http://www.iaeme.com/IJM/index.asp 148 editor@iaeme.com

International Journal of Management (IJM)

Volume 8, Issue 3, May–June 2017, pp.148–155, Article ID: IJM_08_03_016

Available online at

http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=8&IType=3

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

© IAEME Publication

THE RELATION BETWEEN R&D

EXPENDITURES AND FINANCIAL

PERFORMANCE OF TEXTILE FIRMS TRADED

IN ISTANBUL STOCK EXCHANGE (BIST):

EVALUATION THROUGH PANEL DATA

ANALYSIS

Dr. Cevdet A. KAYALI,

Assoc. Prof. Business Administration Department,

Celal Bayar University, Manisa, TURKEY

ABSTRACT

Globalisation has brought a change in the concept of competition for business

firms, transforming price competition into a competition for enhancing the quality of

non-price good and services, transforming regional competition into global

competition, raising brand awareness and also increasing the value added generated

by brand equity. This situation led to the diversification of products and shortening of

product lifetime depending on costumer behaviours. As a result, the rules determined

by this competition increase the significance of Research and Development for

product quality, variety and also for corporate competitiveness.

In this study, panel data analysis is performed to assess not only the Textile Sector

which holds an important place in Turkish Economy but also the impact of Research

and Development investments of 14 firms, competing in national and international

markets in this sector with public securities traded in Istanbul Stock Exchange, on

their market prices, net sales and equity capital.

As a result of this study, it is understood that except for share price and equity

capital variables, net sales variable produces significant results. It is concluded that

there is a positive correlation between intangible fixed assets and net sales.

Key words: Textile Sector, Finance Performance, Data Panel Analysis.

Cite this Article: Dr. Cevdet A. KAYALI, The Relation Between R&D Expenditures

and Financial Performance of Textile Firms Traded in Istanbul Stock Exchange

(BIST): Evaluation through Panel Data Analysis. International Journal of

Management, 8 (3), 2017, pp. 148–155.

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=8&IType=3

The Relation Between R&D Expenditures and Financial Performance of Textile Firms Traded in

Istanbul Stock Exchange (BIST): Evaluation through Panel Data Analysis

http://www.iaeme.com/IJM/index.asp 149 editor@iaeme.com

1. INTRODUCTION

R&D activity is one of the principal elements enabling a business firm to make innovations,

to introduce itself to the outside world and to ensure its competitiveness by means of adding

to its knowledge. Because in the current economic climate, survival of firms under fierce

competition depends on their ability to make high efficiency production in terms of almost all

business functions. What provides high efficiency is inarguably its success in R&D activities.

Innovation must be maintained by constantly developing new ideas and methods concerning

every aspect of the business so that competition is sustained.

Textile and Apparel Industry has been one of the oldest and most important economic

activities along with agriculture throughout the human history. Replacement of animal pelts

with cotton and wool fabrics increased the significance of textile over time and when James

Watt utilised steam power to bring mechanisation and automation in textile industry in the

UK; this marked the beginning of a new era. This period which is called the Industrial

Revolution brought an increase in outputs and mass production. Industrial Revolution

beginning with the textile sector transformed the limited production of looms into mechanized

mass production. In the literature on economy of the period, the definition of an industrialized

country was closely identified with fabrics. In 20

th

century, textile and apparel industry

became a sector which completely adopted mechanization and automation technologies. The

advancement of computer technologies towards the end of 20

th

century undoubtedly played a

major role in this. With this transformation, while the leading countries of the sector

gravitated towards computer-aided machine production, textile production shifted to

developing countries. In this sense, the textile sector, which was the main element of

industrialization process of first-industrializing countries in 18

th

century, was also the driving

force behind economic development of newly-emerging and developing countries in 20

th

century. On the other hand, constant evolution of computer-assisted manufacturing increased

the significance of design and branding, thus, making products with high added value more

important.

Innovations in textile and apparel sector in terms of products include microfiber kitchen

cloths developed by the firm 3M, double-sided wearable product of Colin’s Jeans, smart

tracksuits by Nike and Adidas, and increased quality and design in terms of manufacturing.

Marketing and presenting products beyond the limits of stores, for example in supermarkets

and gas stations, enabled textile and apparel sector to grow consistently, increasing its

importance both in national and world economy. R&D activities of business firms constitute

an important basis for these developments.

In this study, the impact of R&D expenditures on financial performances of 14 firms

traded in Istanbul Stock Exchange (BIST) and operating in Turkish textile sector is examined

through Panel Data Analysis.

2. HISTORY OF TEXTILE SECTOR

Textile became one of the important industries of China in 12

th

century. For instance, an

emperor from Sung dynasty collected 1.17 million rolls of fabric as tax provisions in this

century. Chinese textile industry is remarkable especially due to its mechanized features.

