Bonding hypothesis

-

Ebook Investments (Tenth edition): Part 2 presents the following content: Chapter 9 the capital asset pricing model, chapter 10 arbitrage pricing theory and multifactor models of risk and return, chapter 11 the efficient market hypothesis, chapter 12 behavioral finance and technical analysis, chapter 13 empirical evidence on security returns, chapter 14 bond prices and yields, chapter 15 the term structure of interest rates, chapter 16 managing bond portfolios, chapter 17 macroeconomic and industry analysis, chapter 18 equity valuation models, chapter 19 financial statement analysis, chapte...

761p

761p  haojiubujain01

haojiubujain01

06-06-2023

06-06-2023

7

7

4

4

Download

Download

-

Ebook Essentials of investments (Seventh edition): Part 1 presents the following content: Chapter 1 investments: background and issues; chapter 2 asset classes and financial instruments; chapter 3 securities markets; chapter 4 mutual funds and other investment companies; chapter 5 risk and return: pastand prologue; chapter 6 efficient diversification; chapter 7 capital asset pricing and arbitrage pricing theory; chapter 8 the efficient market hypothesis; chapter 9 behavioral finance and technical analysis; chapter 10 bond prices and yields; chapter 11 managing bond portfolios.

396p

396p  runthenight04

runthenight04

04-01-2023

04-01-2023

22

22

7

7

Download

Download

-

Ebook Essentials of investments (Seventh edition): Part 2 presents the following content: Chapter 1 investments: background and issues; chapter 2 asset classes and financial instruments; chapter 3 securities markets; chapter 4 mutual funds and other investment companies; chapter 5 risk and return: pastand prologue; chapter 6 efficient diversification; chapter 7 capital asset pricing and arbitrage pricing theory; chapter 8 the efficient market hypothesis; chapter 9 behavioral finance and technical analysis; chapter 10 bond prices and yields; chapter 11 managing bond portfolios.

364p

364p  runthenight04

runthenight04

04-01-2023

04-01-2023

23

23

7

7

Download

Download

-

Money and Banking: Lecture 17 provides students with content about: tax effect; term structure of interest rate; term structure of treasury interest rates; expectations hypothesis; liquidity premium; tax-exempt bond yield;... Please refer to the lesson for details!

18p

18p  hanlamcoman

hanlamcoman

26-11-2022

26-11-2022

13

13

4

4

Download

Download

-

This paper presents a new model for valuing hybrid defaultable financial instruments, such as, convertible bonds. In contrast to previous studies, the model relies on the probability distribution of a default jump rather than the default jump itself, as the default jump is usually inaccessible. As such, the model can back out the market prices of convertible bonds. A prevailing belief in the market is that convertible arbitrage is mainly due to convertible underpricing. Empirically, however, we do not find evidence supporting the underpricing hypothesis.

30p

30p  timxiao

timxiao

25-07-2020

25-07-2020

45

45

2

2

Download

Download

-

The primary objective of this study is to extend the bonding hypothesis by developing what we term as the relative bonding hypothesis. We hypothesize that firms seek the advantages of stronger investor protections by listing in countries whose governance is relatively better than its own.

17p

17p  vimadrid2711

vimadrid2711

18-12-2019

18-12-2019

9

9

1

1

Download

Download

-

(bq) part 2 book "investments" has contents: empirical evidence on security returns, behavioral finance and technical analysis, the efficient market hypothesis, managing bond portfolios, the term structure of interest rates, option valuation, futures markets, equity valuation models,...and other contents.

728p

728p  bautroibinhyen21

bautroibinhyen21

14-03-2017

14-03-2017

67

67

10

10

Download

Download

-

This dissertation covers three topics—three points of view—of issues in international migration. The first paper examines a new facet of the question “Who migrates?” by taking a detailed look at the cognitive and mental health profiles of migrants to investigate a potential psycho-cognitive selection (a mentally healthy migrant hypothesis) as an explanation of an observed positive difference between th

0p

0p  anhnangmuahe2013

anhnangmuahe2013

09-03-2013

09-03-2013

43

43

1

1

Download

Download

-

For decades, researchers have been puzzled by three sets of empirical results associated with the pricing of initial public o¤erings (IPOs). Besides the well-documented underpricing puzzle and hot-issue market puzzle1, severe long-run underperformance of IPOs is reported recently by Ritter (1991) and Loughran and Ritter (1995), suggesting that market ine¢ciency may be even more pervasive than previously recognized. Thus, the IPO market, albeit small in scale, has become a leading example of anomalies against the e¢cient market hypothesis (Fama 1998)....

152p

152p  mualan_mualan

mualan_mualan

25-02-2013

25-02-2013

61

61

11

11

Download

Download

-

By estimating the default jump risk premium, this paper essentially tests the assumptions underlying the conditional diversification hypothesis of JLY (2001). These authors prove that, if default jumps are conditionally independent across firms and if the economy contains an infinite number of bonds, default jump risk cannot be priced. Intuitively, in this case the default jump risk can be fully diversified. Our results indicate that default jumps are not conditionally independent across firms and/or that not enough corporate bonds are traded to fully diversify default jump risk.

51p

51p  enter1cai

enter1cai

16-01-2013

16-01-2013

47

47

5

5

Download

Download

-

Before buying shares in a bond fund, investors should understand the fundamentals—including the potential risks and rewards—of different types of bond funds.This Plain Talk brochure explains the basics of bond fund investing, including how bond mutual funds work, what different types of bond funds exist, and how investors can select bond funds that best meet their needs.

33p

33p  enter1cai

enter1cai

16-01-2013

16-01-2013

55

55

2

2

Download

Download

-

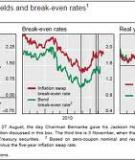

This paper estimates the impact of monetary policy actions on bill, note, and bond yields, using data from the futures market for Federal funds to separate changes in the target funds rate into anticipated and unanticipated components. Bond rates’ response to anticipated changes is essentially zero, while their response to unanticipated movements is large and highly significant. Surprise policy actions have little effect on near-term expec- tations of future actions, which helps explain the failure of the expectations hypothesis on the short end of the yield curve....

8p

8p  taisaocothedung

taisaocothedung

09-01-2013

09-01-2013

55

55

3

3

Download

Download

-

The remainder of this paper proceeds as follows: Section III introduces the Campbell- Shiller dividend-price ratio model and then briefly develops the variant used in my empirical analysis. Section IV provides a description of the data and empirical methodology and lays out the specific predictions of the model. Section V discusses the empirical findings, including tests of the model and hypothesis tests regarding expected inflation’s effect on equity valuations. In section VI, I construct explicit ex ante estimates of expected long-run stock returns.

67p

67p  bocapchetnguoi

bocapchetnguoi

06-12-2012

06-12-2012

52

52

3

3

Download

Download

CHỦ ĐỀ BẠN MUỐN TÌM