http://www.iaeme.com/IJM/index.asp 134 editor@iaeme.com

International Journal of Management (IJM)

Volume 8, Issue 3, May–June 2017, pp.134–142, Article ID: IJM_08_03_014

Available online at

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=8&IType=3

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

IMPACT OF CAPITAL MARKET ON NIGERIAN

ECONOMY, 1981 - 2014

Ugwuanyi, Charles Uche (Ph.D)

Department Of Economics,

Michael Okpara University Of Agriculture, Umudike,

Abia State, Nigeria

ABSTRACT

This study examined the impact of the capital market on Nigerian economy. Time

series data were collected on Real Gross Domestic Product, Market Capitalization,

All Share Index and Turnover Ratio from 1981 - 2014. The study employed Unit root,

Cointegration and Granger Causality Tests as well as Ordinary Least Square method

in the empirical analysis. The unit root tests show that the variables were not

stationary at level but all became stationary at first difference. They were said to be

integrated of the order one, 1(1) at first difference. The Cointegration Test revealed

that all the variables were cointegrated, showing a long-run equilibrium relationship

between capital market and Nigerian economy. The Granger Causality Test shows a

unidirectional causality between the variables in the model. The OLS result indicates

that the coefficient of determination, i.e. the R-squared has a value of 0.988849. This

implies that 98 percent changes in the Real Gross Domestic Product of Nigeria could

be attributed to the independent variables. The MCAP & TURNR have coefficient

values of 0.899656 and 0.375083 with t-statistic of 14.60231 and 2.879237

respectively. The All Share Index (ASHI) has negative coefficient value of -0.265177

and t-statistic value of -5.667988. The implication of these findings is that the capital

market in Nigeria appears not to be contributing enough to the economy as ASHI seen

in economic literature as a better stock market indicator than MCAP and TURNR has

negative impact on the economy. The findings support the Efficient Market

Hypothesis. The study recommend improved information on past performances of

companies, equity returns, equity prices, and stock/company listing to avoid

unreasonable speculation by investors in financial assets. It will improve the

performance of capital market in Nigeria.

Key words: Capital Market, Nigerian Economy, Efficient Market Hypothesis, Equity

returns, financial assets.

Cite this Article: Ugwuanyi, Charles Uche (Ph.D), Impact of Capital Market on

Nigerian Economy, 1981-2014. International Journal of Management, 8 (3), 2017, pp.

134–142. http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=8&IType=3

Impact of Capital Market on Nigerian Economy, 1981-2014

http://www.iaeme.com/IJM/index.asp 135 editor@iaeme.com

1. INTRODUCTION

The perception of the economic policy in Nigeria and elsewhere is that the capital market

is a driver or lubricant that keeps turning the wheel of the economy to growth and

development because of its imperative functions of not just mobilizing long term funds and

channeling them to productive investment but also efficiently allocating these funds to

projects that make best returns to fund owners [1], [2], [3], [4], and [5]. Today, the activities

and performance of capital market in Nigeria have much wider implications and these arise

partly because of the growing influence of ideas and structure associated with the concept of

democracy. The capital market has been identified as an institution that contributes to the

socio-economic growth and development of emerging and developed economies.

These are made possible through some of the vital roles it plays, such as channeling

resources, promoting reforms to modernize the financial sector, financial intermediation

capacity to link deficit to the surplus sector of the economy and as a veritable tool in the

mobilization and allocation of savings among competitive uses which are critical to the

growth and efficiency of the economy [6]. [7], argues that a nation requires a lot of local and

foreign investments to attain sustainable economic growth and development. [8], states that

capital market contributes to economic growth through the specific services it performs either

directly or indirectly, notable among these functions are: mobilization of savings, creation of

liquidity, risk diversification, improved dissemination and acquisition of information and

enhanced incentive for corporate control. However, the paucity of long-term capital has posed

the greatest predicament to economic growth and development in Nigeria.

Therefore, using the cointegration test, Granger causality test and Ordinary Least Square

analysis we studied the interaction of capital market variables in increasing economic growth

in Nigeria. This is very important because share index and other variables determine the

investors’ response in capital market.

The purpose of this article is to identify the long-run effect of All Share Index, Market

Capitalization and Turnover ratio on Nigerian economy.

The article is organized as follows: Section one introduces the study while section two

reviews the related literatures. Section three highlights the methodology employed in the

study and the sources of data. Section four presents and discusses the empirical results.

