Earned Income Tax Credits

-

To assess the relationship between the presence and generosity of statelevel Earned Income Tax Credits (EITC) and multiple self-reported measures of general health. The generosity of state EITC policies is positively associated with significant reductions in frequent mental distress and poor physical health, especially during months when the credit is received.

10p

10p  vigamora

vigamora

25-05-2023

25-05-2023

4

4

2

2

Download

Download

-

The primary reason for the falls in average income in 2010-11 was the fall in earnings. Pre-tax earnings fell by 7.1% in real terms in 2010-11, mostly due to the falls in the real earnings of those employed as opposed to a fall in the numbers employed. From 2008-10 real average incomes still grew, based on a relatively stable real employment income and strong real-terms growth in income from state benefits and tax credits. In 2010-11 medium incomes before taxes and benefits was 7.8% lower than its 2007-08 peak. The IFS asserts that there are good reasons to be pessimistic...

10p

10p  hoangphiyeah1tv

hoangphiyeah1tv

18-04-2013

18-04-2013

40

40

4

4

Download

Download

-

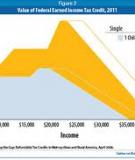

Expanding the Earned Income Tax Credit (EITC). The EITC is a refundable tax credit -- primarily for low-income working families with children – that has lifted more children out of poverty than any other single program or category of programs. 13 According to the Center for Budget and Policy Priorities, the EITC kept an estimated 3.4 million women and girls above the poverty line in 2010. This tax credit enables a newly employed single mother of two to supplement her earnings as soon as she starts work. If this mother earns $20,000 a year, she stands to...

34p

34p  nhacnenzingme

nhacnenzingme

23-03-2013

23-03-2013

48

48

4

4

Download

Download

-

Ensuring More Families Receive Their Child Tax Credit (CTC). The Child Tax Credit reduces the amount of federal taxes low-income families must pay by up to $1,000 for each qualifying child under the age of 17. For example, a family of four that would otherwise owe $4,000 in taxes might only owe $2,000 after receiving the credit for each of their children. Though the CTC was expanded to a maximum of $1,000 per child from $600 per child in 2002, the credit remained unavailable to millions of low-income families because the minimum amount of earned income...

30p

30p  nhacnenzingme

nhacnenzingme

23-03-2013

23-03-2013

46

46

4

4

Download

Download

-

Even if you are not required to register your business with the host government, you may still want to register with the U.S. government. Remember, if you are out of the U.S. for at least 330 days per year, you can claim in 2010 up to $91,500 of Foreign Earned Income for which you are not taxed. If your company is registered in the U.S., it will be easier to substantiate the origin of your income. You may also want to buy credits for your Social Security Account quarterly so that you continue to build your lifelong average income...

52p

52p  bi_ve_sau

bi_ve_sau

05-02-2013

05-02-2013

39

39

3

3

Download

Download

-

To receive the earned income credit, taxpayers file their regular tax re- turn and fill out the six-line Schedule EIC that gathers information about qualifying children. The EITC is refundable, meaning that it is paid out by the Treasury regardless of whether the taxpayer has any federal income tax liability. There are several basic tests for EITC eligibility. The taxpayer must have both earned and adjusted gross income below a threshold that varies by year and by family size. Most EITC payments go to taxpayers with at least one “qualifying child.

90p

90p  enterroi

enterroi

01-02-2013

01-02-2013

55

55

6

6

Download

Download

-

Another major change to the EITC occurred as part of the 1993 budget bill. In his first State of the Union Address, President Clinton said, “The new direction I propose will make this solemn, simple commitment: By ex- panding the refundable earned income tax credit, we will make history; we will reward the work of millions of working poor Americans by realizing the principle that if you work forty hours a week and you’ve got a child in the house, you will no longer be in poverty.

56p

56p  enterroi

enterroi

01-02-2013

01-02-2013

46

46

2

2

Download

Download

-

Child Tax Credit and Working Tax Credit help to support families with children and working people on low incomes. Child Tax Credit supports families with children and young persons aged from 16 but under 20 years old. You can claim whether or not you are in work. All families with children, with income of up to £58,000 a year (or up to £66,000 a year if there is a child under one year old), can claim the credit in the same way. Working Tax Credit supports working people (whether employed or self-employed) on low incomes by topping up earnings. Child Tax Credit and...

24p

24p  enter1cai

enter1cai

12-01-2013

12-01-2013

87

87

2

2

Download

Download

-

Researchers as well as policymakers have expressed concerns that some contract features in the credit-card and subprime mortgage markets may induce consumers to borrow too much and to make suboptimal contract and repayment choices.1 These concerns are motivated in part by intuition and evidence on savings and credit suggesting that consumers have a time-inconsistent taste for immediate gratification and often naïvely underestimate the extent of this taste.

6p

6p  enter1cai

enter1cai

12-01-2013

12-01-2013

45

45

1

1

Download

Download

CHỦ ĐỀ BẠN MUỐN TÌM