INTERNATIONAL HUMAN RESOURCE

MANAGEMENT

Compensation & Benefits

2

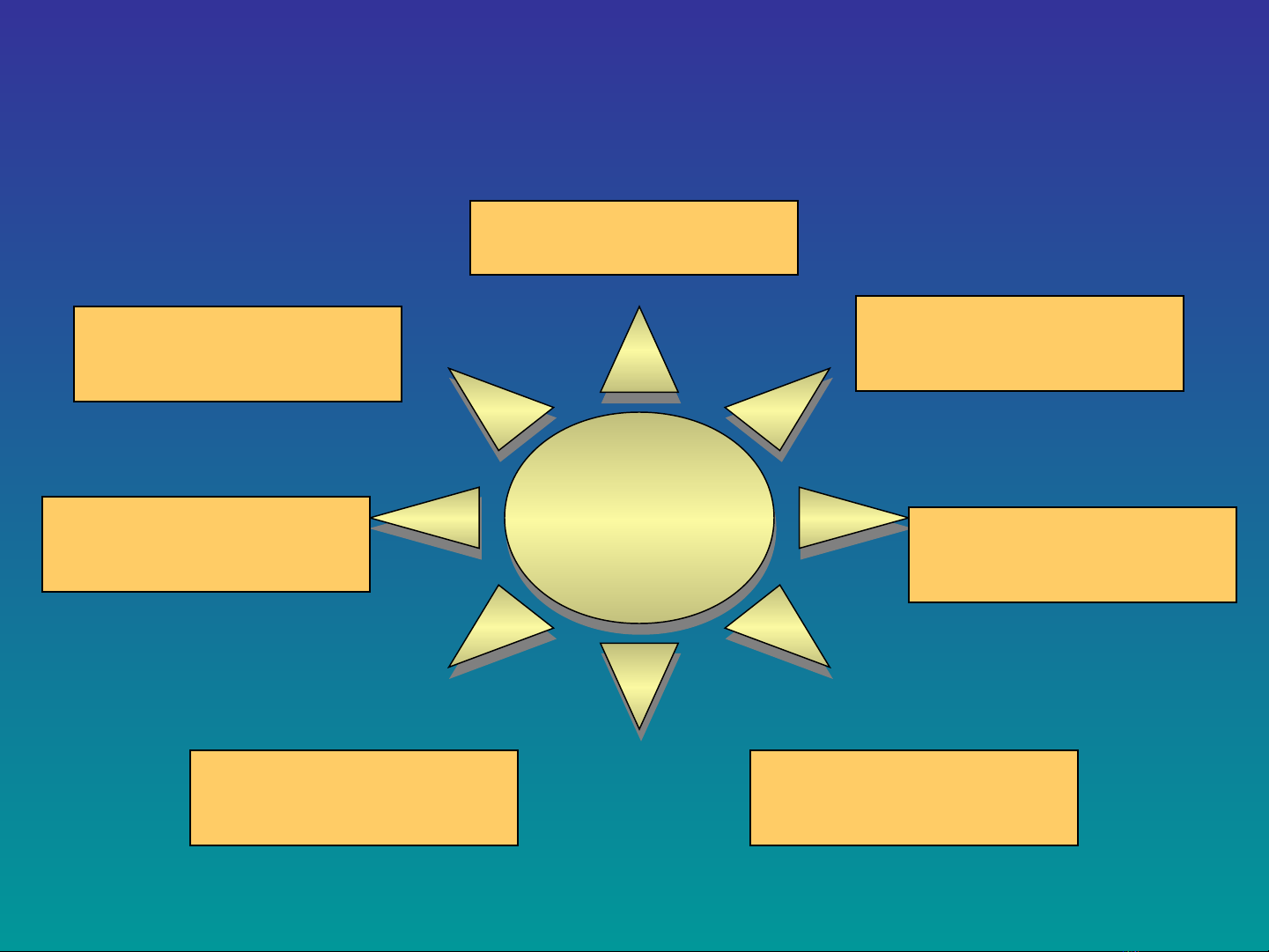

Expatriate Compensation & Benefits

Compensation

Benefits

Compensation

Benefits

Employment and

Taxation Laws

Organization’s Com-

pensation Policy

Competitors

Standard of Living

Political and Social

Environment

Allowances Economic

Conditions

Expatriate Costs

•Expatriate costs may pose a multiple-

fold expense in relation to employees

who are not sent as expatriates to

foreign destinations, and are usually

significantly higher than the

compensation accorded to HCNs and

TCNs

3

4

•Example:

•a Chinese manager with 15 years experience costs

less than USD 70,000 per annum, while

•a US expatriate manager with corresponding

expertise would cost his or her organization USD

300,000 per year

5

Goals of an International Organization’s

Compensation Policy (1)

1) Policy should be consistent with the overall

strategy, structure and business needs of the

international organization

2) Policy must work to attract and retain staff in those

areas where the international organization has the

greatest needs and opportunities. As a

consequence, the policy must be competitive and

recognize factors such as incentive for serving in a

foreign location, tax equalization and reimbursement

for reasonable costs