Lastly, section five provides the conclusions and policy implications.

2. LITERATURE REVIEW

The Nigerian economy has over the years been subjected to series of social, political and

economic policies and reforms. The policy and reform journeys saw the need to encourage

private capital in development, and established Nigerian Stock Exchange (NSE) in 1961.

However, the Capital Market effectively started operations in Nigeria on 5th June, 1961,

under the provision of the Lagos Stock Exchange Act 1961, which transformed into the

Nigerian Stock Exchange in December 1977 as a result of the review of the Nigerian

Financial System [9]. The Securities and Exchange Commission (SEC) was established in

1979 through the SEC Act 1979, to regulate the capital market, but commenced actual

operation in 1980. Since then, various forms of financial instruments have been issued in the

capital market by new and existing businesses to finance product development, new projects

or general business expansion.

The capital market is divided into the primary and the secondary market. The primary

market or the new issues market provides the avenue through which government and

corporate bodies raise fresh funds through the issuance of securities which is subscribed to by

the public or selected group of investors. The secondary market provides an avenue for sale

and purchase of existing securities.

Ugwuanyi, Charles Uche (Ph.D)

http://www.iaeme.com/IJM/index.asp 136 editor@iaeme.com

[10], found that the secondary market activities have impacted more on Nigeria per capita

income by tending to grow stock market earnings through wealth than the primary market.

Many studies have been carried out on capital market and economic growth in Nigeria.

These studies have produced differing findings and conclusions.

Study by [11], found that the total value of stock has a negative effect on GDP growth

rate. According to [12], the capital market in Nigeria has the potentials of growth inducing but

it has not contributed meaningfully to the economic growth of Nigeria. Another study by [13]

found that the capital market has an insignificant impact on the Nigerian economy.

In contrast to the above findings, studies by [14], [15], [16], [17], [18], [19], [20], [21] and

[22] conclude that positive relationship exists between capital market and economic growth in

Nigeria.

All these studies adopted basically the same methods of OLS and ECM, and variables

such as total value of stock, all share index, market capitalization, GDP, money supply,

interest rate e.t.c., but for different time frames.

In view of the above controversy in empirical outcomes, theoretically, this study is

anchored on Efficient Market Hypothesis developed by [23]. According to the Efficient

Market Hypothesis (EMH), financial markets are efficient or prices are efficient on traded

assets that have already reflected all known information and therefore are unbiased because

they represent the collective beliefs of all investors about future prospects. The hypothesis

posits that past information is useful in improving the predictive accuracy of equity returns

and equity prices tend to exhibit long memory or long range dependence on equity returns.

In a country, where the market is highly and unreasonably speculative, investors will be

discouraged from parting with their funds for fear of incurring financial losses. In such

situation, it has detrimental effect on economic growth of the country, meaning investors will

refuse to invest in financial assets. The implication is that companies cannot raise additional

capital for expansion. This suggests that efficiency of the capital market is a necessary

condition for economic growth

3. ECONOMETRIC METHODOLOGY

3.1. Model Specification

This paper uses Ordinary Least Squares technique, cointegration and Granger causality tests

to identify the relationship between capital market and economic growth of Nigeria.

The Ordinary Least Squares (OLS) provides satisfactory results for estimates of structural

parameters. It also involves decision on whether the parameters are statistically significant

and theoretically meaningful. The capital market - economic growth hypothesis was tested

according to four macroeconomic variables which were built upon the following augmented

function:

RGDP = f (ASHI, TURNR, MCAP) (1)

Where:

RGDP = Real Gross Domestic Product (as proxy for economic growth)

ASHI = All Share Index

TURNR = Turnover Ratio

MCAP = Market Capitalization

In a more explicit and econometric form, equation (1) can be stated as

RGDP

t

=α

0

+ α

1

ASHI

t

+ α

2

TURNR

t

+ α

3

MCAP

t

+ e

t

(2)

Where

Impact of Capital Market on Nigerian Economy, 1981-2014

http://www.iaeme.com/IJM/index.asp 137 editor@iaeme.com

α

0

is the constant term

α

1

- α

3

= coefficients of each of the variable

t = is the time trend and

e

t

is the stochastic random term

By log linearising, the model becomes;

log (RGDP

t

) = α

0

+ α

1

log (ASHI

t

) + α

2

log (TURNR

t

) + α

3

log (MCAP

t

) + e

t

(3)

where: log = Natural log.

