1

CHAPTER 1: INTRODUCTION OF THE STUDY

1.1.

Rationale

Life Insurance has a profound humanistic meaning. It not only helps

individuals and families protect their children and family members from

financial loss due to the loss of loved ones, but also hepls people to save

money for their future financial needs. In addition, for the socio-economy,

life Insurance contributes to mobilize a large capital sources for the

investment of the economics development. It also contributes to enhance the

awareness of thrift practice, live with the responsibilities to ourself, our

family and our community.

Life insurance agencies help to increase the value of insurance products

as well as bring revenue, reputation and customer confidence in the life

insurance companies. Moreover, life insurance agencies is the representative

for insurance companies, thus the companies will response all the actions or

shortcomings of the authorized agencies. Therefore, Vietnamese Life

Insurance agencies play an importance role in the distribution channel that

brings the main sources of revenue for the companies, and the relationship

between the agencies and the companies is as closed as the relationship of

key employees in the Insurers.

However, there is a fact that the turnover rate of agencies in the life

insurance market in the world as well as in Vietnam is very high. The

intention to leave the business and the turnover has been identified as the

main obstacle to the success of insurers and any business globally. The

intention to leave the companies is very important because the employee goes

through a very serious consideration process before the final deciding.

Therefore, the firms need to have effective and timely solutions to eliminate

the intention of leaving agencies to help them reduce the turnover rate, save

2

costs and improve business efficiency.

All things considers, the study of the topic: "Researching the factors

affecting the intention to leave the organizations of life insurance agencies in

Vietnam" has both theoretical and practical meanings.

1.2. Objectives, questions and tasks of

the research

1.2.1. Research o

bjectives

To study factors affecting the intention to leave the organization of life

insurance agencies in Vietnam. From that, the

authors will

propose some

solutions to reduce the leaving rate of life insurance agencies, and increase

the rate of maintenance the life insurance agencies in Vietnam.

1.2.2. R

esearch q

uestions

- Which factors that affect on the intention to leave the organizations of

life insurance agents in Vietnam?

- How do these factors impact on the intention to leave the organizations

of life insurance agents in Vietnam?

- Which solutions need to be taken to reduce the rate of leaving the

business, thereby increasing the rate of maintenance of the research capacity

of the insurers in Vietnam?

1.2.3. Research tasks

1) Review study

The review aims to research representative cases in the world as well as

in Vietnam about the factors affecting the intention to leave the the

organization of life insurance agencies.

Combining review and in-depth interviews to find research gaps in the

context of Vietnamese life insurance market.

2) Building research model

3

Combining different approaches including in-depth interviews with

experts and the life insurance agencies and review, the

research will

identifies the most suitable factors, criteria and scales to study the factors

affecting the intention to leave the organization in the context of Vietnam.

From there, the research model, the survey questionnaire was established.

3) Impact factors test research

The data collected from the survey will be processed using SPSS 22.0

software to verify the factors that affect the intention of leaving the business

of the life insurance agencies.

4) Recommendations

Based on the results of qualitative research and investigative research,

the authors would like to proposes some solutions to reduce the rate of the

turnover of insurance agencies.

1.3.

Subjects and scope of the study

1.3.1 Research s

ubjects

- Factors affecting the intention to leave the business of life insurance

agents in Viet Nam;

1.3.2.

Research

s

cope

1.3.2.1 About the content

- Researching the factors affacting and the impact level those factors on

the intention to leave the organization of life insurance agents in Viet Nam;

- Studying life insurance agency individuals, do not research agency

organizations;

- Only researching the intention to leave the insurance companies; do not

study the decision to quit, fire and quit the job of life insurance agents in Viet

Nam;

1.3.2.2 About research area

4

- The study was conducted in Vietnamese life insurance market from

2014 to 2019

1.3.2.3 About research time

- The study is conducted in the period 2014-2019

1.4. Research methodology and research process

1.4.1 Qualitative research

- Interview experts and agencies

1.4.2. Quantitative research

- The thesis uses descriptive statistical method

- Methods of investigation

1.5. New contributions of the thesis

- Determine the model and test the factors affecting the life insurance

agent's intention to leave the business;

- Clarifying the specific impact level of each factor affecting the

intention to leave the life insurance agency enterprise;

- Proposing recommendations to help life insurance agents lower the rate

of leaving the business of Vietnam life insurance agents.