According to resources, twisting mills in China date back to 1035 A.D. [Clellan, J.E., Dom,

H.,2013, p.148]

In 1733, John Kay invented a “flywheel” that accelerated weaving and in 1775, the

invention of the cylindrical scanning machine made spinning more efficient. With these

developments, textile sector reached an important stage. After 1785, the weaving process was

finally mechanized with a steam-powered mechanical loom. For this reason, labour

productivity in cotton industry increased by 200 times between 1712 and 1812. The number

Dr. Cevdet A. KAYALI

http://www.iaeme.com/IJM/index.asp 150 editor@iaeme.com

of mechanical looms increased from 2400 to 100.000 in ten years (1823 – 1833).

Mechanization of textile production marked the emergence of an industrial civilisation in the

UK [Mc Clellan, J.E., Dom, H.,2013, p.332]. As the starting point of Industrial Revolution,

textile industry became a principal milestone in history. Textile production also led to rapid

advancement in independent technologies (raw materials, side technologies etc.). This process

initiated by Industrial Revolution still continues today, and even though producer countries

have changed, its magnitude for world economy has only grown further. Textile and apparel

sector with its inventions based upon functionality and design is not only a leading sector for

national economy thanks to its products with high added value but it also compels business

firms to be more efficient in competition.

3. POSITION OF TEXTILE SECTOR IN TURKISH ECONOMY

Textile is one of the oldest sectors in Turkey. What immediately comes to mind in the history

of this traditional sector are carpet looms of Anatolia, mohair and sof [Note 1] of Ankara,

sericulture of Bursa, cotton of Adana and relatively advanced ottoman weaving in Rumelia.

While the primary reason behind the halt in textile sector in Ottoman Empire was the increase

of imports in the process initiated by Industrial Revolution, the secondary factor was the

treaty of commerce signed with the UK. In this way, textile industry lost competitive power

and domestic market was dominated by imported products. The levels of production

decreased incessantly.

With the foundation of the Republic, industrialization accelerated and factories to

manufacture consumer goods were established within the frame of State Economic

Enterprises. The most significant of them all was Nazilli Basma Fabrikası (Nazilli Printed

Cloth Factory) which started operation in 1937 after 2 years of construction [Kuruç,2012,

p.369].

The main goals were to reduce foreign dependency and to increase domestic production in

textile industry along with enhancing resource productivity in domestic raw materials. In the

later years, with the engagement of private sector in producing power, textile sector came to

the fore within Turkish economy. By mid-1990s, the total export of textile, apparel and

leather industry exceeded 8 billion dollars increasing its share in total Turkish exports to 40%,

thus making textile the leading industry in terms of foreign exchange generation. In addition,

the textile industry employs about 30% of all workers in the manufacturing industry and

generates 17% of the total added value in the entire manufacturing industry [Ansel, 1999,

p.183]. In the 2000s, production and exports increased.

According to report of Turkish Textile Industry Council in the 8

th

Turkish Sectorial

Economy Forum prepared by the Union of Chambers and Commodity Exchanges of Turkey,

in 2014, while Turkey’s textile exports amounted to US $ 15.4 billion, textile imports

amounted to US $ 5.9. It is an important sector due to its foreign trade surplus. Among the

Top 1000 Industrial Enterprises, there are 102 enterprises of the sector and there are 20 sector

companies amongst the Top 500 Companies [TOBB, 2014, p.233].

4. THE CONCEPT OF COMPETITIVENESS

Competitiveness is a layered concept which is defined in three different aspects: firm level,

industrial and international competitiveness. Competitiveness at the firm level is defined as

the ability of a given firm to make production at a lower cost than its competitors in national

or international markets (price and cost competitiveness); the equal or superior position of a

firm compared to its competitors in terms of product quality, appeal of the product or the

service offered (quality competitiveness); the ability to innovate and invent [Eroğlu;

Özdamar, 2006, p.86].

The Relation Between R&D Expenditures and Financial Performance of Textile Firms Traded in

Istanbul Stock Exchange (BIST): Evaluation through Panel Data Analysis

http://www.iaeme.com/IJM/index.asp 151 editor@iaeme.com

In terms of industrial competitiveness, it refers to an industry which is more productive

and efficient compared to its competitors.

International competitiveness is that the basket of goods created by the countries in the

production process is in demand in other markets and thus contributes to the process of

growth and prosperity in the country [Manavgat; Kaya, 2016, p.3]. For example, international

competitiveness of Turkish Textile Industry signifies the fact that Turkish textile products are

more in demand compared to the products of competing countries. Starting at the firm level,

competitiveness may later reach industrial levels and turn into international competitiveness.

Just as circular waves created by one sinking stone.