3.2. Description of Data and Sources

We used annual data for the period 1981-2014. The annual variables were – Real Gross

Domestic Product (RGDP), Turnover Ratio (TURNR), All Share Index (ASHI) and Market

Capitalization (MCAP). Data were sourced from Securities and Exchange Commission

Annual Reports and Accounts (various years), Central Bank of Nigeria (CBN) Statistical

Bulletin (2014), National Bureau of Statistics Annual Reports for the various years.\

3.3. Estimation Technique

The study employed a four step procedure in order to determine the impact, long run and

causality relationships between capital market and economic growth.

First, the Augmented Dickey-Fuller (ADF) test was used to check whether each data

series is integrated and has a unit root.

Secondly, the results of the integration tests were then pursued by co-integration tests. The

existence of long run equilibrium (stationary) relationships among economic variables is

referred to in the literature as cointegration. The Johansen procedure was employed to

examine the question of cointegration. It provided not only an estimation methodology but

also explicit procedures for testing for the number of cointegrating vectors as well as for

restrictions suggested by economic theory in a multivariate setting.

Thirdly, Pair-wise Granger Causality Test was conducted to determine whether the current

and lagged values of one variable affect another. An implication of Granger representation

theories is that if two variables, say X

t

and Y

t

are cointegrated and each is individually 1(1),

then either X

t

must Granger-cause Y

t

or Y

t

must Granger-cause X

t

.

Lastly, the OLS was employed to provide the estimates of the structural parameters used

to verify the validity of the estimates and to determine whether they actually represent

economic theory.

4. EMPIRICAL RESULTS

4.1. Unit Root Test

We tested whether the relevant variables in equation (3) are stationary and to determine their

order of integration. The results of the ADF test were provided in table 1 and 2.