5

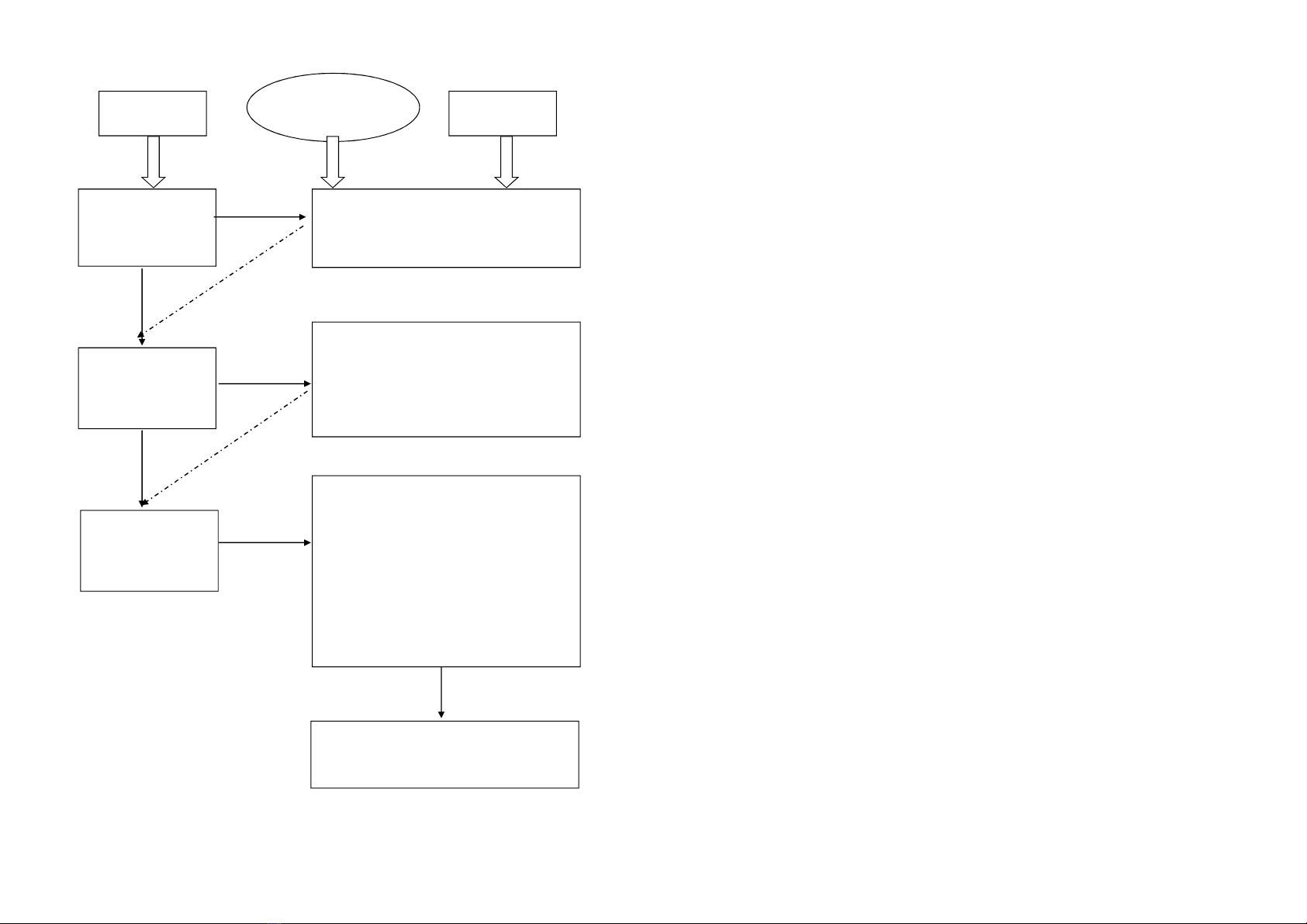

(Source: Author)

Activities Results

Tools

/Method

Overview of the

research

Research gap

The research model

Scale

Qualitative research

(In-depth interview

with experts and

agents

)

- Research model in the Vietnamese

context

- Scale system

- Questionnaire with that ladder system has

been edited and supplemented

- Results of analysis of the current situation

of the life insurance market, the

development of life insurance agents in

Vietnam

- Research hypothesis testing results

- Evaluate the impact of the factors on the

intention to leave the organization

- Average rating of life insurance agent in

Vietnam on factors

Qualitative research

Suggestions, recommendations

In-depth

interview

-

Secondary data

- Questionnaire

-Cronbach's

Anpha, EFA

- Regression

analysis

- Descriptive

statistics

6

Diagram 1.1. Research method and process of the thesis

1.6. The layout of the thesis

The five chapters include the following:

Chapter 1: Introduction to the research

Chapter 2: Research overview and the impact of factors on Vietnam life

insurance agentcies' intention to leave the organization

Chapter 3: Research Methodology

Chapter 4: Life insurance agent in Vietnam life insurance market and

research results

Chapter 5: Some proposals and recommendations to reduce the rate of

leaving insurance enterprises of Vietnam life insurance agents

7

CHAPTER 2: RESEARCH OVERVIEW AND THE IMPACT OF

FACTORS ON VIET NAM LIFE INSURANCE AGENCIES’

