Liquidity constraints

-

Ebook "Isotope geochemistry" presents a comprehensive introduction to radiogenic and stable isotope geochemistry. The first five chapters cover fundamentals including the physics of nuclei, radioactive decay, nucleosynthesis, geochronology, and the theory of stable isotope fractionation. The next chapter focuses on the isotope geochemistry of meteorites and their constraints on the formation of the solar system and the Earth.

495p

495p  nhanphanguyet

nhanphanguyet

28-01-2024

28-01-2024

5

5

2

2

Download

Download

-

Our research aims at investigating by what means do firms decide debt maturity (DM) structure in Vietnamese context involving certain levels of financial constraints. It is found that, with stronger financial profiles, unconstrained firms are more likely to endure the effects of liquidity risk and information asymmetry, whereas those constrained seem to be subjected to various consequences resulting from these frictions.

11p

11p  sotritu

sotritu

18-09-2021

18-09-2021

24

24

3

3

Download

Download

-

Challenges and constraints faced by Maitris in delivering veterinary services in Chhattisgarh, India

The present investigation was carried out in four districts of Chhattisgarh state to assess the challenges and constraints faced by Maitris in delivering the livestock veterinary services in the rural areas. Most of the Maitris stated that people do not pay properly for their services (74%), people expect to provide service as like veterinary officers of the department (91%), remuneration paid by government for their service is not satisfactory (95%), and not earning enough from the profession (60%).

5p

5p  kethamoi5

kethamoi5

03-06-2020

03-06-2020

15

15

0

0

Download

Download

-

This paper conducts an empirical research on the relations between liquidity constraints and economic growth. Based on Kiyotaki & Moore (2019), we establish our econometric model and do regressions with a panel data covering 33 countries from 1996 to 2017.

12p

12p  cothumenhmong4

cothumenhmong4

24-03-2020

24-03-2020

34

34

2

2

Download

Download

-

This study aims to model lenders’ haircut decision specifically for stocks. The mathematical model showed that lenders face a trade-off between profit and risk exposure in a secured loan; consequently, haircuts are determined in the solvency as a stochastic variable. It was assumed coherently to industry practice that lenders use parametric VaR for collateral valuation. In this model, lenders’ probability selection in the VaR approach indicates their risk tolerance, which was captured through to asset liquidity and market volatility expectations.

28p

28p  trinhthamhodang2

trinhthamhodang2

19-01-2020

19-01-2020

26

26

1

1

Download

Download

-

This paper studies the effects of market liquidity and other factors on investment of non-financial companies listed on Vietnam's stock exchange for the 2008–2013 period by adopting different measures of investment and liquidity, and considering the impact of interaction between liquidity and others, including issuing, financial constraints, and growth opportunities, on firm investment.

17p

17p  danhnguyentuongvi27

danhnguyentuongvi27

18-12-2018

18-12-2018

17

17

2

2

Download

Download

-

As seen above, the leasing sector is new but growing and leases are written for three-to-five year terms. The banking sector is consolidating, assets are growing, deposits are on the increase, and the sector is liquid. However, the banks perceive the rewards of short-term lending utilizing highly liquid assets and long-term loans utilizing real estate as collateral are greater than the risks of long-term lending to the agriculture or industrial sectors secured by equipment.

16p

16p  loginnhanh

loginnhanh

22-04-2013

22-04-2013

41

41

4

4

Download

Download

-

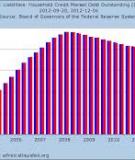

Investor base: about 70 percent of private bonds were purchased by banks in 2011. Their participation has increased further recently partly because they have faced constraints in expanding consumer loans given increased risk and higher cost in the sector, and therefore have sought alternative higher-yield investment instruments. Liquidity in the secondary market is very limited as many banks tend to hold private bonds until maturity. Retail investors’ participation remains low (see Figure 11). ...

16p

16p  hongphuocidol

hongphuocidol

04-04-2013

04-04-2013

66

66

8

8

Download

Download

-

Society relies on well-functioning capital markets to promote economic progress in businesses and households. To that goal, academics argue that capital markets should provide for price discovery and liquidity, where the best way to find out what an asset is worth is to attempt to sell it. As long as there are a large number of market participants, bidding among them leads to price discovery, and an asset is sold quickly resulting in liquidity. Moreover, in a well functioning market the price should be close to its intrinsic value.

94p

94p  haiduong_1

haiduong_1

03-04-2013

03-04-2013

53

53

10

10

Download

Download

-

The purpose of this book is to offer a unifying conceptual framework for the normative study of taxation and related subjects in public eco- nomics. Such a framework necessarily begins with a statement of the social objective, taken here to be the maximization of a conventional social welfare function, and then asks how various government instru- ments are best orchestrated to achieve it. The structure is built on the foundation provided by the fundamental theorems of welfare econom- ics.