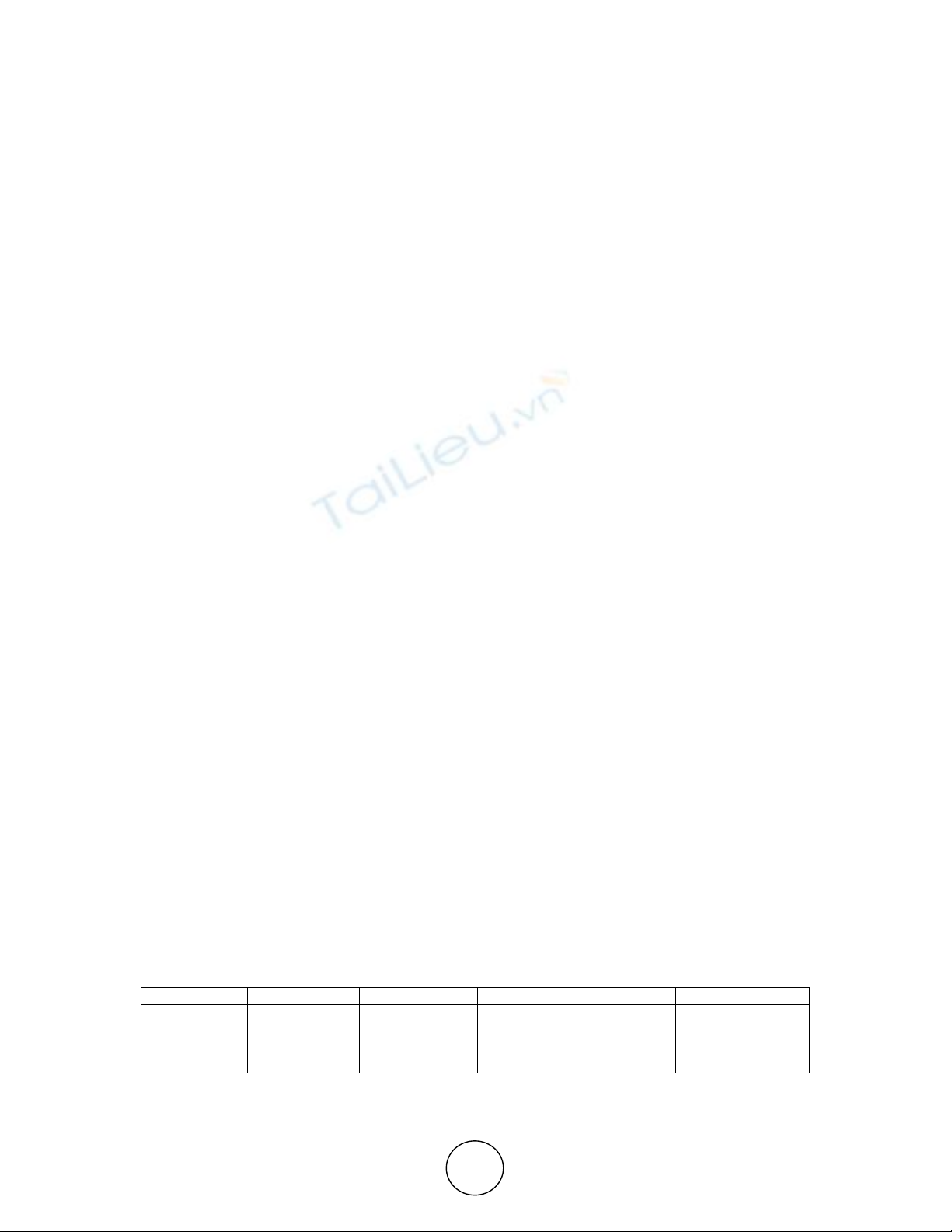

Table 1 Unit Root Test for Stationarity at Levels, (Intercept and Trend)

Variables ADF Test 5% Critical Order of Interpretation Remarks

LRGDP

LASHI

LTURNR

LMCAP

-2.128327

-2.368928

-2.288621

-2.437887

-3.552973

-3.557759

-3.557759

-3.557759

-

-

-

-

Not Stationary

Not Stationary

Not Stationary

Not Stationary

Note: Mackinnon (1991) critical value for rejection of hypothesis of unit root applied.

Source: Author’s estimation using Eviews 7.0.

Ugwuanyi, Charles Uche (Ph.D)

http://www.iaeme.com/IJM/index.asp 138 editor@iaeme.com

The result in table 1 shows that all the variables were not stationary at levels. This can be

seen by comparing the observed values (in absolute terms) of ADF test statistic with the

critical values (also in absolute terms) of the test statistic at the 5% level of significance. The

results in table 1 provide strong evidence of non stationarity. Therefore, the null hypothesis is

accepted and it is sufficient to conclude that there is a presence of unit root in the variables at

levels.

Table 2 Unit Root Test for Stationarity at First Difference (Intercept and Trend)

Variables ADF Test 5% Critical Order of Interpretation Remarks

LRGDP

LASHI

LTURNR

LMCAP

-5.279981

-5.463069

-5.177698

-4.345574

-3.557759

-3.557759

-3.557759

-3.557759

1(1)

1(1)

1(1)

1(1)

Stationary

Stationary

Stationary

Stationary

Note: Mackinnon (1991) critical value for rejection of hypothesis of unit root applied.

Source: Author’s estimation using Eviews 7.0.

The result in table 2 reveals that all the variables became stationary at first difference. On

the basis of this, the null hypothesis of non-stationarity is rejected and it is concluded that the

variables are stationary. This implies that all the variables are integrated of order one, i.e.

1(1).

4.2. Cointegration Test Result

Having confirmed the stationarity of the variables at 1(1), we proceeded to examine the

presence of cointegration among the variables. When cointegration relationships exist it

means that capital market and economic growth share a common trend and long-run

equilibrium as suggested theoretically. We employed the Johansen and Juselius multivariate

cointegration test. The model with lag I was chosen with the linear deterministic test

assumption and the result is presented in table 3.