One of the key factors that determine the competitiveness of firms both in their own

industries and in international markets is the power of technology and the potential to improve

existing technology. In this respect, R&D expenditures rise to prominence. Success in R&D

expenditures provide firms with rights such as know-how, patents, licences etc. and ensure

superior competitiveness compared to their competitors from a legal and economic point of

view.

5. CONCEPT OF RESEARCH AND DEVELOPMENT

R&D is defined by OECD as any creative systematic activity undertaken in order to increase

the stock of knowledge, including knowledge of man, culture and society, and the use of this

knowledge to devise new applications. In addition, according to OECD, research and

development is a term covering three different activities.

Basic Research: It is experimental or theoretical work undertaken primarily to acquire new

knowledge of the underlying foundations of phenomena and observable facts, without any

particular application or use in view.

Applied Research: Applied research is also aimed at acquiring new knowledge. It,

however, contains a direct, original practical aim or objective.

Experimental Development: It is systematic work, drawing on existing knowledge gained

from research and/or practical experience, that is directed to producing new materials,

products or devices; to installing new processes, systems and services; or to improving

substantially those already produced or installed (OECD, 2002).

Overall, R&D expenditures consist of expenses incurred to develop a new product, to

make innovations in the existing product, or to improve the production technologies in use.

What is important here is to assess whether these expenses are indeed for research and

development or not. This is also an important issue in determining the commercial and

financial profits of businesses (Gerşil, Soysal, 2012, p.59).

According to the intangible asset application standard in Turkish Accounting Standards

(TMS 38), while research is defined as an original and planned study undertaken in order to

gain a new scientific technical knowledge and understanding; development is qualified as the

application of research results or other information in the production, planning or design of

new or significantly improved materials, devices, products, processes, systems or services

before commencement of commercial production or use[Sağlam; Yolcu; Eflatun, 2015, p.313]

While research and development at micro level constitute expenditures and costs

undertaken by firms so as to maintain and improve competitiveness, at macro level it also

defines the level of technology and technological capability of an individual country in

relation to that sector. While large-scale firms incur both product and production based R&D

expenditures, small-scale firms make only product based research and development expenses

and investments due to undercapitalization.

Dr. Cevdet A. KAYALI

http://www.iaeme.com/IJM/index.asp 152 editor@iaeme.com

6. SCOPE OF RESEARCH

In this study, the impact of R&D investments in terms of competitiveness (national and

international) made between 2010 and 2016 by 14 textile firms with equity shares traded in

Istanbul Stock Exchange (BIST) is examined.

