Treasury bills

-

Ebook The global money markets: Part 1 includes contents: Chapter 1 introduction, chapter 2 money market calculations, chapter 3 U.S. treasury bills, chapter 4 agency instruments, chapter 5 corporate obligations: commercial paper and medium-term notes, chapter 6 debt obligations of financial institutions, chapter 7 floating-rate securities. Please refer to the documentation for more details.

127p

127p  haojiubujain02

haojiubujain02

03-07-2023

03-07-2023

5

5

3

3

Download

Download

-

After reading the material in this chapter, you should be able to: Differentctiiate between interest-bearing and non-interest-bearing notes; calculate bank discount and proceeds for simple discount notes; calculate and compare the interest, maturity value, proceeds, and effeve rate of a simple interest note with a simple discount note; explain and calculate the effective rate for a Treasury bill;...

27p

27p  koxih_kothogmih10

koxih_kothogmih10

26-10-2020

26-10-2020

15

15

0

0

Download

Download

-

After reading the material in this chapter, you should be able to: Differentctiiate between interest-bearing and non-interest-bearing notes; calculate bank discount and proceeds for simple discount notes; calculate and compare the interest, maturity value, proceeds, and effeve rate of a simple interest note with a simple discount note; explain and calculate the effective rate for a Treasury bill;...

12p

12p  koxih_kothogmih10

koxih_kothogmih10

26-10-2020

26-10-2020

10

10

1

1

Download

Download

-

After studying this chapter you will be able to understand: Money market and financial services, what are the important instruments of Pakistan money market? Call/notice money market, inter bank transfer money, treasury bills, certificates of deposits (CD), commercial papers.

21p

21p  nanhankhuoctai10

nanhankhuoctai10

23-07-2020

23-07-2020

9

9

1

1

Download

Download

-

Chapter 11 - Money market instruments: Treasury bills, repurchase agreements, federal funds, and bank CDs. After studying this chapter you will be able to: examine the characteristics of Treasury bills and the workings of the government securities market, learn how securities dealers operate and why they are so important to the functioning of the money market.

44p

44p  thuongdanguyetan03

thuongdanguyetan03

18-04-2020

18-04-2020

17

17

3

3

Download

Download

-

Chapter 11 - Fundamentals of interest rate futures. The main contents of the chapter consist of the following: Interest rate futures; treasury bills, eurodollars, and their futures contracts; hedging with eurodollar futures; treasury bonds and their futures contracts; pricing interest rate futures contracts; spreading with interest rate futures.

56p

56p  thuongdanguyetan03

thuongdanguyetan03

18-04-2020

18-04-2020

14

14

1

1

Download

Download

-

The study seeks to investigate empirically the relationship between the monetary policy instruments used by the Central Bank of Nigeria and stock market performance measured by the growth of market capitalization in the Nigerian Stock Exchange Market. We employed time series data that spanned from 1980-2013. This period was considered due to the liberalization of the financial sector.

23p

23p  trinhthamhodang2

trinhthamhodang2

21-01-2020

21-01-2020

28

28

4

4

Download

Download

-

Chapter 7 - Money markets. The purpose of this chapter is to explain how money markets work and to describe how businesses, governmental units, and individuals use and participate in these important markets. The money markets are where depository institutions and other businesses adjust their liquidity positions by borrowing or investing for short periods of time.

35p

35p  nomoney12

nomoney12

04-05-2017

04-05-2017

41

41

4

4

Download

Download

-

Chapter 11 - Promissory notes, simple discount notes, and the discount process. In this chapter, the learning objectives are: Differentctiiate between interest-bearing and non-interest-bearing notes; calculate bank discount and proceeds for simple discount notes; calculate and compare the interest, maturity value, proceeds, and effeve rate of a simple interest note with a simple discount note; explain and calculate the effective rate for a Treasury bill.

14p

14p  nomoney9

nomoney9

04-04-2017

04-04-2017

46

46

2

2

Download

Download

-

Lending is an investment and investments are all about the comparison of alternatives and the assessment of risks -vs- return. Up until recently, the government was issuing treasury notes with yields in excess of 40%. Consequently, banks found treasuries more attractive than long-term loans yielding 16-20%. Treasury bills have since declined from the high levels, but still offer an attractive return on investment when comparing liquidity, the high transactional costs of long-term lending, and the short-term nature of the investment.

15p

15p  loginnhanh

loginnhanh

22-04-2013

22-04-2013

77

77

2

2

Download

Download

-

A Fund may engage in securities lending pursuant to the terms of an agreement which includes restrictions as set out in Canadian securities legislation. Collateral held is government Treasury Bills and qualified Notes. Income from securities lending is included in the Statement of Operations and is recognized when earned. The securities on loan continue to be displayed in the Statement of Investment Portfolio. The market value of the securities loaned and collateral held is determined daily.

