Giới thiệu tài liệu

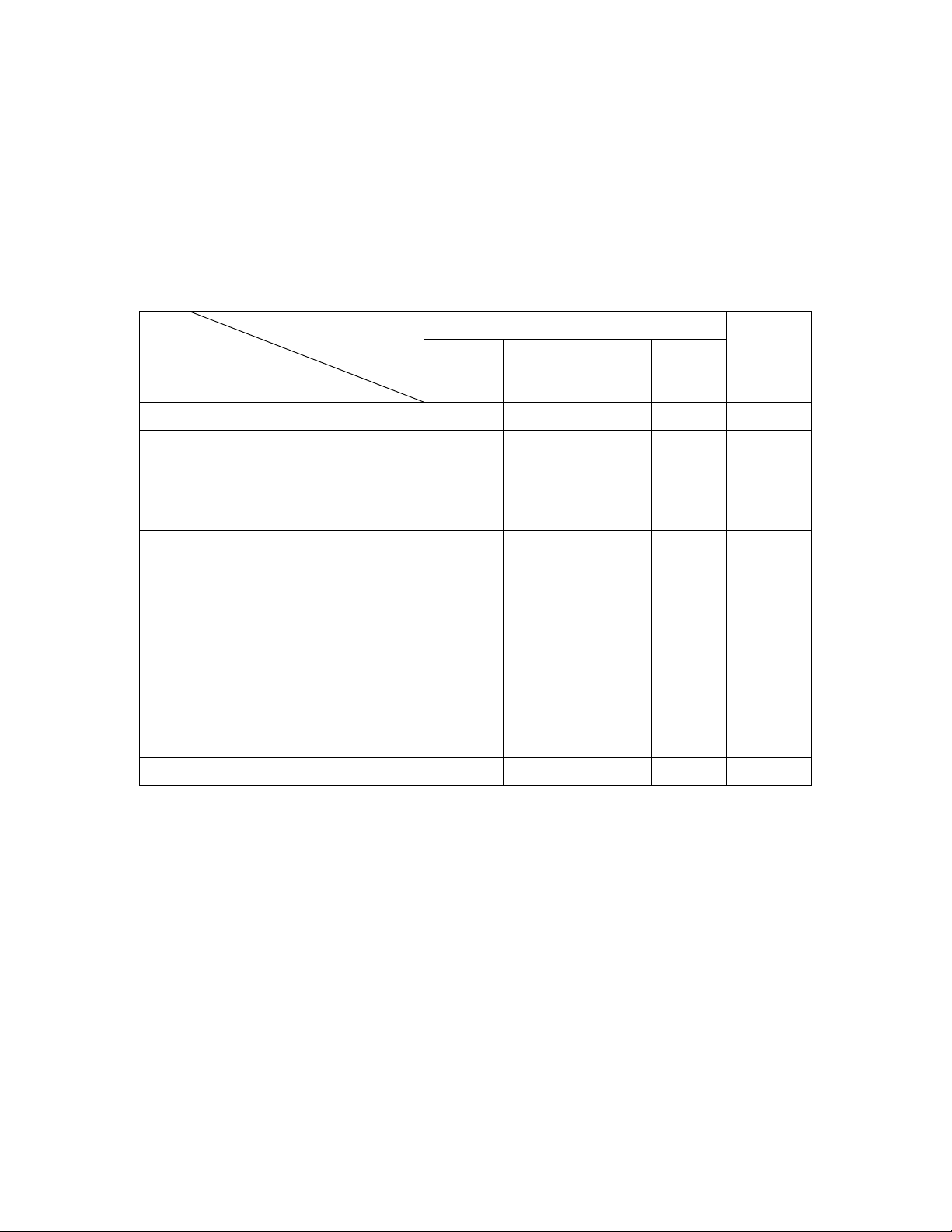

The systematic allocation of costs is fundamental to accurate financial reporting and effective cost management within any enterprise. This document, "Bảng Phân bổ Nguyên liệu, Vật liệu, Công cụ, Dụng cụ" (Allocation Table of Raw Materials, Tools, and Supplies), designated as Form No. 07-VT and mandated by Circular No. 99/2025/TT-BTC, serves as a critical accounting voucher. It provides a structured framework for businesses to precisely distribute expenses associated with nguyên liệu, vật liệu, công cụ, và dụng cụ to relevant cost centers and expense accounts. Understanding and correctly applying this form is paramount for ensuring the integrity of financial records, complying with regulatory standards, and supporting informed decision-making processes.

Đối tượng sử dụng

Accountants, chief accountants, financial managers, and internal auditors in Vietnamese enterprises, particularly those involved in manufacturing, production, or any business requiring detailed cost allocation and compliance with Vietnamese accounting standards. Also relevant for accounting students and researchers studying cost accounting practices in Vietnam.

Nội dung tóm tắt

This "Bảng Phân bổ Nguyên liệu, Vật liệu, Công cụ, Dụng cụ" (Form 07-VT) is an essential tool in kế toán chi phí, designed to meticulously track and distribute the value of nguyên liệu, vật liệu, công cụ, and dụng cụ from inventory accounts (specifically Tài khoản 152 and 153) to their ultimate expense destinations. The form operates by crediting the inventory accounts and simultaneously debiting various tài khoản chi phí based on the item's usage. Key debit categories include TK 621 for chi phí nguyên liệu, vật liệu trực tiếp in production (e.g., for specific workshops or products), TK 623 for machine operating costs, and TK 627 for general manufacturing overheads. Beyond production, it also caters to overheads like TK 641 for chi phí bán hàng and TK 642 for chi phí quản lý doanh nghiệp, as well as TK 242 for chi phí chờ phân bổ where costs are amortized over time. The structured layout allows for recording both planned (Giá hạch toán) and actual (Giá thực tế) values, providing a mechanism for variance analysis and enhanced kiểm soát chi phí. Its application ensures that all consumed resources are accurately attributed to the correct cost objects or periods, leading to precise calculation of product costs and overall profitability. The note clarifies that enterprises have the flexibility to adapt this biểu mẫu chứng từ kế toán to suit their specific operational characteristics and management needs, while adhering to the overarching principles set forth by the Ministry of Finance's Circular No. 99/2025/TT-BTC. This systematic approach is vital for robust financial reporting, aiding strategic decisions, and maintaining compliance with national accounting standards.

![Mẫu Thuyết minh sáng kiến, giải pháp [mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2025/20251125/nganga_09/135x160/79251764067060.jpg)