477p

477p  layon_5

layon_5

28-03-2013

28-03-2013

59

59

14

14

Download

Download

-

From a banking group’s perspective, a range of factors play a role in the choice of branching versus subsidiarization, including banks’ business focus and differences in regulatory and tax regimes across jurisdictions. Banks with significant wholesale operations tend to prefer a more centralized branch model that provides the flexibility to manage liquidity and credit risks globally and serve the needs of large clients. The funding costs for the wholesale group are likely to be lower under the branch structure, given the flexibility to move funds to where they are most needed.

23p

23p  machuavo

machuavo

19-01-2013

19-01-2013

52

52

3

3

Download

Download

-

Margin Loans. A national bank may use an alternative approach to calculate its capital requirement for certain eligible bank margin loans to customers for the purpose of buying or carrying margin stock.

32p

32p  bi_ve_sau

bi_ve_sau

17-01-2013

17-01-2013

40

40

2

2

Download

Download

-

PDi and LDi are aimed at testing the incidence of adverse selection: whether firms in poor financial health and/or facing liquidity constraints are more likely to seek and get access to bank credit. In the case of the liquidity dummy there is no ambiguity about the causality and the interpretation of the results in terms of adverse selection. However, in the case of the profitability dummy, again we cannot fully eliminate the endogeneity problem because – as mentioned before – firm’s profit/loss position may affect also bank’s decision to extend the loan.

49p

49p  enterroi

enterroi

01-02-2013

01-02-2013

60

60

9

9

Download

Download

-

Why was it a mistake for the Fed to flood the system with so much liquidity that short- term interest rates were driven toward zero? In line with textbook economic theory, the Fed focused mainly on the shortfall in aggregate demand rather than on the underlying supply constraint on credit availability. However, starting from a position where interest rates are already very low, say 2 percent as in early 2008, reducing them to zero has only a second-order effect on expanding aggregate demand.

23p

23p  taisaocothedung

taisaocothedung

09-01-2013

09-01-2013

47

47

3

3

Download

Download

-

Chemical oxidation technologies are predominantly used to address contaminants in the source area saturated zone and capillary fringe. Cost concerns can preclude the use of chemical oxidation technologies to address large and dilute petroleum contaminant plumes. More frequently, chemical oxidation technologies are employed to treat smaller source areas where the petroleum mass is more concentrated.

477p

477p  cao_can

cao_can

29-12-2012

29-12-2012

51

51

11

11

Download

Download

-

We show that the main testable implication of the buffer stock model is that the covariance between the wealth gap (the difference between actual and target wealth) and consumption is (strongly) positive. Although we focus on Carroll’s version of the buffer stock model, the test applies equally well to Deaton’s case. In Carroll, buffer stock behavior emerges from the tension between impatience, prudence, and the chance of zero earnings. Impatient individuals would like to anticipate consumption, but the chance of zero future earnings generates a demand for wealth.

254p

254p  bocapchetnguoi

bocapchetnguoi

05-12-2012

05-12-2012

55

55

4

4

Download

Download

-

Although research on limits to arbitrage is far from played out, it is fair to say that a broad consensus is emerging with respect to the key ideas and modeling ingredients. This should not be too surprising, given that the relevant tools all come from neoclassical microeconomics: arbitrageurs can be modeled as fully rational, with no need to appeal to any behavioral or psychological biases.

46p

46p  bocapchetnguoi

bocapchetnguoi

05-12-2012

05-12-2012

38

38

1

1

Download

Download

-

The 2009 OECD Working Paper „Pension Fund Investment in Infrastructure‟ (Inderst 2009) discusses barriers to pension funds‟ investment in infrastructure projects in general – which can be seen to apply also to green investments.

161p

161p  quaivatdo

quaivatdo

19-11-2012

19-11-2012

72

72

6

6

Download

Download

-

CHAPTER 56 NUCLEAR POWER William Kerr Department of Nuclear Engineering University of Michigan Ann Arbor, Michigan 56.1 HISTORICAL PERSPECTIVE 56.1.1 The Birth of Nuclear Energy 56.1.2 Military Propulsion Units 56.1.3 Early Enthusiasm for Nuclear Power 56.1.4 U.S. Development of Nuclear Power CURRENT POWER REACTORS, AND FUTURE PROJECTIONS 56.2. 1 Light- Water-Moderated Enriched-Uranium-Fueled Reactor 56.2.2 Gas-Cooled Reactor 56.2.3 Heavy-Water-Moderated Natural-Uranium-Fueled Reactor 56.2.4 Liquid-Metal-Cooled Fast Breeder Reactor 56.2.

24p

24p  hadalabo

hadalabo

29-09-2010

29-09-2010

78

78

6

6

Download

Download

CHỦ ĐỀ BẠN MUỐN TÌM