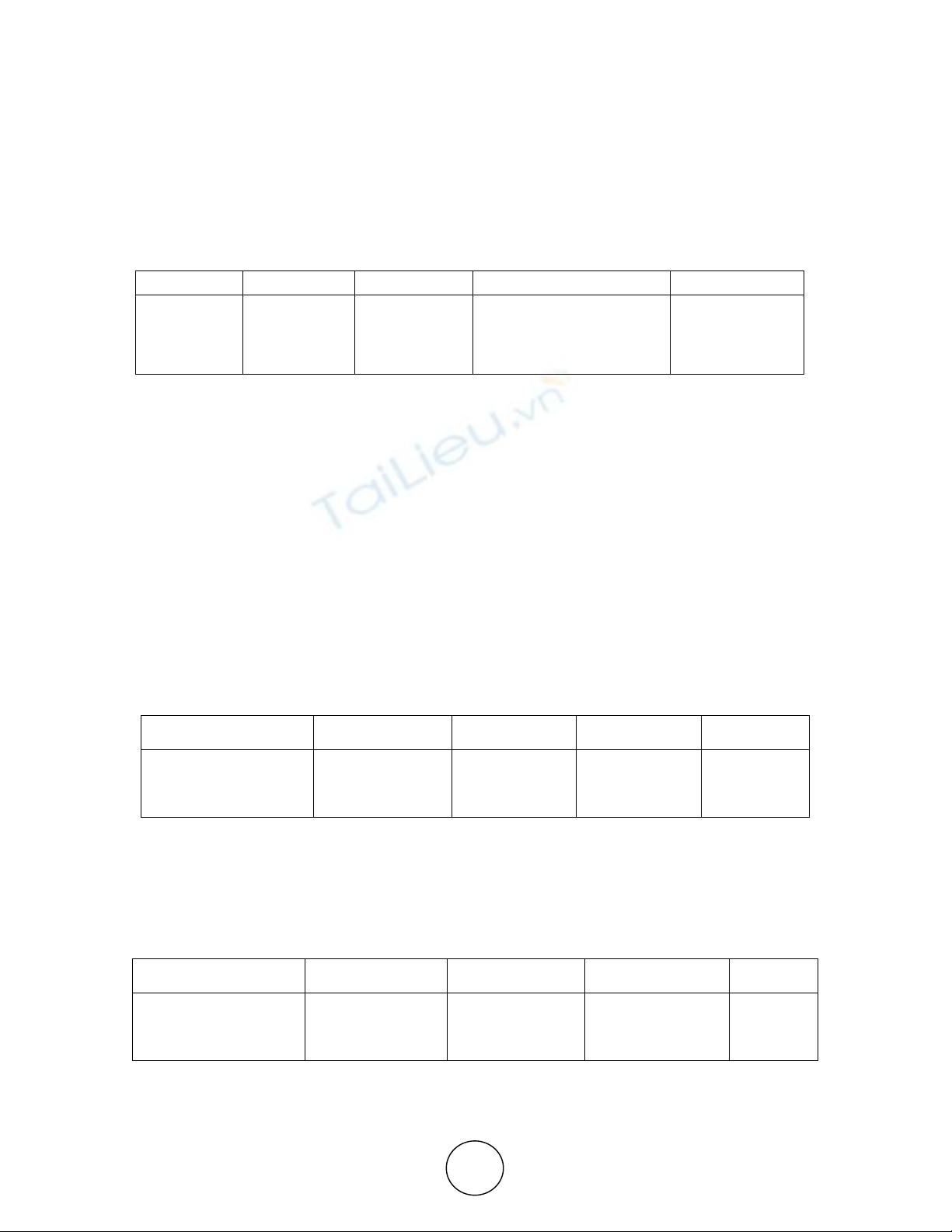

Table 3 Unrestricted Cointegration Rank Test (Trace)

Hypothesized No. of

CE(S)

Eigen Value Trace Statistic 0.05 Critical

Value

Prob**

None*

At most 1*

At most 2*

At most 3*

0.767324

0.686026

0.537465

0.176530

114.6181

67.95856

30.88833

6.215291

47.85613

29.79707

15.49471

3.841466

0.0000

0.0000

0.0001

0.0127

Note: Trace test indicates 4 cointegrating eqn (s) at the 0.05 level

*denotes rejection of the hypothesis at the 0.05 level

**Mackinnon-Haug-Michelis (1999)

ρ

-values

Source: Author’s estimation using Eviews 7.0

Table 4 Unrestricted Cointegration Rank Test (Maximum Eigen Value)

Hypothesized No. of

CE(S)

Eigen Value Max-Eigen

Statistic

0.05 Critical Value Prob**

None*

At most 1*

At most 2*

At most 3*

0.767324

0.686026

0.537465

0.176530

46.65950

37.07023

24.67304

6.215291

27.58434

21.13162

14.26460

3.841466

0.0001

0.0001

0.0008

0.0127

Note: Max-Eigen value test indicates 4 cointegrating eqn (s) at the 0.05 level

*denotes rejection of the hypothesis at the 0.05 level

![Bảng kê mua vào không có hóa đơn: [Hướng dẫn/Mẫu] chi tiết](https://cdn.tailieu.vn/images/document/thumbnail/2019/20190620/nguyenyenyn117/135x160/4891560998594.jpg)

![Câu hỏi trắc nghiệm và bài tập Thị trường chứng khoán [mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2026/20260127/hoahongcam0906/135x160/57691769497618.jpg)