22

$4

3

$47

$12

$15.67

$3

4

$50

$15

$12.50

$3

5

$54

$19

$10.80

$4

6

$59

$24

$9.83

$5

7

$65

$30

$9.29

$6

8

$72

$37

$9

$7

9

$80

$45

$8.89

$8

3 How are economies of scale different from economies of scope? How might a manager

use these concepts in planning for the firm? What may limit their usefulness in actual

decisions?

Answer:

Economies of scale relate to declining average cost as the scale of production for a

particular good increases. At greater scale, the firm can engage in capital-intensive

production, benefit from specialization of labor, and leverage advertising spending.

Economies of scope occur when the cost of producing multiple (that is, different)

goods together is less than the aggregate cost of producing each item separately. This

occurs when a single production process yields multiple outputs, when production of one

good or service includes knowledge that can be transferred to other processes/products,

or when clusters of goods or services are complementary.

Under economies of scale, a manager will usually seek to increase production in order

to reduce LAC. Assuming sufficient demand, the result will be increased profit (revenues

increase more than costs). Similarly, if there are economies of scope, adding a new good

to the firm’s product lines is likely to generate revenue at a more rapid rate than it will

raise cost. Economies of scope will generally lead to conglomerate firms that offer a

variety of related goods or services, rather than separate enterprises that specialize in one

good or service.

4 A farm equipment firm produces small tractors at total cost: C = 37,500,000 + 5,000Q +

1.5Q2, where Q denotes annual tractors output. Regional demand for small tractors is

given by: P = 30,000 – Q.

a. Determine the firm’s optimal output and price and its annual profit from tractors.

b. Because of increased foreign competition, the demand for the firm’s tractors falls

permanently to: P = 20,000 – Q. The firm is considering closing its plant immediately.

By doing so, it can probably save $18 million of its annual $37.5 million in fixed costs.

Alternatively, it can continue to operate the plant for 12 months after which if it shuts

down it can walk away from its labor contracts and plant lease and incur no continuing

costs. Determine its most profitable operating strategy.

Answer:

a. To find optimal output, we set MR = MC. We know: MC = dC/dQ = 5,000 + 3Q.

Thus, we have 30,000 - 2Q = 5,000 + 3Q, implying, Q* = 5,000 and P* = $25,000.

In turn, profit is: (25,000)(5,000) – [37,500,000 + (5,000)(5,000) + 1.5(5,000)2] =

$50,000,000.

b. Setting MR = MC after the drop in demand, we have MR = 20,000 – 2Q = 5,000

+ 3Q, implying Q* = 3,000 and P* = $17,000. If the firm continues to operate, its

revenue is $51 million, and its total cost is $66 million, so its loss for the next 12

months is $15 million. This is better than shutting down and incurring a loss of

$19.5 million. Clearly, in 12 months (when it can avoid future labor and lease

costs), the firm should shut down the factory if demand continues to be depressed.

![Câu hỏi ôn tập Kinh tế môi trường: Tổng hợp [mới nhất/chuẩn nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20251223/hoaphuong0906/135x160/56451769158974.jpg)

![Giáo trình Kinh tế quản lý [Chuẩn Nhất/Tốt Nhất/Chi Tiết]](https://cdn.tailieu.vn/images/document/thumbnail/2026/20260122/lionelmessi01/135x160/91721769078167.jpg)