24p

24p  hongphuocidol

hongphuocidol

04-04-2013

04-04-2013

58

58

7

7

Download

Download

-

The FDIC does not insure safe deposit boxes or their contents. The FDIC does not insure U.S. Treasury bills, bonds or notes, but these investments are backed by the full faith and credit of the United States government. How much insurance coverage does the FDIC provide? The standard maximum deposit insurance amount is described as the “SMDIA” in FDIC regulations.

0p

0p  nunongnuna

nunongnuna

03-04-2013

03-04-2013

42

42

9

9

Download

Download

-

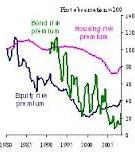

Furthermore, debt management policies can be all the more effective in the special case of the zero lower bound (ZLB). This is because policies aimed at shortening the duration of debt held by the public (ie selling Treasury bills and buying government bonds) may lower long-term yields without raising short-term yields, which are glued close to zero at the ZLB. But note that the corollary of the ZLB argument on its own is a policy asymmetry. Central banks may need to buy government bonds when at the ZLB if they want to stimulate demand. But they have no need to...

35p

35p  taisaovanchuavo

taisaovanchuavo

23-01-2013

23-01-2013

72

72

4

4

Download

Download

-

The Federal Reserve is a key participant in the money market. The Federal Reserve controls the supply of reserves available to banks and other depository institutions primarily through the purchase and sale of Treasury bills, either outright in the bill market or on a temporary basis in the market for repurchase agreements. By controlling the supply of reserves, the Federal Reserve is able to influence the federal funds rate. Movements in this rate, in turn, can have pervasive effects on other money market rates.

37p

37p  taisaovanchuavo

taisaovanchuavo

23-01-2013

23-01-2013

69

69

4

4

Download

Download

-

Governments The U.S. Treasury and state and local governments raise large sums in the money market. The Treasury raises funds in the money market by selling short-term obligations of the U.S. government called Treasury bills. Bills have the largest volume outstanding and the most active secondary market of any money market instrument. Because bills are generally considered to be free of default risk, while other money market instruments have some default risk, bills typically have the lowest interest rate at a given maturity.

53p

53p  taisaovanchuavo

taisaovanchuavo

23-01-2013

23-01-2013

56

56

5

5

Download

Download

-

The high costs of fighting the wars in Iraq and Afghanistan have rekindled congressional interest in the concept of the sale of a Treasury security to help finance these war costs. In the 111th Congress, three bills have been introduced that would permit the issuance of a war bond: S. 2846, H.R. 4315, and H.R. 4385. Although these bills are silent on any relationship between the proposed “war bonds” and World War II-era war bonds, the question has been raised whether or not the issuance of war bonds during the Second World War serves as a good model for a new “war bond.

7p

7p  taisaocothedung

taisaocothedung

12-01-2013

12-01-2013

39

39

2

2

Download

Download

-

In the current crisis, the Keynesian response of stimulating aggregate demand through easy money and loose fiscal policy is correct to a point. But flooding the system with excess liquidity that drives short-term interest rates to near zero has been a serious mistake. By the end of 2008, the interest rates on federal funds and short-term Treasury Bills were virtually zero— where they remain today (figure 1). In this liquidity trap, the interbank market remains almost paralyzed so that further Fed injections of liquidity simply led to a buildup of excess reserves in U.S.

16p

16p  taisaocothedung

taisaocothedung

09-01-2013

09-01-2013

51

51

3

3

Download

Download

-

Maghyereh (2002) investigated the long-run relationship between the Jordanian stock prices and selected macroeconomic variables, again by using Johansen’s (1988) cointegration analysis and monthly time series data for the period from January 1987 to December 2000. The study showed that macroeconomic variables were reflected in stock prices in the Jordanian capital market.

36p

36p  bocapchetnguoi

bocapchetnguoi

05-12-2012

05-12-2012

59

59

2

2

Download

Download

-

The rising profile of SWFs is a direct consequence of the massive accumulation of global foreign reserve assets over the past decade. While reserve accumulation has occurred in many emerging market economies, it has been especially sharp among oil producers and Asian countries that have large trade-surpluses with the United States and other developed countries. In these countries, reserves have swelled to levels far in excess of the amount needed for balance of payments support, thus presenting an opportunity for foreign exchange reserve managers to maximize returns.

10p

10p  thangbienthai

thangbienthai

20-11-2012

20-11-2012

53

53

5

5

Download

Download

-

Instruments used to predict future mutual fund returns include the aggregate dividend yield, the default spread, the term spread, and the yield on the three-month T-bill, variables identified by Keim and Stambaugh (1986) and Fama and French (1989) as important in predicting U.S. equity returns. The dividend yield is the total cash dividends on the value- weighted CRSP index over the previous 12 months divided by the current level of the index. The default spread is the yield differential between Moodys BAA-rated and AAA- rated bonds.

134p

134p  quaivatdo

quaivatdo

19-11-2012

19-11-2012

70

70

9

9

Download

Download

CHỦ ĐỀ BẠN MUỐN TÌM