INTENTION TO LEAVE THE ORGANIZARION

2.1. Life insurance agenies intention to leave the business

2.1.1. Life insurance and life insurance agent

2.1.1.1. Overview of life insurance

The life insurance concept is mainly studied on two technical and legal

aspects. Either way, life insurance can be understood as a type of insurance

for insured events related to life, health conditions associated with the life of

the insured. Life insurance is an effective tool to help insured to plan and

implement future financial plans to protect relatives and family against

financial risks or difficulties human longevity

2.1.2. Life insurance agent

2.1.2.1 Concepts and features

Life insurance agent can be understood as an individual or organization

authorized by the insurer to perform activities related to the introduction, sale

of insurance products and other activities on the basis of an agency contract.

2.1.2.2 The role of life insurance agent

- For insurance enterprises

- For people participating in insurance

- For society and the economy

2.1.2.3. Classification of life insurance agent

- Based on agent's authority

- Based on the time of operation of the agent:

8

- Based on the main duties of the agent:

2.1.2.4. Duties of agents:

- Selling insurance products

- Contracting

- Collecting insurance premiums, issuing receipts or other documents

under the authorization and guidance of the insurer

- Customer care

2.1.2.5 Agent's responsibility

Life insurance agents must ensure the performance of certain

responsibilities in agency contracts as well as comply with legal and

regulations of the business.

2.1.2.6. Characteristics and qualities required for an agent to succeed

and stand firmly in the profession

For a business with its own unique characteristics such as the life

insurance insurance, the quality required for life insurance agents to succeed

and stand firmly in the profession is affirmed that it is effective sales;

patience; effective time management; positive attitude.

2.1.2. The intention to leave the business and some concepts

2.1.2.1. Intending to leave the business

The concept of "The intention to leave the organization" has been paid

attention by many researches and clarified with many identical views.

However, the concept used in Bluedorn, A. (1982) is clear, easy to define and

evaluate the level of intention to leave the enterprise, so this concept is used

in the thesis. Bluedorn, A. (1982) said: "The intention to leave the

organization is understood as the plan of the employee's intention to leave

the current enterprise"

9

2.1.2.2. Some related concepts

Decided to leave the business

Fired

Quit job

2.2. Factors affecting life insurance agents' intention to leave the

business

Rusell L. Handton (2009) affirms that the intention to leave the

enterprise is the main reason leading to the real decision to quit the business,

so Rusell L. Handton (2009) states that it is the main reason of many studies.

research to find out the factors influencing the intention to leave the business

in order to find timely and appropriate solutions to reduce the business exit.

Overview of the relationship between the factors affecting the life insurance

agent's intention to leave the business.

2.2.1. The relationship between organizational commitment and the

intention to leave the business

Nguyen Van Thang, (2015), on page 135 cited the statements of Meyer

and Alen (1991) defining organizational commitment as a psychological state

(desires, needs, responsibilities) showing the relationship. of the employee

and the organization and has an impact on the desire to stay in the

organization.

The results of the study Rusell L. Handton (2009) collected survey

results from 19300 emails confirmed that commitments to businesses have an

impact on the intention of insurance agents to leave in the context of the US

insurance market. In which, the strongest impact on the insurance agent's

intention to leave in both the short and long term is emotional commitment,

calculation commitment.

2.2.2. The relationship between business satisfaction and the intention

10

to leave the business

The research by Russel L. Handlon used the concept of satisfaction cited

from (Spector, 1997): “Job satisfaction is how people perceive their work and

different aspects. of the job, which is the degree to which people like (are

pleased) or dislike (unsatisfied) their job ".

In the field of insurance, there is a difference in the impact of job

satisfaction on the intention to leave the business due to different research

contexts as well as studies that focus on research in different areas such as

research fields of non-life insurance, non-life insurance, life insurance, health

insurance; context; The sampling range is also very narrow and wide.

2.2.3. The relationship between organizational equity and the intention

to leave the business

Research by Rusell L. Handlon (2009), p. 6 quoted Martison et al (2006)

's definition of organizational equity. "Organizational equity is a term used to

refer to individual perceptions of fairness of decisions and decision-making

processes in an organization and the effect of those perceptions on behavior ”.

Research results of Rusell L. Handlon (2009) confirmed that the factor

of equity in business has the weakest impact among 3 groups of factors

(agency's commitment to business, organizational equity, and satisfaction)

with work to the intention to leave the business in the insurance industry.

2.2.4. The relationship between corporate ethical values and the

intention to leave the organization

Shelby D. Hunt et al (1989) on page 80 quoted the concept of Jansen and

Von Glinow (1985) asserting that the ethical values of corporate are not just

the foundation of all other values involved. to product and service quality, but

also helps to set and maintain standards that describe 'right' what to do and

"worth doing".