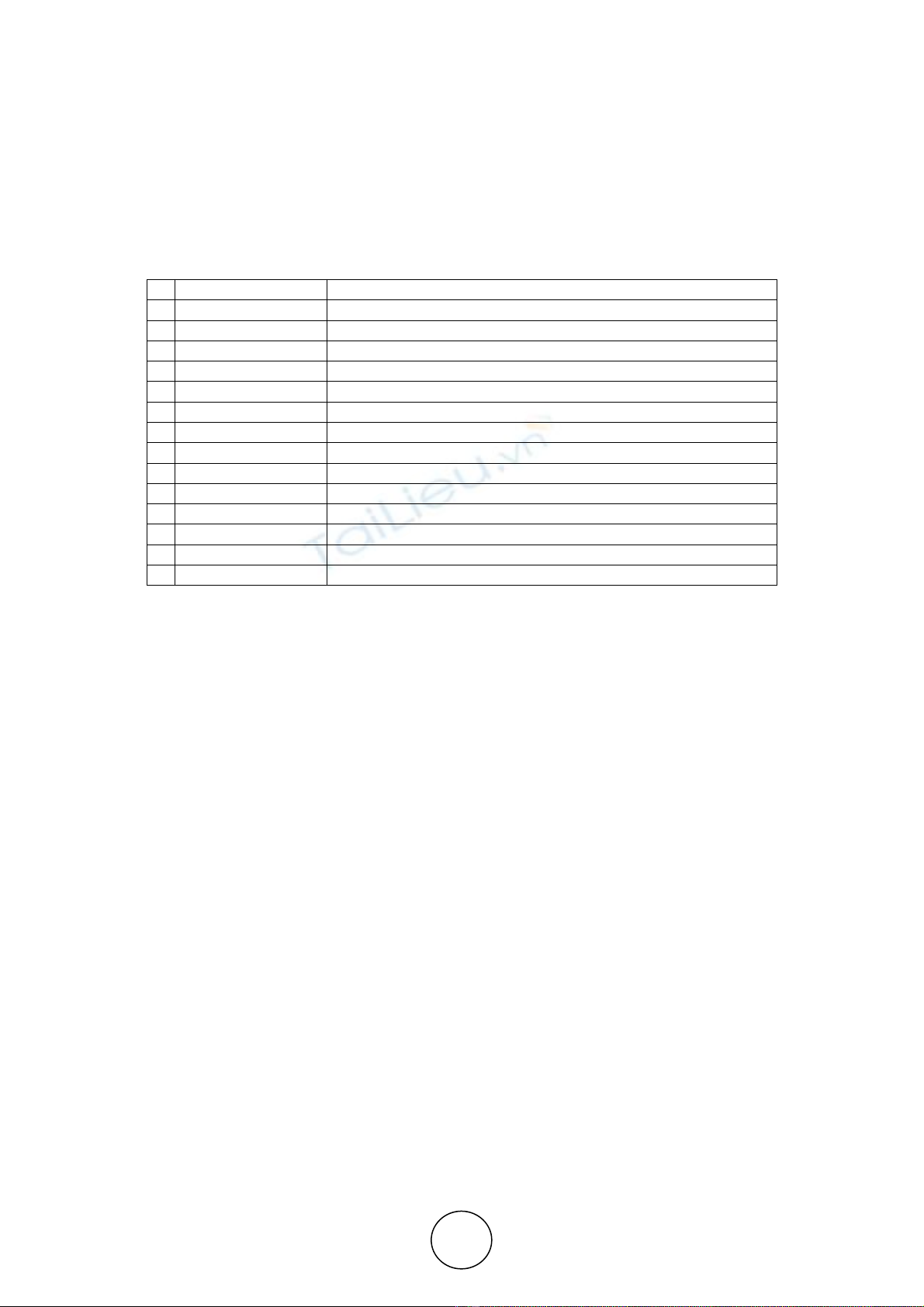

The names and BIST codes of the firms analysed in the research are provided in Table 1.

Table 1

BIST CODE FIRM NAME

1 AKSA AKSA AKRİLİK A.Ş.

2 ATEKS AKIN TEKSTİL A.Ş.

3 ARSAN ARSAN TEKSTİL TİCARET VE SANAYİ A.Ş.

4 BLCYT BİLİCİ YATIRIM SANAYİ VE TİCARET A.Ş.

5 BOSSA BOSSA TİCARET VE SANAYİ İŞLETMELERİ T.A.Ş.

6 DAGI DAGİ GİYİM SANAYİ VE TİCARET A.Ş.

7 DIRIT DİRİTEKS DİRİLİŞ TEKSTİL SANAYİ VE TİCARET A.Ş.

8 HATEK HATEKS HATAY TEKSTİL İŞLETMELERİ A.Ş.

9 KRTEK KARSU TEKSTİL SANAYİİ VE TİCARET A.Ş.

10

LUKSK LÜKS KADİFE TİCARET VE SANAYİİ A.Ş.

11

SKTAS SÖKTAŞ TEKSTİL SANAYİ VE TİCARET A.Ş.

12

SNPAM SÖNMEZ PAMUKLU SANAYİİ A.Ş.

13

YATAS YATAŞ YATAK VE YORGAN SANAYİ VE TİCARET A.Ş.

14

YUNSA YÜNSA YÜNLÜ SANAYİ VE TİCARET A.Ş.

**[Note 2]

See for translation

6.1. Research Objective

Evaluation of the relation between R&D investments made by firms to enhance

competitiveness and their share prices, net sales and equity capital indicating ownership

rights.

6.2. Research Assumptions

The changes in intangible fixed assets are explored in terms of their impact on share prices,

net sales and equity capital of various firms, under the assumption that R&D expenditures are

registered in accordance with the capitalization requirements set by Turkish Accounting

Standards.

7. ECONOMETRIC METHODOLOGY

This study draws upon Panel Data Method. Panel Data Method may be defined as colligation

of sectional observations over a certain period of time [Baltagi, 2005, p.1]. Within this

context, the regression model for the panel data, which contains both the time series and the

horizontal cross-sectional data, can be expressed as in equation (1):

Y

i,t

= β

0

+ β

1

x

’i,t

+ ε

i,t

(1)

In this model, i=1,2,…,N represent the cross-section units and t=1,2,…,T represent the

observation numbers of each cross-section unit, i.e. the time dimension. On the other hand, it

refers to the error term of the i’th economic unit in t period. Error terms must be independent

and IID (0 and σ2) for all cross-section units and time dimension [Maddala, 2002, p.274].

The unit root properties of the series considered in the Panel Data Method are of great

importance. In the first generation panel unit root tests, it is generally based on the dynamic

fixed effects model, which resembles ADF (Augmented Dickey-Fuller);

![Thuyết minh Dự án đầu tư Nhà máy sản xuất bột cá [Mới nhất]](https://cdn.tailieu.vn/images/document/thumbnail/2018/20180531/lapduandautu/135x160/2037095_2211.jpg)